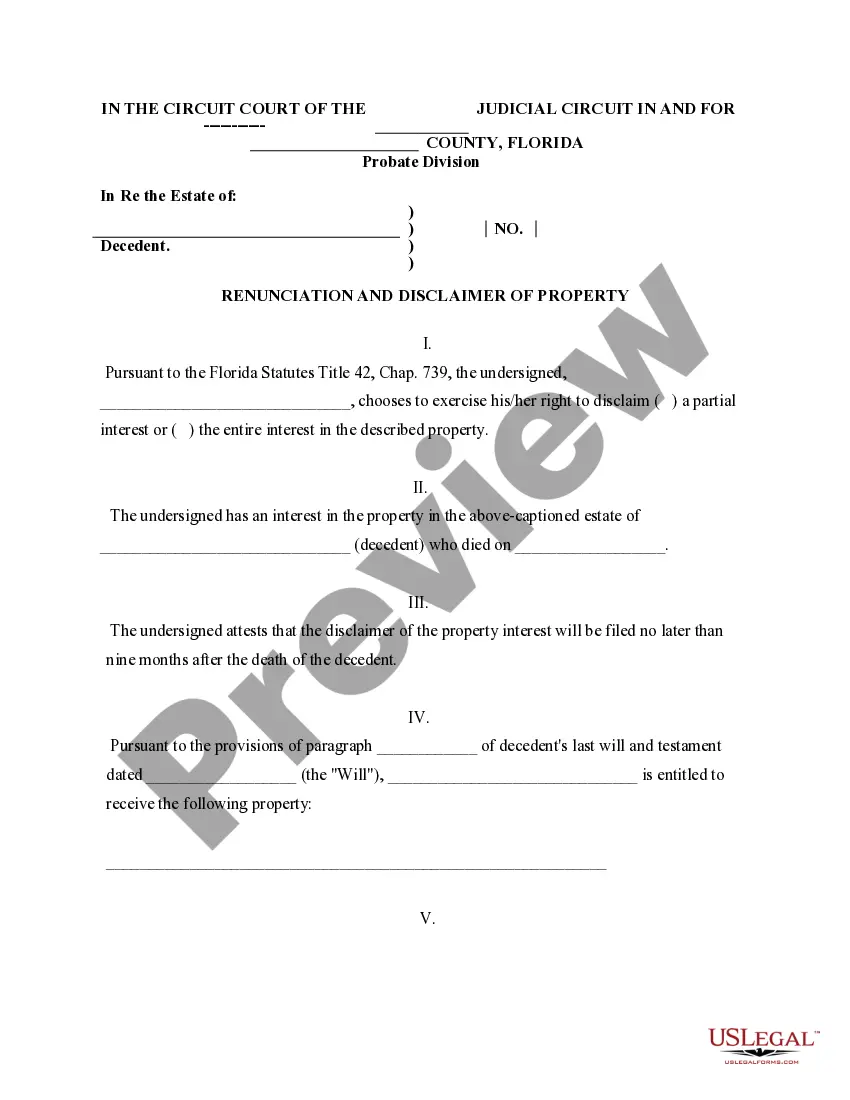

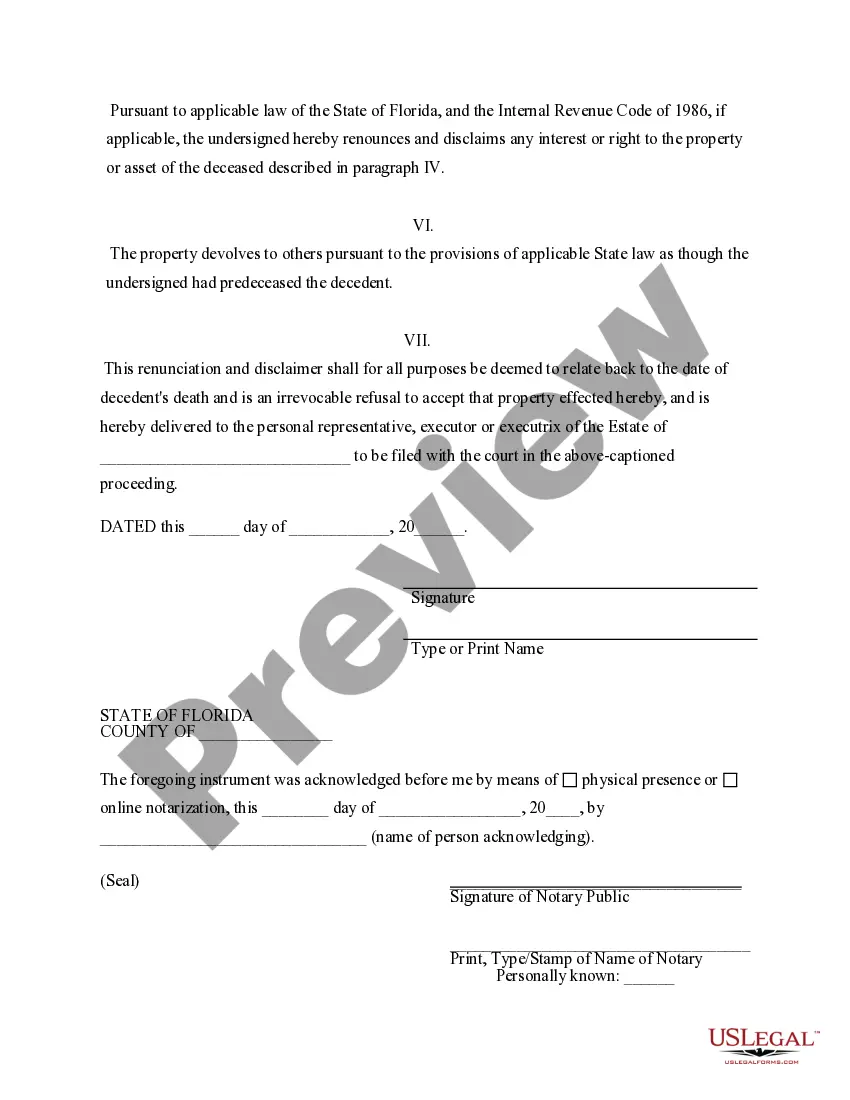

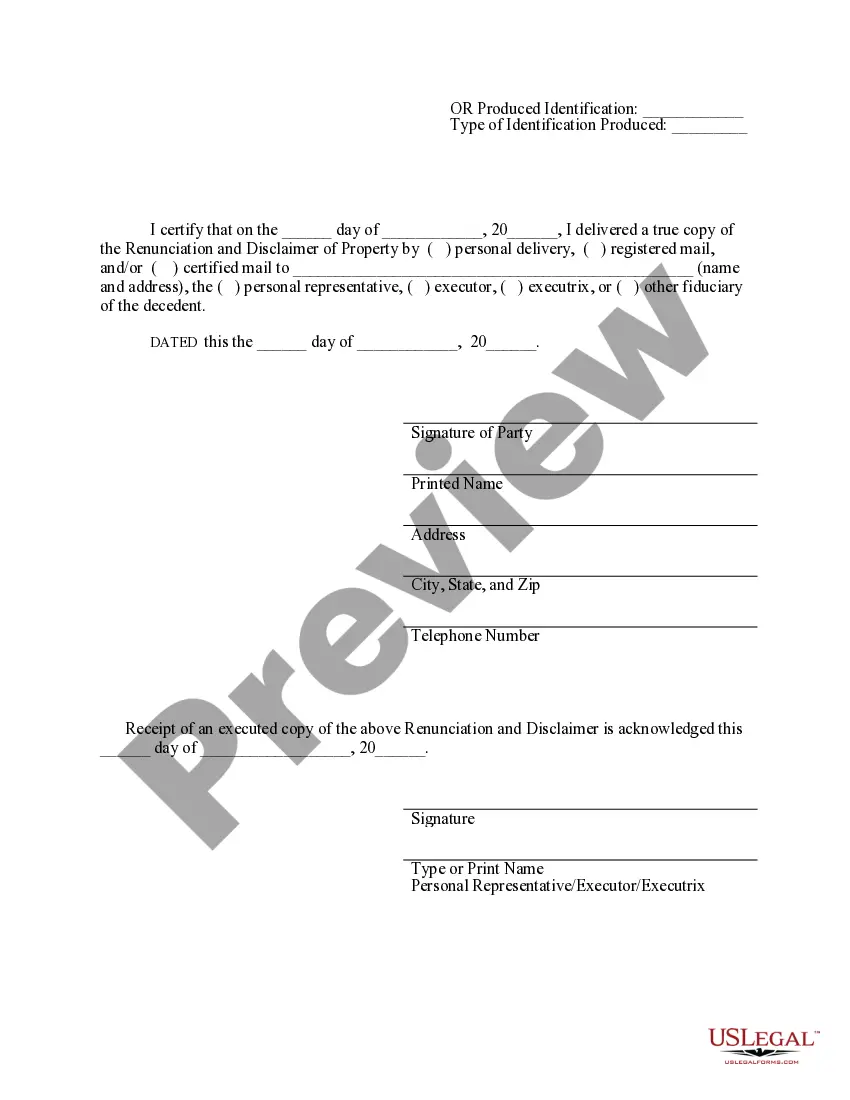

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. However, pursuant to the Florida Statutes Title 42, Chap. 732, the beneficiary is entitled to renounce a portion of or the entire interest in the property. For the disclaimer to be valid, the beneficiary must file the disclaimer within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Hialeah Florida Renunciation And Disclaimer of Property from Will by Testate is a legal process that enables individuals to willingly give up their rights to inherit property as stated in a will. This renunciation and disclaimer can be initiated by individuals who have been named as beneficiaries in a will but have decided to forego their entitlement. This action allows the property to be passed on to alternative beneficiaries or follow the rules of intestate succession. There are different types of Hialeah Florida Renunciation And Disclaimer of Property from Will by Testate, each with its own unique circumstances. Some of these situations may include: 1. Voluntary Renunciation: In this case, the named beneficiary voluntarily relinquishes their claim to the property mentioned in the will. This can occur for various reasons, such as the beneficiary being financially stable and preferring the assets to be distributed to other beneficiaries who might need them more. 2. Inadequate Provision: If a beneficiary believes that the property they were designated in the will is not sufficient or reasonable, they may choose to renounce their claim. This could occur if the property is heavily encumbered or requires extensive maintenance, making it burdensome for the beneficiary. 