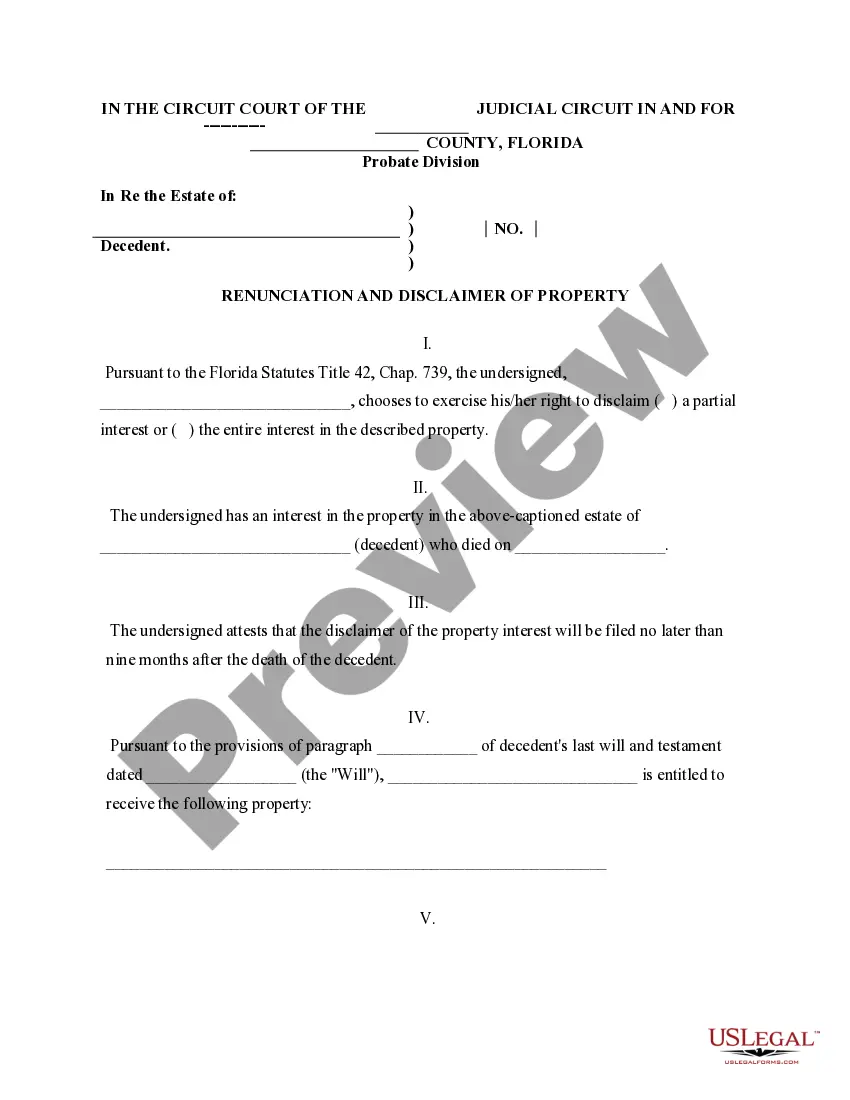

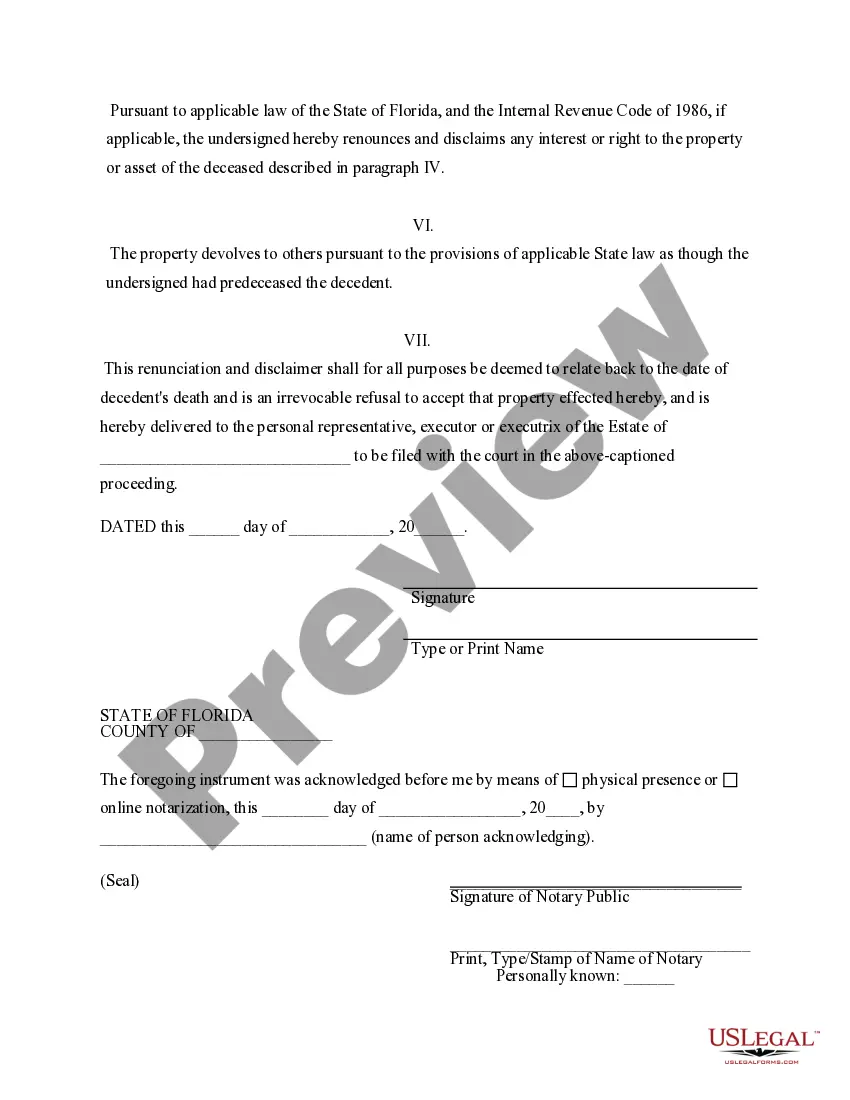

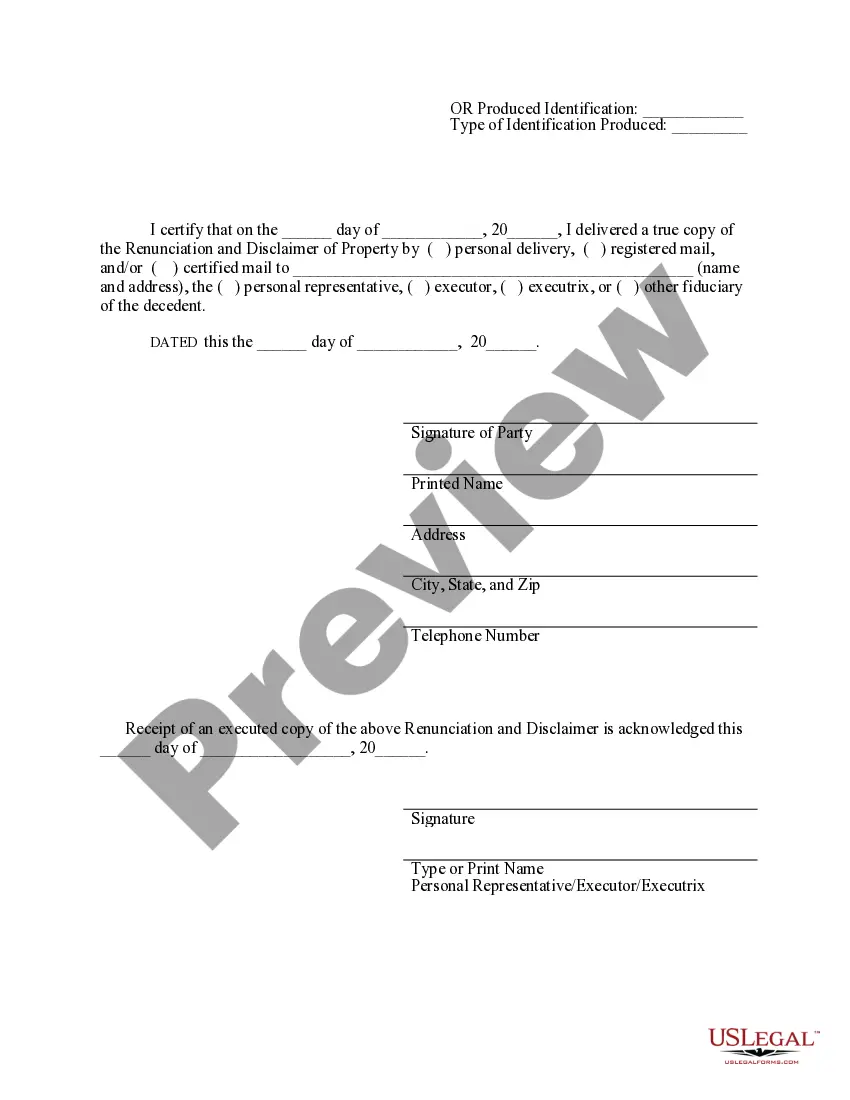

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. However, pursuant to the Florida Statutes Title 42, Chap. 732, the beneficiary is entitled to renounce a portion of or the entire interest in the property. For the disclaimer to be valid, the beneficiary must file the disclaimer within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Tallahassee, the capital of Florida, follows specific laws and regulations regarding the renunciation and disclaimer of property from a testate (valid will). This legal procedure allows individuals named as beneficiaries in a will to renounce or disclaim their rights to inherit the property or assets left to them. 1. Tallahassee Florida Renunciation And Disclaimer of Property from Will by Testate: The renunciation and disclaimer process in Tallahassee pertains to the act of voluntarily waiving a person's right to receive property as outlined in a valid will. This renunciation can be done for various reasons, such as reducing tax liabilities, avoiding conflicts within the family, or simply not wanting to inherit the property. 2. Types of Tallahassee Florida Renunciation And Disclaimer of Property from Will by Testate: a. Partial Renunciation: In some cases, a beneficiary may choose to renounce or disclaim only a portion of the property or assets left to them. This can be a strategic move to maintain certain assets or to distribute them differently among other beneficiaries. b. Complete Renunciation: Complete renunciation occurs when a beneficiary renounces or disclaims their entire share of the property or assets mentioned in the will. By doing so, they forego their right to inherit any part of the