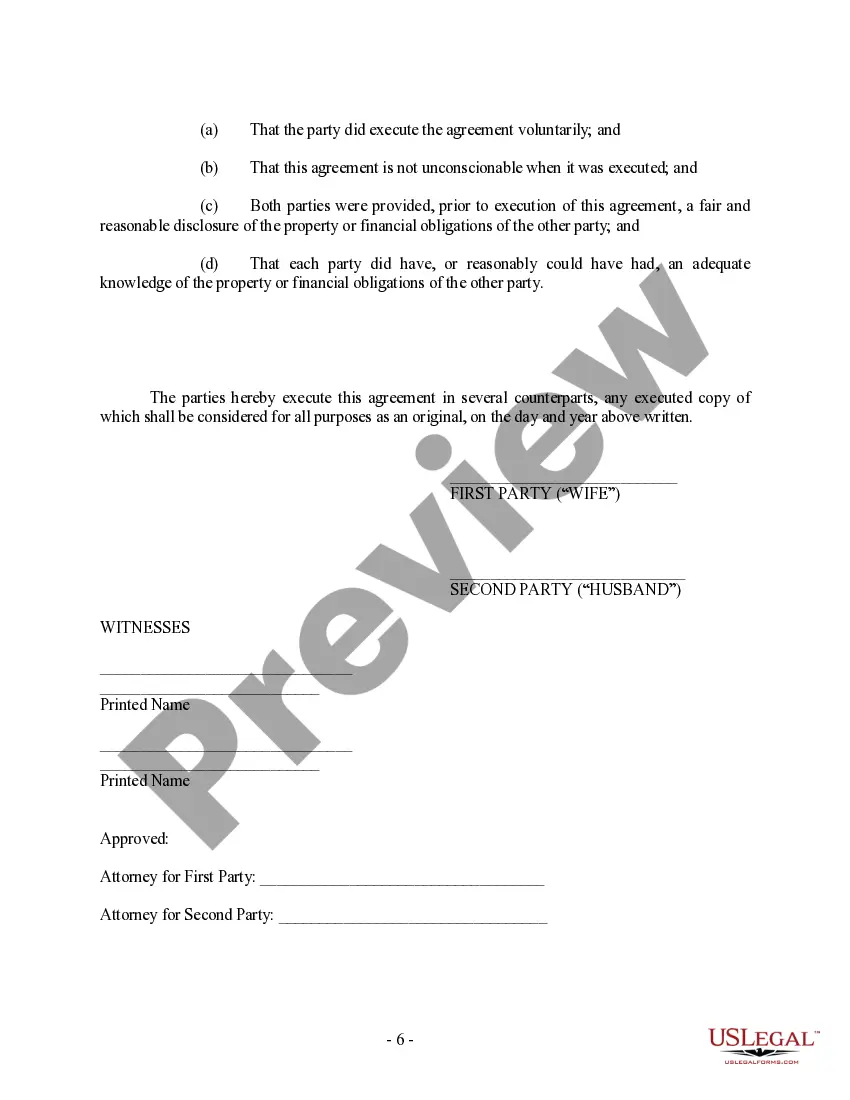

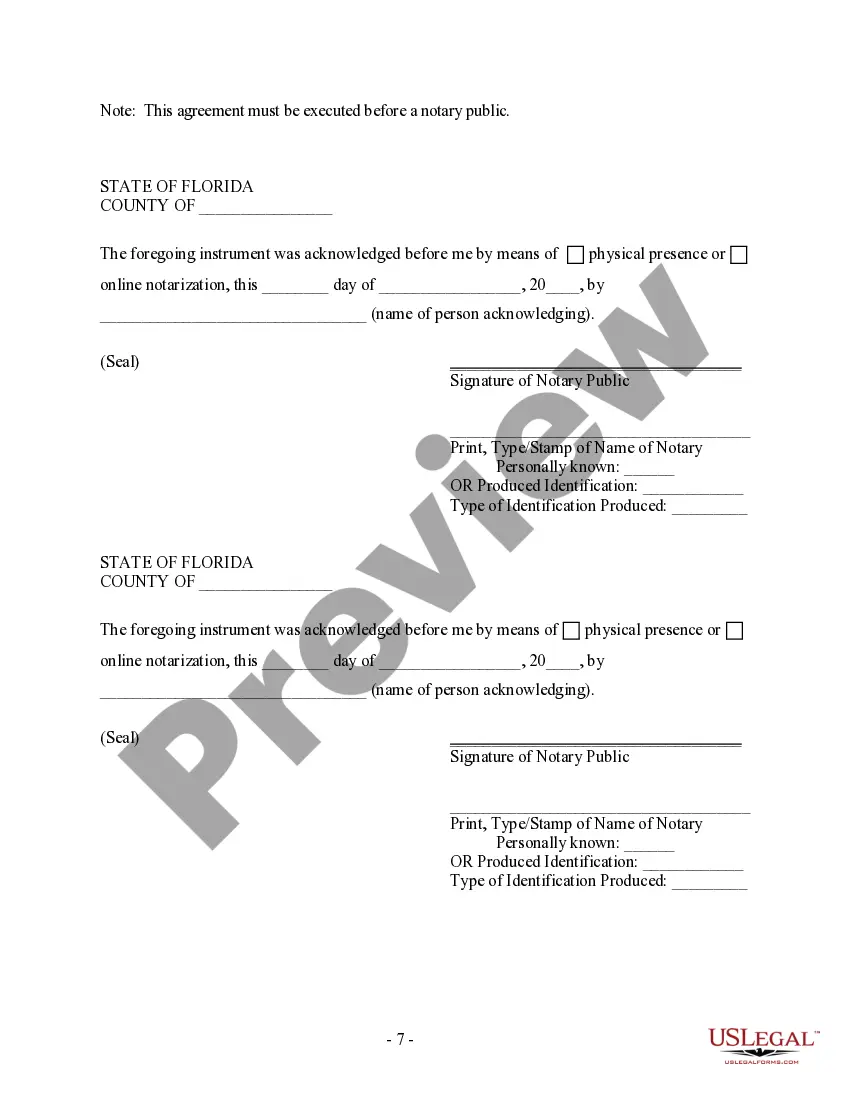

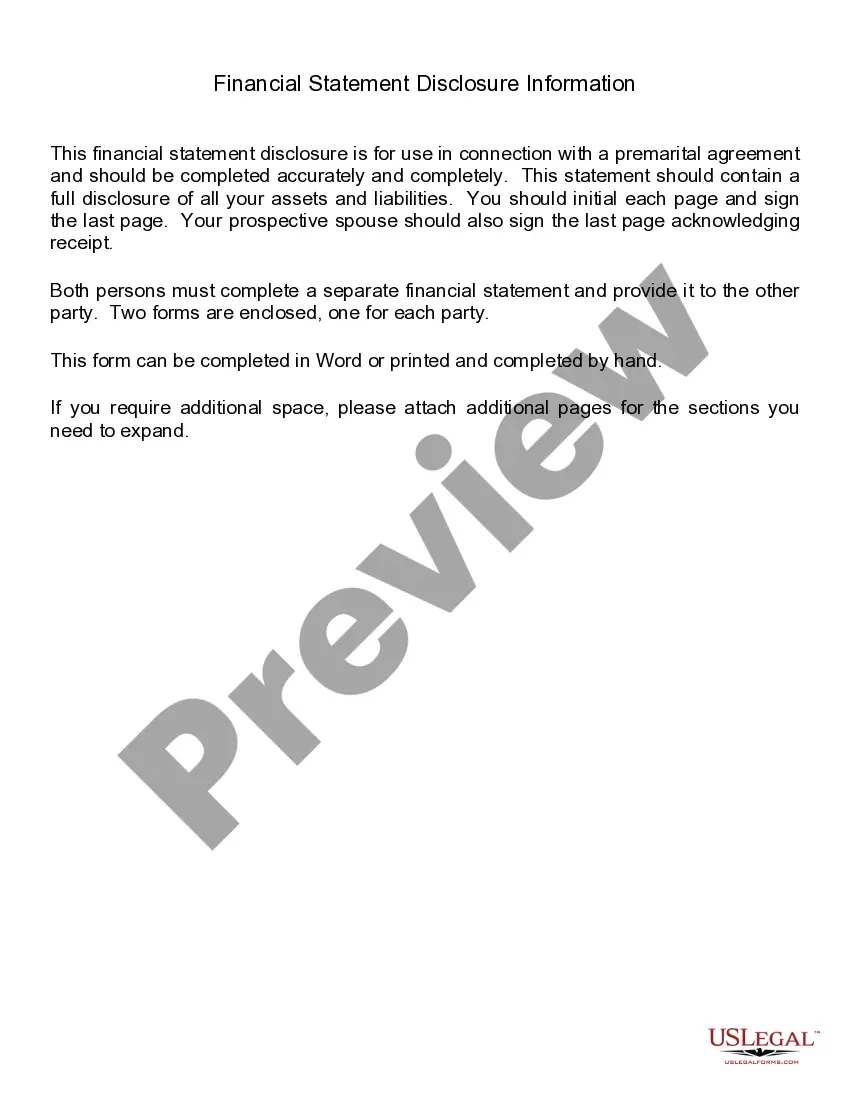

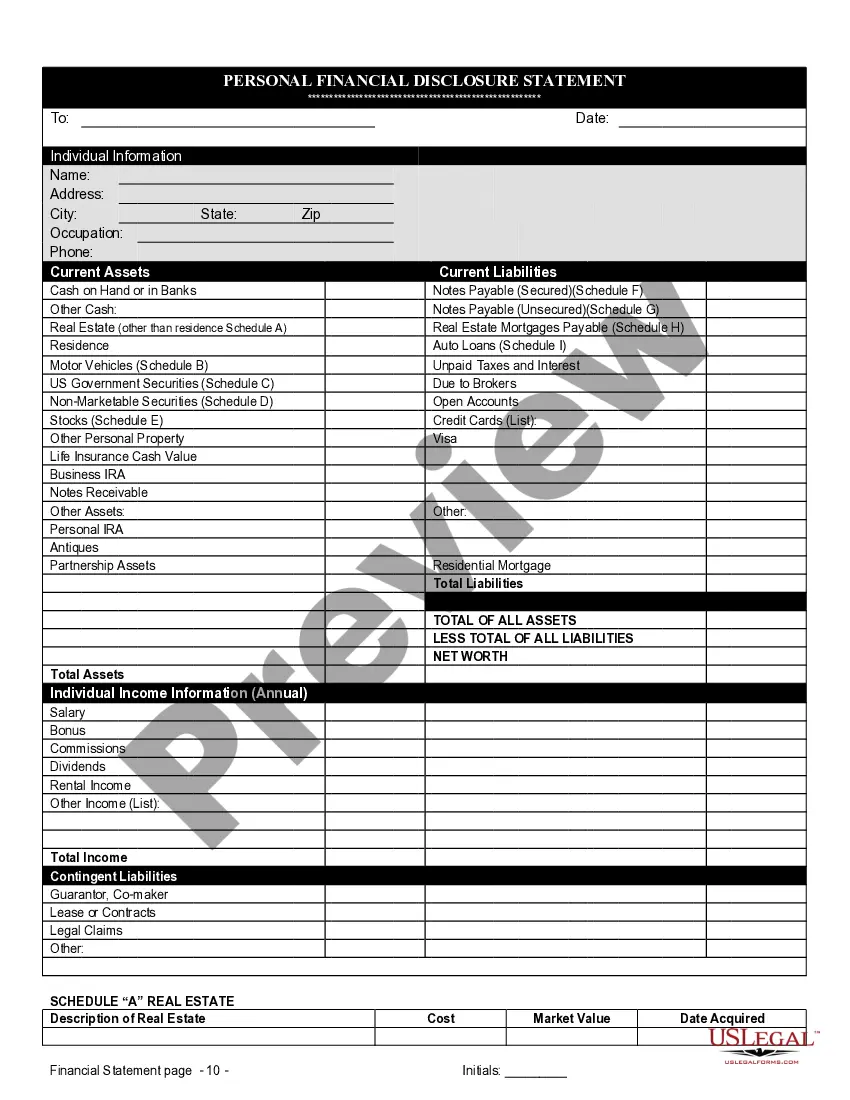

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Pembroke Pines Florida Prenuptial Premarital Agreement with Financial Statements is an essential legal document that outlines the financial rights and responsibilities of both parties entering into a marriage or civil union in Pembroke Pines, Florida. This agreement helps protect individuals' assets and estate plans in case of divorce, separation, or death. It is essential to consult with an experienced family lawyer in Pembroke Pines to ensure the agreement complies with the state's laws and covers all necessary aspects. The Pembroke Pines Florida Prenuptial Premarital Agreement with Financial Statements typically includes detailed sections covering various financial aspects of the couple's relationship. Some prominent topics covered in this agreement may include: 1. Asset Division: The agreement outlines the division and distribution of assets and debts owned by each party before and during the marriage. It aims to establish a fair and equitable distribution plan that both parties can agree upon. 2. Spousal Support: The agreement may address spousal support or alimony payments, including the amount, duration, and conditions under which it may be provided. This provision helps protect the financial stability of both parties, especially when one spouse earns significantly more than the other. 3. Inheritance and Estate Planning: Prenuptial agreements often cover plans for inheritance and estate distribution, ensuring that each party's wishes are respected and followed in case of death. This provision is particularly crucial for couples with significant personal or family wealth. 