This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

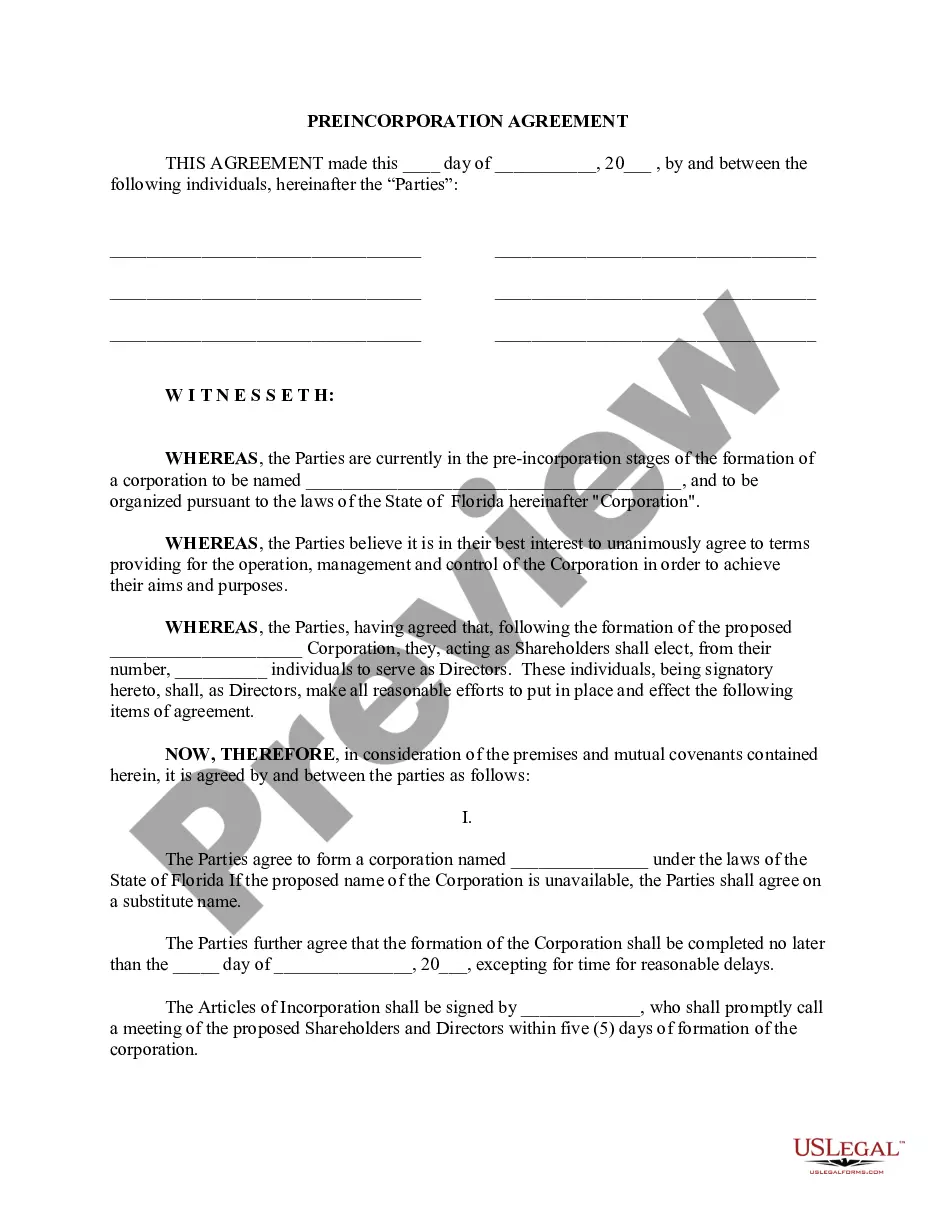

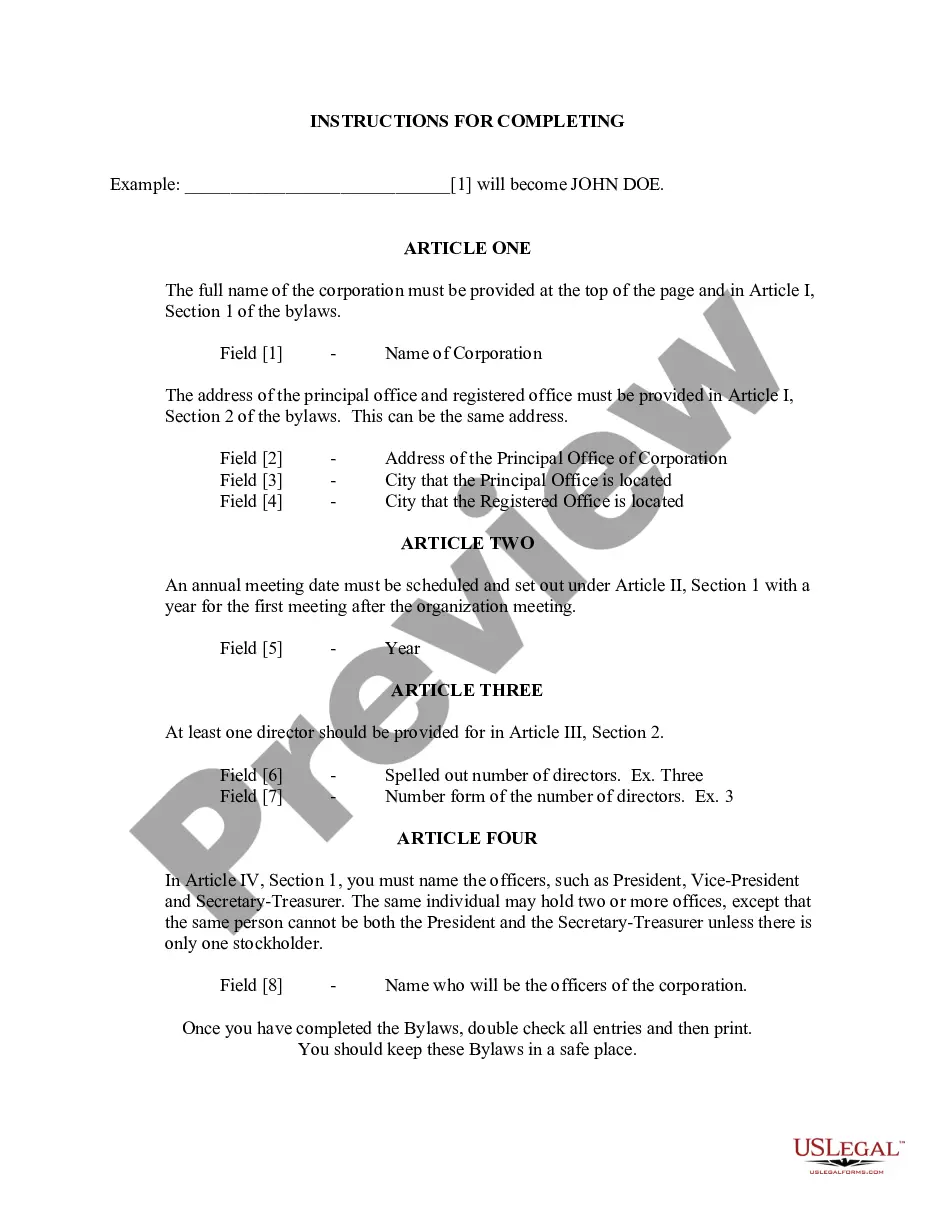

The Tampa Florida Articles of Incorporation for Domestic For-Profit Corporation is a legal document required by the state of Florida to officially establish and register a for-profit company in Tampa. These articles serve as the foundational documentation for establishing the corporation's existence, structure, and operating procedures. It is essential to complete this process accurately and in compliance with the Florida statutes and guidelines. The Tampa Florida Articles of Incorporation generally include the following key elements: 1. Corporation Name: The articles must specify the chosen corporate name, ensuring it is unique and not already registered with the state. 2. Registered Office and Agent: The office address and registered agent's details must be provided. The agent is responsible for receiving official correspondence and legal documents on behalf of the corporation. 3. Purpose of the Corporation: The articles should state the general nature of the business to be conducted by the corporation. 4. Capital Stock: The authorized number of shares and par value, if any, should be defined. Additionally, the classes or series of shares that may be issued can be specified. 5. Directors and Officers: The names and addresses of the initial directors and principal officers need to be included. 6. Incorporates: The names, addresses, and signatures of the individuals or entities forming the corporation must be listed as incorporates. They are responsible for initiating the filing process. 7. Duration: The duration of the corporation, whether perpetual or limited, must be stated. 8. Optional Provisions: The articles may also include additional provisions that further define the structure or operations of the corporation. While the central components of the Tampa Florida Articles of Incorporation remain consistent, there may be different versions or variations based on specific requirements or circumstances. For instance, subtypes of the domestic for-profit corporation may include professional corporations (such as law or accounting firms) or close corporations (typically smaller closely-held businesses). These specialized types may require additional or modified provisions tailored to their unique characteristics and regulations. Properly drafting the Tampa Florida Articles of Incorporation for Domestic For-Profit Corporation is crucial for a smooth and legally compliant establishment of a business entity in Tampa. Seeking professional guidance or utilizing reputable legal resources can ensure the accuracy and adequacy of