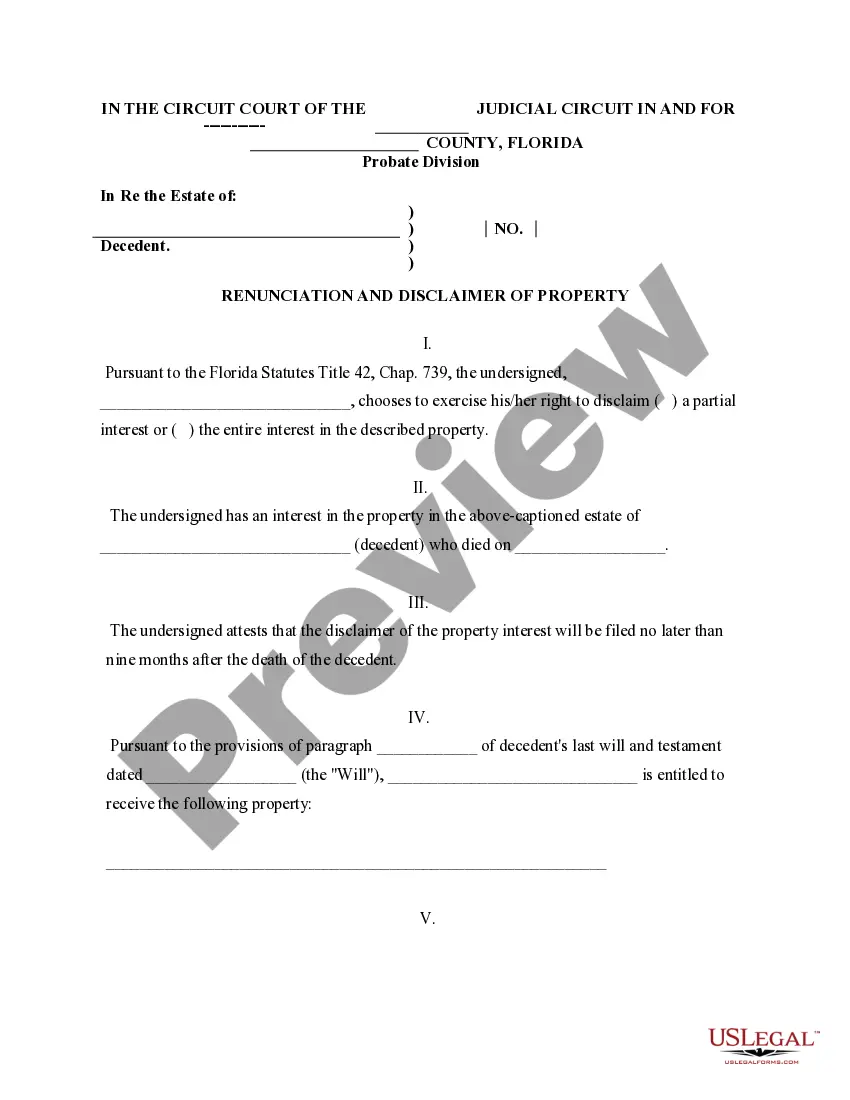

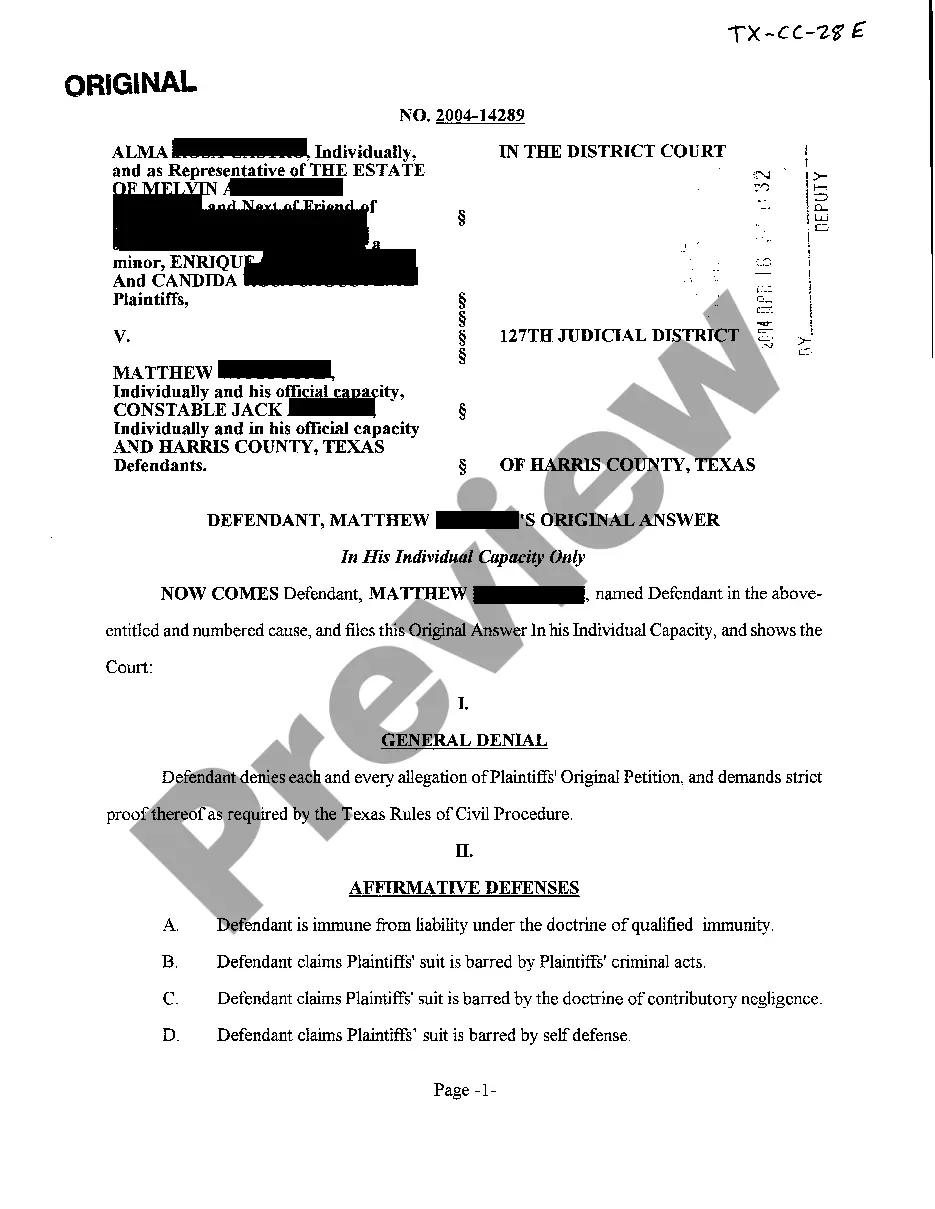

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. However, pursuant to the Florida Statutes Title 42, Chap. 732, the beneficiary is entitled to renounce a portion of or the entire interest in the property. For the disclaimer to be valid, the beneficiary must file the disclaimer within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Orlando Florida Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out Orlando Florida Renunciation And Disclaimer Of Property From Will By Testate?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial issues. To achieve this, we seek legal services that are typically expensive. However, not every legal issue is as complicated. Many of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library enables you to take control of your affairs without the necessity of an attorney.

We provide access to legal document templates that are not always readily available. Our templates are tailored to specific states and regions, which significantly eases the search process.

Benefit from US Legal Forms whenever you need to quickly and securely locate and download the Orlando Florida Renunciation And Disclaimer of Property from Will by Testate or any other document. Simply Log In/">Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it in the My documents tab.

