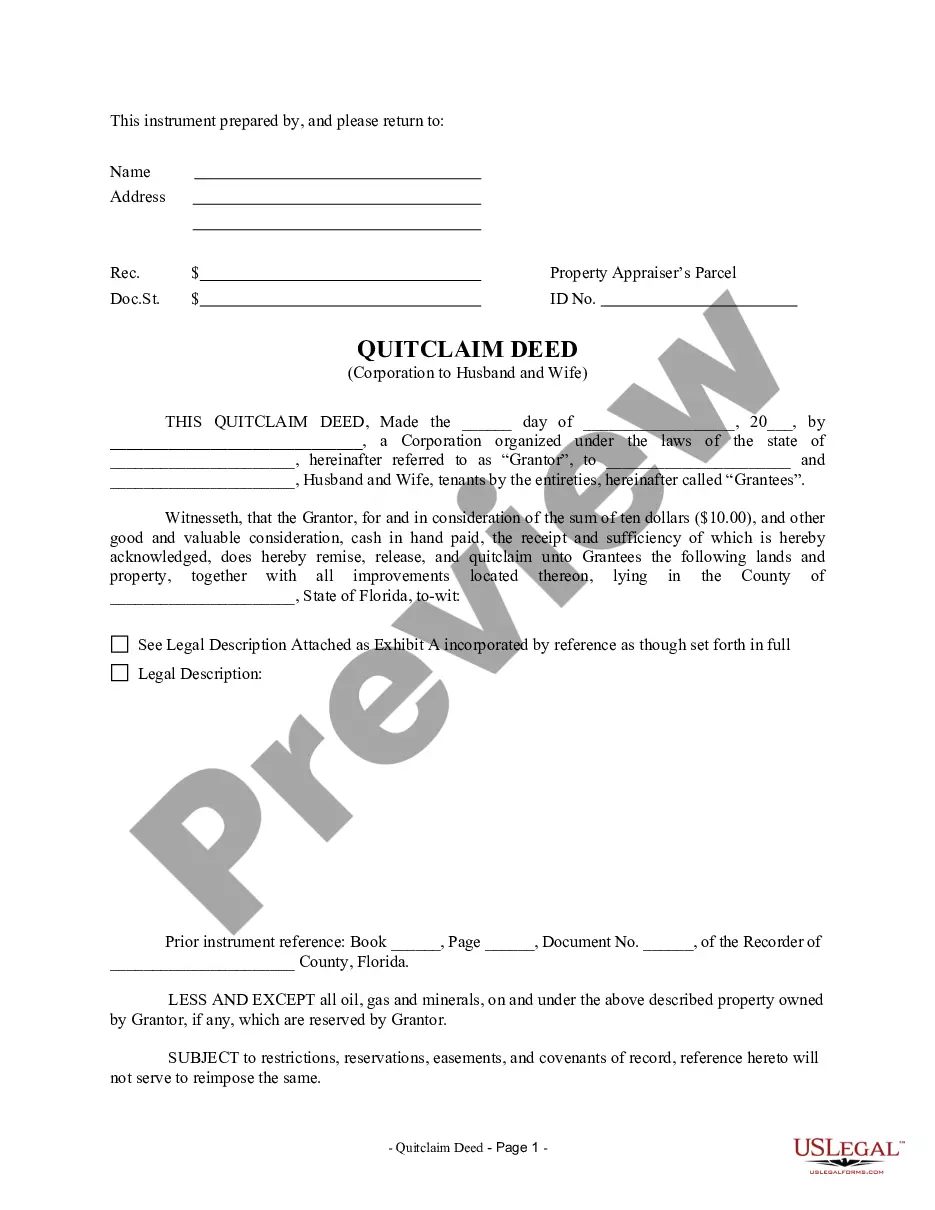

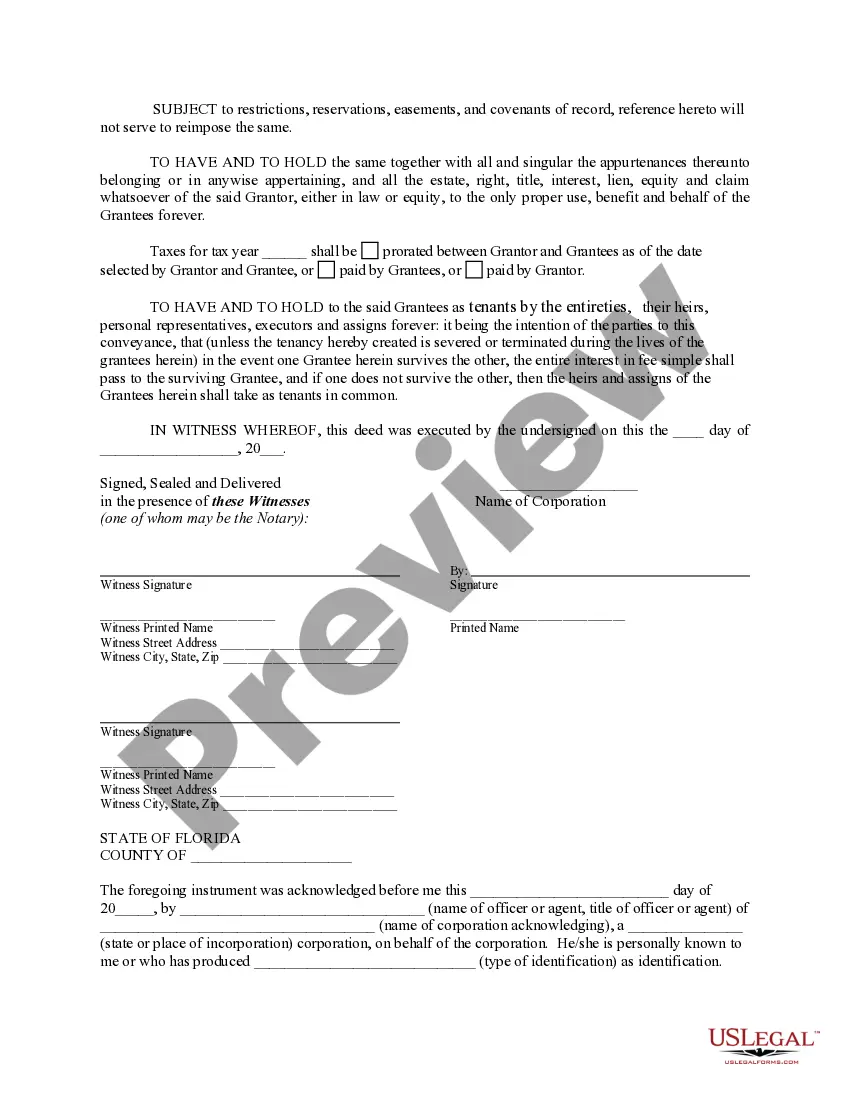

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

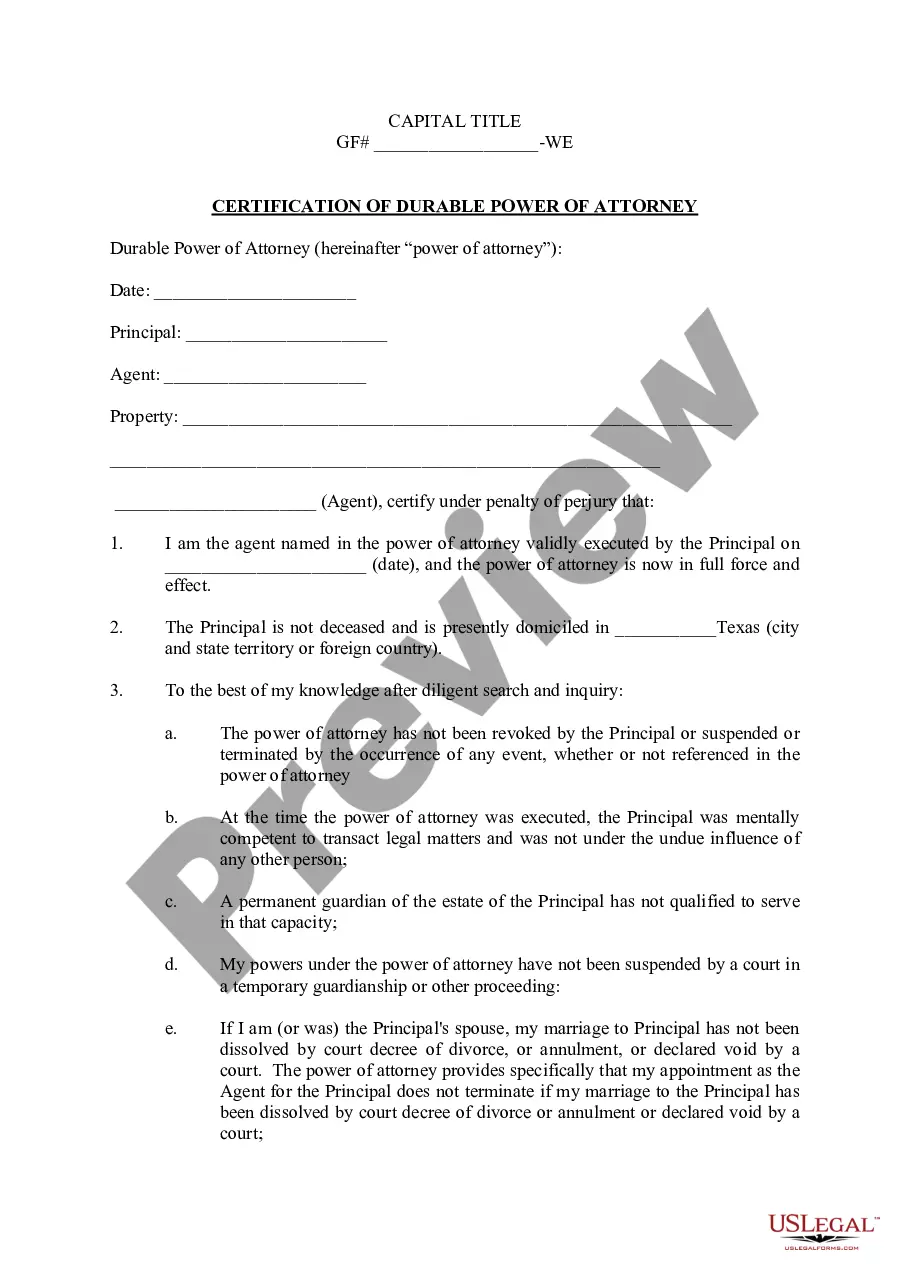

A St. Petersburg Florida Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of property from a corporation to a married couple. This type of deed is commonly used when a corporation wishes to convey property ownership to both spouses jointly. It is essential to understand the specifics of this deed to ensure a smooth property transfer process. Key Features of a St. Petersburg Florida Quitclaim Deed from Corporation to Husband and Wife: 1. Property Transfer: A Quitclaim Deed allows the corporation to legally transfer property rights to the husband and wife simultaneously. It conveys any interest or claim the corporation has in the property to the couple. 2. Ownership Rights: By using a Quitclaim Deed, the corporation does not guarantee that it holds any particular interest in the property. It simply transfers the ownership it currently has, without any warranties regarding the title. 3. Marital Status Requirement: This type of Quitclaim Deed is specifically designed for a married couple. Both the husband and wife must be named as grantees in the deed, signifying their joint ownership of the property. 4. Unique Legal Language: The deed may include specific legal language, such as covenants or representations, detailing the corporation's authority to transfer the property and confirming the couple's acceptance of the property under certain conditions. 5. Legal Assistance: It is highly recommended for both parties, the corporation, and the couple, to seek the assistance of a qualified real estate attorney specializing in St. Petersburg, Florida property law. This ensures that all legal requirements are met, protecting the interests of both parties involved in the transaction. Different Types of St. Petersburg Florida Quitclaim Deed from Corporation to Husband and Wife: 1. Individual and Corporate Ownership: In some cases, a husband or wife may own the property individually and wish to add the corporation as a co-owner. This variation of the Quitclaim Deed would name the individual spouse(s) as the additional grantees in the deed alongside the corporation. 