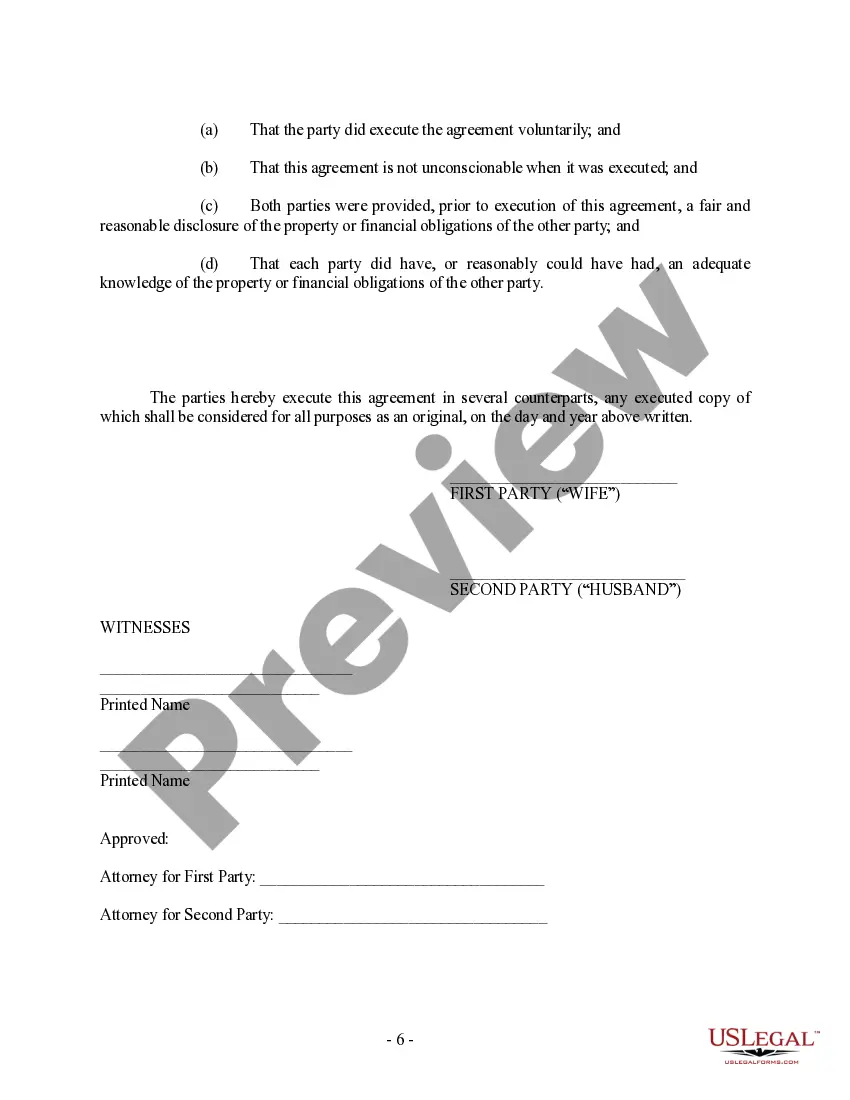

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

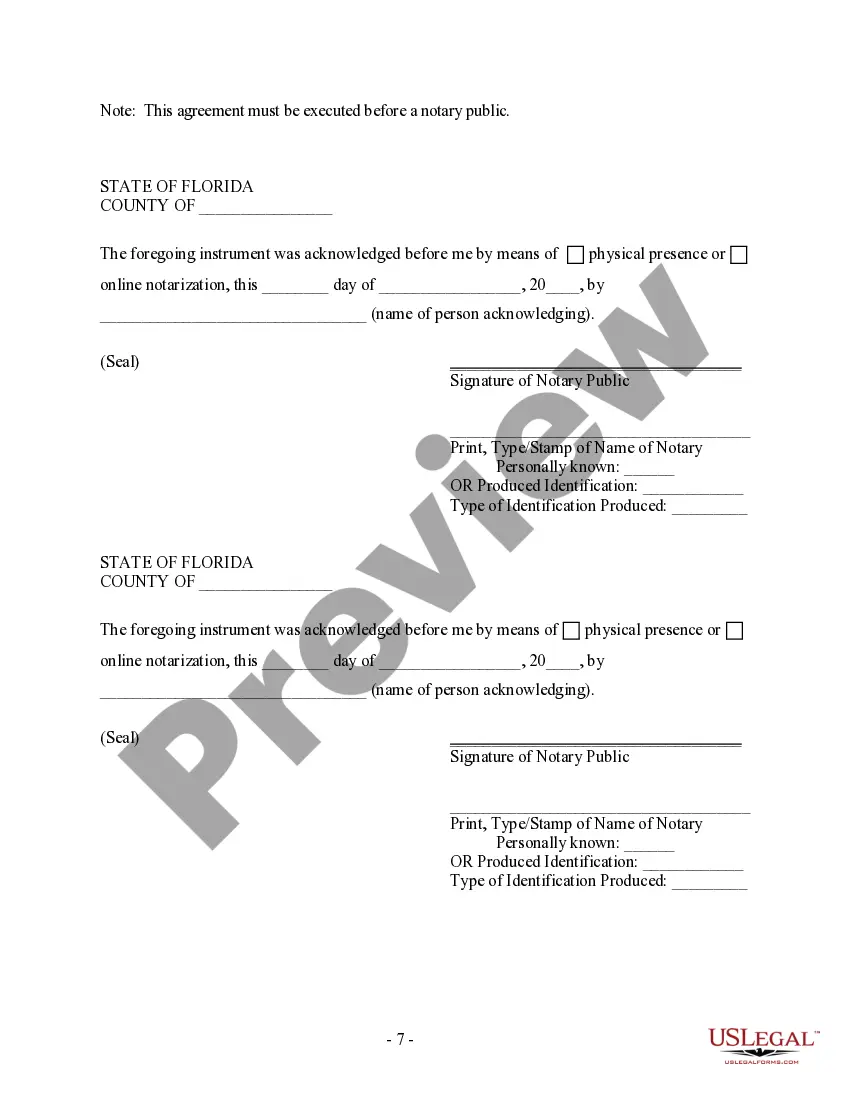

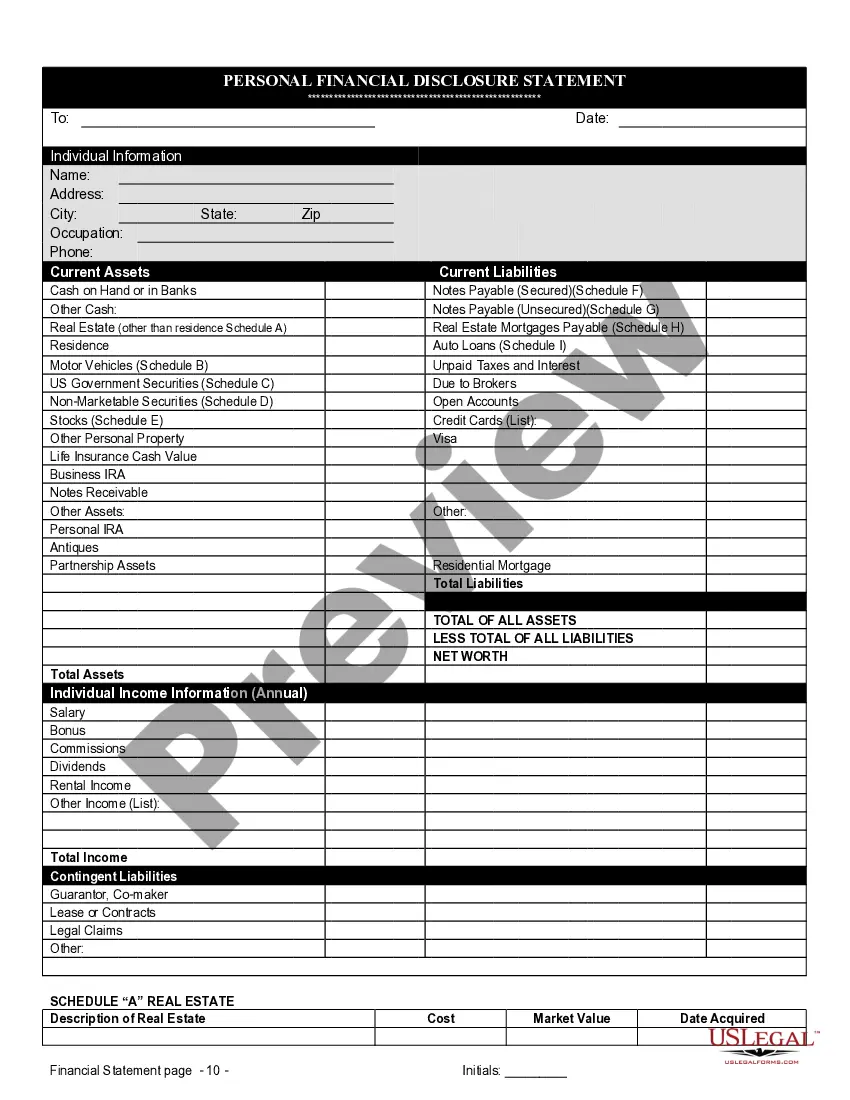

Hialeah, Florida Prenuptial Premarital Agreement with Financial Statements: A Comprehensive Overview A Hialeah, Florida prenuptial premarital agreement with financial statements is a legally binding contract that is specifically designed to protect the interests of both parties in the event of a divorce or separation. This agreement is signed by a couple prior to their marriage or civil partnership and outlines the division of assets, property, debts, and spousal support in case the relationship ends. In Hialeah, Florida, couples opting for a prenuptial premarital agreement greatly benefit from the clarity and transparency it offers when it comes to financial matters. By establishing clear expectations and intentions at the beginning of a marriage, this agreement helps alleviate potential conflicts and uncertainties down the line. Key components of a Hialeah, Florida prenuptial premarital agreement include: 1. Definitions: This section clearly defines the terms used throughout the agreement, ensuring that both parties have a shared understanding of all key aspects. 2. Assets and Property Division: The agreement outlines how the couple's assets, including real estate, investments, businesses, vehicles, and personal belongings, will be divided in case of divorce. It may specify the percentage distribution, the party responsible for any debts associated with certain assets, and any provisions for potential future acquisitions. 3. Debts and Liabilities: This section addresses the division of debts, such as credit card debts, mortgages, student loans, and any possible financial obligations incurred during the marriage. By outlining how these debts will be allocated, both partners have a clear understanding of their financial responsibilities. 4. Alimony and Spousal Support: A prenuptial premarital agreement can establish predetermined terms for alimony or spousal support, should the marriage dissolve. It may specify the duration, amount, and manner of payment. However, child support cannot be predetermined in a prenuptial agreement, as it involves the legal rights and responsibilities towards children, which must be determined by a court in the best interest of the child. 