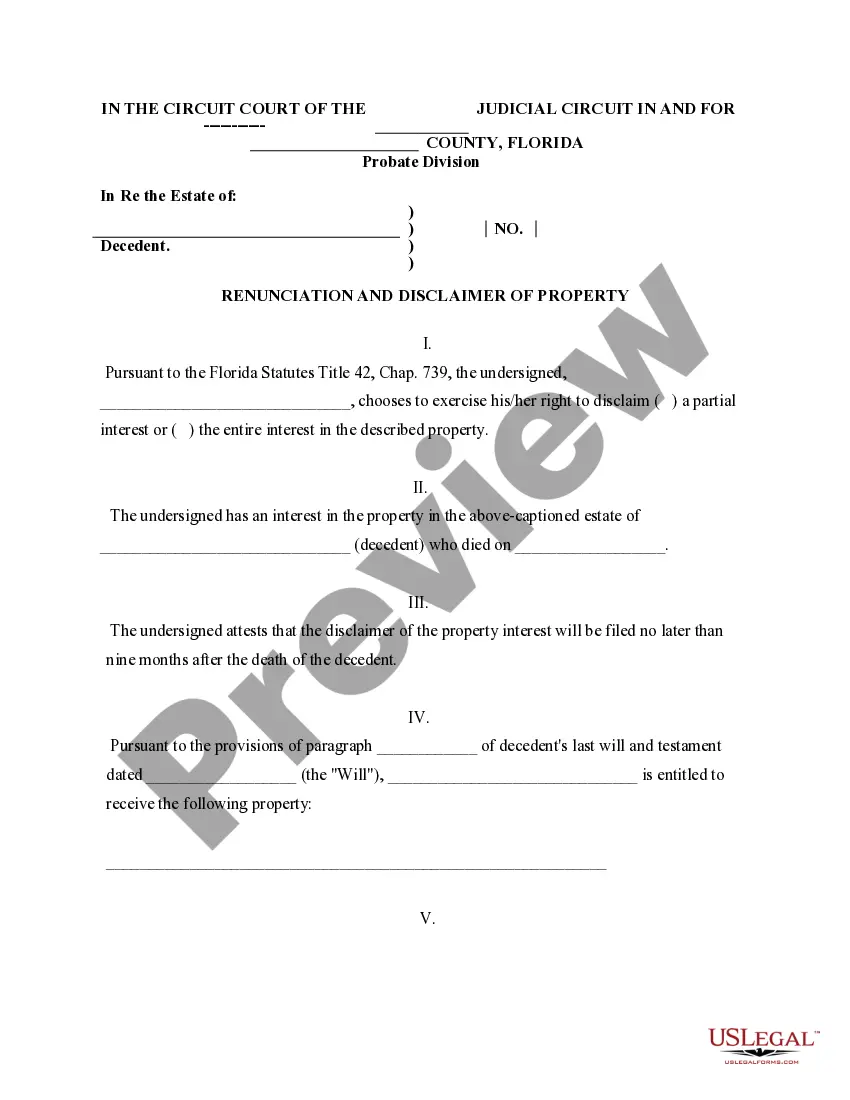

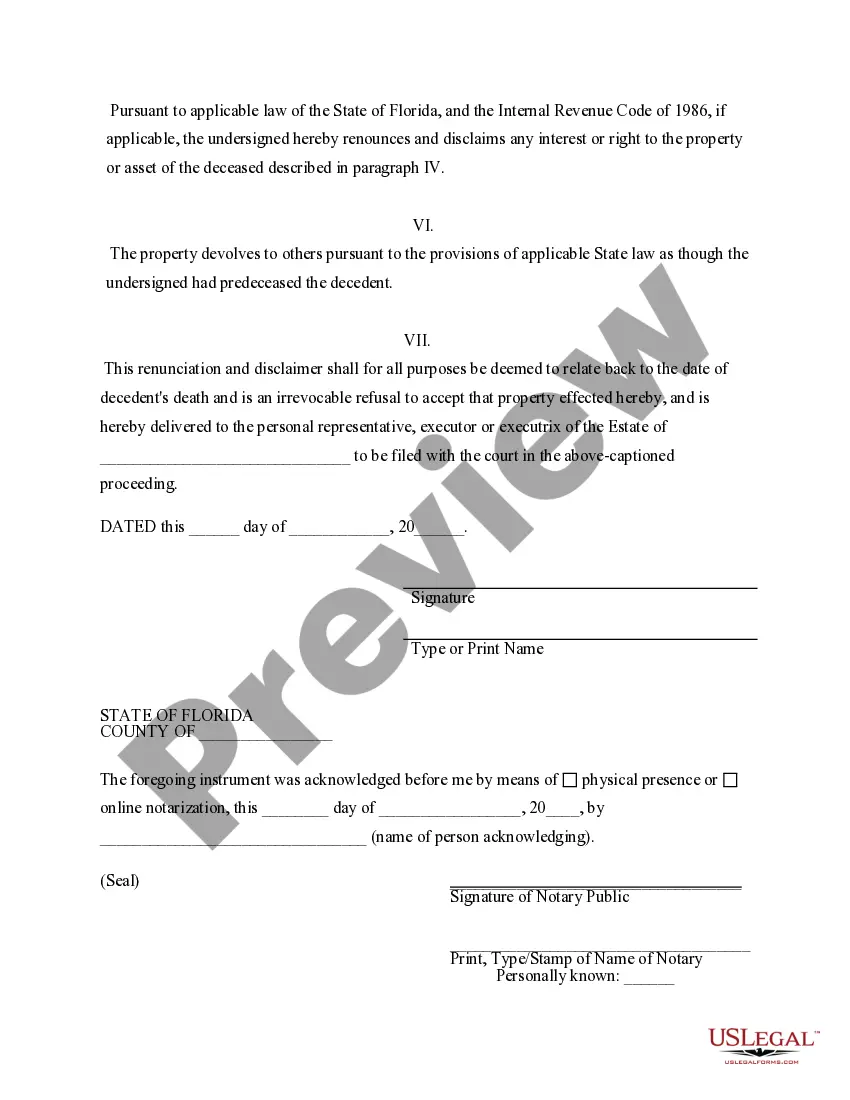

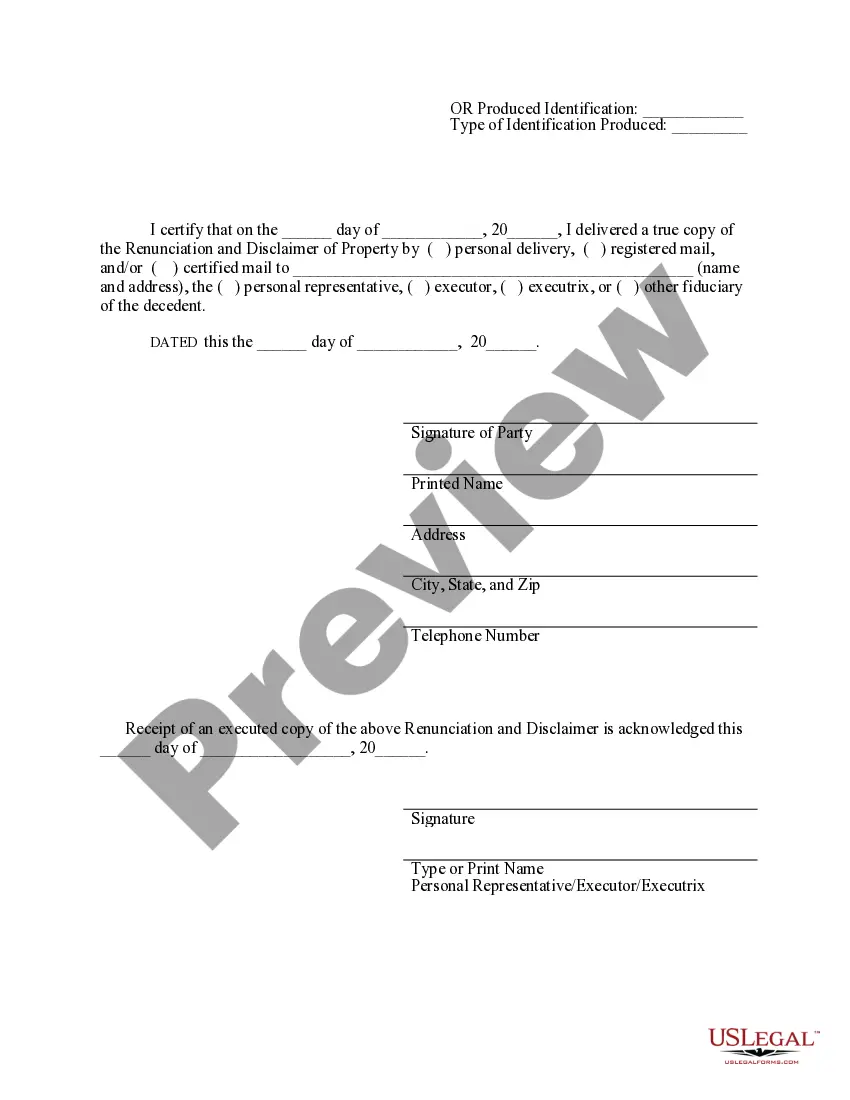

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. However, pursuant to the Florida Statutes Title 42, Chap. 732, the beneficiary is entitled to renounce a portion of or the entire interest in the property. For the disclaimer to be valid, the beneficiary must file the disclaimer within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Port St. Lucie Florida Renunciation And Disclaimer of Property from Will by Testate

Description

How to fill out Florida Renunciation And Disclaimer Of Property From Will By Testate?