estate. c. Specific Asset Disclaimer: This particular type of renunciation involves disclaiming a specific asset or property mentioned in the will. The beneficiary can choose to disclaim only certain assets while accepting others. d. Residuary Estate Disclaimer: A residuary estate includes all the remaining assets and properties that are not specifically mentioned or distributed in the will. The beneficiary can choose to renounce their right to the entire residuary estate or only a portion of it. e. Contingent Renunciation: This type of renunciation occurs when a beneficiary renounces their inheritance under a specific condition or circumstance. For example, a beneficiary may refuse to inherit a property if a particular debt is associated with it. It's essential to consult with a qualified attorney in Tallahassee, Florida, to understand the legal implications, requirements, and deadlines for renunciation and disclaimer of property from a testate will. The attorney can guide individuals through the necessary steps and paperwork involved in the renunciation process while ensuring compliance with Florida's state laws.Tallahassee, the capital of Florida, follows specific laws and regulations regarding the renunciation and disclaimer of property from a testate (valid will). This legal procedure allows individuals named as beneficiaries in a will to renounce or disclaim their rights to inherit the property or assets left to them. 1. Tallahassee Florida Renunciation And Disclaimer of Property from Will by Testate: The renunciation and disclaimer process in Tallahassee pertains to the act of voluntarily waiving a person's right to receive property as outlined in a valid will. This renunciation can be done for various reasons, such as reducing tax liabilities, avoiding conflicts within the family, or simply not wanting to inherit the property. 