An AB trust is a trust created by a married couple to avoid probate and minimize federal estate tax. An AB trust is created by each spouse placing property into a trust and naming someone other than his or her spouse as the final beneficiary of that trust. Upon the death of the first spouse, the surviving spouse does not own the assets in that spouse's trust outright, but has a limited power over the assets in accordance with the terms of the trust. Such powers may include the right to receive interest or income earned by the trust, to use the trust property during his or her lifetime, e.g. to live in a house, and/or to use the trust principal for his or her health, education, or support. Upon the death of the second spouse, the trust passes to the final beneficiary of the trust. For estate tax purposes, the trust is included in the first, but not the second, spouse's estate and therefore, avoids double taxation.

Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B

Description

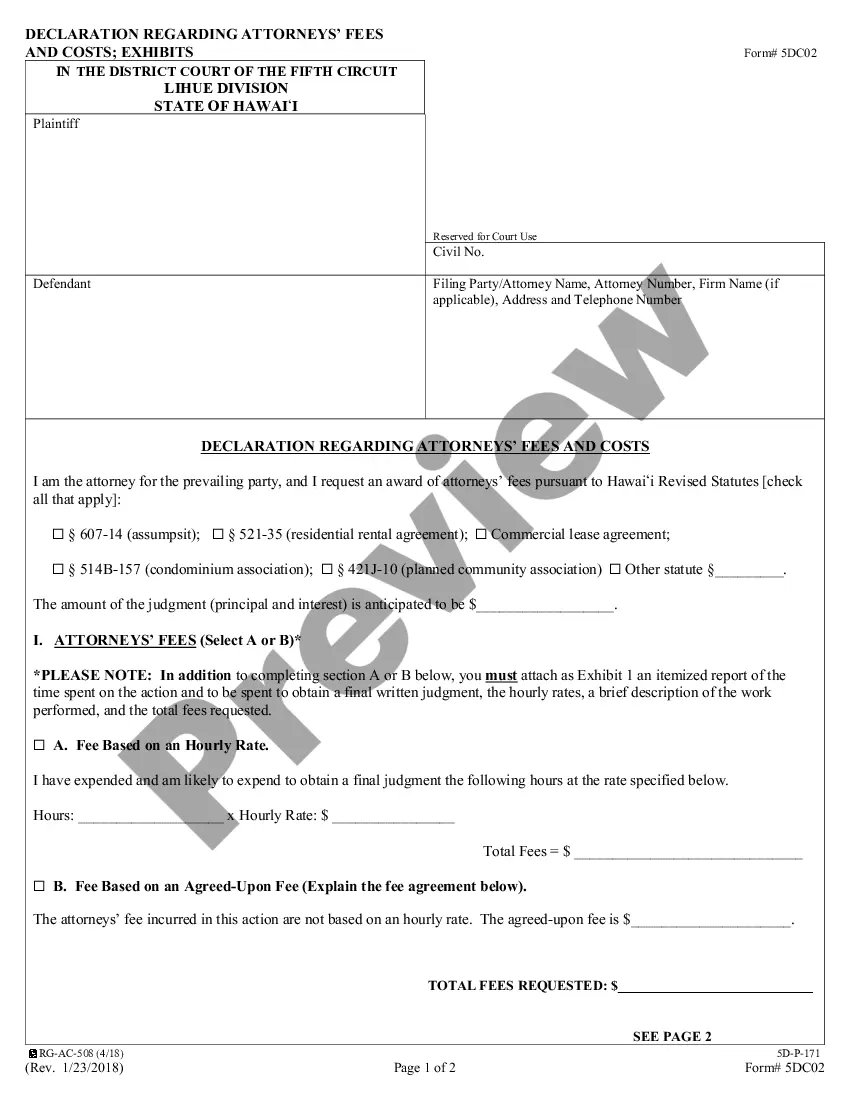

How to fill out Florida Marital Deduction Trust - Trust A And Bypass Trust B?

