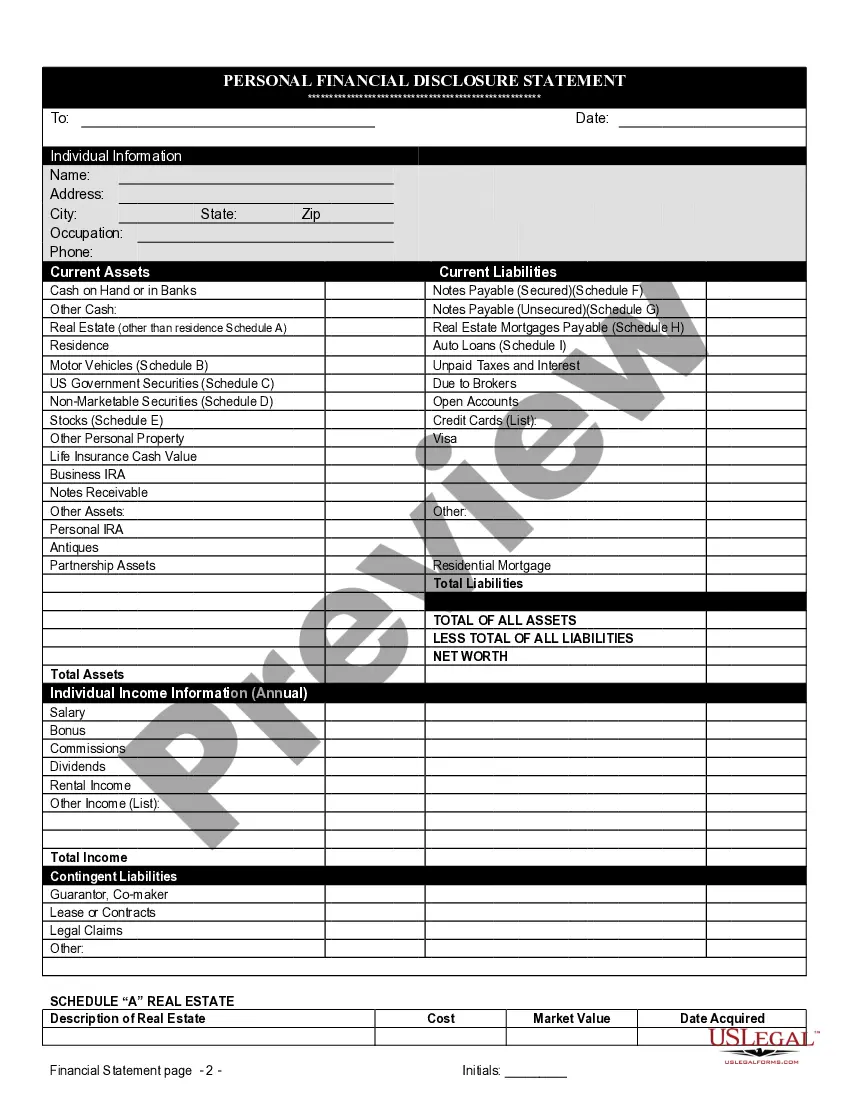

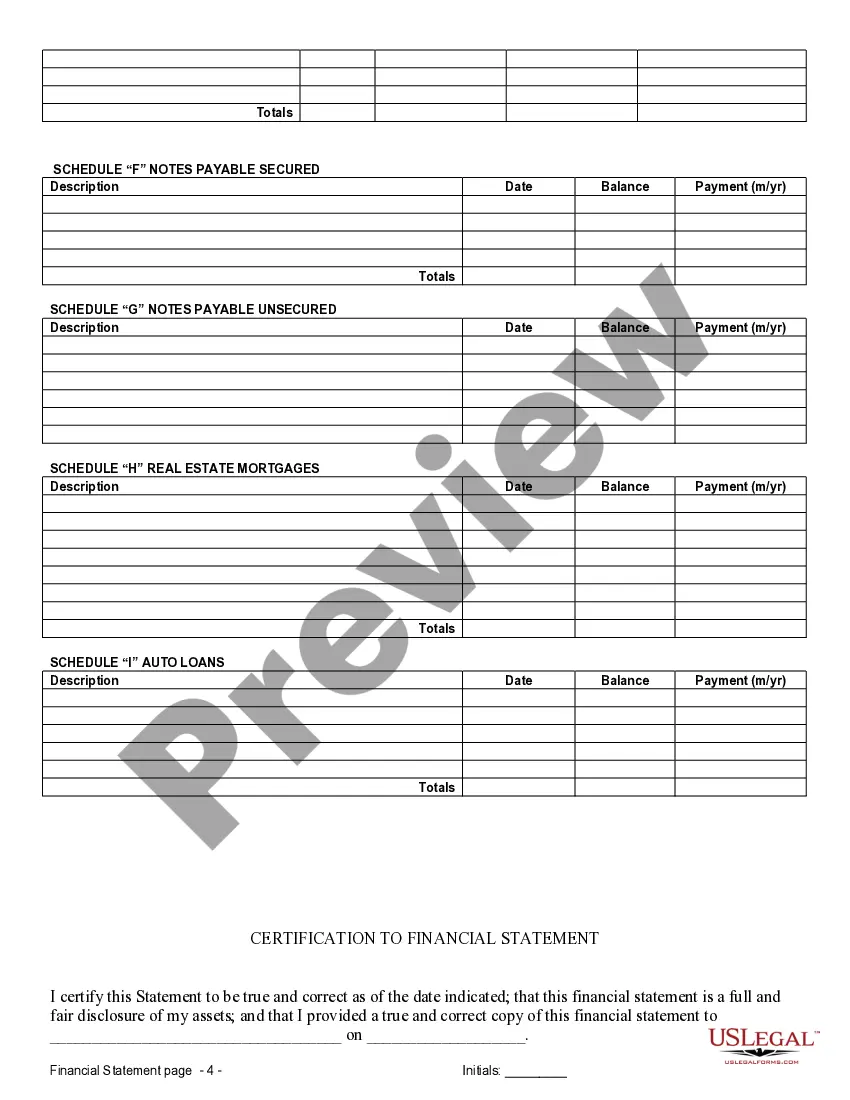

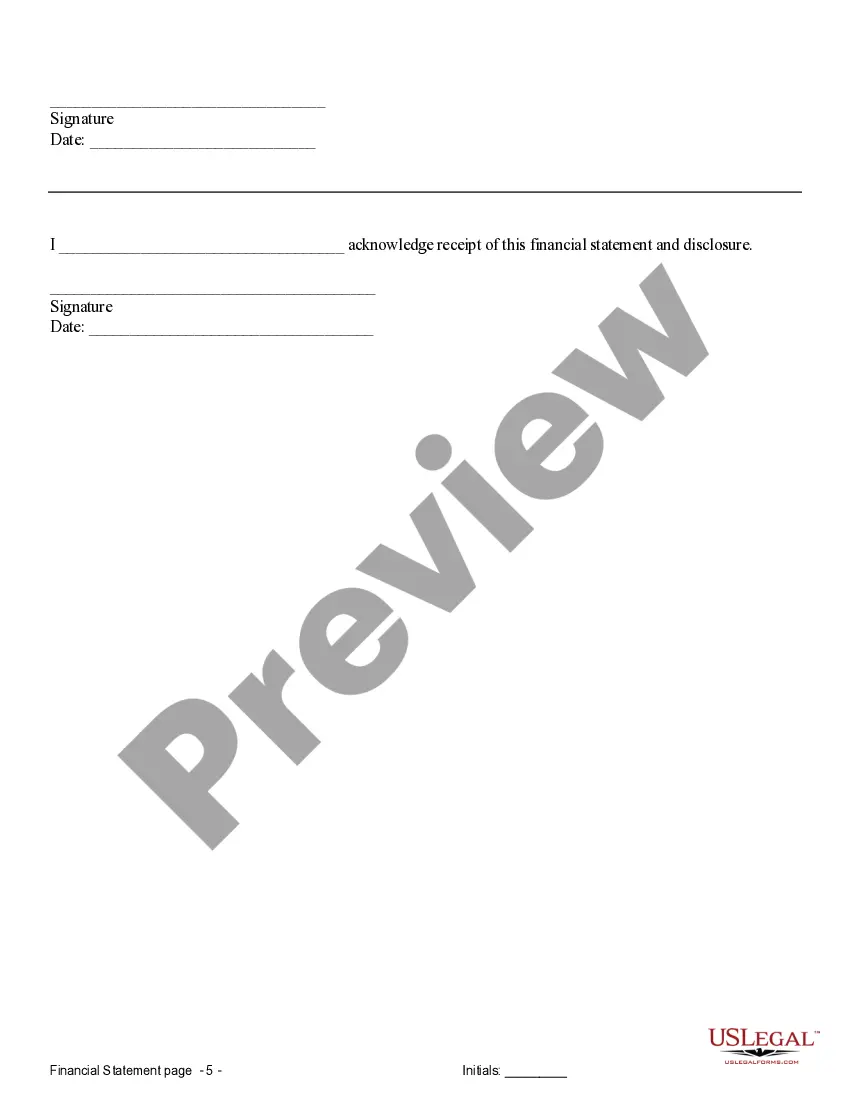

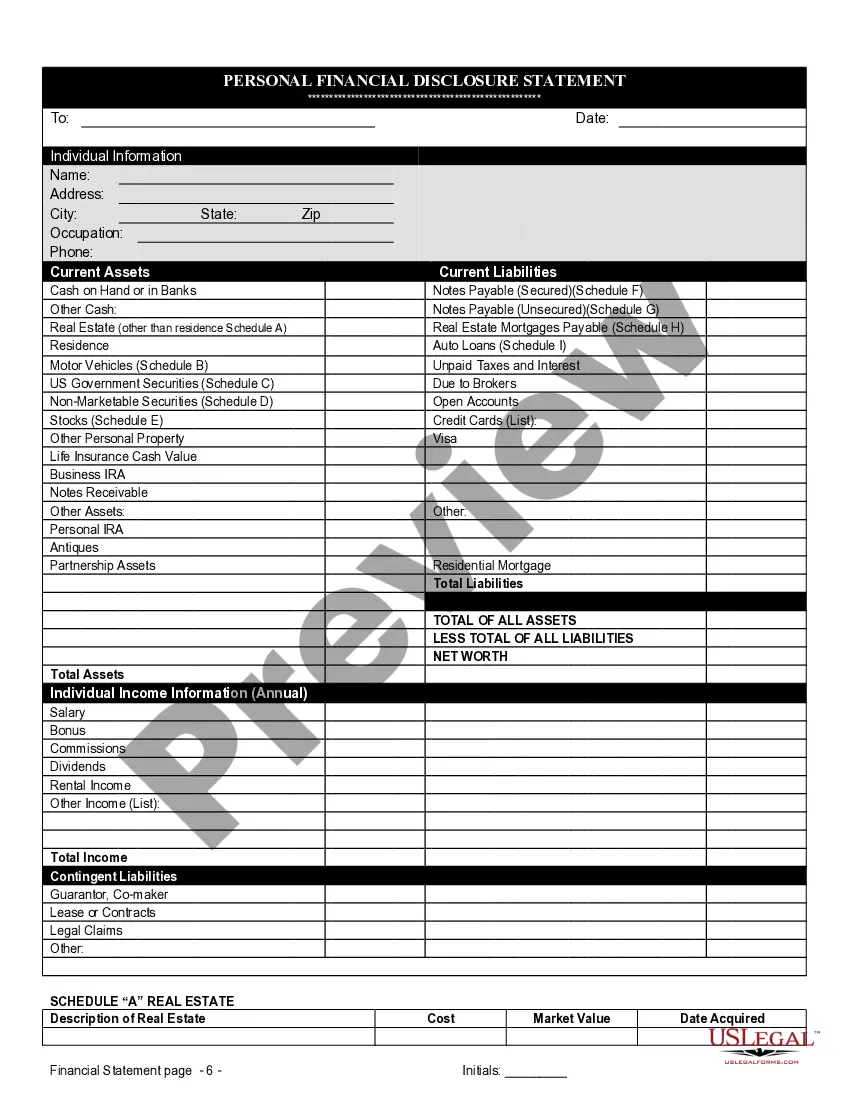

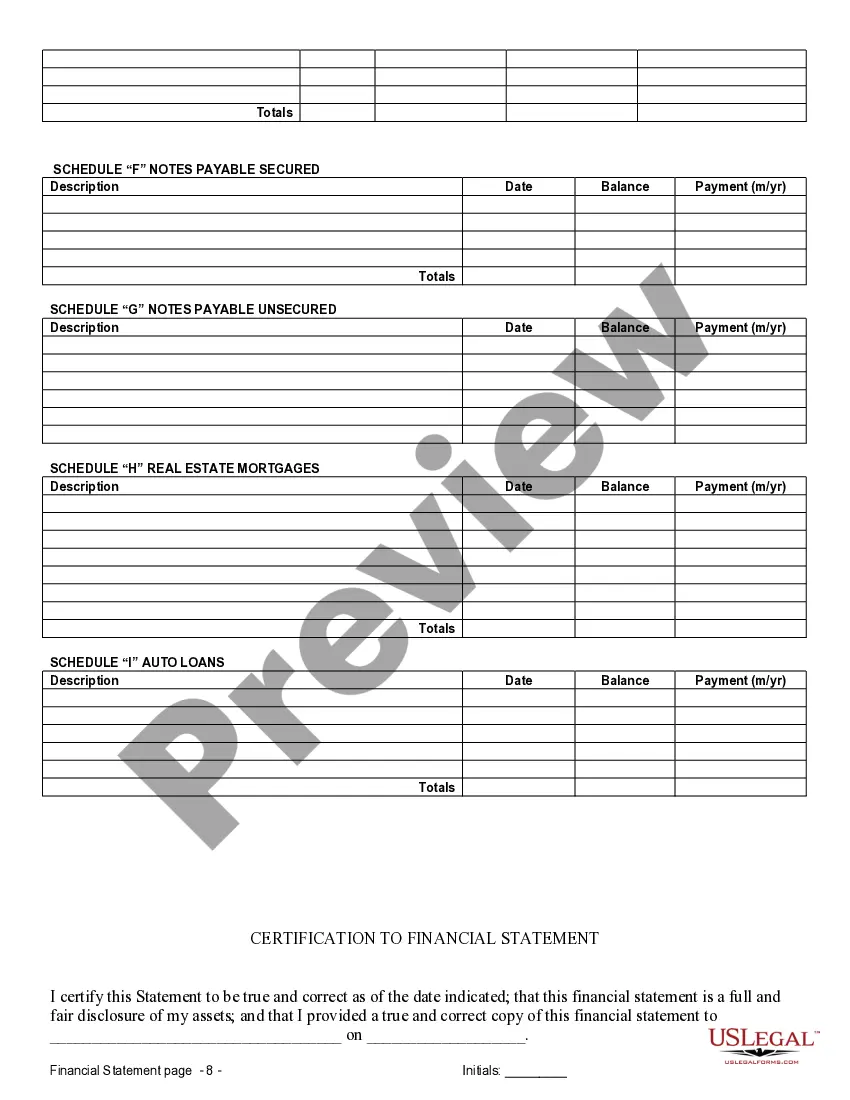

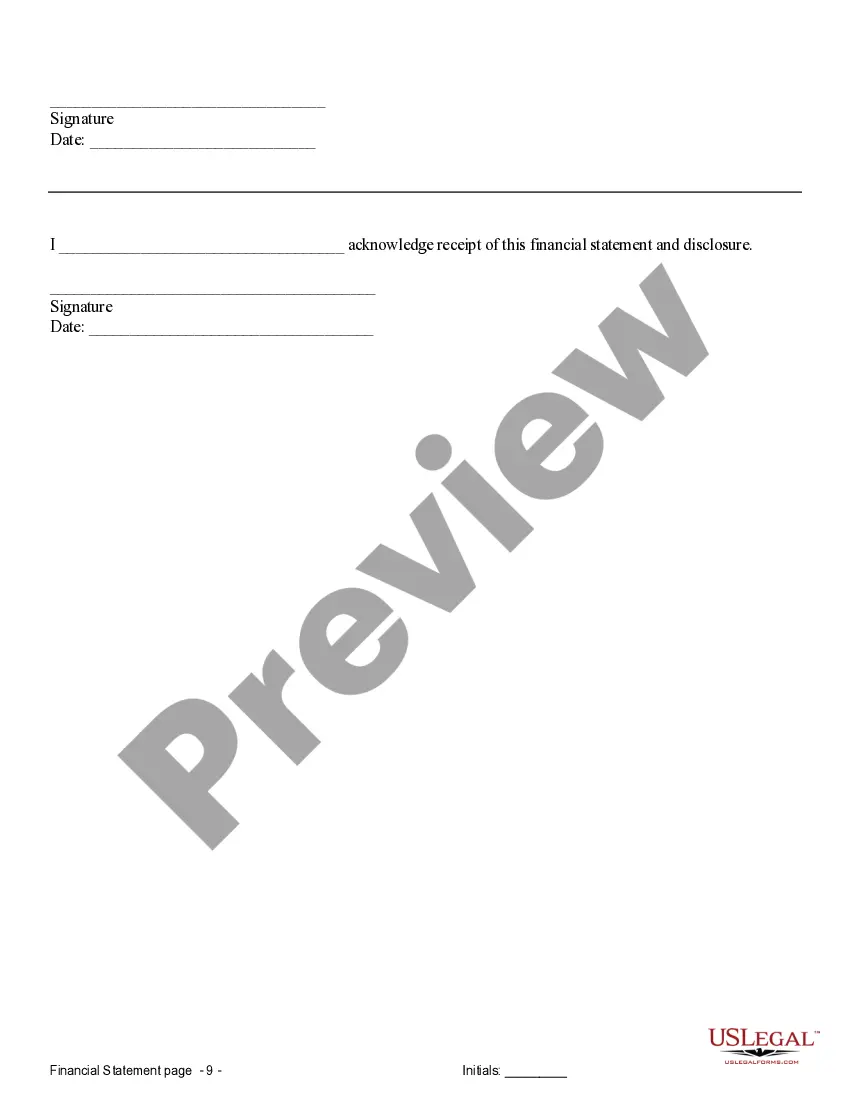

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

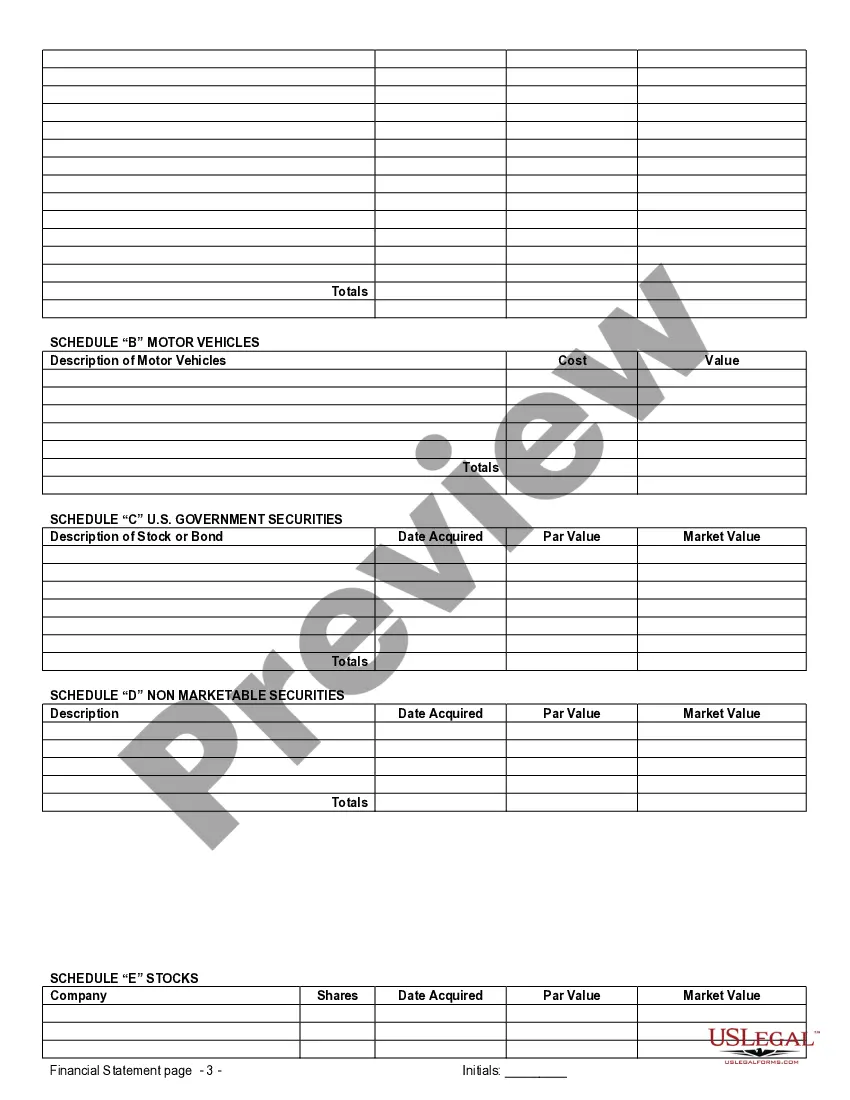

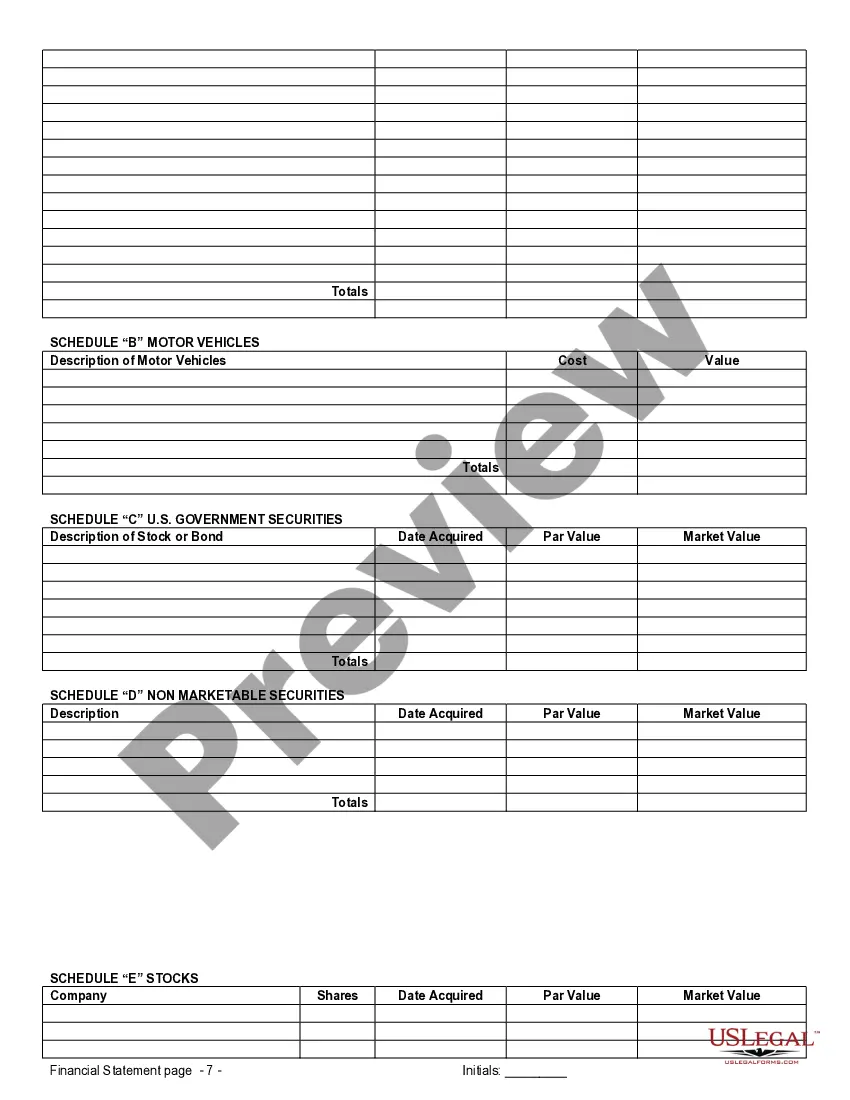

Title: Understanding Tallahassee Florida Financial Statements in Connection with Prenuptial Premarital Agreements Description: If you are considering a prenuptial or premarital agreement in Tallahassee, Florida, it is crucial to understand the concept of financial statements and their significance in the agreement. Financial statements provide a comprehensive overview of each party's financial situation, assets, liabilities, and income. In this article, we will explore the different types of Tallahassee Florida financial statements that are typically used in connection with prenuptial or premarital agreements. 