2. Corporate Property Distribution: Another scenario may involve a corporation distributing property owned solely by the corporation to the husband and wife jointly. This deed would transfer full ownership interest to the couple without any involvement of individual ownership rights. 3. Partial Corporate Interest: This type of Quitclaim Deed is applicable when the corporation wishes to transfer only a portion of its interest in a property to the husband and wife. The deed would specify the percentage or share of ownership being transferred and reflect the corporation's retained interest in the property. Remember, specific legal requirements and variations can vary depending on the circumstances and jurisdiction. Consulting with a legal professional experienced in St. Petersburg, Florida real estate matters is crucial to ensure the appropriate deed is prepared and executed accurately.A St. Petersburg Florida Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of property from a corporation to a married couple. This type of deed is commonly used when a corporation wishes to convey property ownership to both spouses jointly. It is essential to understand the specifics of this deed to ensure a smooth property transfer process. Key Features of a St. Petersburg Florida Quitclaim Deed from Corporation to Husband and Wife: 1. Property Transfer: A Quitclaim Deed allows the corporation to legally transfer property rights to the husband and wife simultaneously. It conveys any interest or claim the corporation has in the property to the couple. 2. Ownership Rights: By using a Quitclaim Deed, the corporation does not guarantee that it holds any particular interest in the property. It simply transfers the ownership it currently has, without any warranties regarding the title. 