If you are in search of an authentic template for forms, it’s challenging to discover a superior service compared to the US Legal Forms website – one of the most comprehensive collections available online.

Here, you can obtain a vast array of document samples for business and personal purposes categorized by types and regions, or by key terms.

Utilizing our enhanced search feature, acquiring the latest Port St. Lucie Florida Renunciation And Disclaimer of Property from Will by Testate is as straightforward as 1-2-3.

Complete the payment. Use your credit card or PayPal account to conclude the registration process.

Receive the form. Specify the desired format and download it to your device. Make adjustments. Complete, modify, print, and sign the received Port St. Lucie Florida Renunciation And Disclaimer of Property from Will by Testate.

- Furthermore, the validity of every document is validated by a team of skilled attorneys who routinely examine the templates on our site and update them in accordance with the latest state and county requirements.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Port St. Lucie Florida Renunciation And Disclaimer of Property from Will by Testate is to Log In to your account and press the Download button.

- If you are utilizing US Legal Forms for the first time, follow the instructions provided below.

- Ensure you have located the form you desire. Review its description and make use of the Preview function to examine its content. If it doesn’t satisfy your needs, use the Search bar located at the top of the screen to find the suitable document.

- Verify your choice. Click the Buy now option. Afterwards, choose your desired pricing plan and enter your details to register for an account.

Form popularity

FAQ

In Florida, if there is no will, you generally have two years from the date of death to probate the estate. However, if the estate is small and qualifies for summary administration, you might be able to expedite the process. It's important to act promptly to ensure that property renunciations and disclaimers are handled properly in instances of Port St. Lucie Florida Renunciation And Disclaimer of Property from Will by Testate.

Filing a petition for summary administration in Florida starts with completing the appropriate forms, including the petition itself and potentially a notice to interested parties. You will need to gather supporting documents, such as the deceased’s death certificate and a list of assets. Once this is ready, file everything with the probate court in Port St. Lucie, Florida, adhering to local regulations.

To file a letter of administration in Florida, you must submit a petition to the probate court along with the death certificate and any required documentation proving your relationship to the deceased. The court will review the petition, and if approved, it will issue a letter of administration. This letter allows you to manage the deceased's estate, which may include handling renunciations and disclaimers.

Yes, you can perform summary administration in Florida without hiring a lawyer, as long as you understand the process. This involves submitting the necessary forms and documentation to the court, including evidence that the deceased's assets are eligible for summary administration. However, resources like USLegalForms can provide guidance to ensure that you complete the process correctly.

Filing a will in Florida involves submitting it to the county court where the deceased resided. First, obtain a certified copy of the death certificate and then complete the appropriate probate forms. It’s essential to ensure that the will adheres to Florida law, particularly if it contains explicit renunciations or disclaimers, such as any relating to the Port St. Lucie Florida Renunciation And Disclaimer of Property from Will by Testate.

In Florida, transferring property after death without a will involves a process known as intestate succession. This law dictates how assets are distributed among surviving relatives. If you are navigating this situation in Port St. Lucie, knowing the rules can simplify the process, especially in relation to property disclaimers. For assistance with these legal intricacies, US Legal Forms is a valuable resource to guide you.

Yes, in Florida, wills become public record once they are submitted to the probate court. This means anyone can access these documents. However, certain details may remain confidential depending on the specific circumstances. Understanding this aspect is vital when dealing with matters like the Port St. Lucie Florida Renunciation and Disclaimer of Property from Will by Testate. For a clearer understanding of public records, consider utilizing US Legal Forms.

To obtain a copy of a will in Florida, you can request it from the court where it was filed. Alternatively, if you're a beneficiary, reach out directly to the personal representative. This step is essential when navigating the Port St. Lucie Florida Renunciation and Disclaimer of Property from Will by Testate. For further help, US Legal Forms provides the necessary resources to streamline your search.

The original copy of a will in Florida is typically kept by the personal representative or executor of the estate. If the will is filed with the local probate court, it may remain there as part of the public record. Knowing where to find the original document is significant, especially in cases involving the Port St. Lucie Florida Renunciation and Disclaimer of Property from Will by Testate. If you have questions, US Legal Forms can assist you in this process.

In Florida, beneficiaries do have a right to receive a copy of the will. This ensures transparency regarding the distribution of assets. If you are a beneficiary in Port St. Lucie, understanding your rights is crucial for navigating the property renunciation process. Should you need assistance, consider using US Legal Forms for straightforward guidance.