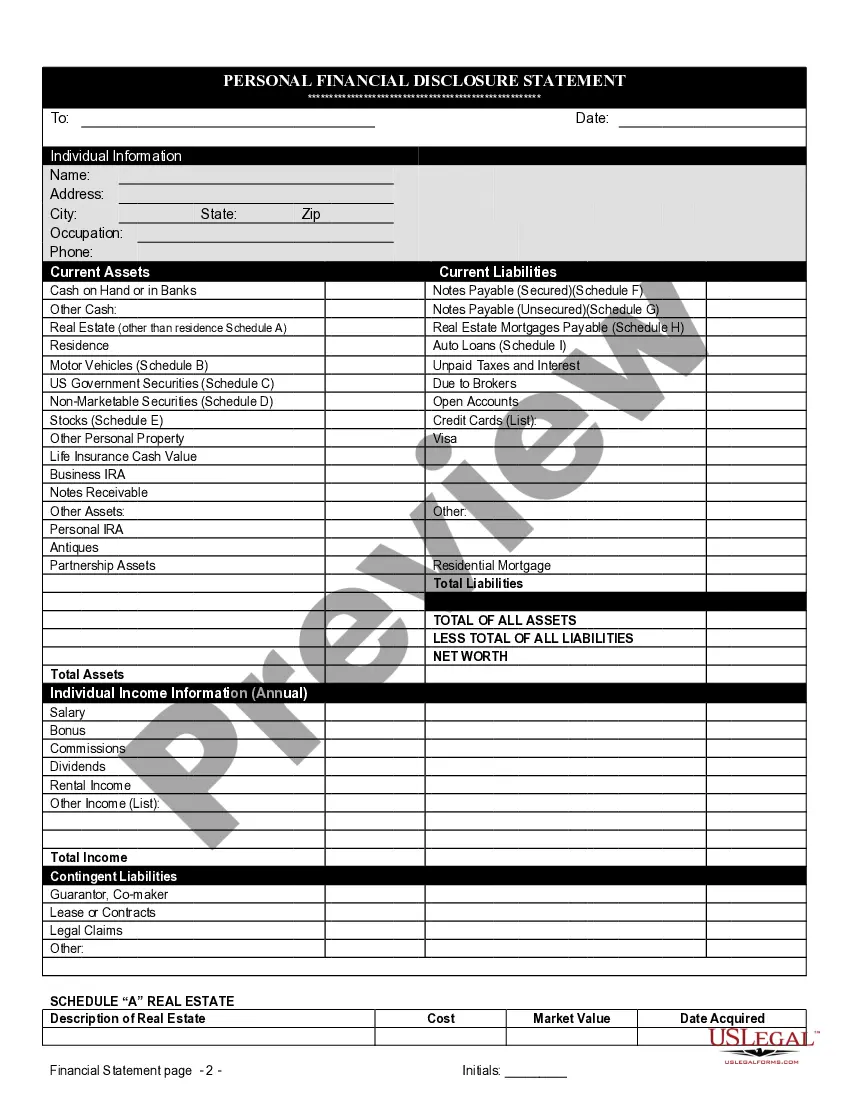

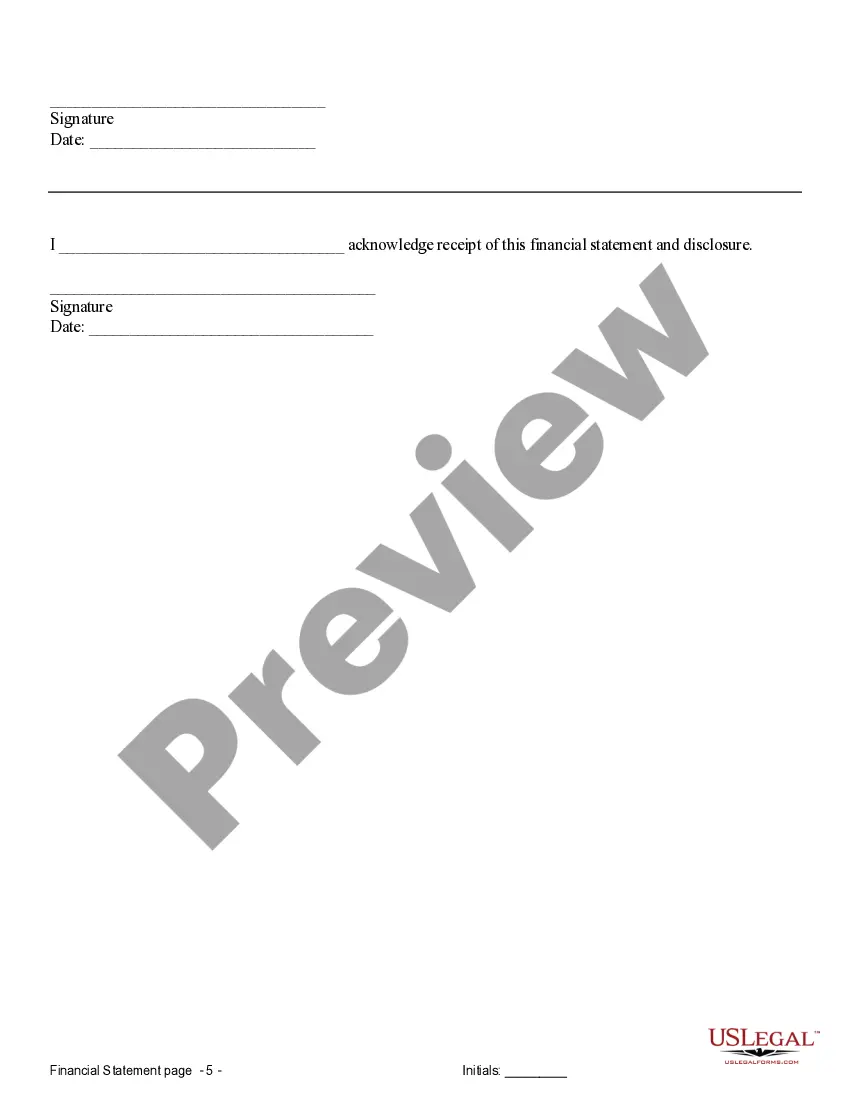

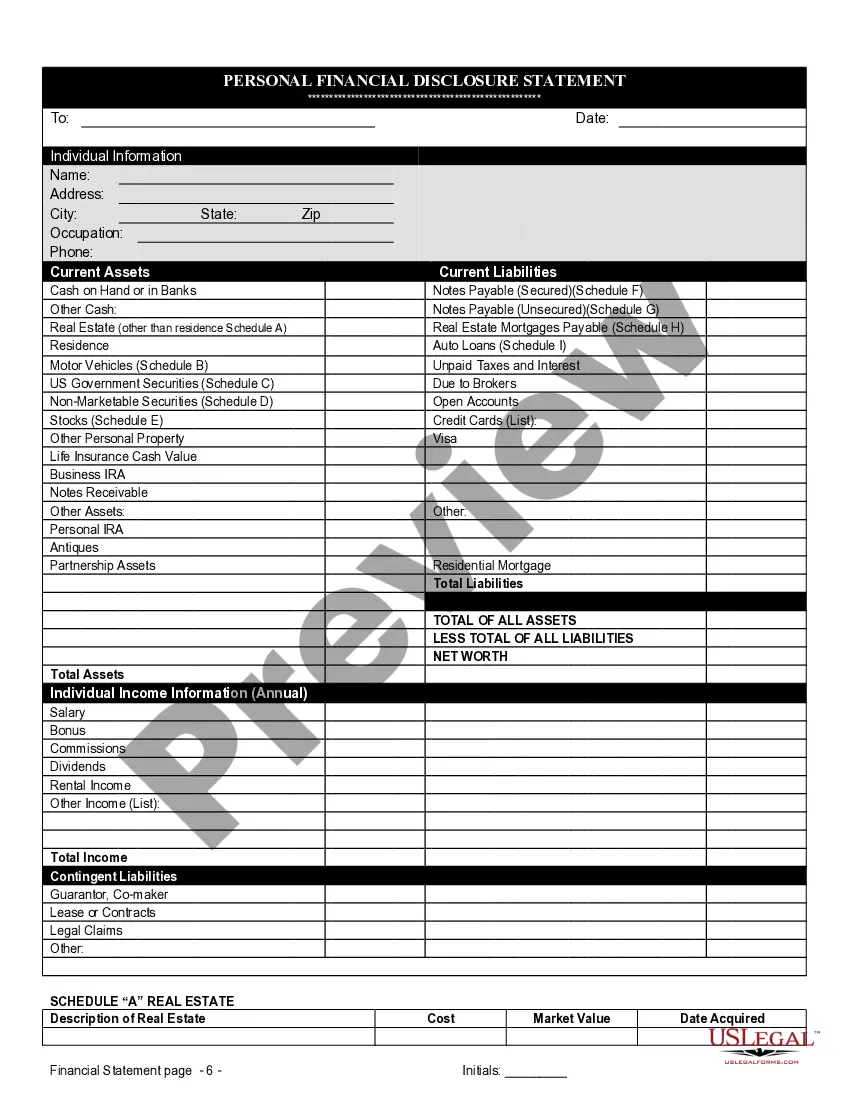

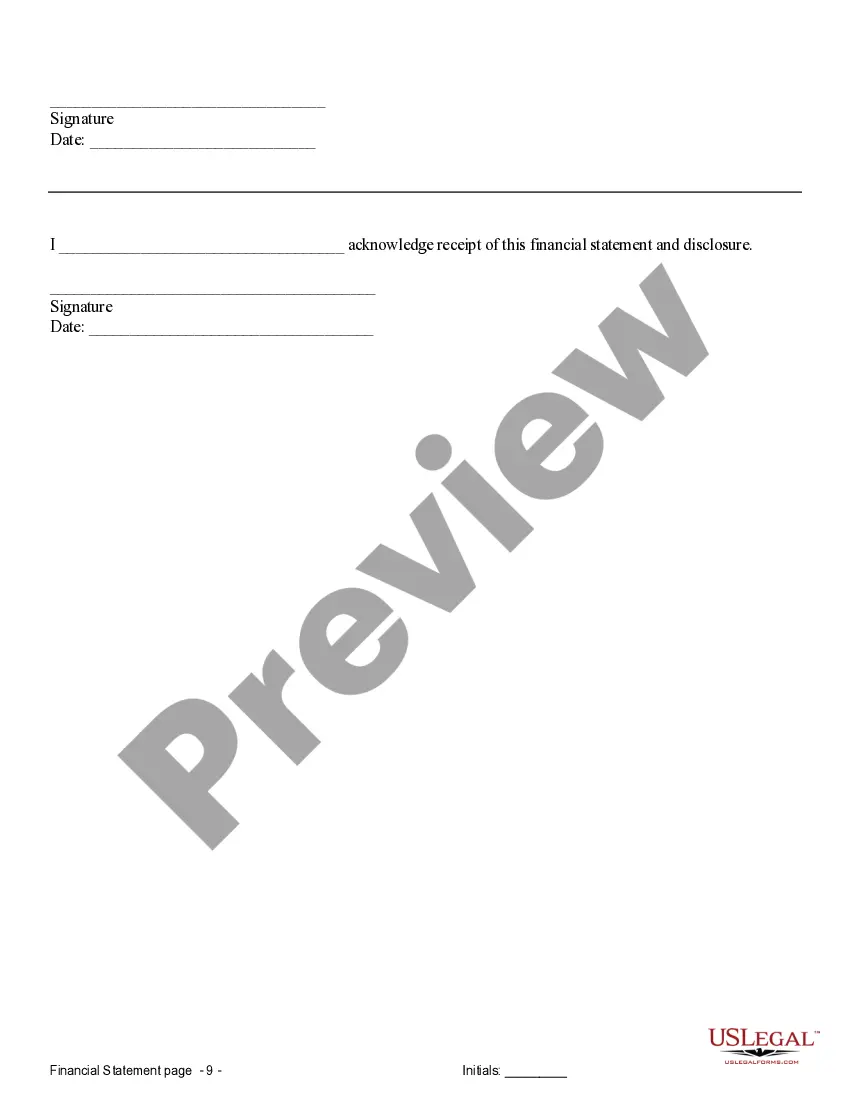

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

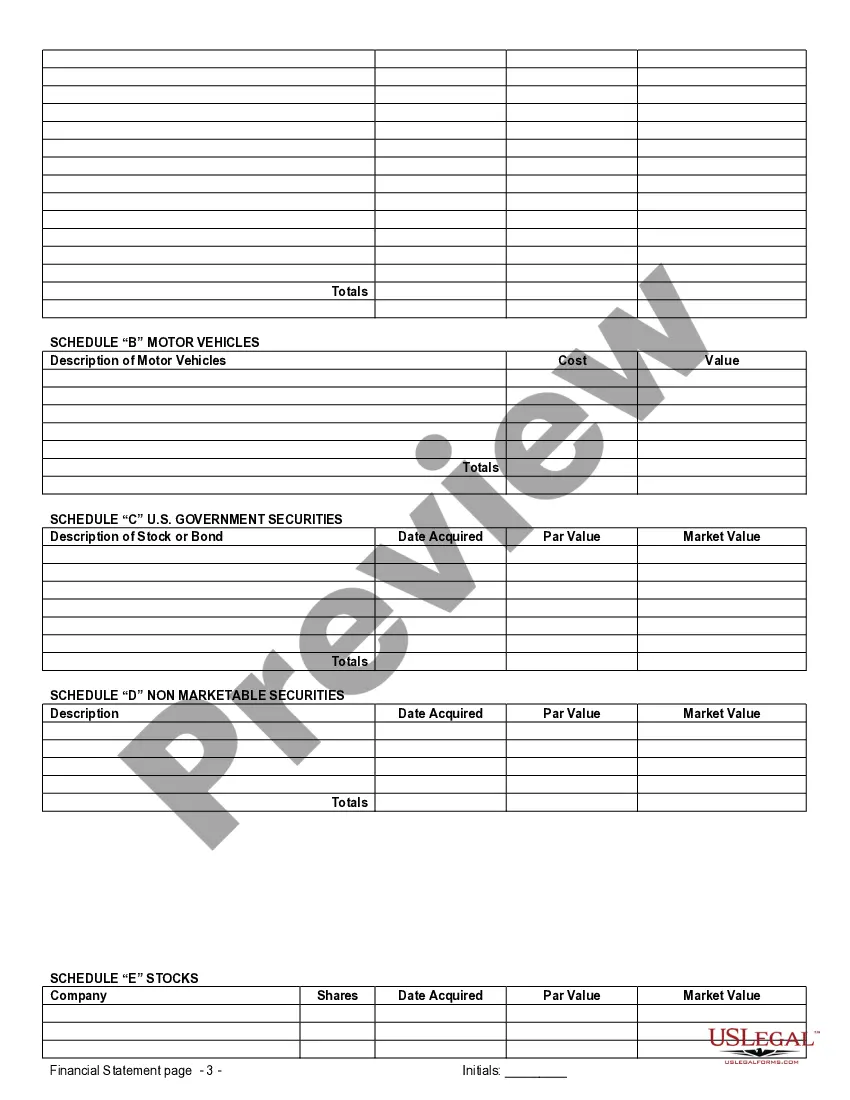

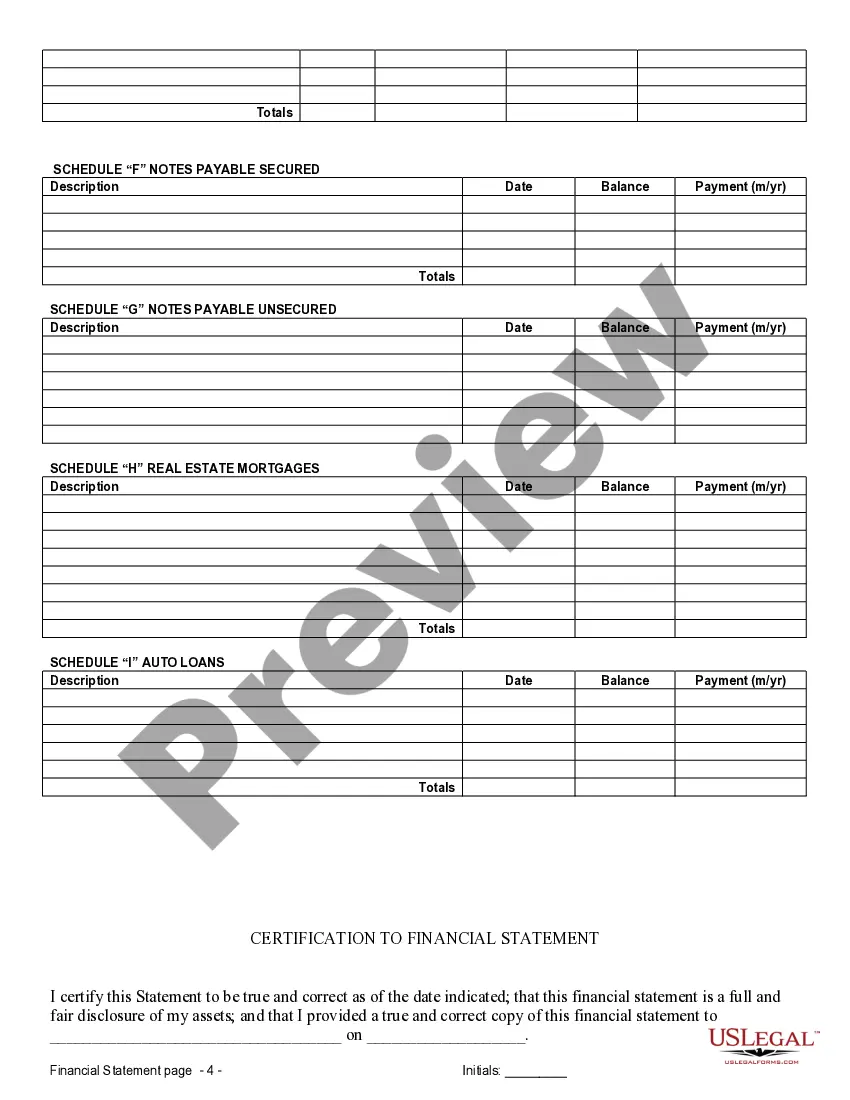

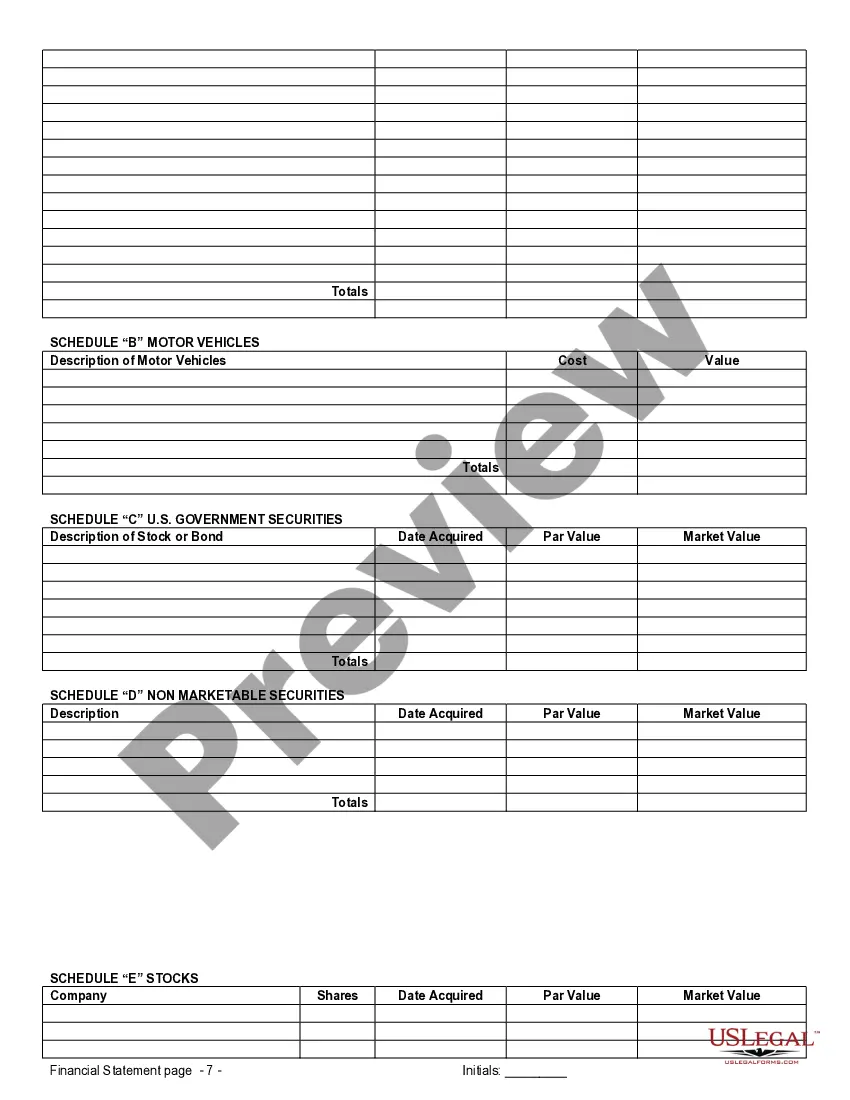

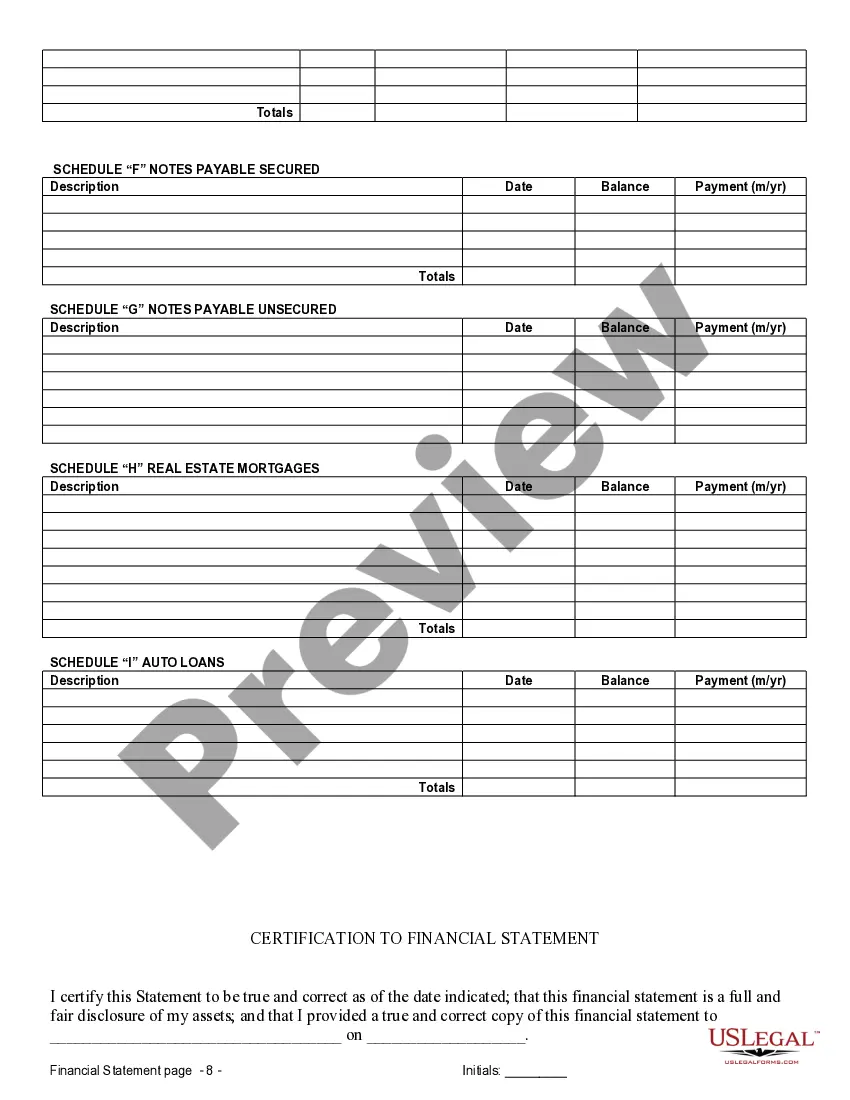

Pompano Beach Florida Financial Statements in Connection with Prenuptial Premarital Agreement: A Detailed Description In the vibrant coastal city of Pompano Beach, Florida, couples considering a prenuptial or premarital agreement may need to provide various financial statements to ensure the agreement's validity. These financial statements play a crucial role in establishing transparency, fairness, and protection of individual assets and liabilities for both parties involved. Let us delve into the key details of Pompano Beach Florida Financial Statements specifically in connection with prenuptial or premarital agreements. 