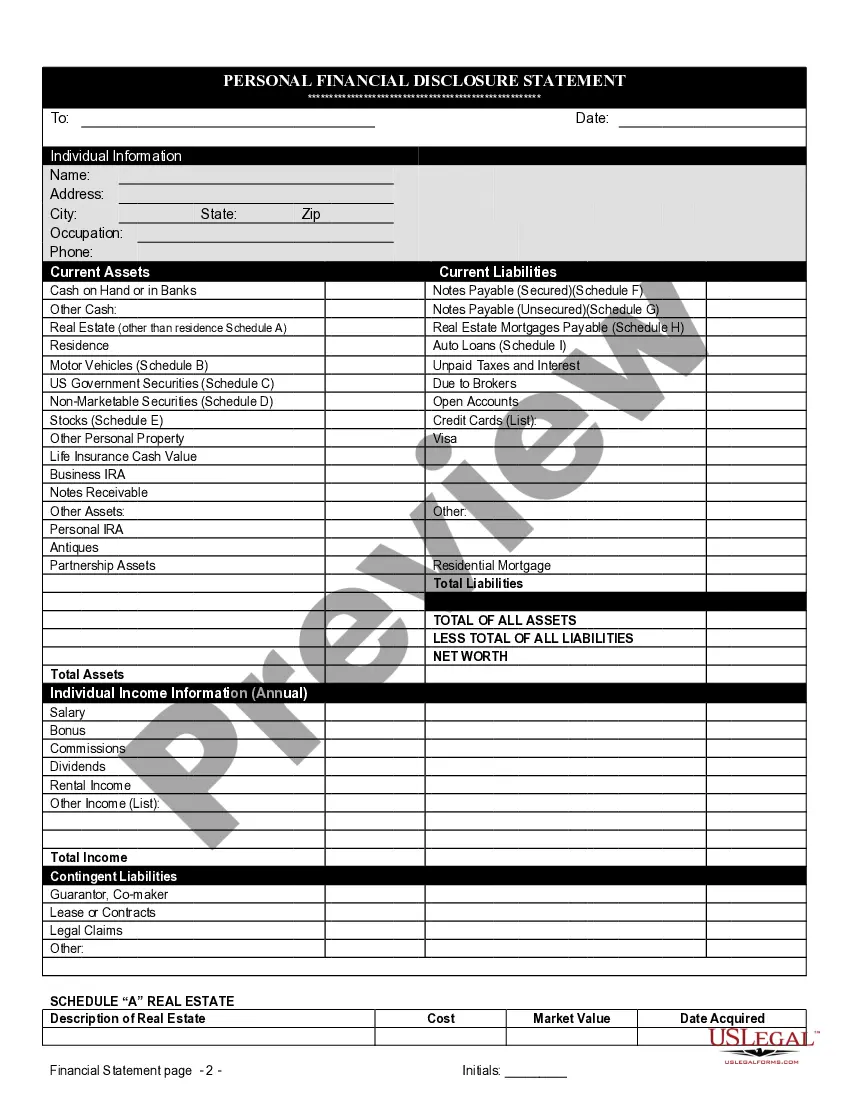

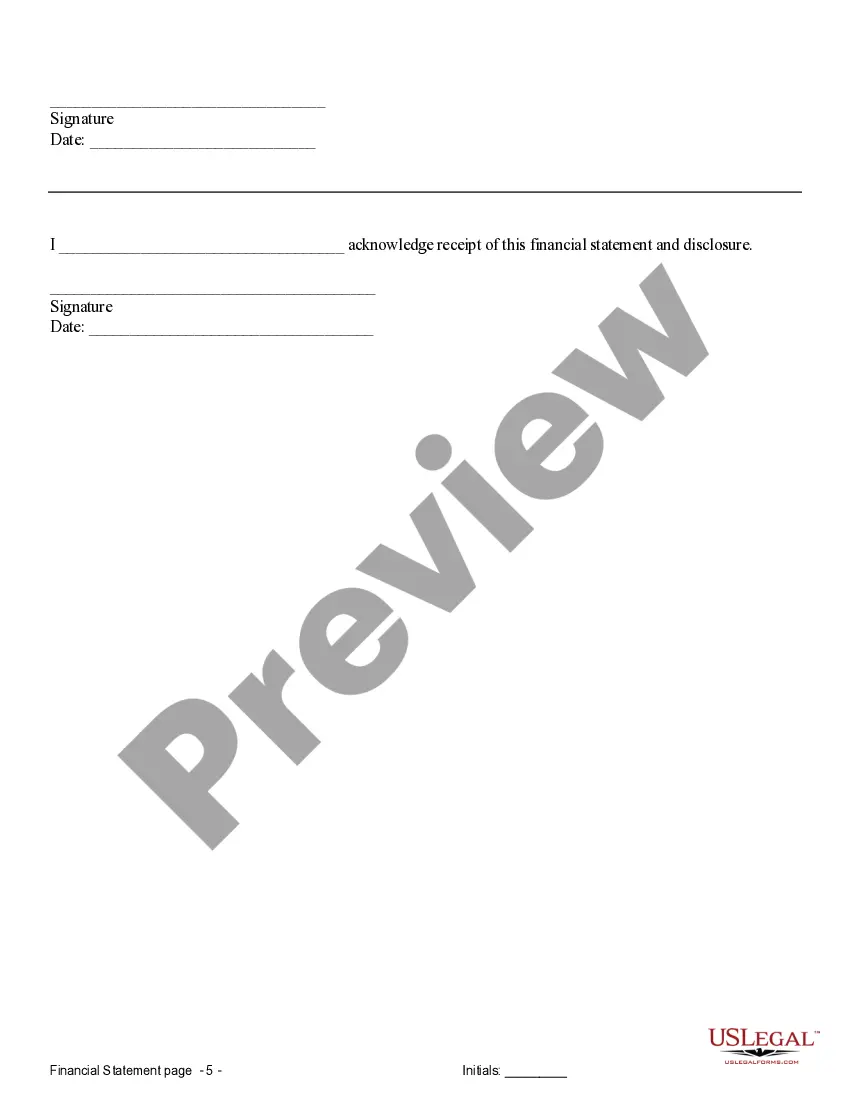

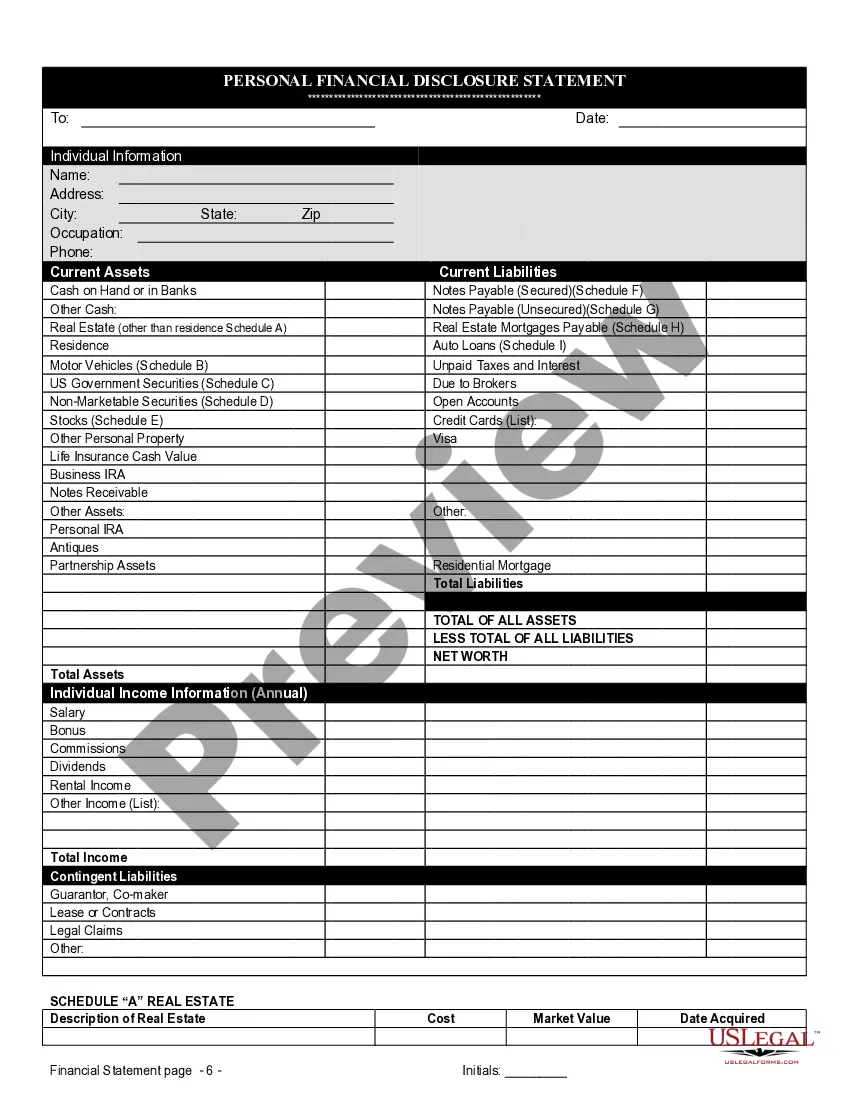

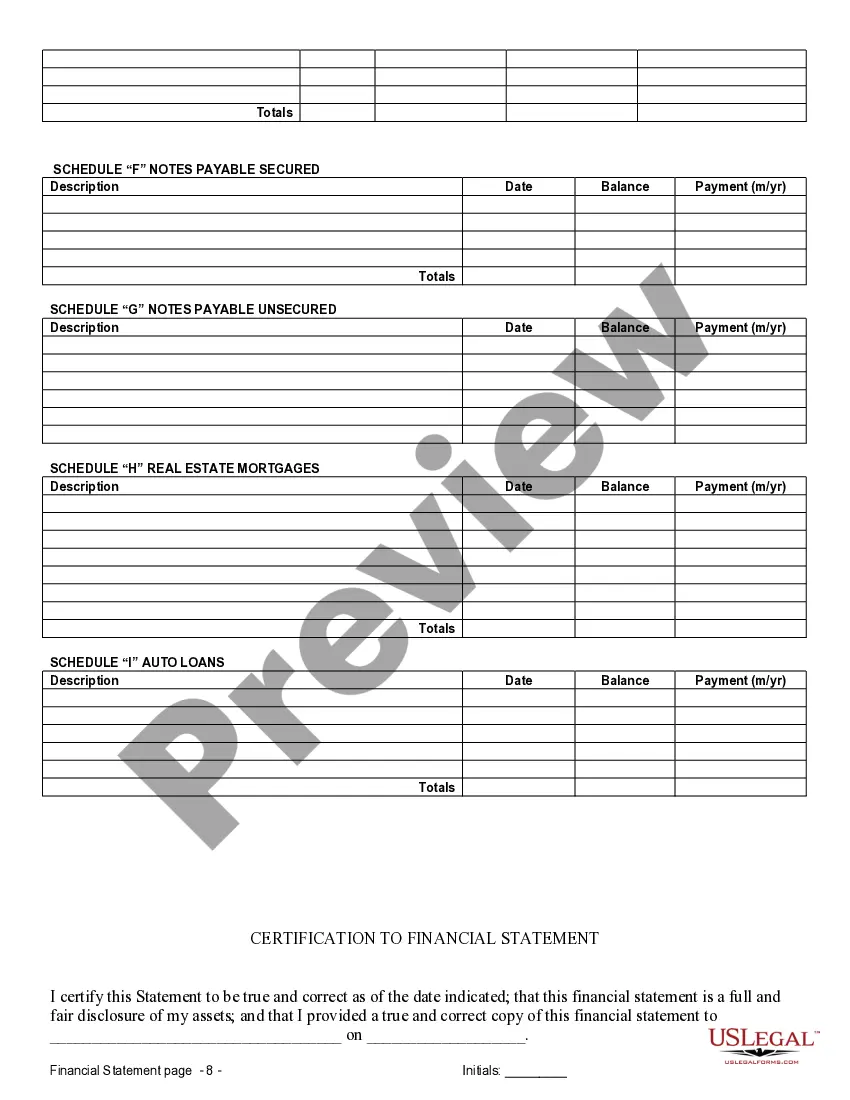

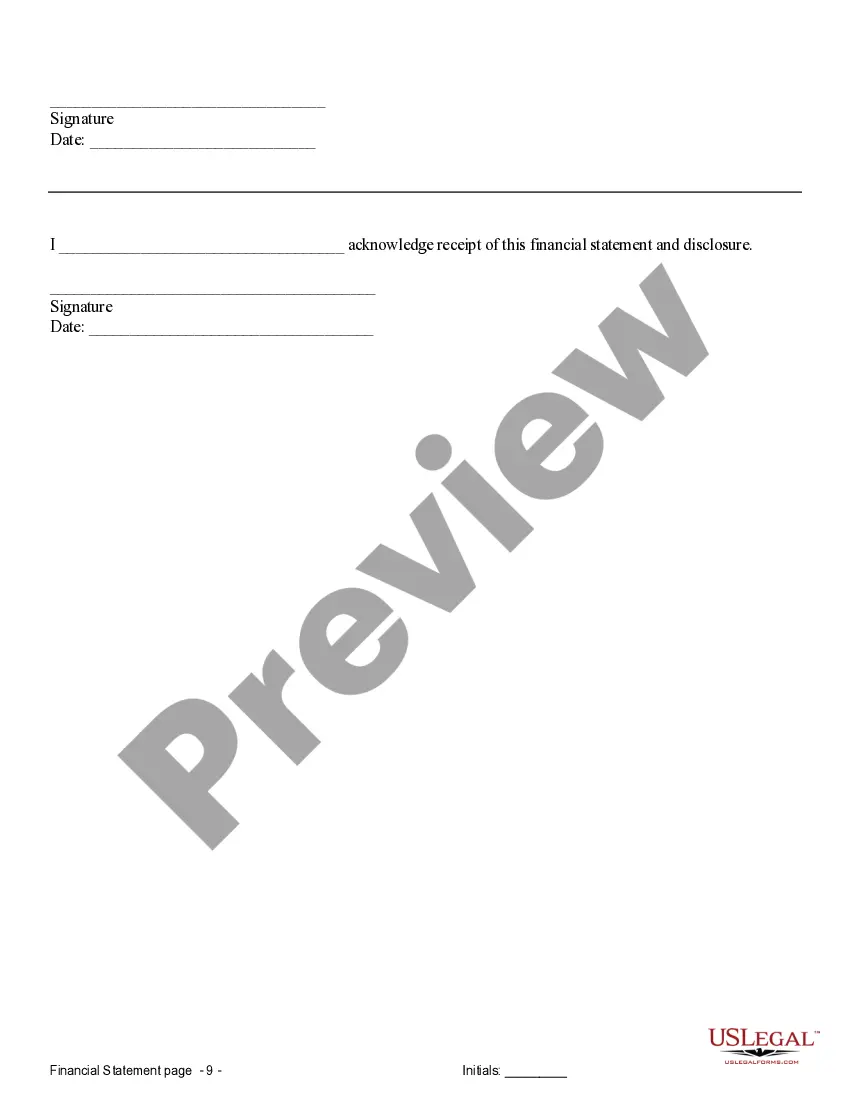

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

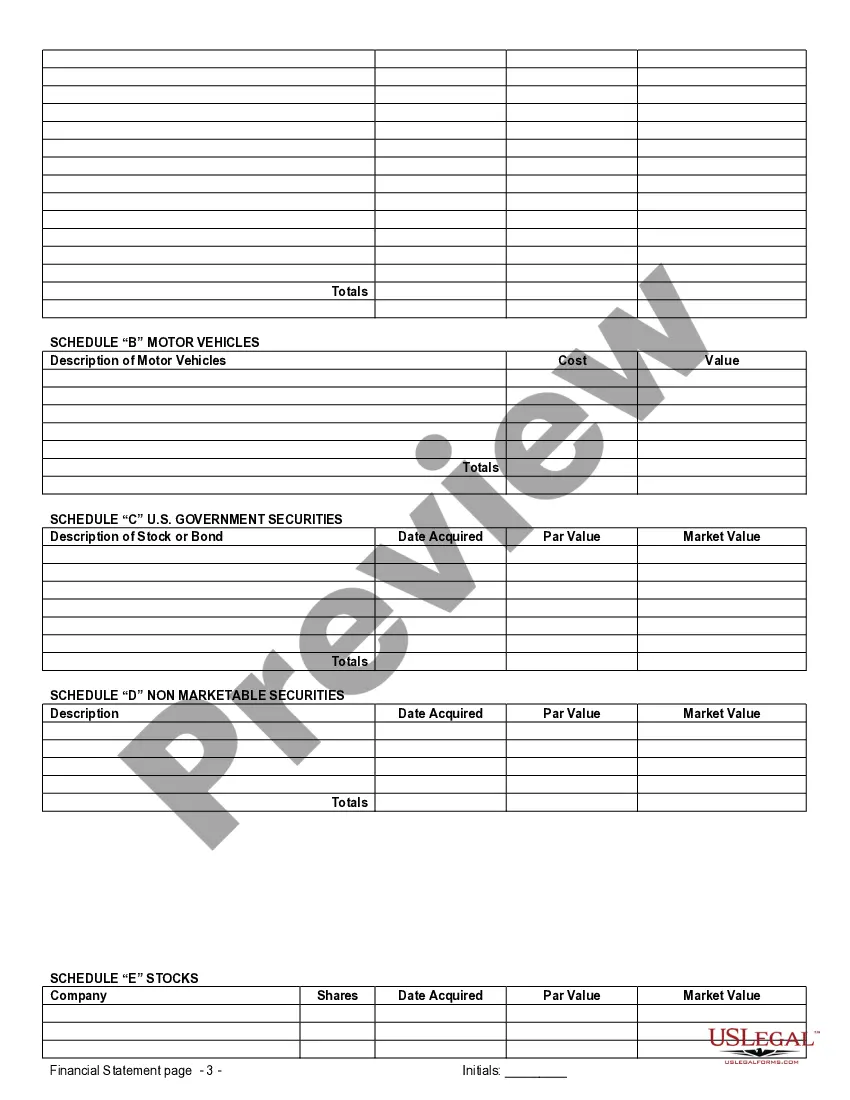

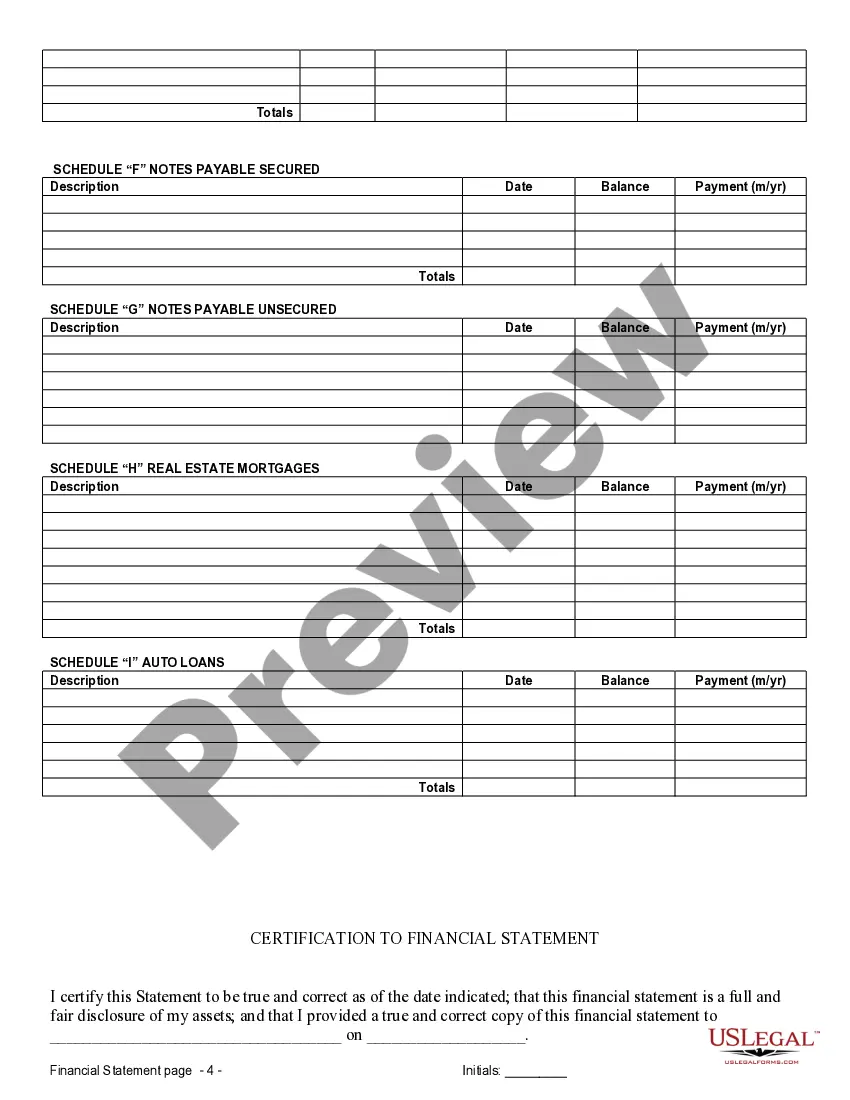

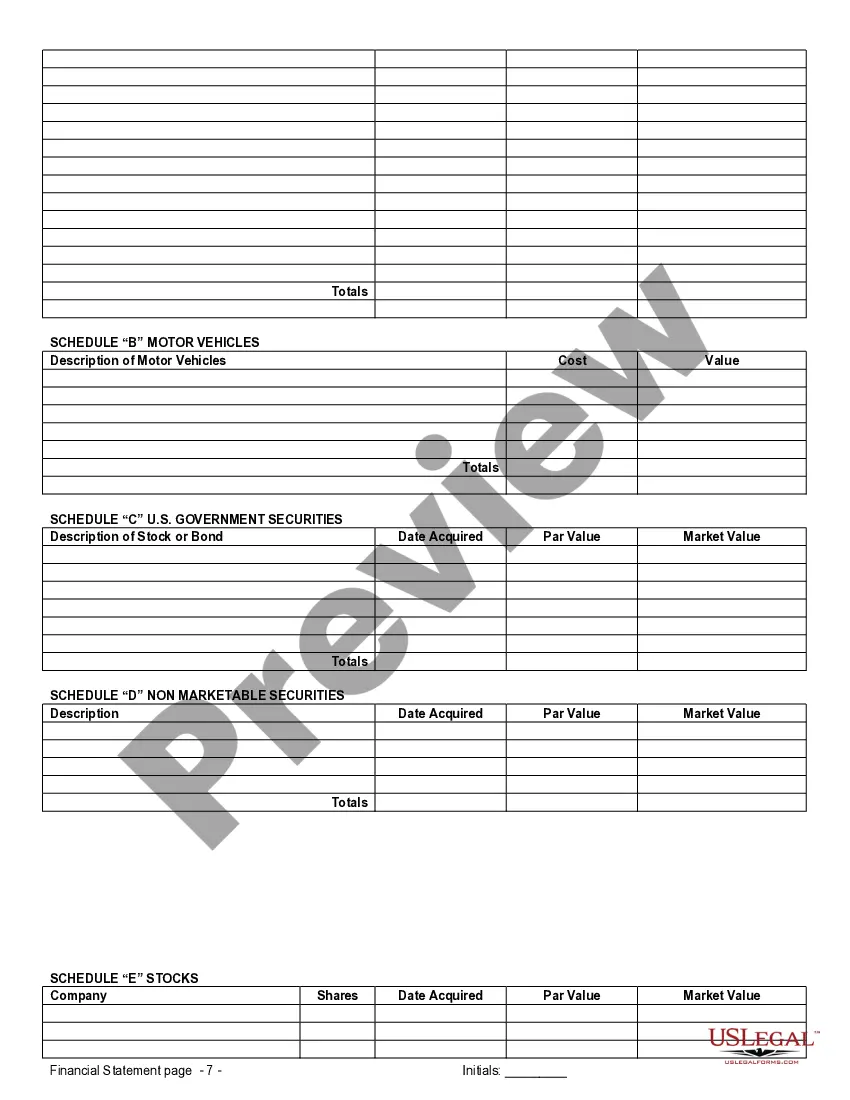

Port St. Lucie Florida Financial Statements only in Connection with Prenuptial Premarital Agreement are crucial documents that play a significant role in protecting the financial interests of both parties entering into a marriage. These statements provide a comprehensive overview of each individual's assets, liabilities, and financial obligations, ensuring transparency and facilitating fair distribution of assets in the event of divorce or separation. Here are some relevant keywords and types of financial statements related to this topic: 1. Port St. Lucie, Florida: Highlighting the specific location, this term helps to establish the context for the financial statements and cater to audiences specifically searching for information in this area. 2. Financial Statements: These