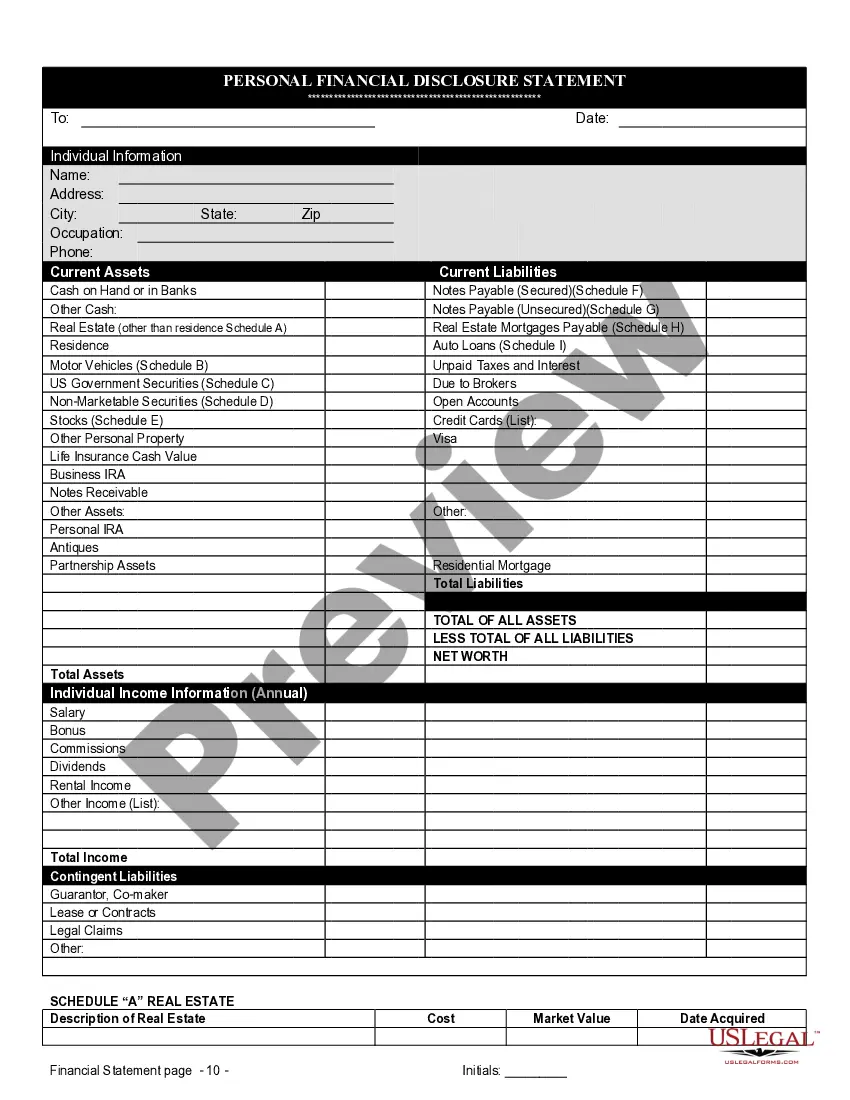

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Miami-Dade Florida Prenuptial Premarital Agreement with Financial Statements is a legally binding contract entered into by couples prior to their marriage or civil union in Miami-Dade County, Florida. This agreement aims to establish the rights, obligations, and distribution of assets between the couple in the event of a divorce or separation. One of the key components of this agreement is the inclusion of financial statements. These statements provide an overview of each party's financial status and help determine the division of assets, debts, and liabilities. By disclosing their financial information, both individuals can ensure transparency and fairness when addressing financial matters in the future. The Miami-Dade Florida Prenuptial Premarital Agreement with Financial Statements allows couples to protect their individual assets, investments, and property rights acquired prior to the marriage. It provides detailed provisions regarding the distribution of assets, spousal support, child custody, and other matters in case the marriage ends in divorce or separation. Different types or variations of Miami-Dade Florida Prenuptial Premarital Agreement with Financial Statements include: 1. Traditional Prenuptial Agreement: This is the most common type of agreement where couples outline the division of assets, debts, and property rights. 2. Business Protection Prenuptial Agreement: This type of agreement focuses on protecting the business interests of one or both parties. It establishes provisions regarding the ownership, control, and division of business assets and income. 3. Inheritance Protection Prenuptial Agreement: This agreement is designed to safeguard the inheritance rights of either party. It ensures that inherited assets remain separate property and are not subject to division in case of divorce or separation. 4. Debt Responsibility Prenuptial Agreement: This type of agreement clarifies the responsibility for existing debts and limits each party's liability for debts incurred by the other before or during the marriage. 5. Property Protection Prenuptial Agreement: This agreement is specifically tailored to protect specific properties owned by one or both parties. It outlines the ownership, management, and division of such properties in the event of a divorce or separation. It is essential for couples in Miami-Dade County, Florida, who are considering a prenuptial agreement with financial statements, to consult with experienced family law attorneys. These attorneys can guide them through the process, ensure compliance with Florida state laws, and help draft a comprehensive and enforceable agreement that addresses their unique needs and circumstances.Miami-Dade Florida Prenuptial Premarital Agreement with Financial Statements is a legally binding contract entered into by couples prior to their marriage or civil union in Miami-Dade County, Florida. This agreement aims to establish the rights, obligations, and distribution of assets between the couple in the event of a divorce or separation. One of the key components of this agreement is the inclusion of financial statements. These statements provide an overview of each party's financial status and help determine the division of assets, debts, and liabilities. By disclosing their financial information, both individuals can ensure transparency and fairness when addressing financial matters in the future. The Miami-Dade Florida Prenuptial Premarital Agreement with Financial Statements allows couples to protect their individual assets, investments, and property rights acquired prior to the marriage. It provides detailed provisions regarding the distribution of assets, spousal support, child custody, and other matters in case the marriage ends in divorce or separation. Different types or variations of Miami-Dade Florida Prenuptial Premarital Agreement with Financial Statements include: 1. Traditional Prenuptial Agreement: This is the most common type of agreement where couples outline the division of assets, debts, and property rights. 2. Business Protection Prenuptial Agreement: This type of agreement focuses on protecting the business interests of one or both parties. It establishes provisions regarding the ownership, control, and division of business assets and income. 3. Inheritance Protection Prenuptial Agreement: This agreement is designed to safeguard the inheritance rights of either party. It ensures that inherited assets remain separate property and are not subject to division in case of divorce or separation. 4. Debt Responsibility Prenuptial Agreement: This type of agreement clarifies the responsibility for existing debts and limits each party's liability for debts incurred by the other before or during the marriage. 5. Property Protection Prenuptial Agreement: This agreement is specifically tailored to protect specific properties owned by one or both parties. It outlines the ownership, management, and division of such properties in the event of a divorce or separation. It is essential for couples in Miami-Dade County, Florida, who are considering a prenuptial agreement with financial statements, to consult with experienced family law attorneys. These attorneys can guide them through the process, ensure compliance with Florida state laws, and help draft a comprehensive and enforceable agreement that addresses their unique needs and circumstances.