1. Personal Balance Sheet: The personal balance sheet provides a snapshot of an individual's financial position at a specific point in time. It includes assets, such as real estate, investments, vehicles, bank accounts, and personal property, as well as liabilities like mortgages, loans, and credit card debts. This statement is essential for determining the initial financial standing of each partner before entering into a marriage or civil union. 2. Income Statement: The income statement showcases an individual's income and expenses over a defined period. It serves as an outline of one's financial performance, detailing sources of income, such as employment, investments, or businesses, and various expenditures like monthly bills, living expenses, and taxes. This statement enables both parties to understand each other's earning potential, ensuring a fair agreement is reached regarding income distribution during the marriage and potential spousal support in case of divorce. 3. Bank Statements: Bank statements provide detailed records of an individual's transactions, including deposits, withdrawals, transfers, and other financial activities within their bank accounts. These statements offer insight into the individual's banking history, financial habits, and overall liquidity. Analyzing bank statements can help evaluate monetary contributions, habits of savings or spending, and can impact the division of finances between partners. 4. Investment Statements: Investment statements encompass documentation related to various investment accounts, including stocks, bonds, mutual funds, retirement plans, and other investment vehicles. These statements outline the value of investments, dividends received, and any associated costs or fees. Understanding the investment portfolios of both parties ensures a clear picture of their overall net worth and aids in the fair division of assets during the marriage or potential separation. 5. Debt Statements: Debt statements consist of records detailing any outstanding debts, including credit card balances, student loans, personal loans, or mortgages. These statements are crucial to assess the extent of financial obligations and their potential impact on each party's