1. Balance Sheet: A balance sheet is a vital component of a financial statement and includes a snapshot of an individual's or couple's financial worth. It encompasses assets, such as real estate, investments, bank accounts, personal property, and liabilities, such as mortgages, loans, or credit card debts. The balance sheet assists in determining the division of assets in the event of a divorce or separation. 2. Income Statement: The income statement focuses on the income and expenses of an individual or couple. It provides a detailed breakdown of various sources of income, including salaries, investments, rental income, or business profits. Additionally, it outlines expenses such as rent or mortgage payments, utilities, insurance, taxes, and other everyday expenditures. The income statement demonstrates the financial capacity of each party and ensures a fair distribution of income-related responsibilities in the prenuptial agreement. 3. Statement of Net Worth: The statement of net worth is a comprehensive financial statement that combines elements of both balance sheet and income statement. It reveals an individual's or couple's net worth by subtracting liabilities from assets, while also taking into account income and expenses. This statement helps ascertain the overall financial health and can be used as a reference point for determining spousal support or other financial obligations. 4. Credit Report: A credit report is an important component of financial statements as it provides a comprehensive overview of an individual or couple's credit history. It includes information about outstanding debts, loan payments, credit card history, bankruptcies, and other financial obligations. Reviewing credit reports is essential to assess each party's financial reliability and identify any potential issues that may impact future financial stability. In conclusion, Tallahassee