3. Marital Status Requirement: This type of Quitclaim Deed is specifically designed for a married couple. Both the husband and wife must be named as grantees in the deed, signifying their joint ownership of the property. 4. Unique Legal Language: The deed may include specific legal language, such as covenants or representations, detailing the corporation's authority to transfer the property and confirming the couple's acceptance of the property under certain conditions. 5. Legal Assistance: It is highly recommended for both parties, the corporation, and the couple, to seek the assistance of a qualified real estate attorney specializing in St. Petersburg, Florida property law. This ensures that all legal requirements are met, protecting the interests of both parties involved in the transaction. Different Types of St. Petersburg Florida Quitclaim Deed from Corporation to Husband and Wife: 1. Individual and Corporate Ownership: In some cases, a husband or wife may own the property individually and wish to add the corporation as a co-owner. This variation of the Quitclaim Deed would name the individual spouse(s) as the additional grantees in the deed alongside the corporation. 2. Corporate Property Distribution: Another scenario may involve a corporation distributing property owned solely by the corporation to the husband and wife jointly. This deed would transfer full ownership interest to the couple without any involvement of individual ownership rights. 3. Partial Corporate Interest: This type of Quitclaim Deed is applicable when the corporation wishes to transfer only a portion of its interest in a property to the husband and wife. The deed would specify the percentage or share of ownership being transferred and reflect the corporation's retained interest in the property. Remember, specific legal requirements and variations can vary depending on the circumstances and jurisdiction. Consulting with a legal professional experienced in St. Petersburg, Florida real estate matters is crucial to ensure the appropriate deed is prepared and executed accurately.