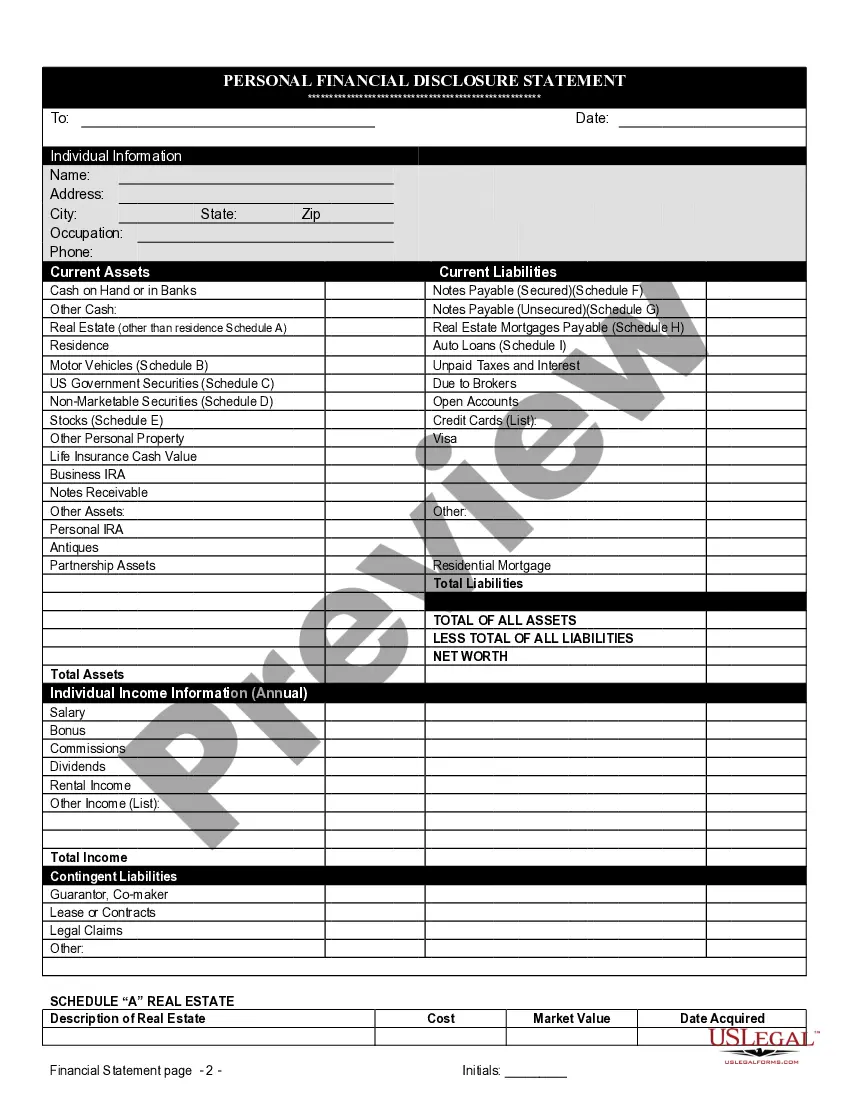

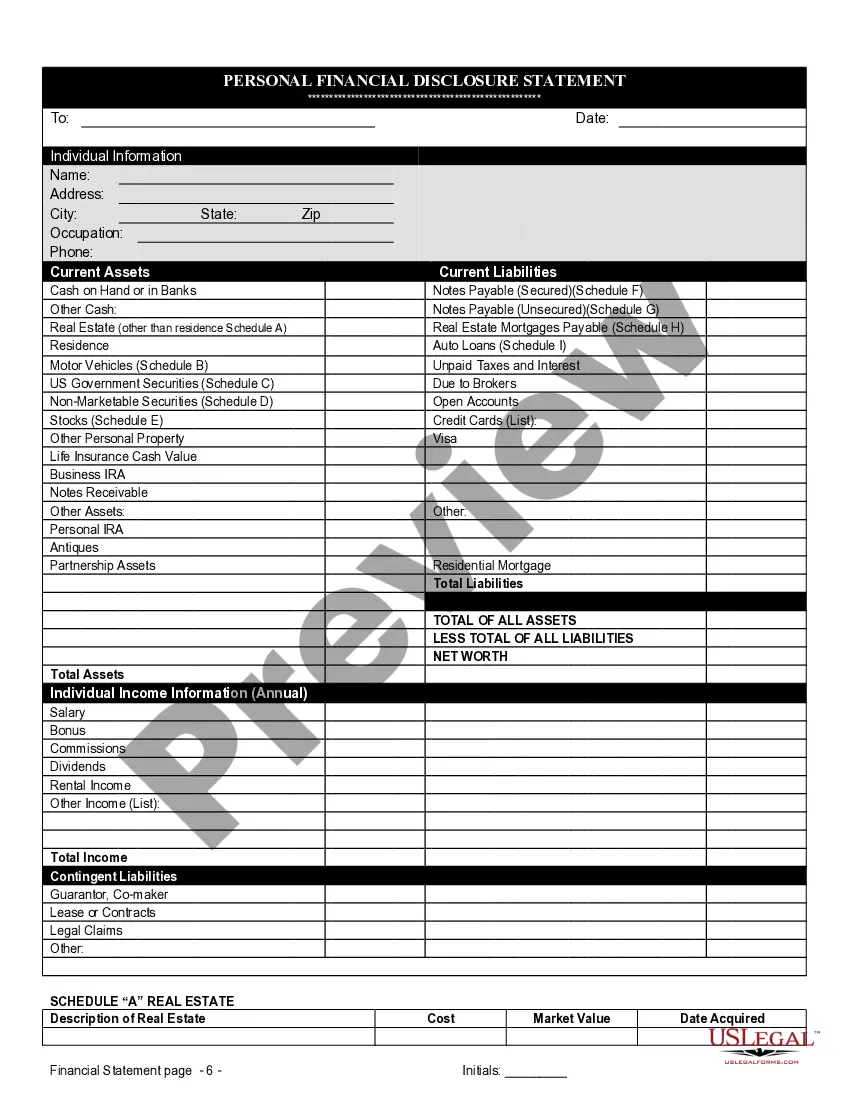

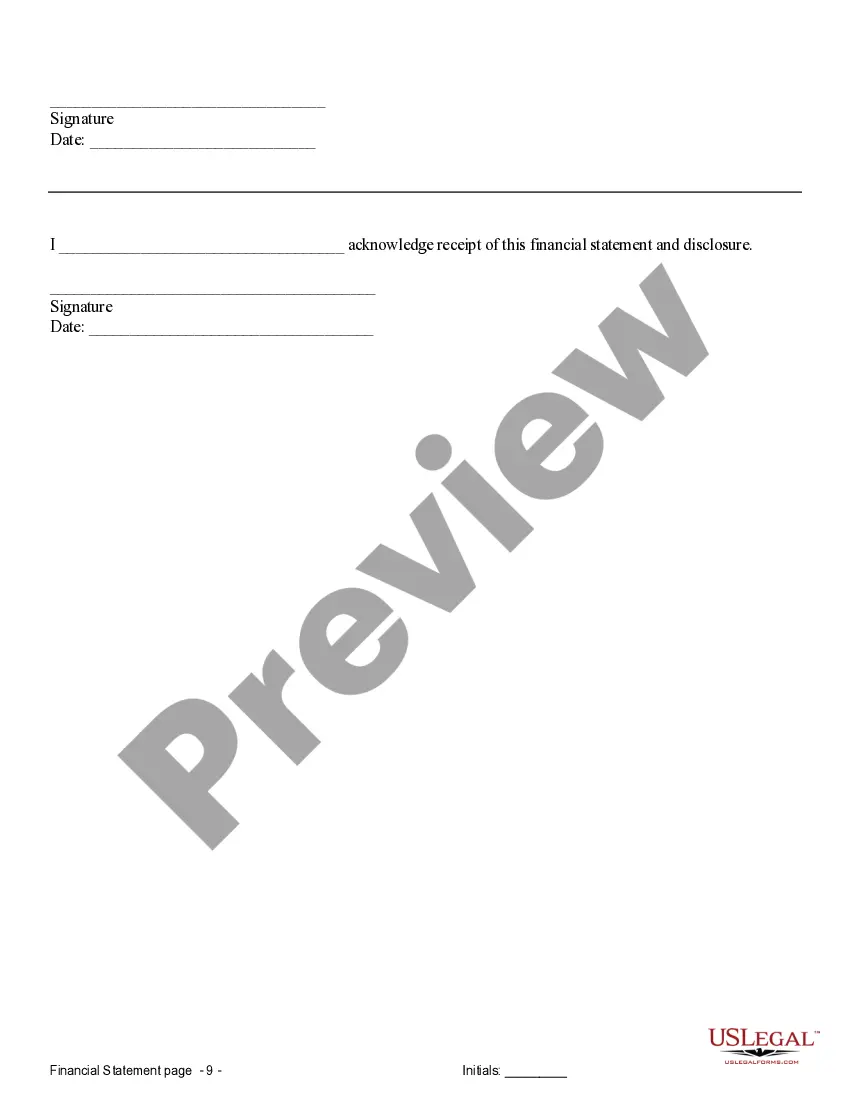

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

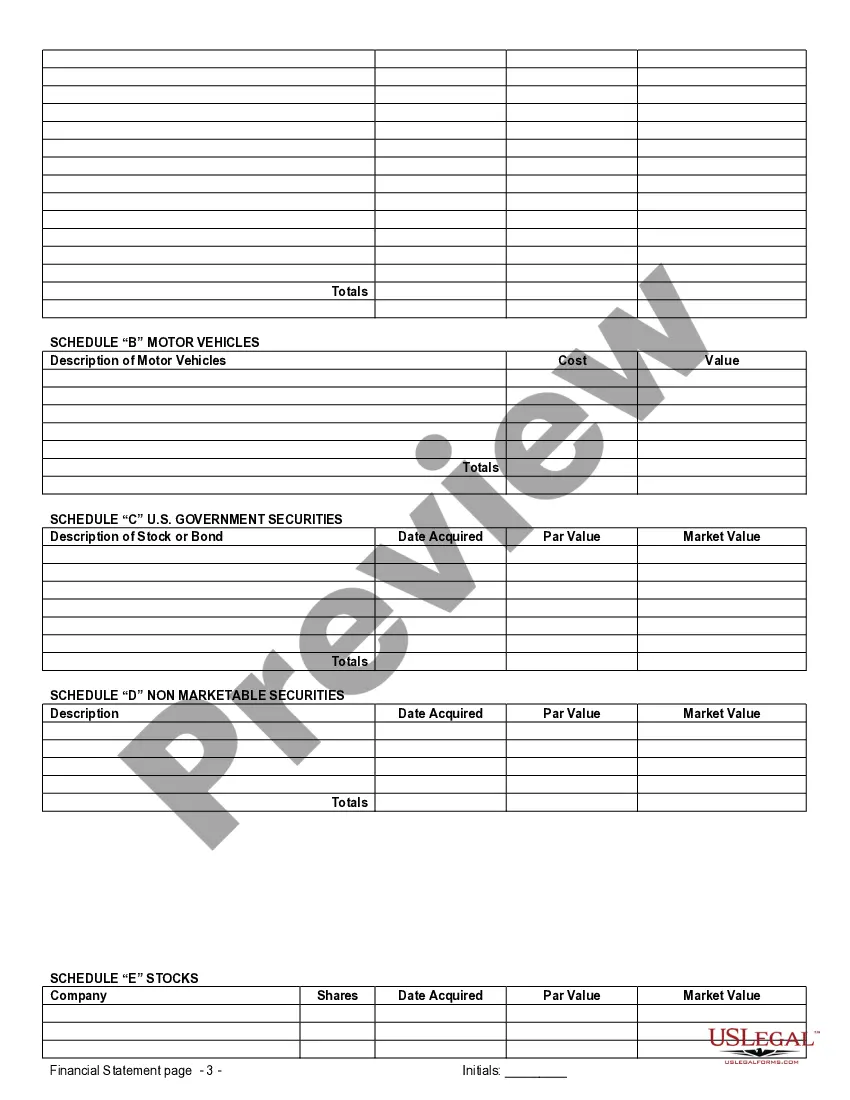

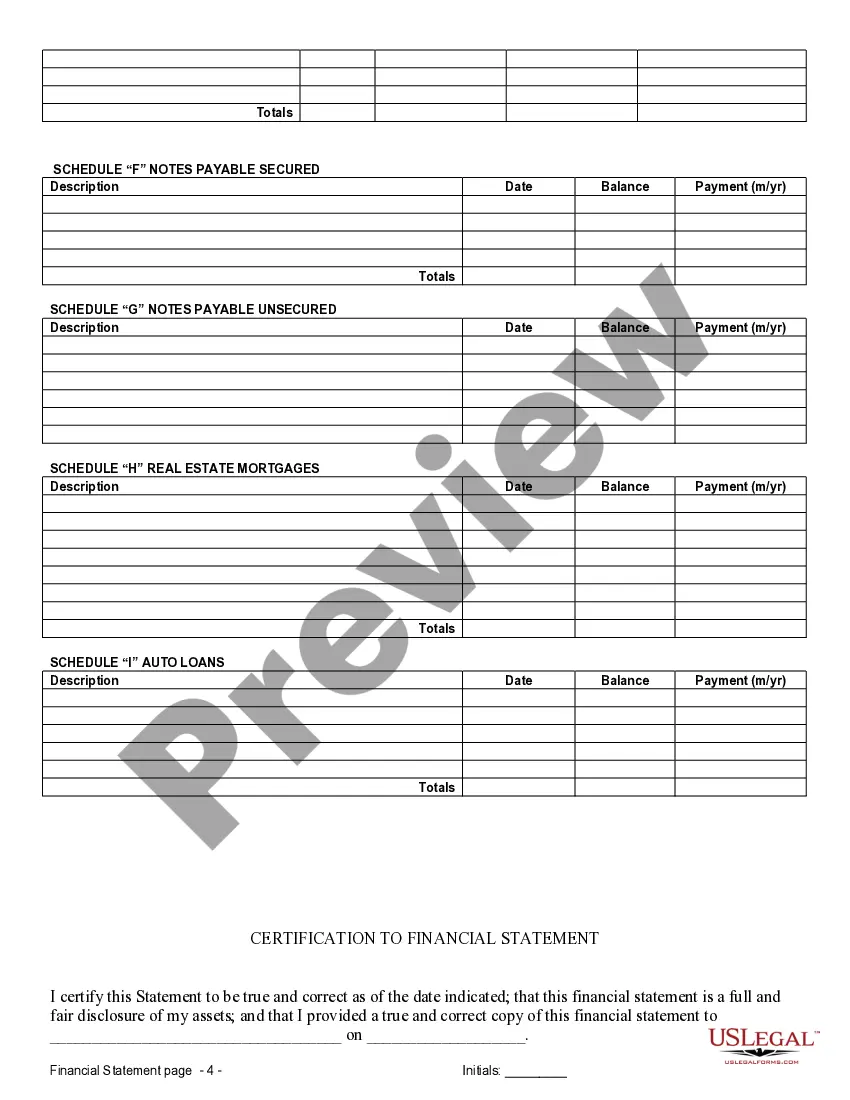

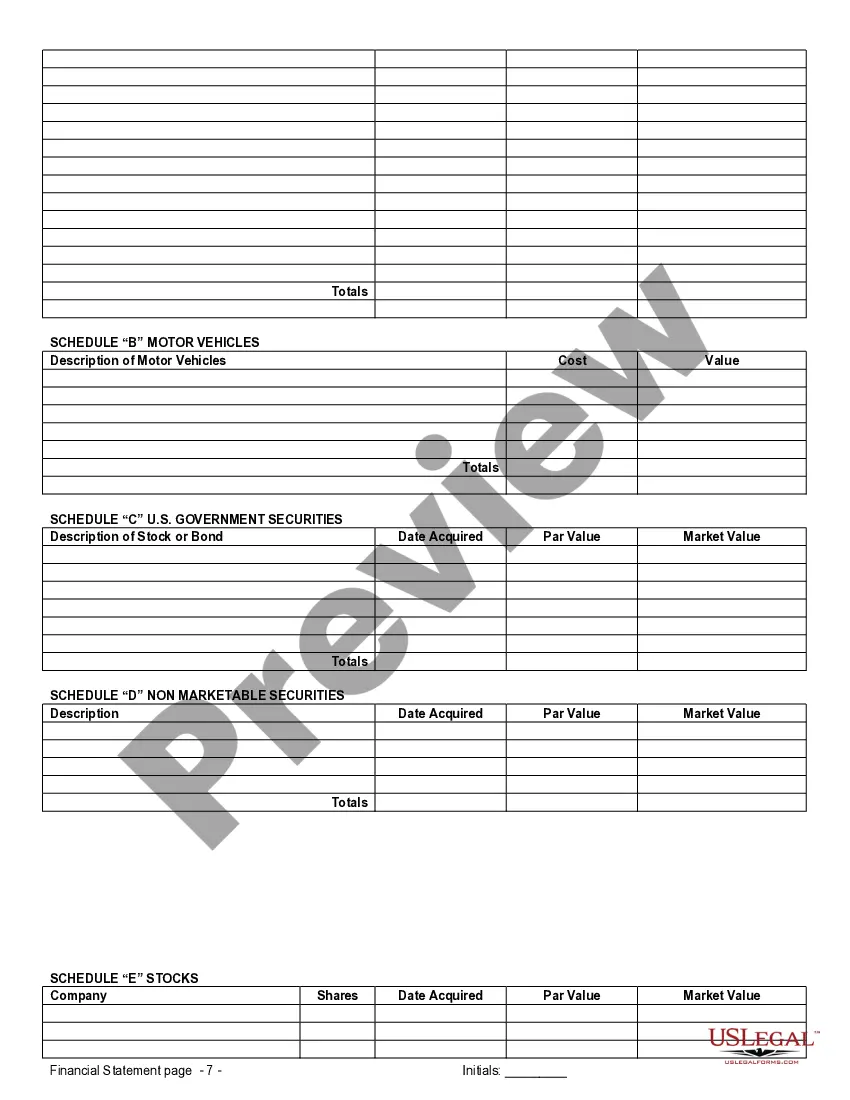

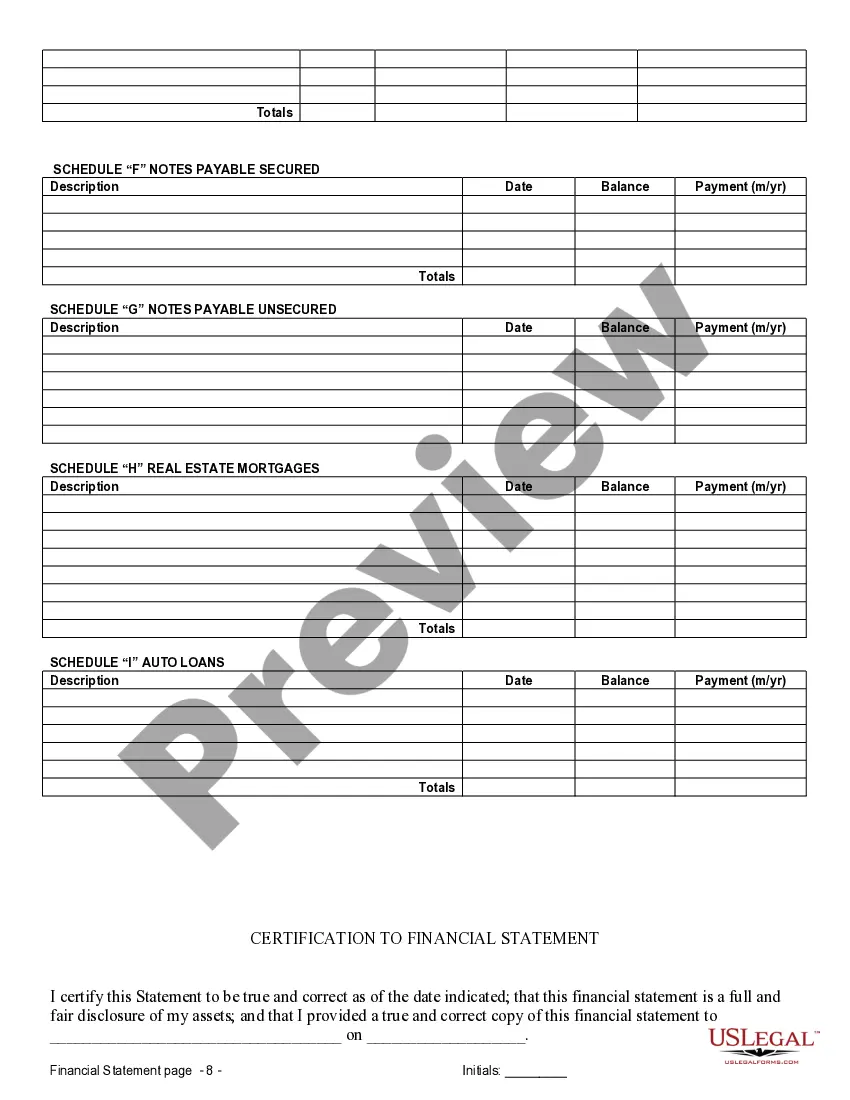

St. Petersburg Florida Financial Statements only in Connection with Prenuptial Premarital Agreement serve as crucial legal documents that outline the financial status of individuals entering into a prenuptial agreement. These statements provide a comprehensive overview of each party's assets, liabilities, income, and expenses, helping to establish a fair division of assets or obligations in case of divorce or separation. Here are different types of St. Petersburg Florida Financial Statements commonly used in connection with prenuptial or premarital agreements: 1. Personal Asset Statement: This document details the individual's personal assets such as real estate properties, investments, bank accounts, vehicles, and any other significant assets owned by each party. 