documents represent a snapshot of an individual's financial standing, including their income, expenditures, assets, and debts. They provide a detailed account of one's financial situation and are essential for effective financial planning and decision-making. 3. Prenuptial Agreement: A prenuptial, or premarital, agreement is a legal contract entered into by a couple before their marriage. It outlines the division of assets, spousal support, and other financial considerations in case of divorce or separation. Financial statements are typically required when drafting this agreement to ensure an accurate assessment of each party's financial position. 4. Assets: Assets refer to any property, investments, savings, or other valuable possessions owned by an individual. It is crucial to list and identify all assets accurately in financial statements to determine their value and respective ownership. 5. Liabilities: Liabilities encompass any outstanding debts, loans, mortgages, or financial obligations that an individual may have. These should be clearly outlined in financial statements to ensure transparency and avoid disputes when dividing responsibilities during a separation. 6. Net Worth: Net worth is the difference between an individual's assets and liabilities, representing their overall financial standing or wealth. Calculating net worth is vital in prenuptial agreements as it assists in establishing a fair distribution of assets if the marriage ends. 7. Income and Expenses: Financial statements often include a breakdown of an individual's income sources and their monthly expenses. This information provides insight into an individual's financial stability and helps determine support levels in a prenuptial agreement. 8. Separate Property: When entering marriage, individuals may have certain assets or properties that they consider separate or non-marital. These are not subject to division in the event of divorce or separation but should still be disclosed in financial statements for clarity and transparency. 9. Business Interests: If either party owns a business or has investments in companies, it is crucial to disclose these interests in financial statements. This allows for appropriate evaluation of their value and determines how they will be handled in case of separation. 