5. Financial Disclosure: Full and accurate financial disclosure is a critical aspect of a prenuptial premarital agreement in Hialeah, Florida. Both parties are required to provide detailed financial statements, including assets, liabilities, income, and expenses. This transparency ensures that each partner enters into the agreement with a complete understanding of the other's financial situation. It is important to note that while a Hialeah, Florida prenuptial premarital agreement with financial statements covers various financial aspects, it does not replace or override state laws governing child support, child custody, or visitation rights. These matters are determined separately by a court based on the best interests of the child. Different types of Hialeah, Florida prenuptial premarital agreements may include variations based on the unique circumstances and needs of the couple. For example, couples with significant personal or business assets may opt for a high-asset prenuptial agreement, while those with blended families might consider a prenuptial agreement that includes provisions for stepchildren's inheritance rights. In conclusion, a Hialeah, Florida prenuptial premarital agreement with financial statements provides couples with a sound legal framework for addressing financial matters in the event of divorce or separation. By incorporating accurate financial disclosure and outlining clear provisions, this agreement fosters transparency, protects both parties' interests, and helps prevent potentially costly disputes.Hialeah, Florida Prenuptial Premarital Agreement with Financial Statements: A Comprehensive Overview A Hialeah, Florida prenuptial premarital agreement with financial statements is a legally binding contract that is specifically designed to protect the interests of both parties in the event of a divorce or separation. This agreement is signed by a couple prior to their marriage or civil partnership and outlines the division of assets, property, debts, and spousal support in case the relationship ends. In Hialeah, Florida, couples opting for a prenuptial premarital agreement greatly benefit from the clarity and transparency it offers when it comes to financial matters. By establishing clear expectations and intentions at the beginning of a marriage, this agreement helps alleviate potential conflicts and uncertainties down the line. Key components of a Hialeah, Florida prenuptial premarital agreement include: 1. Definitions: This section clearly defines the terms used throughout the agreement, ensuring that both parties have a shared understanding of all key aspects. 