Florida financial statements hold great significance when entering into a prenuptial or premarital agreement. By thoroughly understanding and including these statements in the agreement, couples can establish a fair and comprehensive understanding of each other's financial situation. This transparent approach ensures financial security and facilitates a smoother resolution in the event of divorce or separation. Keywords: Tallahassee Florida, financial statements, prenuptial agreement, premarital agreement, balance sheet, income statement, statement of net worth, credit report, financial worth, assets, liabilities, income, expenses, divorce, separation, financial security.Title: Understanding Tallahassee Florida Financial Statements in Connection with Prenuptial Premarital Agreements Description: If you are considering a prenuptial or premarital agreement in Tallahassee, Florida, it is crucial to understand the concept of financial statements and their significance in the agreement. Financial statements provide a comprehensive overview of each party's financial situation, assets, liabilities, and income. In this article, we will explore the different types of Tallahassee Florida financial statements that are typically used in connection with prenuptial or premarital agreements. 1. Balance Sheet: A balance sheet is a vital component of a financial statement and includes a snapshot of an individual's or couple's financial worth. It encompasses assets, such as real estate, investments, bank accounts, personal property, and liabilities, such as mortgages, loans, or credit card debts. The balance sheet assists in determining the division of assets in the event of a divorce or separation. 2. Income Statement: The income statement focuses on the income and expenses of an individual or couple. It provides a detailed breakdown of various sources of income, including salaries, investments, rental income, or business