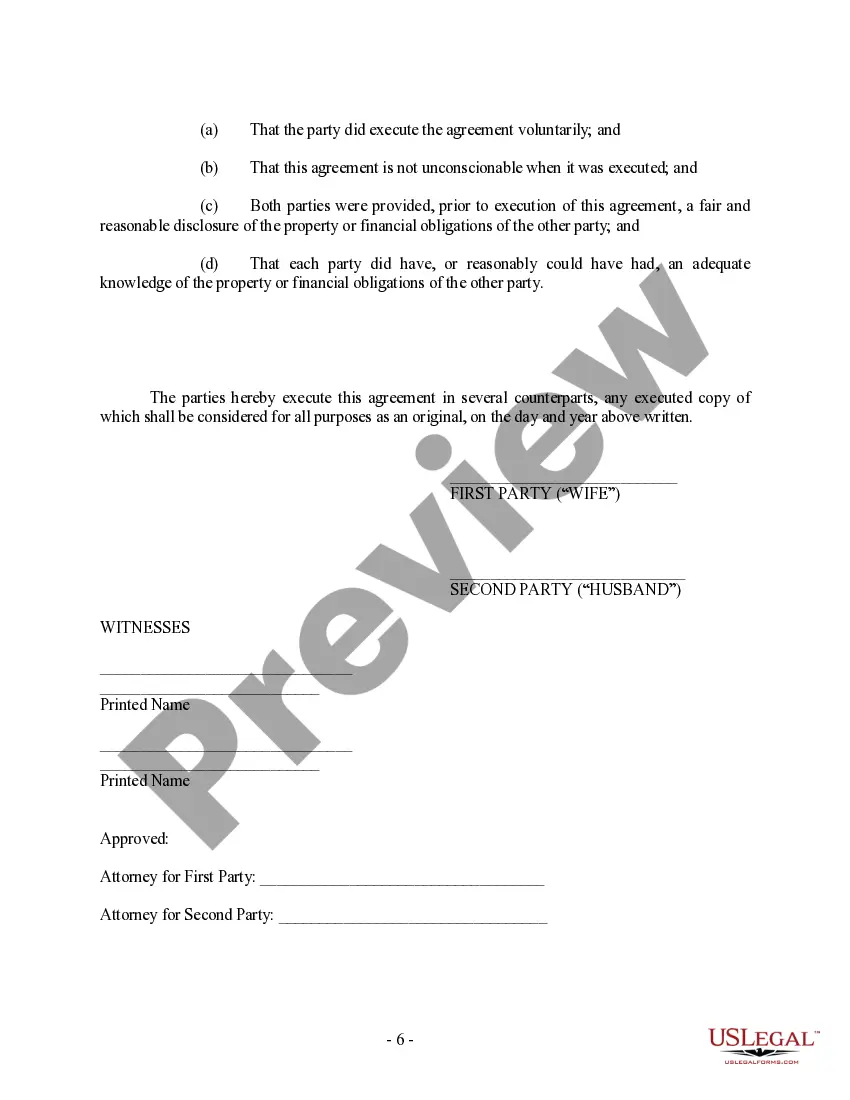

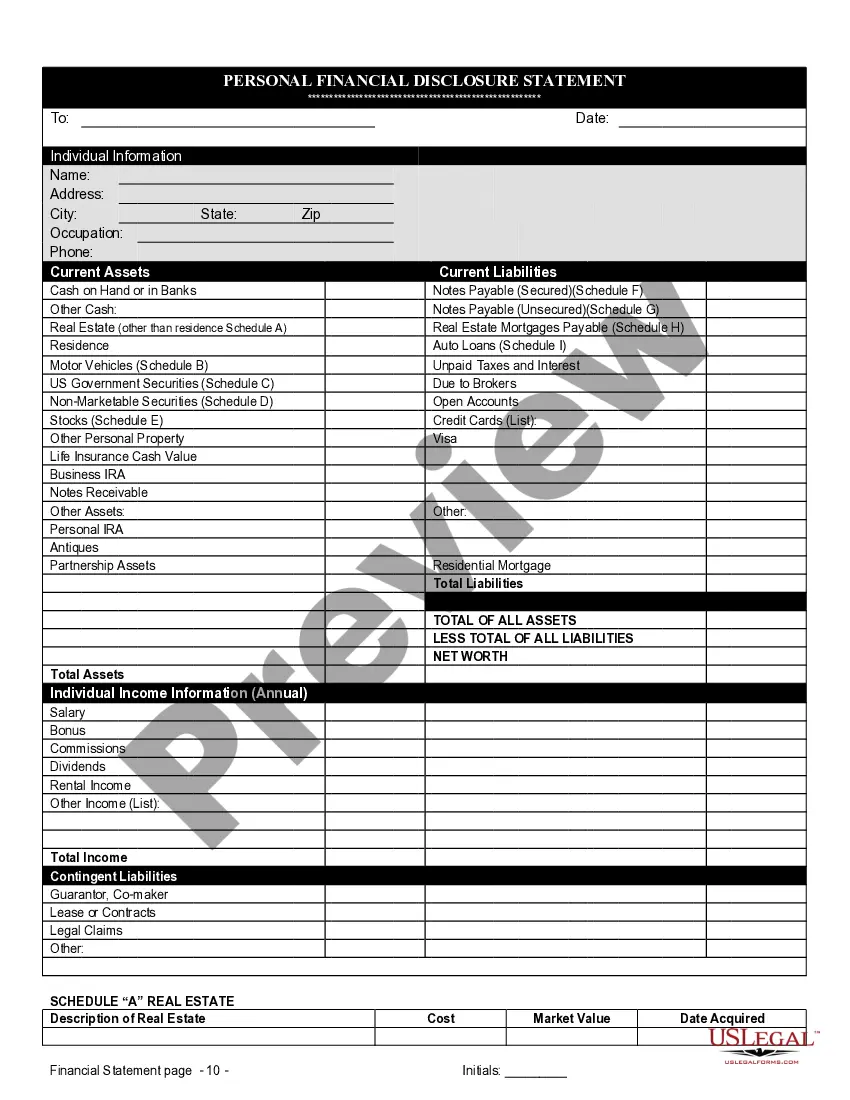

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

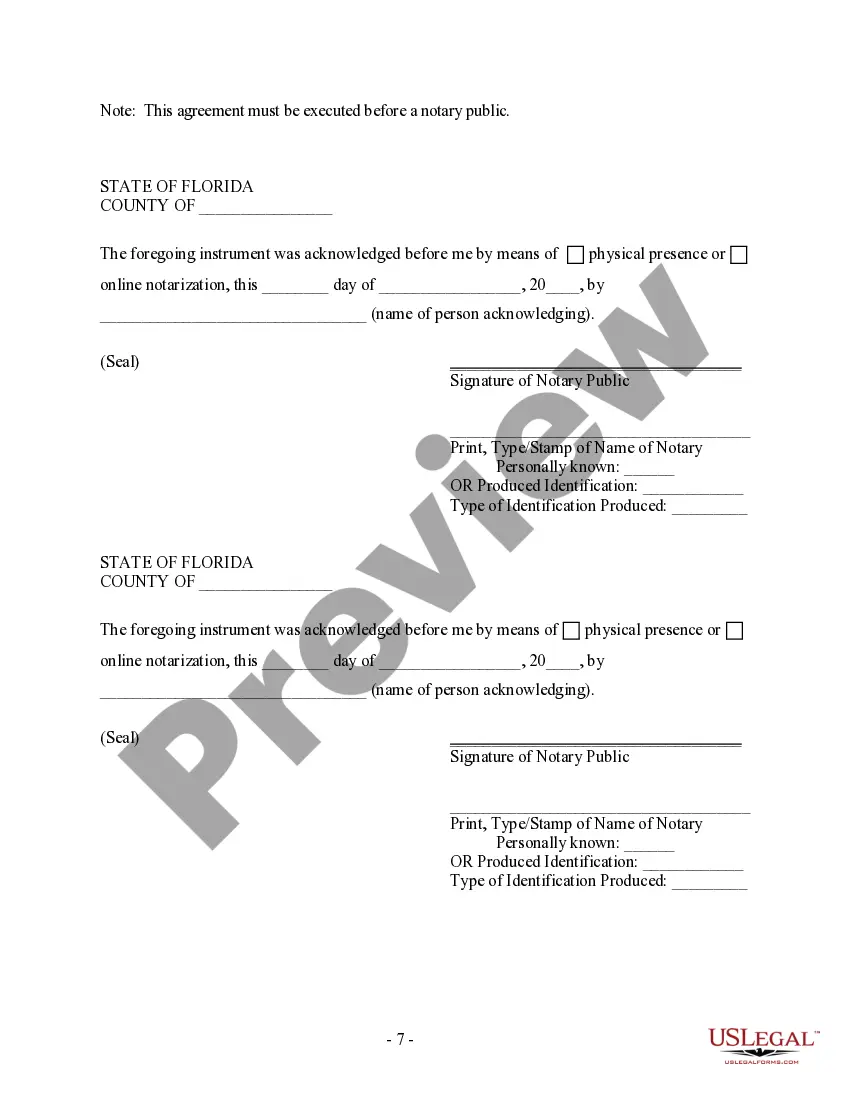

Tallahassee Florida Prenuptial Premarital Agreement with Financial Statements: A Comprehensive Overview A Tallahassee Florida prenuptial premarital agreement with financial statements is an essential legal document that provides protection and clarity for couples planning to get married in Tallahassee, Florida. This agreement aims to address potential financial concerns and property division in case of a divorce or separation. The Tallahassee Florida prenuptial premarital agreement includes detailed provisions and financial statements that outline the rights and responsibilities of each party involved. This document is crucial for safeguarding individual assets, minimizing future conflicts, and ensuring a fair and transparent distribution of property and debts. There are various types of Tallahassee Florida prenuptial premarital agreements with financial statements tailored to suit different circumstances. Some notable types include: 1. Property Division Agreement: This type of prenuptial agreement focuses on defining how assets and debts will be divided in case of a divorce. It outlines specific properties, investments, and debts owned before the marriage and clarifies their individual ownership or potential shared ownership. 2. Alimony or Spousal Support Agreement: This agreement addresses the issue of financial support or alimony payments that one party may be entitled to receive in the event of a divorce. It specifies the amount, duration, and conditions under which alimony will be provided, ensuring both parties are aware of their rights and responsibilities. 