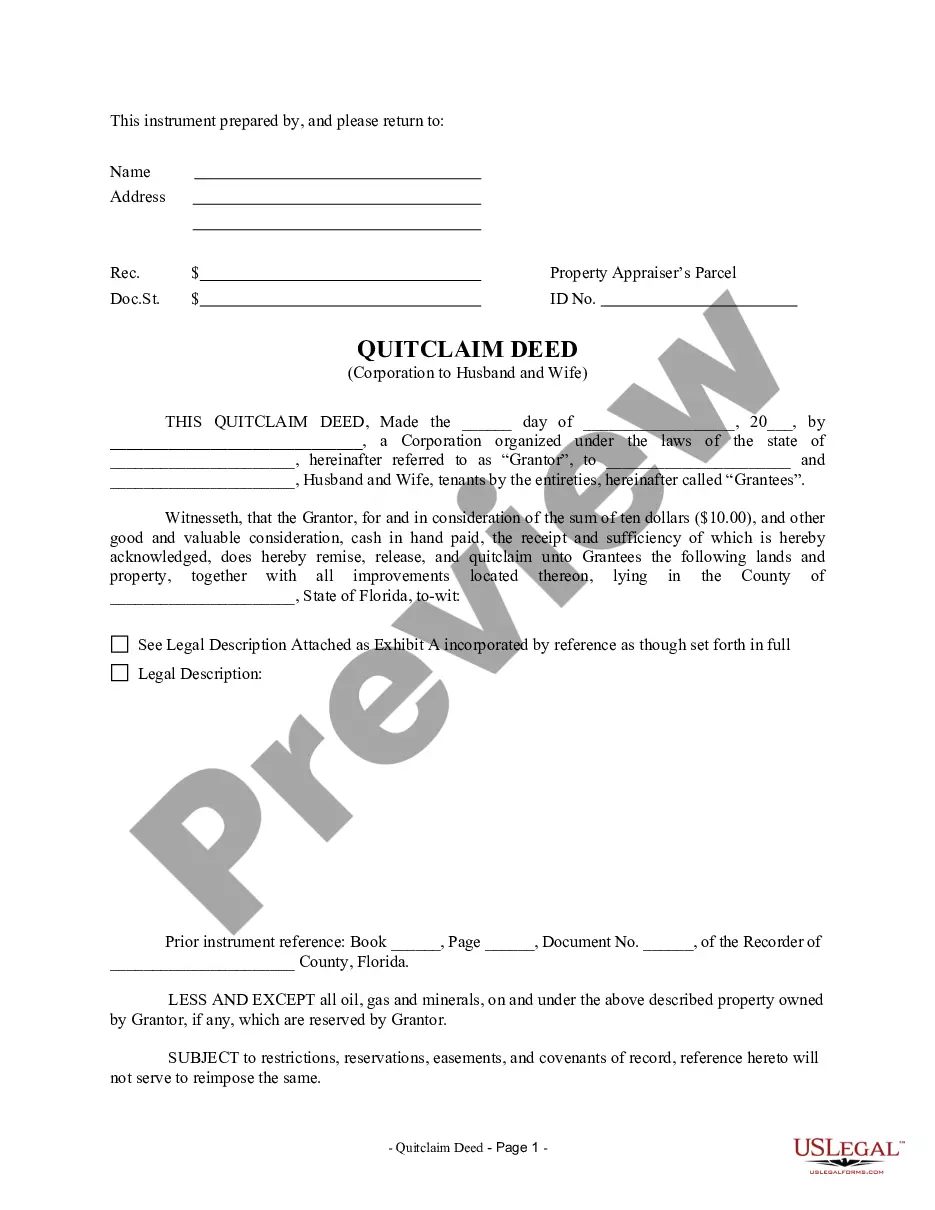

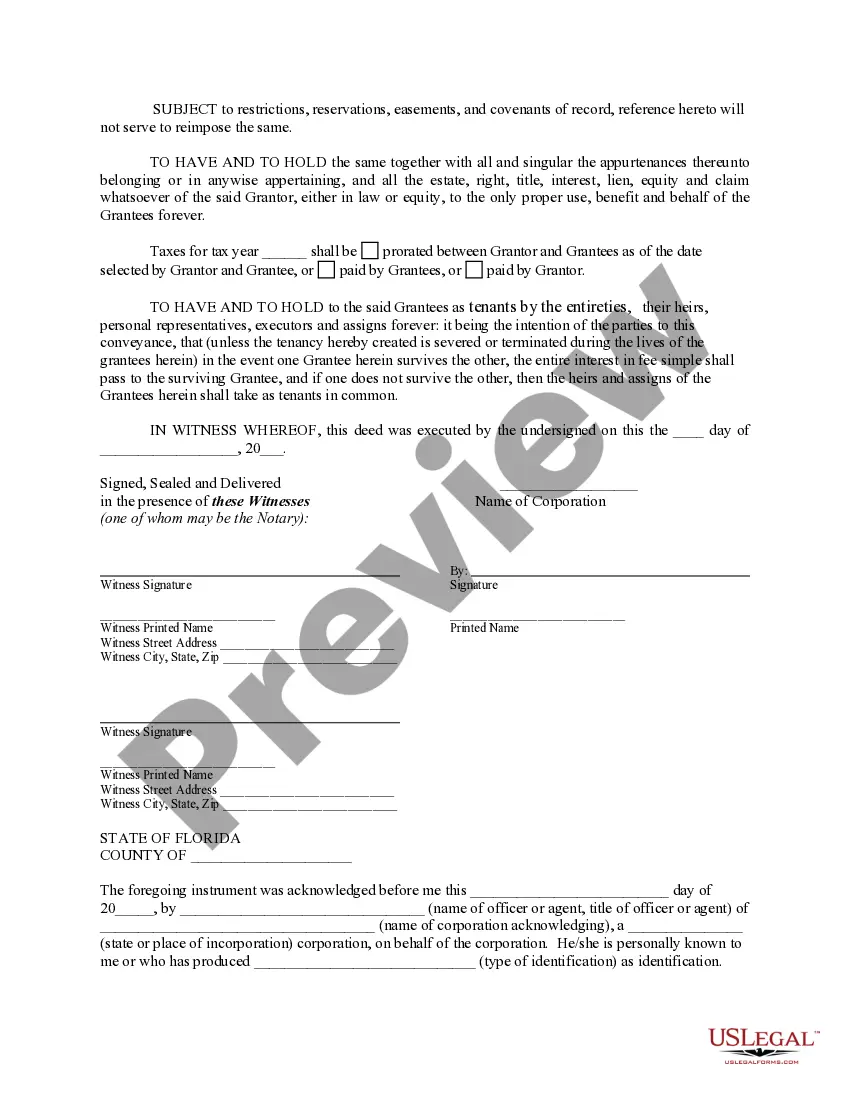

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Palm Beach Florida Quitclaim Deed from Corporation to Husband and Wife is a legally binding document that transfers ownership of real estate property from a corporation to a married couple. This type of deed ensures that the property is transferred from the corporation's ownership to the joint ownership of the husband and wife. A Quitclaim Deed is a type of deed that allows the transferring party (the corporation in this case) to release any claim they may have on the property without providing any warranties or guarantees. It is commonly used for transfers between family members or in cases where the parties trust each other. The Palm Beach Florida Quitclaim Deed from Corporation to Husband and Wife is commonly executed when a corporation wishes to convey property to a married couple, ensuring joint ownership rights and responsibilities. It is crucial to ensure that the deed complies with the legal requirements and is properly recorded with the county clerk's office to establish the transfer of ownership. Different types of Palm Beach Florida Quitclaim Deeds from Corporation to Husband and Wife may include variations based on specific circumstances or additional agreements between the parties involved. For instance, some deeds might include provisions regarding shared expenses, maintenance responsibilities, or the handling of potential disputes between the husband and wife. These variations can help secure the interests of both parties and provide clarity regarding their rights and obligations. When executing a Palm Beach Florida Quitclaim Deed from Corporation to Husband and Wife, it is advisable to consult legal professionals specializing in real estate law to ensure the deed is drafted accurately and in compliance with all applicable laws. Hiring a qualified attorney will guarantee that the parties' interests are protected and that the transfer of ownership is properly finalized. In conclusion, a Palm Beach Florida Quitclaim Deed from Corporation to Husband and Wife is a legal instrument used to transfer ownership of real estate property from a corporation to a married couple. It is essential to employ the services of legal professionals to navigate the intricacies of the process and ensure all requirements are met. This type of deed helps protect the rights and interests of both parties involved in the property transfer.