3. Conflict of Interest: Sometimes, beneficiaries may be involved in a relationship or profession that creates a conflict of interest with the inherited property. In such cases, they may decide to renounce their claim to avoid any potential legal or ethical complications that may arise. 4. Financial Stability: Beneficiaries who are financially secure or have alternative sources of income may choose to renounce their inheritance to ensure that the assets are distributed to those who are in greater need. This act may also help minimize estate taxes or other financial obligations associated with the property. It is crucial to note that the specific terms and conditions for a Hialeah Florida Renunciation And Disclaimer of Property from Will by Testate may vary depending on factors such as state laws, individual circumstances, and the content of the will itself. Seeking legal guidance from an experienced attorney is highly recommended ensuring compliance with local regulations and to navigate the renunciation process effectively.Hialeah Florida Renunciation And Disclaimer of Property from Will by Testate is a legal process that enables individuals to willingly give up their rights to inherit property as stated in a will. This renunciation and disclaimer can be initiated by individuals who have been named as beneficiaries in a will but have decided to forego their entitlement. This action allows the property to be passed on to alternative beneficiaries or follow the rules of intestate succession. There are different types of Hialeah Florida Renunciation And Disclaimer of Property from Will by Testate, each with its own unique circumstances. Some of these situations may include: 1. Voluntary Renunciation: In this case, the named beneficiary voluntarily relinquishes their claim to the property mentioned in the will. This can occur for various reasons, such as the beneficiary being financially stable and preferring the assets to be distributed to other beneficiaries who might need them more. 2. Inadequate Provision: If a beneficiary believes that the property they were designated in the will is not sufficient or reasonable, they may choose to renounce their claim. This could occur if the property is heavily encumbered or requires extensive maintenance, making it burdensome for the beneficiary. 3. Conflict of Interest: Sometimes, beneficiaries may be involved in a relationship or profession that creates a conflict of interest with the inherited property. In such cases, they may decide to renounce their claim to avoid any potential legal or ethical complications that may arise. 4. Financial Stability: Beneficiaries who are financially secure or have alternative sources of income may choose to renounce their inheritance to ensure that the assets are distributed to those who are in greater need. This act may also help minimize estate taxes or other financial obligations associated with the property. It is crucial to note that the specific terms and conditions for a Hialeah Florida Renunciation And Disclaimer of Property from Will by Testate may vary depending on factors such as state laws, individual circumstances, and the content of the will itself. Seeking legal guidance from an experienced attorney is highly recommended ensuring compliance with local regulations and to navigate the renunciation process effectively.