profits. Additionally, it outlines expenses such as rent or mortgage payments, utilities, insurance, taxes, and other everyday expenditures. The income statement demonstrates the financial capacity of each party and ensures a fair distribution of income-related responsibilities in the prenuptial agreement. 3. Statement of Net Worth: The statement of net worth is a comprehensive financial statement that combines elements of both balance sheet and income statement. It reveals an individual's or couple's net worth by subtracting liabilities from assets, while also taking into account income and expenses. This statement helps ascertain the overall financial health and can be used as a reference point for determining spousal support or other financial obligations. 4. Credit Report: A credit report is an important component of financial statements as it provides a comprehensive overview of an individual or couple's credit history. It includes information about outstanding debts, loan payments, credit card history, bankruptcies, and other financial obligations. Reviewing credit reports is essential to assess each party's financial reliability and identify any potential issues that may impact future financial stability. In conclusion, Tallahassee Florida financial statements hold great significance when entering into a prenuptial or premarital agreement. By thoroughly understanding and including these statements in the agreement, couples can establish a fair and comprehensive understanding of each other's financial situation. This transparent approach ensures financial security and facilitates a smoother resolution in the event of divorce or separation. Keywords: Tallahassee Florida, financial statements, prenuptial agreement, premarital agreement, balance sheet, income statement, statement of net worth, credit report, financial worth, assets, liabilities, income, expenses, divorce, separation, financial security.