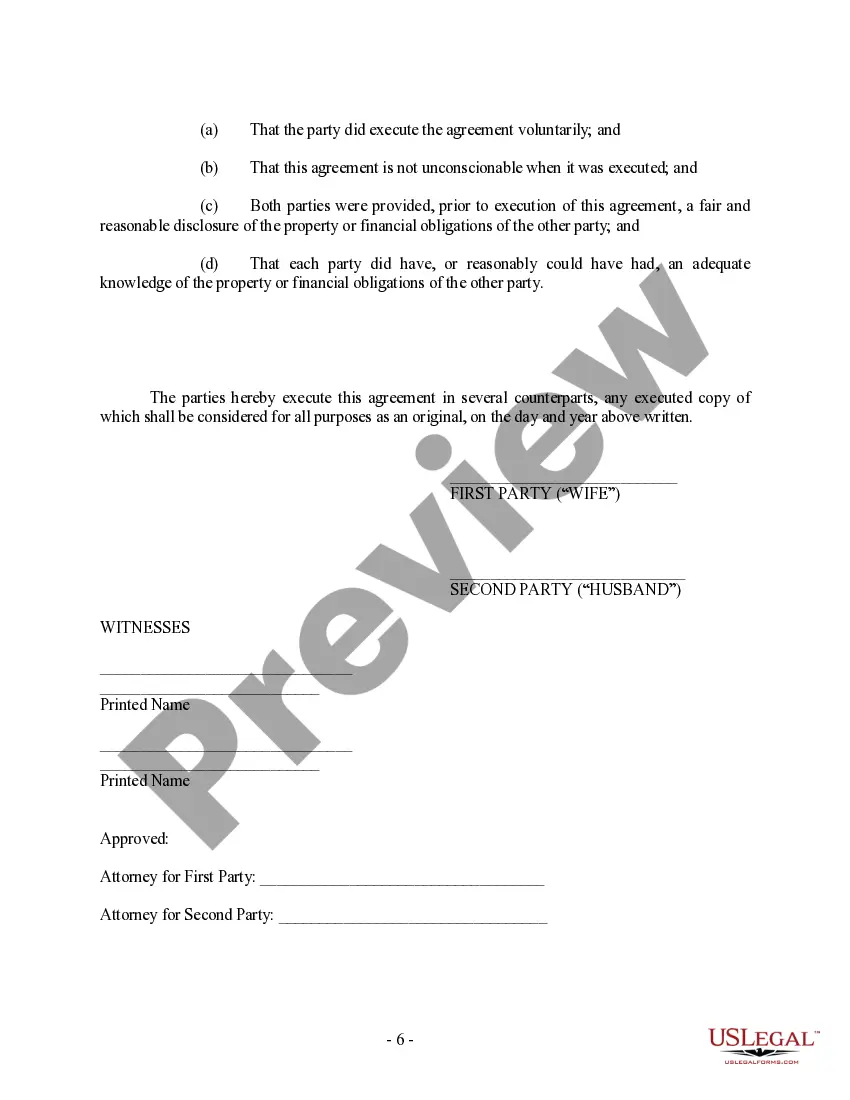

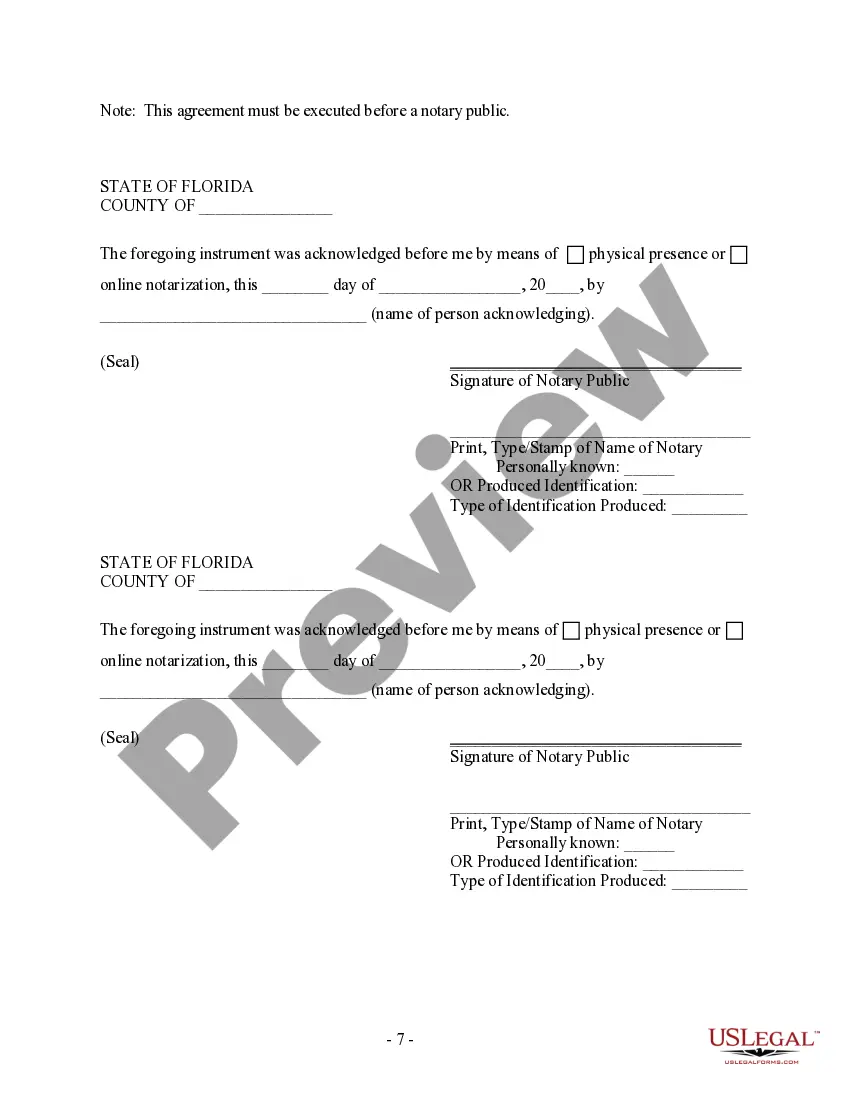

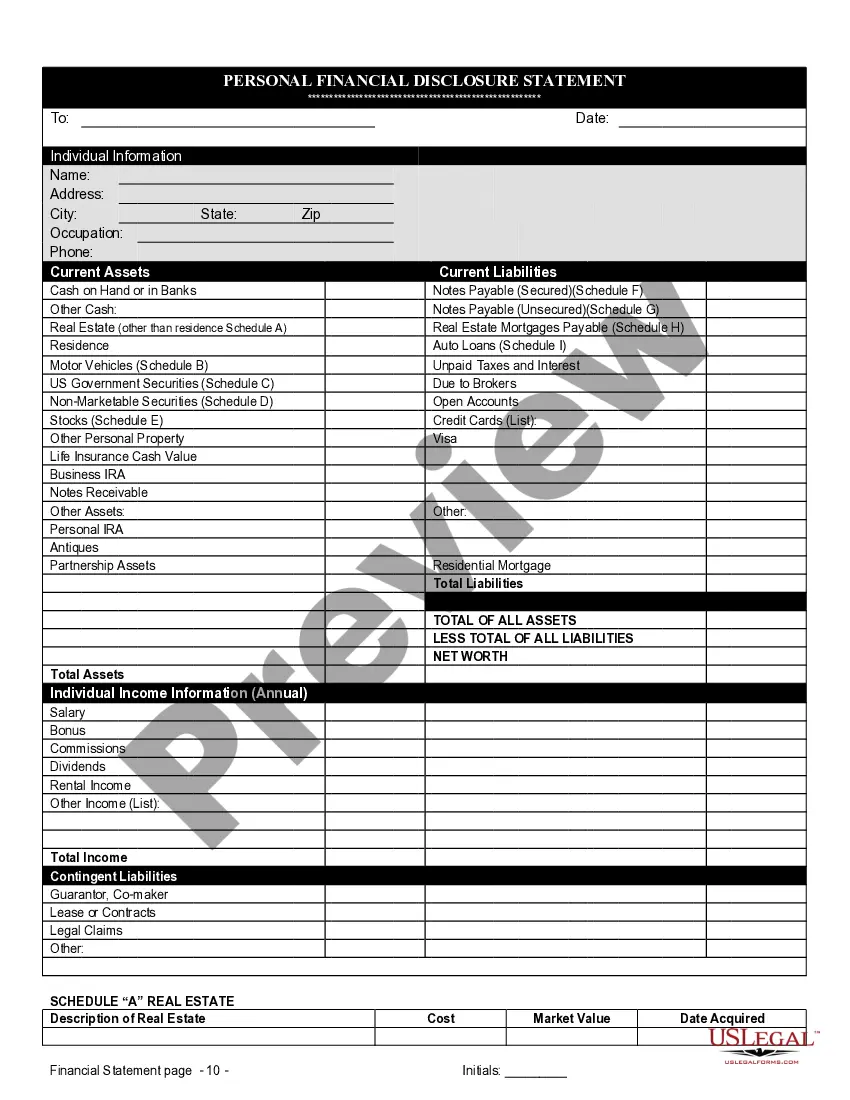

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Palm Beach Florida Prenuptial Premarital Agreement with Financial Statements is a legally binding contract signed by a couple prior to their marriage, containing provisions outlining how their assets, debts, and other financial matters will be managed during the marriage and in the event of divorce or separation. The agreement is tailored to meet the specific needs and requirements of couples residing in Palm Beach, Florida. This comprehensive prenuptial agreement serves as a safeguard for both parties, ensuring transparency and clarity when it comes to their financial situation. It covers various aspects such as property division, spousal support, child custody, and other relevant matters. By providing a thorough understanding of each party's financial standing before entering into marriage, this agreement aims to prevent potential conflicts and disputes in the future. The Palm Beach Florida Prenuptial Premarital Agreement with Financial Statements can be further categorized into specific types based on individual circumstances and preferences. Some common variants include: 1. Traditional Prenuptial Agreement: This type of agreement focuses on preserving the separate property and assets of each spouse, clearly stating their ownership and intended distribution in case of divorce or separation. It often includes provisions related to alimony, property division, and debt management. 2. Business-oriented Prenuptial Agreement: For couples with business interests, this type of agreement addresses the division of business assets, revenue, and ongoing operations. It may outline the rights and responsibilities of each spouse regarding the business, ensuring its continuity in case of marital dissolution. 3. Legacy Protection Prenuptial Agreement: Suitable for individuals with substantial inheritance or considerable family wealth, this agreement sets provisions to protect inherited assets or family wealth from becoming marital property. It may also outline provisions for future generations, specifying how these assets should be managed. 