the articles, reducing the risk of potential complications in the future.The Tampa Florida Articles of Incorporation for Domestic For-Profit Corporation is a legal document required by the state of Florida to officially establish and register a for-profit company in Tampa. These articles serve as the foundational documentation for establishing the corporation's existence, structure, and operating procedures. It is essential to complete this process accurately and in compliance with the Florida statutes and guidelines. The Tampa Florida Articles of Incorporation generally include the following key elements: 1. Corporation Name: The articles must specify the chosen corporate name, ensuring it is unique and not already registered with the state. 2. Registered Office and Agent: The office address and registered agent's details must be provided. The agent is responsible for receiving official correspondence and legal documents on behalf of the corporation. 3. Purpose of the Corporation: The articles should state the general nature of the business to be conducted by the corporation. 4. Capital Stock: The authorized number of shares and par value, if any, should be defined. Additionally, the classes or series of shares that may be issued can be specified. 5. Directors and Officers: The names and addresses of the initial directors and principal officers need to be included. 6. Incorporates: The names, addresses, and signatures of the individuals or entities forming the corporation must be listed as incorporates. They are responsible for initiating the filing process. 7. Duration: The duration of the corporation, whether perpetual or limited, must be stated. 8. Optional Provisions: The articles may also include additional provisions that further define the structure or operations of the corporation. While the central components of the Tampa Florida Articles of Incorporation remain consistent, there may be different versions or variations based on specific requirements or circumstances. For instance, subtypes of the domestic for-profit corporation may include professional corporations (such as law or accounting firms) or close corporations (typically smaller closely-held businesses). These specialized types may require additional or modified provisions tailored to their unique characteristics and regulations. Properly drafting the Tampa Florida Articles of Incorporation for Domestic For-Profit Corporation is crucial for a smooth and legally compliant establishment of a business entity in Tampa. Seeking professional guidance or utilizing reputable legal resources can ensure the accuracy and adequacy of the articles, reducing the risk of potential complications in the future.