Cape Coral Florida LLC Formation for Rental Property is a legal process of establishing a Limited Liability Company (LLC) specifically designed for owning and managing rental properties in Cape Coral, Florida. LLC is a popular business structure that provides liability protection to its owners (known as members) while offering flexibility in terms of management, taxation, and asset protection. By forming an LLC for rental property purposes, investors can safeguard their personal assets from potential legal claims or debts associated with the rental property. Additionally, LCS offer various tax advantages and simplifications, making it an attractive choice for real estate investors in Cape Coral. There are several types of Cape Coral Florida LLC Formations suited for rental property owners, depending on their unique requirements: 1. Single-Member LLC: This type of LLC is owned and managed by a single individual, providing the most straightforward and simplified structure for small-scale rental property owners. 2. Multi-Member LLC: As the name suggests, multi-member LCS involve multiple owners or members who jointly own and manage the rental property. This type of LLC is ideal for partnerships or real estate investing groups. 3. Series LLC: A series LLC is a unique LLC structure that allows investors to segregate assets and liabilities within separate series or cells, each with different rental properties. This type of LLC formation provides an added layer of asset protection, allowing investors to separate their risks among different properties. When forming a Cape Coral Florida LLC for a rental property, individuals must follow specific steps and comply with the legal requirements. Firstly, they need to choose a unique name for their LLC, ensuring it complies with the state's naming rules. Then, they must file the necessary formation documents, including Articles of Organization, with the Florida Division of Corporations. Additionally, the LLC must designate a registered agent to receive legal documents on its behalf. Once the LLC is formed, it is essential to obtain an Employee Identification Number (EIN) from the Internal Revenue Service (IRS) for tax purposes. This number is used to identify the LLC when dealing with financial transactions, employees, and taxes. In conclusion, Cape Coral Florida LLC Formation for Rental Property is a legal process that real estate investors undertake to establish an LLC specifically for owning and managing rental properties in Cape Coral. By forming an LLC, investors benefit from liability protection, tax advantages, and asset segregation. The different types of LLC formations for rental properties include single-member LCS, multi-member LCS, and series LCS, each suited for varying ownership and management structures.

Cape Coral Florida LLC Formation for Rental Property

State:

Florida

City:

Cape Coral

Control #:

FL-00LLC-1-2

Format:

Word;