2. Assets and Property Division: The agreement outlines how the couple's assets, including real estate, investments, businesses, vehicles, and personal belongings, will be divided in case of divorce. It may specify the percentage distribution, the party responsible for any debts associated with certain assets, and any provisions for potential future acquisitions. 3. Debts and Liabilities: This section addresses the division of debts, such as credit card debts, mortgages, student loans, and any possible financial obligations incurred during the marriage. By outlining how these debts will be allocated, both partners have a clear understanding of their financial responsibilities. 4. Alimony and Spousal Support: A prenuptial premarital agreement can establish predetermined terms for alimony or spousal support, should the marriage dissolve. It may specify the duration, amount, and manner of payment. However, child support cannot be predetermined in a prenuptial agreement, as it involves the legal rights and responsibilities towards children, which must be determined by a court in the best interest of the child. 5. Financial Disclosure: Full and accurate financial disclosure is a critical aspect of a prenuptial premarital agreement in Hialeah, Florida. Both parties are required to provide detailed financial statements, including assets, liabilities, income, and expenses. This transparency ensures that each partner enters into the agreement with a complete understanding of the other's financial situation. It is important to note that while a Hialeah, Florida prenuptial premarital agreement with financial statements covers various financial aspects, it does not replace or override state laws governing child support, child custody, or visitation rights. These matters are determined separately by a court based on the best interests of the child. Different types of Hialeah, Florida prenuptial premarital agreements may include variations based on the unique circumstances and needs of the couple. For example, couples with significant personal or business assets may opt for a high-asset prenuptial agreement, while those with blended families might consider a prenuptial agreement that includes provisions for stepchildren's inheritance rights. In conclusion, a Hialeah, Florida prenuptial premarital agreement with financial statements provides couples with a sound legal framework for addressing financial matters in the event of divorce or separation. By incorporating accurate financial disclosure and outlining clear provisions, this agreement fosters transparency, protects both parties' interests, and helps prevent potentially costly disputes.