Lakeland Florida LLC Formation for Real Estate: A Comprehensive Guide If you are looking to establish a real estate business in Lakeland, Florida, forming a limited liability company (LLC) can be an excellent choice. An LLC offers many benefits such as limited liability protection, tax advantages, flexibility in management, and credibility to potential investors or partners. This detailed description provides an overview of Lakeland Florida LLC formation for real estate, along with relevant keywords to enhance understanding. 1. What is Lakeland Florida LLC Formation for Real Estate? Lakeland Florida LLC Formation for Real Estate refers to the process of establishing a limited liability company specifically tailored for real estate ventures in Lakeland, Florida. An LLC is a legal entity that combines the limited liability protection of a corporation with the flexible taxation and management structure of a partnership. 2. Advantages of Forming an LLC for Real Estate: — Limited Liability: By forming an LLC, your personal assets will be protected from any liabilities or debts incurred by the business. This ensures that your personal finances remain separate from the business's obligations. — Tax FlexibilityLCSCs offer considerable tax advantages, allowing you to choose how your business income is taxed. By default, an LLC is taxed as a pass-through entity, meaning the profits and losses flow through to the members' personal tax returns. — Management FlexibilityLCSCs provide flexibility in choosing the management structure. You can opt for member-managed LCS, where all members participate in decision-making, or manager-managed LCS, where a manager is appointed to handle the day-to-day operations. — Credibility and Professionalism: Establishing an LLC can enhance your business's credibility and professionalism, making it more attractive to potential investors, lenders, or partners. 3. Types of Lakeland Florida LLC Formation for Real Estate: — Single-Member LLC: This is a popular choice for real estate investors operating as sole proprietors. It involves a single owner or member who has complete control and liability for the LLC and its real estate investments. — Multi-Member LLC: In this case, the LLC consists of two or more members who contribute capital or services and share the profits and liabilities. Multi-member LCS are often formed when multiple investors come together to pool their resources for real estate ventures in Lakeland. — Series LLC: Although not yet recognized in Florida, a series LLC is an attractive option for real estate investors in other states. It allows multiple properties or assets to be held under one LLC while keeping them separate from one another, thereby minimizing liability risks across the portfolio. In conclusion, Lakeland Florida LLC Formation for Real Estate is a vital step for establishing a real estate business in Lakeland, Florida. By forming an LLC, investors can benefit from limited liability protection, tax advantages, management flexibility, and enhanced credibility. Whether it's a single-member LLC, multi-member LLC, or series LLC (in other states), understanding the different types of LLC formation can help investors choose the best structure for their real estate goals in Lakeland.

Lakeland Florida LLC Formation for Real Estate

State:

Florida

City:

Lakeland

Control #:

FL-00LLC-1-1

Format:

Word;