Rich Text

Instant download

Public form

Description

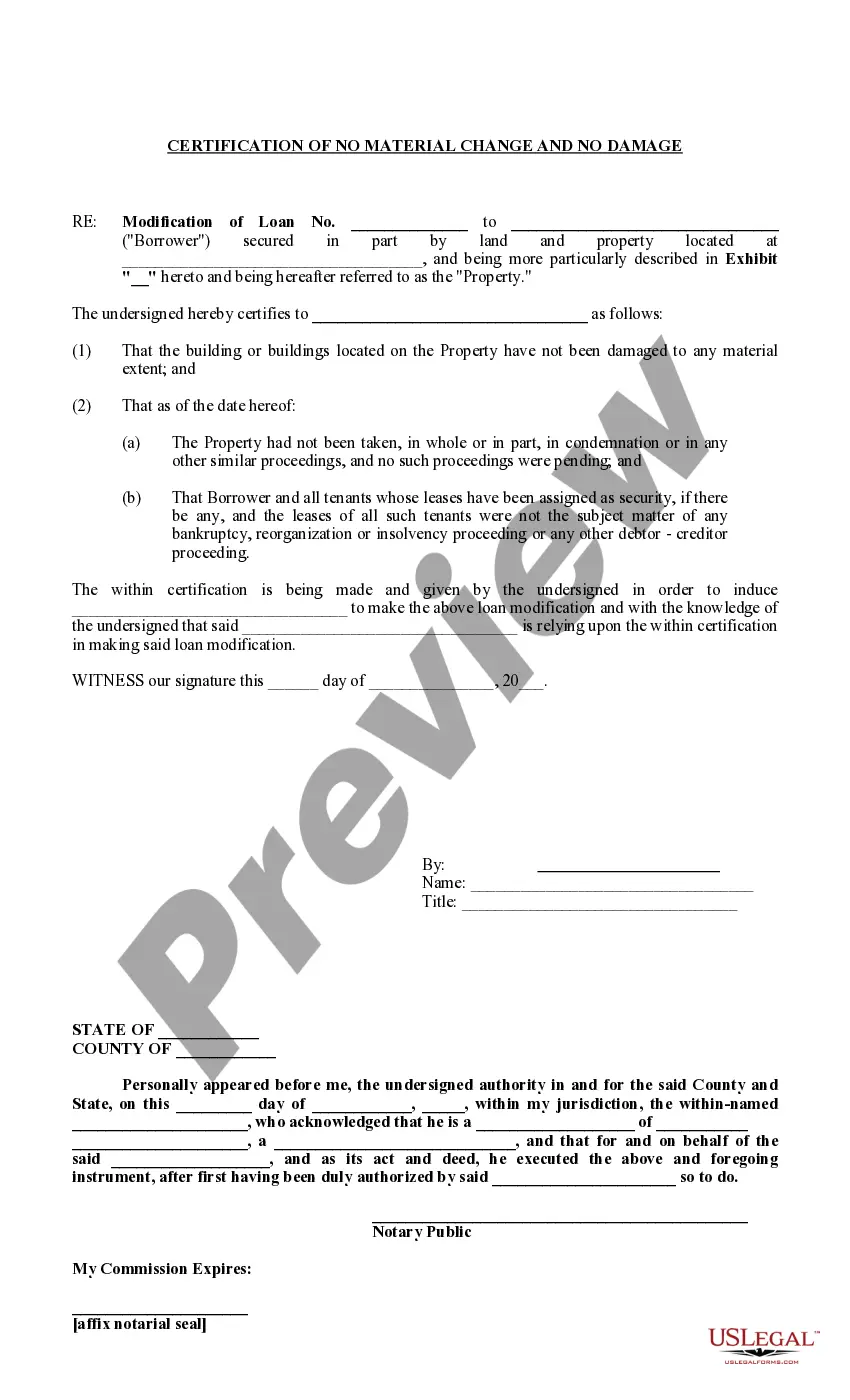

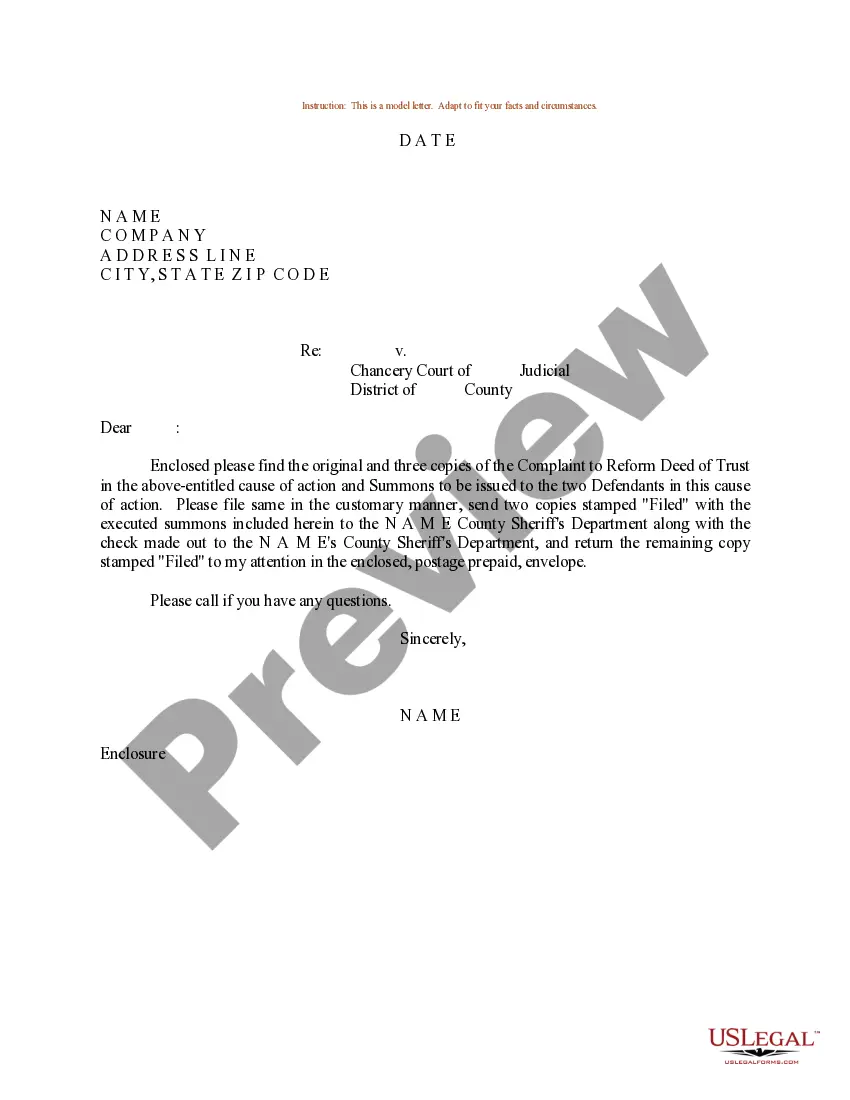

Includes Step by Step Instructions, Articles of Formation, Operating Agreement, Resolutions and other forms. Subject to Availability.

Cape Coral Florida LLC Formation for Rental Property is a legal process of establishing a Limited Liability Company (LLC) specifically designed for owning and managing rental properties in Cape Coral, Florida. LLC is a popular business structure that provides liability protection to its owners (known as members) while offering flexibility in terms of management, taxation, and asset protection. By forming an LLC for rental property purposes, investors can safeguard their personal assets from potential legal claims or debts associated with the rental property. Additionally, LCS offer various tax advantages and simplifications, making it an attractive choice for real estate investors in Cape Coral. There are several types of Cape Coral Florida LLC Formations suited for rental property owners, depending on their unique requirements: 1. Single-Member LLC: This type of LLC is owned and managed by a single individual, providing the most straightforward and simplified structure for small-scale rental property owners. 2. Multi-Member LLC: As the name suggests, multi-member LCS involve multiple owners or members who jointly own and manage the rental property. This type of LLC is ideal for partnerships or real estate investing groups. 