3. Business Interests Agreement: Particularly relevant for entrepreneurs, this agreement addresses the treatment of business assets and interests in case of a divorce. It outlines how ownership, management, and control of businesses or professional practices will be handled if the marriage ends. 4. Debt Allocation Agreement: This type of prenuptial agreement focuses on determining the responsibility for existing debts and those potentially incurred during the marriage. It ensures that debts are allocated fairly and in accordance with each party's financial capability. All Tallahassee Florida prenuptial premarital agreements with financial statements must meet the legal requirements of the state. They must be voluntarily entered into by both parties, be in writing, and executed before the marriage takes place. Each party may choose to have independent legal representation for fair and informed negotiations. In conclusion, a Tallahassee Florida prenuptial premarital agreement with financial statements provides an effective way to address financial matters and potential disputes in a transparent and legally binding manner. By incorporating comprehensive provisions and relevant financial statements, this agreement protects the rights and interests of both parties, ensuring a fair and equitable distribution of assets, debts, and potential spousal support.Tallahassee Florida Prenuptial Premarital Agreement with Financial Statements: A Comprehensive Overview A Tallahassee Florida prenuptial premarital agreement with financial statements is an essential legal document that provides protection and clarity for couples planning to get married in Tallahassee, Florida. This agreement aims to address potential financial concerns and property division in case of a divorce or separation. The Tallahassee Florida prenuptial premarital agreement includes detailed provisions and financial statements that outline the rights and responsibilities of each party involved. This document is crucial for safeguarding individual assets, minimizing future conflicts, and ensuring a fair and transparent distribution of property and debts. There are various types of Tallahassee Florida prenuptial premarital agreements with financial statements tailored to suit different circumstances. Some