4. Debt Protection Prenuptial Agreement: This type of agreement is beneficial when one or both parties enter the marriage with significant debts. It establishes the responsibility for each spouse's respective debts, ensuring that they aren't shared in the event of divorce or separation. When drafting a Palm Beach Florida Prenuptial Premarital Agreement with Financial Statements, it is essential to consult with an experienced attorney specializing in family law in Palm Beach County. These legal professionals possess extensive knowledge of local regulations and can provide tailored guidance to ensure the agreement complies with Florida law and effectively protects the rights and interests of both parties involved. Keywords: Palm Beach Florida, prenuptial agreement, premarital agreement, financial statements, assets, debts, property division, spousal support, child custody, separate property, alimony, business-oriented agreement, business assets, revenue, legacy protection, inherited assets, family wealth, debt protection, divorce, separation, attorney, legal professionals, Palm Beach County.Palm Beach Florida Prenuptial Premarital Agreement with Financial Statements is a legally binding contract signed by a couple prior to their marriage, containing provisions outlining how their assets, debts, and other financial matters will be managed during the marriage and in the event of divorce or separation. The agreement is tailored to meet the specific needs and requirements of couples residing in Palm Beach, Florida. This comprehensive prenuptial agreement serves as a safeguard for both parties, ensuring transparency and clarity when it comes to their financial situation. It covers various aspects such as property division, spousal support, child custody, and other relevant matters. By providing a thorough understanding of each party's financial standing before entering into marriage, this agreement aims to prevent potential conflicts and disputes in the future. The Palm Beach Florida Prenuptial Premarital Agreement with Financial Statements can be further categorized into