3. Series LLC: A series LLC is a unique LLC structure that allows investors to segregate assets and liabilities within separate series or cells, each with different rental properties. This type of LLC formation provides an added layer of asset protection, allowing investors to separate their risks among different properties. When forming a Cape Coral Florida LLC for a rental property, individuals must follow specific steps and comply with the legal requirements. Firstly, they need to choose a unique name for their LLC, ensuring it complies with the state's naming rules. Then, they must file the necessary formation documents, including Articles of Organization, with the Florida Division of Corporations. Additionally, the LLC must designate a registered agent to receive legal documents on its behalf. Once the LLC is formed, it is essential to obtain an Employee Identification Number (EIN) from the Internal Revenue Service (IRS) for tax purposes. This number is used to identify the LLC when dealing with financial transactions, employees, and taxes. In conclusion, Cape Coral Florida LLC Formation for Rental Property is a legal process that real estate investors undertake to establish an LLC specifically for owning and managing rental properties in Cape Coral. By forming an LLC, investors benefit from liability protection, tax advantages, and asset segregation. The different types of LLC formations for rental properties include single-member LCS, multi-member LCS, and series LCS, each suited for varying ownership and management structures.

How to fill out Cape Coral Florida LLC Formation For Rental Property?

If you’ve already used our service before, log in to your account and save the Cape Coral Florida LLC Formation for Rental Property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Cape Coral Florida LLC Formation for Rental Property. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!