financial health. They help establish the responsibility of each partner for their respective debts and enable better decision-making regarding debt repayment and the protection of assets from potential creditor claims. By providing comprehensive and accurate Pompano Beach Florida Financial Statements in connection with a prenuptial or premarital agreement, couples can confidently move forward into their marriage with clarity and understanding. These financial statements assist in meticulously outlining each partner's financial status and obligations while facilitating the development of a fair and equitable agreement. It's important to consult with legal professionals specializing in family law or matrimonial law to ensure compliance with local regulations and to obtain expert guidance on drafting a prenuptial or premarital agreement that accurately reflects the intentions and goals of both parties. Keywords: Pompano Beach Florida, financial statements, prenuptial agreement, premarital agreement, personal balance sheet, income statement, bank statements, investment statements, debt statements, assets, liabilities, financial transparency, fair agreement, financial performance, net worth, banking history, investment portfolios, debt obligations, creditor claims.Pompano Beach Florida Financial Statements in Connection with Prenuptial Premarital Agreement: A Detailed Description In the vibrant coastal city of Pompano Beach, Florida, couples considering a prenuptial or premarital agreement may need to provide various financial statements to ensure the agreement's validity. These financial statements play a crucial role in establishing transparency, fairness, and protection of individual assets and liabilities for both parties involved. Let us delve into the key details of Pompano Beach Florida Financial Statements specifically in connection with prenuptial or premarital agreements. 1. Personal Balance Sheet: The personal balance sheet provides a snapshot of an individual's financial position at a specific point in time. It includes assets, such as real estate, investments, vehicles, bank accounts, and personal property, as well as