2. Income Statement: This statement presents a breakdown of the individual's income sources, including employment salaries, business income, rental properties, investments, and any other sources of regular cash flow. 3. Liability Statement: This statement outlines any existing debts, loans, mortgages, or financial obligations held by each party, including credit card debt, student loans, or outstanding mortgage payments. 4. Business Financial Statement: If either or both parties own a business, this statement provides a comprehensive overview of the business's financial health, including revenue, expenses, assets, and liabilities. It may include profit and loss statements, balance sheets, and cash flow reports. 5. Tax Returns: Recent tax returns for each party play a significant role in disclosing income, deductions, and any financial obligations related to taxes. They are commonly requested to provide a comprehensive view of the individual's financial situation. 6. Bank Statements: Recent bank statements for both personal and business accounts are often required to verify income, expenses, and overall financial status. 7. Retirement Account Statements: Statements from retirement accounts, such as 401(k)s or IRAs, are necessary to evaluate the value and growth of these assets, ensuring a fair distribution in case of divorce or separation. 8. Property Deeds and Titles: Documents proving ownership for real estate properties, vehicles, or other valuable assets should be included to establish their existence and respective values. These St. Petersburg Florida Financial Statements are essential components of prenuptial or premarital agreements. They provide clear transparency about each party's financial circumstances, minimizing potential disputes and ensuring a fair understanding of how assets and liabilities will be handled during a potential future dissolution of the