notable types include: 1. Property Division Agreement: This type of prenuptial agreement focuses on defining how assets and debts will be divided in case of a divorce. It outlines specific properties, investments, and debts owned before the marriage and clarifies their individual ownership or potential shared ownership. 2. Alimony or Spousal Support Agreement: This agreement addresses the issue of financial support or alimony payments that one party may be entitled to receive in the event of a divorce. It specifies the amount, duration, and conditions under which alimony will be provided, ensuring both parties are aware of their rights and responsibilities. 3. Business Interests Agreement: Particularly relevant for entrepreneurs, this agreement addresses the treatment of business assets and interests in case of a divorce. It outlines how ownership, management, and control of businesses or professional practices will be handled if the marriage ends. 4. Debt Allocation Agreement: This type of prenuptial agreement focuses on determining the responsibility for existing debts and those potentially incurred during the marriage. It ensures that debts are allocated fairly and in accordance with each party's financial capability. All Tallahassee Florida prenuptial premarital agreements with financial statements must meet the legal requirements of the state. They must be voluntarily entered into by both parties, be in writing, and executed before the marriage takes place. Each party may choose to have independent legal representation for fair and informed negotiations. In conclusion, a Tallahassee Florida prenuptial premarital agreement with financial statements provides an effective way to address financial matters and potential disputes in a transparent and legally binding manner. By incorporating comprehensive provisions and relevant financial statements, this agreement protects the rights and interests of both parties, ensuring a fair and equitable distribution of assets, debts, and potential spousal support.