4. Business Interests: If one or both parties own a business, the agreement may outline the division, management, and ownership of the business assets. This provision ensures the protection of individual business interests and continuity of operations in case of a divorce or separation. 5. Debts and Liability: The agreement discusses the responsibility for existing debts and liabilities. It helps clarify how joint debts, such as mortgages, loans, or credit card debts, will be managed and allocated between the spouses. It's important to note that there may be different types of Pembroke Pines Florida Prenuptial Premarital Agreements with Financial Statements, tailored to suit different couples' needs. These variations might include: 1. Standard Prenuptial Agreement: This is a general premarital agreement that covers the basic financial aspects of a couple's relationship, as described above. 2. High Net Worth Prenuptial Agreement: For couples with significant assets, a high net worth prenuptial agreement provides more detailed and comprehensive financial protection. It covers complex financial portfolios, including investments, trusts, and offshore assets. 3. Second Marriage Prenuptial Agreement: This type of agreement addresses the financial concerns of couples entering a second or subsequent marriage, protecting the interests of children from previous relationships and ensuring the preservation of separate assets. 4. Postnuptial Agreement: While similar to a prenuptial agreement, a postnuptial agreement is created after the marriage has taken place. It serves the same purpose as a prenuptial agreement but can be useful for couples seeking to establish financial arrangements they neglected to address before marriage. Regardless of the specific type of Pembroke Pines Florida Prenuptial Premarital Agreement with Financial Statements, it is essential for couples to approach the creation of such a legally binding document with the assistance of an experienced family attorney. This ensures that all relevant