marriage. These statements should be prepared with the assistance of legal professionals to guarantee accuracy, completeness, and compliance with local laws and regulations.St. Petersburg Florida Financial Statements only in Connection with Prenuptial Premarital Agreement serve as crucial legal documents that outline the financial status of individuals entering into a prenuptial agreement. These statements provide a comprehensive overview of each party's assets, liabilities, income, and expenses, helping to establish a fair division of assets or obligations in case of divorce or separation. Here are different types of St. Petersburg Florida Financial Statements commonly used in connection with prenuptial or premarital agreements: 1. Personal Asset Statement: This document details the individual's personal assets such as real estate properties, investments, bank accounts, vehicles, and any other significant assets owned by each party. 2. Income Statement: This statement presents a breakdown of the individual's income sources, including employment salaries, business income, rental properties, investments, and any other sources of regular cash flow. 3. Liability Statement: This statement outlines any existing debts, loans, mortgages, or financial obligations held by each party, including credit card debt, student loans, or outstanding mortgage payments. 4. Business Financial Statement: If either or both parties own a business, this statement provides a comprehensive overview of the business's financial health, including revenue, expenses, assets, and liabilities. It may include profit and loss statements, balance sheets, and cash flow reports. 5. Tax Returns: Recent tax returns for each party play a significant role in disclosing income, deductions, and any financial obligations related to taxes. They are commonly requested to provide a comprehensive view of the individual's financial situation. 6. Bank Statements: Recent bank statements for both personal and business accounts are often required to verify income, expenses, and overall financial status. 7. Retirement Account Statements: Statements from retirement accounts, such as 401(k)s or IRAs, are necessary to evaluate the value and growth of these assets, ensuring a fair distribution in case of divorce or separation. 8. Property Deeds and Titles: Documents proving ownership for real estate properties, vehicles, or other valuable assets should be included to establish their existence and respective values. These St. Petersburg Florida Financial Statements are essential components of prenuptial or premarital agreements. They provide clear transparency about each party's financial circumstances, minimizing potential disputes and ensuring a fair understanding of how assets and liabilities will be handled during a potential future dissolution of the marriage. These statements should be prepared with the assistance of legal professionals to guarantee accuracy, completeness, and compliance with local laws and regulations.