specific types based on individual circumstances and preferences. Some common variants include: 1. Traditional Prenuptial Agreement: This type of agreement focuses on preserving the separate property and assets of each spouse, clearly stating their ownership and intended distribution in case of divorce or separation. It often includes provisions related to alimony, property division, and debt management. 2. Business-oriented Prenuptial Agreement: For couples with business interests, this type of agreement addresses the division of business assets, revenue, and ongoing operations. It may outline the rights and responsibilities of each spouse regarding the business, ensuring its continuity in case of marital dissolution. 3. Legacy Protection Prenuptial Agreement: Suitable for individuals with substantial inheritance or considerable family wealth, this agreement sets provisions to protect inherited assets or family wealth from becoming marital property. It may also outline provisions for future generations, specifying how these assets should be managed. 4. Debt Protection Prenuptial Agreement: This type of agreement is beneficial when one or both parties enter the marriage with significant debts. It establishes the responsibility for each spouse's respective debts, ensuring that they aren't shared in the event of divorce or separation. When drafting a Palm Beach Florida Prenuptial Premarital Agreement with Financial Statements, it is essential to consult with an experienced attorney specializing in family law in Palm Beach County. These legal professionals possess extensive knowledge of local regulations and can provide tailored guidance to ensure the agreement complies with Florida law and effectively protects the rights and interests of both parties involved. Keywords: Palm Beach Florida, prenuptial agreement, premarital agreement, financial statements, assets, debts, property division, spousal support, child custody, separate property, alimony, business-oriented agreement, business assets, revenue, legacy protection, inherited assets, family wealth, debt protection, divorce, separation, attorney, legal professionals, Palm Beach County.