liabilities like mortgages, loans, and credit card debts. This statement is essential for determining the initial financial standing of each partner before entering into a marriage or civil union. 2. Income Statement: The income statement showcases an individual's income and expenses over a defined period. It serves as an outline of one's financial performance, detailing sources of income, such as employment, investments, or businesses, and various expenditures like monthly bills, living expenses, and taxes. This statement enables both parties to understand each other's earning potential, ensuring a fair agreement is reached regarding income distribution during the marriage and potential spousal support in case of divorce. 3. Bank Statements: Bank statements provide detailed records of an individual's transactions, including deposits, withdrawals, transfers, and other financial activities within their bank accounts. These statements offer insight into the individual's banking history, financial habits, and overall liquidity. Analyzing bank statements can help evaluate monetary contributions, habits of savings or spending, and can impact the division of finances between partners. 4. Investment Statements: Investment statements encompass documentation related to various investment accounts, including stocks, bonds, mutual funds, retirement plans, and other investment vehicles. These statements outline the value of investments, dividends received, and any associated costs or fees. Understanding the investment portfolios of both parties ensures a clear picture of their overall net worth and aids in the fair division of assets during the marriage or potential separation. 5. Debt Statements: Debt statements consist of records detailing any outstanding debts, including credit card balances, student loans, personal loans, or mortgages. These statements are crucial to assess the extent of financial obligations and their potential impact on each party's financial health. They help establish the responsibility of each partner for their respective debts and enable better decision-making regarding debt repayment and the protection of assets from potential creditor claims. By providing comprehensive and accurate Pompano Beach Florida Financial Statements in connection with a prenuptial or premarital agreement, couples can confidently move forward into their marriage with clarity and understanding. These financial statements assist in meticulously outlining each partner's financial status and obligations while facilitating the development of a fair and equitable agreement. It's important to consult with legal professionals specializing in family law or matrimonial law to ensure compliance with local regulations and to obtain expert guidance on drafting a prenuptial or premarital agreement that accurately reflects the intentions and goals of both parties. Keywords: Pompano Beach Florida, financial statements, prenuptial agreement, premarital agreement, personal balance sheet, income statement, bank statements, investment statements, debt statements, assets, liabilities, financial transparency, fair agreement, financial performance, net worth, banking history, investment portfolios, debt obligations, creditor claims.