Rich Text

Instant download

Public form

Description

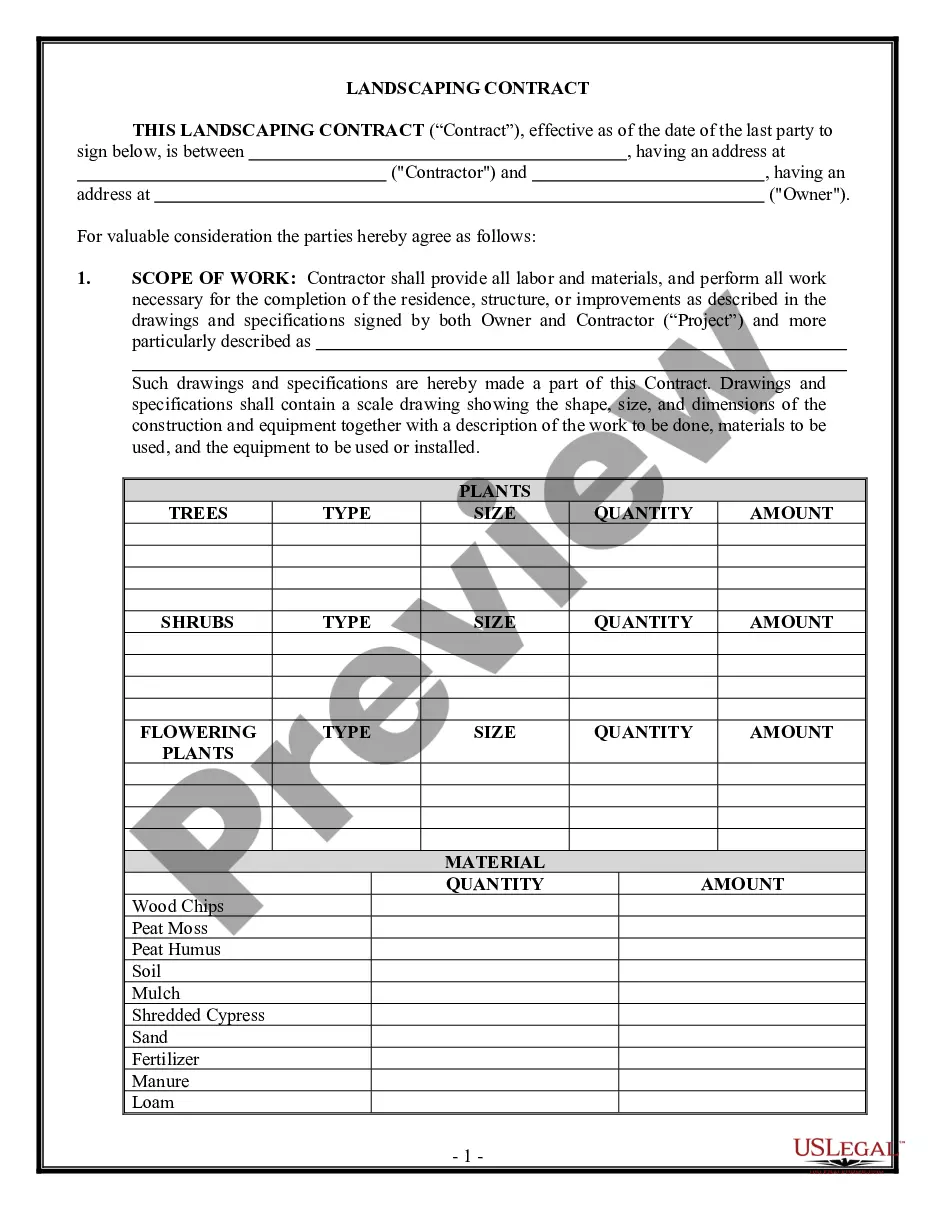

Includes Step by Step Instructions, Articles of Formation, Operating Agreement, Resolutions and other forms. Subject to Availability.

Lakeland Florida LLC Formation for Real Estate: A Comprehensive Guide If you are looking to establish a real estate business in Lakeland, Florida, forming a limited liability company (LLC) can be an excellent choice. An LLC offers many benefits such as limited liability protection, tax advantages, flexibility in management, and credibility to potential investors or partners. This detailed description provides an overview of Lakeland Florida LLC formation for real estate, along with relevant keywords to enhance understanding. 1. What is Lakeland Florida LLC Formation for Real Estate? Lakeland Florida LLC Formation for Real Estate refers to the process of establishing a limited liability company specifically tailored for real estate ventures in Lakeland, Florida. An LLC is a legal entity that combines the limited liability protection of a corporation with the flexible taxation and management structure of a partnership. 2. Advantages of Forming an LLC for Real Estate: — Limited Liability: By forming an LLC, your personal assets will be protected from any liabilities or debts incurred by the business. This ensures that your personal finances remain separate from the business's obligations. — Tax FlexibilityLCSCs offer considerable tax advantages, allowing you to choose how your business income is taxed. By default, an LLC is taxed as a pass-through entity, meaning the profits and losses flow through to the members' personal tax returns. — Management FlexibilityLCSCs provide flexibility in choosing the management structure. You can opt for member-managed LCS, where all members participate in decision-making, or manager-managed LCS, where a manager is appointed to handle the day-to-day operations. — Credibility and Professionalism: Establishing an LLC can enhance your business's credibility and professionalism, making it more attractive to potential investors, lenders, or partners. 3. Types of Lakeland Florida LLC Formation for Real Estate: — Single-Member LLC: This is a popular choice for real estate investors operating as sole proprietors. It involves a single owner or member who has complete control and liability for the LLC and its real estate investments. — Multi-Member LLC: In this case, the LLC consists of two or more members who contribute capital or services and share the profits and liabilities. Multi-member LCS are often formed when multiple investors come together to pool their resources for real estate ventures in Lakeland. — Series LLC: Although not yet recognized in Florida, a series LLC is an attractive option for real estate investors in other states. It allows multiple properties or assets to be held under one LLC while keeping them separate from one another, thereby minimizing liability risks across the portfolio. In conclusion, Lakeland Florida LLC Formation for Real Estate is a vital step for establishing a real estate business in Lakeland, Florida. By forming an LLC, investors can benefit from limited liability protection, tax advantages, management flexibility, and enhanced credibility. Whether it's a single-member LLC, multi-member LLC, or series LLC (in other states), understanding the different types of LLC formation can help investors choose the best structure for their real estate goals in Lakeland.

How to fill out Lakeland Florida LLC Formation For Real Estate?

If you’ve already utilized our service before, log in to your account and download the Lakeland Florida LLC Formation for Real Estate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Lakeland Florida LLC Formation for Real Estate. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!