financial considerations are addressed, and the agreement complies with the laws of Pembroke Pines, Florida.Pembroke Pines Florida Prenuptial Premarital Agreement with Financial Statements is an essential legal document that outlines the financial rights and responsibilities of both parties entering into a marriage or civil union in Pembroke Pines, Florida. This agreement helps protect individuals' assets and estate plans in case of divorce, separation, or death. It is essential to consult with an experienced family lawyer in Pembroke Pines to ensure the agreement complies with the state's laws and covers all necessary aspects. The Pembroke Pines Florida Prenuptial Premarital Agreement with Financial Statements typically includes detailed sections covering various financial aspects of the couple's relationship. Some prominent topics covered in this agreement may include: 1. Asset Division: The agreement outlines the division and distribution of assets and debts owned by each party before and during the marriage. It aims to establish a fair and equitable distribution plan that both parties can agree upon. 2. Spousal Support: The agreement may address spousal support or alimony payments, including the amount, duration, and conditions under which it may be provided. This provision helps protect the financial stability of both parties, especially when one spouse earns significantly more than the other. 3. Inheritance and Estate Planning: Prenuptial agreements often cover plans for inheritance and estate distribution, ensuring that each party's wishes are respected and followed in case of death. This provision is particularly crucial for couples with significant personal or family wealth. 4. Business Interests: If one or both parties own a business, the agreement may outline the division, management, and ownership of the business assets. This provision ensures the protection of individual business interests and continuity of operations in case of a divorce or separation. 