Once you have confirmed that the Orlando Florida Renunciation And Disclaimer of Property from Will by Testate will suit your case, you can select the subscription option and proceed with the payment. You can then download the form in any preferred format. For over 24 years of our existence, we have assisted millions of individuals by providing customizable and up-to-date legal documents. Take advantage of US Legal Forms now to conserve effort and resources!

- The process is equally straightforward if you are unfamiliar with the website!

- You can create your account within minutes.

- Ensure to verify if the Orlando Florida Renunciation And Disclaimer of Property from Will by Testate complies with the laws and regulations of your state and area.

- Additionally, it is essential to review the form's outline (if available), and if you detect any inconsistencies with what you initially sought, look for an alternative form.

Form popularity

FAQ

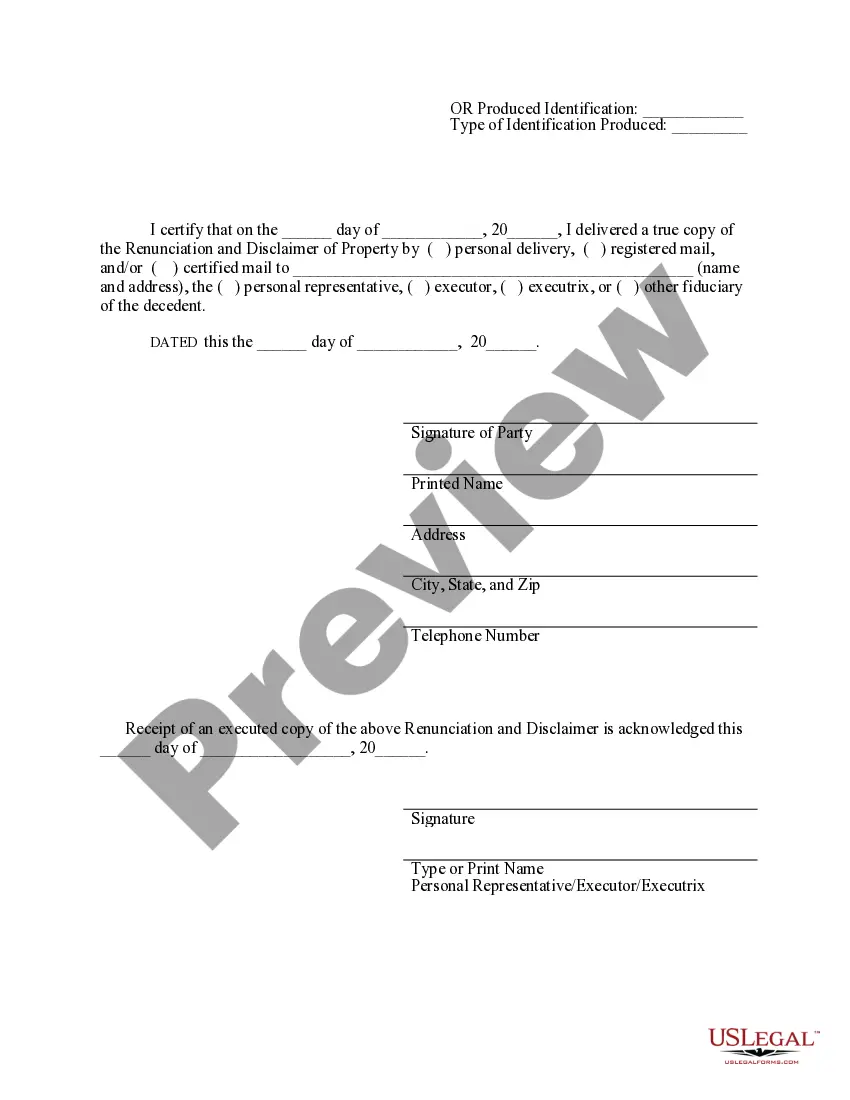

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

Whatever, the reason, Florida law does not force a person to take what is left to them in a will, and a person who wishes to renounce or disclaim inherited property may do so.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