2. Types of Tallahassee Florida Renunciation And Disclaimer of Property from Will by Testate: a. Partial Renunciation: In some cases, a beneficiary may choose to renounce or disclaim only a portion of the property or assets left to them. This can be a strategic move to maintain certain assets or to distribute them differently among other beneficiaries. b. Complete Renunciation: Complete renunciation occurs when a beneficiary renounces or disclaims their entire share of the property or assets mentioned in the will. By doing so, they forego their right to inherit any part of the estate. c. Specific Asset Disclaimer: This particular type of renunciation involves disclaiming a specific asset or property mentioned in the will. The beneficiary can choose to disclaim only certain assets while accepting others. d. Residuary Estate Disclaimer: A residuary estate includes all the remaining assets and properties that are not specifically mentioned or distributed in the will. The beneficiary can choose to renounce their right to the entire residuary estate or only a portion of it. e. Contingent Renunciation: This type of renunciation occurs when a beneficiary renounces their inheritance under a specific condition or circumstance. For example, a beneficiary may refuse to inherit a property if a particular debt is associated with it. It's essential to consult with a qualified attorney in Tallahassee, Florida, to understand the legal implications, requirements, and deadlines for renunciation and disclaimer of property from a testate will. The attorney can guide individuals through the necessary steps and paperwork involved in the renunciation process while ensuring compliance with Florida's state laws.