10. Retirement Accounts and Benefits: Financial statements should include details of any retirement accounts, pensions, or other retirement benefits that either party holds. These accounts can impact the division of assets and should be accurately assessed to ensure fair allocation. In conclusion, Port St. Lucie Florida Financial Statements only in Connection with Prenuptial Premarital Agreement are essential documents that provide a detailed overview of each party's financial situation when entering a marriage. They involve various types of statements, including assets, liabilities, net worth, income and expenses, separate property, business interests, and retirement accounts. These statements ensure transparency, protect individual financial interests, and facilitate fair decision-making in the event of divorce or separation.Port St. Lucie Florida Financial Statements only in Connection with Prenuptial Premarital Agreement are crucial documents that play a significant role in protecting the financial interests of both parties entering into a marriage. These statements provide a comprehensive overview of each individual's assets, liabilities, and financial obligations, ensuring transparency and facilitating fair distribution of assets in the event of divorce or separation. Here are some relevant keywords and types of financial statements related to this topic: 1. Port St. Lucie, Florida: Highlighting the specific location, this term helps to establish the context for the financial statements and cater to audiences specifically searching for information in this area. 2. Financial Statements: These documents represent a snapshot of an individual's financial standing, including their income, expenditures, assets, and debts. They provide a detailed account of one's financial situation and are essential for effective financial planning and decision-making. 3. Prenuptial Agreement: A prenuptial, or premarital, agreement is a legal contract entered into by a couple before their marriage. It outlines the division of assets, spousal support, and other financial considerations in case of divorce or separation. Financial statements are typically required when drafting this agreement to ensure an accurate assessment of each party's financial position. 4. Assets: Assets refer to any property, investments, savings, or other valuable possessions owned by an individual. It is crucial to list and identify all assets accurately in financial statements to determine their value and respective ownership. 