5. Debts and Liability: The agreement discusses the responsibility for existing debts and liabilities. It helps clarify how joint debts, such as mortgages, loans, or credit card debts, will be managed and allocated between the spouses. It's important to note that there may be different types of Pembroke Pines Florida Prenuptial Premarital Agreements with Financial Statements, tailored to suit different couples' needs. These variations might include: 1. Standard Prenuptial Agreement: This is a general premarital agreement that covers the basic financial aspects of a couple's relationship, as described above. 2. High Net Worth Prenuptial Agreement: For couples with significant assets, a high net worth prenuptial agreement provides more detailed and comprehensive financial protection. It covers complex financial portfolios, including investments, trusts, and offshore assets. 3. Second Marriage Prenuptial Agreement: This type of agreement addresses the financial concerns of couples entering a second or subsequent marriage, protecting the interests of children from previous relationships and ensuring the preservation of separate assets. 4. Postnuptial Agreement: While similar to a prenuptial agreement, a postnuptial agreement is created after the marriage has taken place. It serves the same purpose as a prenuptial agreement but can be useful for couples seeking to establish financial arrangements they neglected to address before marriage. Regardless of the specific type of Pembroke Pines Florida Prenuptial Premarital Agreement with Financial Statements, it is essential for couples to approach the creation of such a legally binding document with the assistance of an experienced family attorney. This ensures that all relevant financial considerations are addressed, and the agreement complies with the laws of Pembroke Pines, Florida.