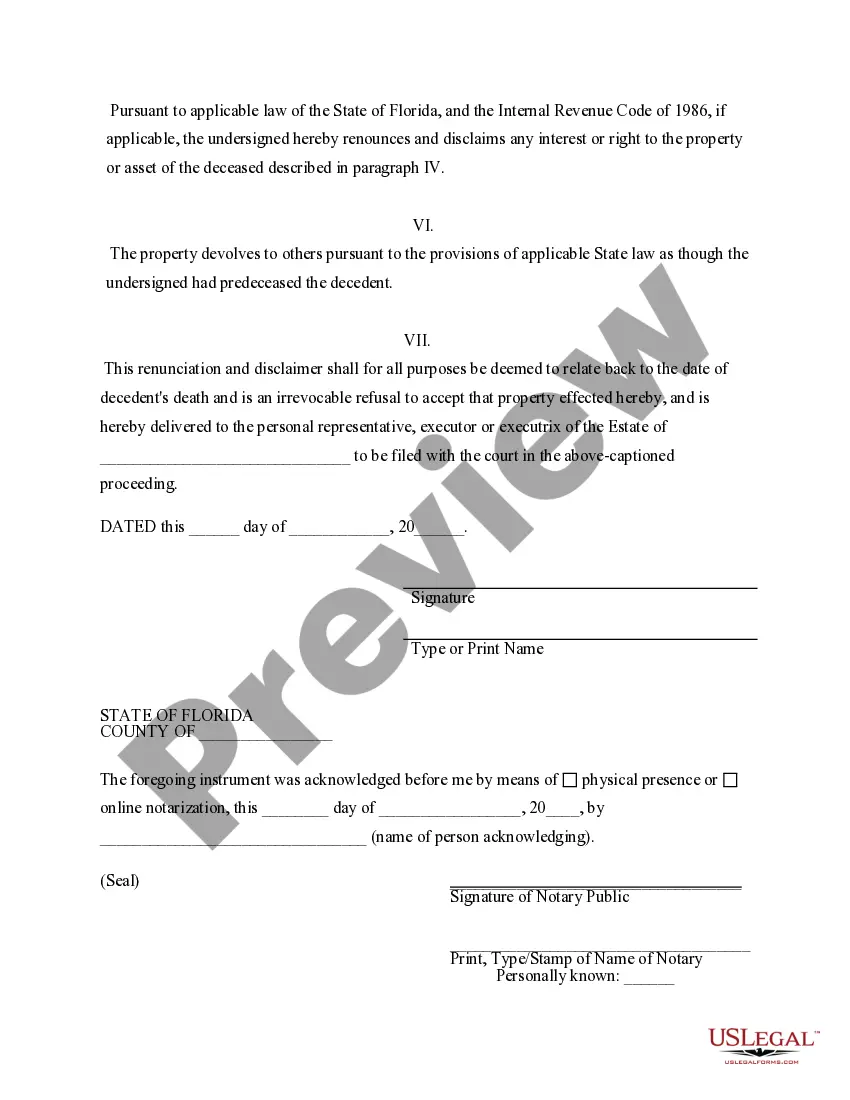

The Act states that for a disclaimer to be effective it must: (1) be in writing; (2) declare that it is a disclaimer; (3) be signed by the person making the disclaimer; and (4) be witnessed and acknowledged in the manner provided for deeds of real estate to be recorded in this state. Fla. Stat.

Florida law allows a person to disclaim interests in Probate and in some circumstances can help a debtor avoid paying their share of an inheritance to creditors. To be effective, the disclaimer must be in writing, witnessed and recorded in the same manner as a deed and the original must be filed. Fla. Stat.

You disclaim the assets within nine months of the death of the person you inherited them from. (There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

A disclaimer is when the recipient (called the ?donee?) refuses a bequest, for example, the donee refuses an inheritance left in a will or trust, refuses the proceeds from an account labeled as pay-on-death account when the original owner dies, or refuses the surviving interest in jointly owned property when one joint

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.