5. Liabilities: Liabilities encompass any outstanding debts, loans, mortgages, or financial obligations that an individual may have. These should be clearly outlined in financial statements to ensure transparency and avoid disputes when dividing responsibilities during a separation. 6. Net Worth: Net worth is the difference between an individual's assets and liabilities, representing their overall financial standing or wealth. Calculating net worth is vital in prenuptial agreements as it assists in establishing a fair distribution of assets if the marriage ends. 7. Income and Expenses: Financial statements often include a breakdown of an individual's income sources and their monthly expenses. This information provides insight into an individual's financial stability and helps determine support levels in a prenuptial agreement. 8. Separate Property: When entering marriage, individuals may have certain assets or properties that they consider separate or non-marital. These are not subject to division in the event of divorce or separation but should still be disclosed in financial statements for clarity and transparency. 9. Business Interests: If either party owns a business or has investments in companies, it is crucial to disclose these interests in financial statements. This allows for appropriate evaluation of their value and determines how they will be handled in case of separation. 10. Retirement Accounts and Benefits: Financial statements should include details of any retirement accounts, pensions, or other retirement benefits that either party holds. These accounts can impact the division of assets and should be accurately assessed to ensure fair allocation. In conclusion, Port St. Lucie Florida Financial Statements only in Connection with Prenuptial Premarital Agreement are essential documents that provide a detailed overview of each party's financial situation when entering a marriage. They involve various types of statements, including assets, liabilities, net worth, income and expenses, separate property, business interests, and retirement accounts. These statements ensure transparency, protect individual financial interests, and facilitate fair decision-making in the event of divorce or separation.