Do you require a reliable and affordable provider of legal forms to obtain the Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish guidelines for living together with your partner or a set of documents to facilitate your divorce proceedings through the court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. All templates that we provide are not generic and are structured in accordance with the specifications of particular states and counties.

To download the document, you need to Log In to your account, search for the necessary form, and click the Download button next to it. Please consider that you can download your previously acquired document templates at any time from the My documents section.

Are you new to our platform? No concerns. You can easily create an account, but beforehand, make sure to do the following.

Now you can register your account. Then choose the subscription plan and move forward to payment. Once the payment is finalized, download the Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B in any accessible file format. You can revisit the website whenever needed and redownload the document at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time studying legal papers online once and for all.

- Verify if the Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B complies with the regulations of your state and locality.

- Read the description of the form (if available) to understand who and what the document is meant for.

- Restart your search if the form isn’t appropriate for your legal needs.

Form popularity

FAQ

A family trust and a bypass trust are not the same, though they share some similarities. A family trust focuses on estate planning and asset management for your loved ones, while a bypass trust specifically aims to reduce estate taxes for your heirs. In a Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B setup, assets can pass to a surviving spouse without immediate tax consequences. By understanding these differences, you can make informed decisions for effective estate planning.

A Trust A, often referred to as a marital trust, provides income to the surviving spouse while keeping the principal amount intact for eventual distribution to other beneficiaries. In contrast, a Bypass Trust B allows assets to pass outside of the surviving spouse’s estate, potentially reducing estate taxes. Understanding the distinctions between a Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B is crucial for effective estate planning. By utilizing our platform, you can easily create these trusts tailored to your needs.

When a surviving spouse dies, the assets held in a bypass trust typically remain outside their estate, thus avoiding estate taxes. This allows the trust to benefit the designated beneficiaries, often children or other family members. The Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B facilitate this process, ensuring that wealth is efficiently transferred and preserved for future generations.

A marital deduction trust allows a surviving spouse to receive trust benefits without paying estate taxes immediately, making it a valuable tool for minimizing tax liabilities. In contrast, a bypass trust is designed to preserve wealth and avoid estate taxes upon the death of the second spouse. The Miramar Florida Marital Deduction Trust - Trust A provides immediate benefits, while Bypass Trust B fosters long-term financial planning.

While a bypass trust offers advantages like estate tax savings, it does have disadvantages, such as the complexity of administration and potential loss of control over assets. The Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B can create separate trusts which may require careful management. Also, any income generated by a bypass trust could be taxable to the beneficiaries, impacting their financial plans.

A trust is a legal arrangement that holds and manages assets for beneficiaries. In contrast, a B trust, often referred to as a bypass trust, is designed to bypass the surviving spouse's estate, helping to minimize estate taxes. The Miramar Florida Marital Deduction Trust - Trust A allows for the surviving spouse to benefit from Trust A, while Trust B preserves wealth for future generations.

The main disadvantage of a trust, such as the Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B, is the initial setup and ongoing management costs. Establishing a trust often requires legal fees and can involve complex paperwork. Additionally, some people find that trusts reduce their control over assets since they have to adhere to the trust's terms.

No, a bypass trust typically does not qualify for the marital deduction. Assets placed in a bypass trust are designed to bypass the surviving spouse’s estate and thus do not receive the same tax advantages as a marital trust. It's essential to distinguish between the Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B when planning your estate.

Bypass trusts provide several benefits, including protecting assets from estate taxes after the death of one spouse. They also allow for greater control over how and when beneficiaries receive their inheritance. Utilizing the Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B can ensure that your financial legacy is preserved according to your wishes.

Certain assets do not qualify for the marital deduction, including life insurance policies owned by the deceased spouse and assets transferred to a non-spousal beneficiary. Additionally, assets placed in irrevocable trusts may also be excluded. Understanding these exclusions is vital when planning your Miramar Florida Marital Deduction Trust - Trust A and Bypass Trust B.