Often, by virtue of provision in the restrictive covenants affecting a subdivision, the homeowners' association will be granted the right to assess the owners, and failing payment have a lien on the defaulting member's property upon the filing in the public records of a notice or claim of the lien.

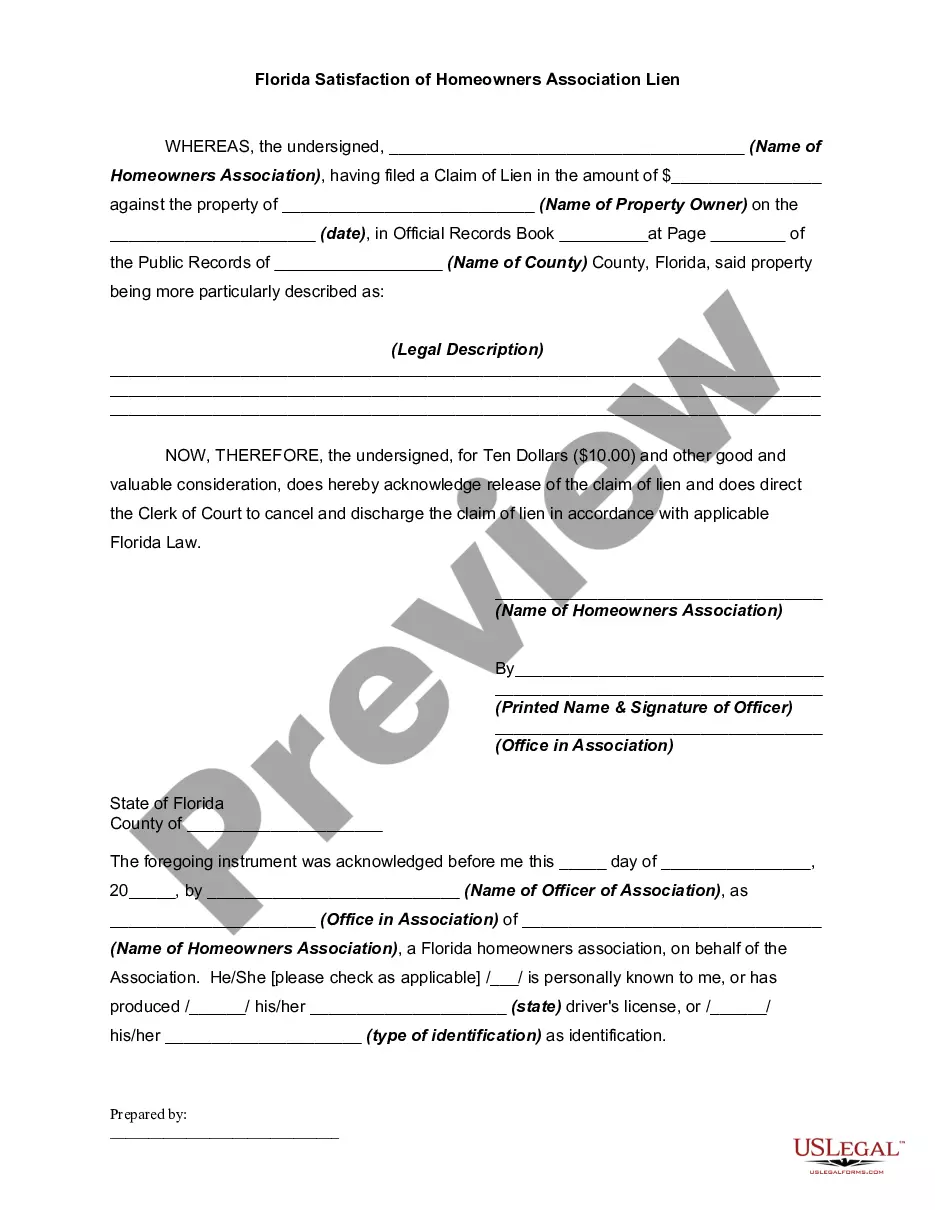

Orange Florida Satisfaction of Homeowners Association Lien is a legal document that homeowners associations (Has) in Orange County, Florida may file against a property owner who fails to pay their association dues, fees, or fines. This lien serves as a claim or encumbrance on the property, which means that it gives the HOA the right to potentially foreclose the property if the homeowner continues to neglect their financial obligations. The purpose of an Orange Florida Satisfaction of Homeowners Association Lien is to protect the interests and financial stability of the HOA, ensuring that all members contribute fairly to the maintenance of the community and its amenities. When a homeowner purchases a property in an HOA-governed community, they agree to abide by the association's guidelines and pay the necessary fees to support the shared costs of the community's upkeep, landscaping, security, and other collective expenses. In Orange County, Florida, there are two primary types of Satisfaction of Homeowners Association Lien: 1. Regular Lien: This type of lien is typically filed when a homeowner fails to pay their regular monthly or annual HOA dues. The lien amount includes the unpaid dues, plus any late fees, interest, or administrative charges incurred due to non-payment. 2. Enforcement Lien: In cases where a homeowner repeatedly neglects their financial obligations or violates the HOA's governing documents, an enforcement lien may be filed. This type of lien can be triggered by chronic non-payment, significant violations of community rules, or failure to rectify violations after receiving proper notice. The process of filing an Orange Florida Satisfaction of Homeowners Association Lien requires the HOA to follow specific legal procedures and timelines. Initially, the homeowner will receive written notices and opportunities to resolve the outstanding debt. If the homeowner continues to neglect their obligations, the HOA may initiate the lien process and file the necessary documents with the Orange County clerk's office. This creates a public record of the lien against the property. Once the homeowner settles their outstanding debt, the HOA will file a Satisfaction of Lien document with the Orange County clerk's office, officially releasing the lien and removing the encumbrance from the property's title. It is important for homeowners to resolve any outstanding liens promptly to avoid potential negative consequences such as damaged credit, legal disputes, or foreclosure. In summary, Orange Florida Satisfaction of Homeowners Association Lien is a legal instrument used by Has in Orange County, Florida, to claim a property owner's unpaid dues or fines. Regular and enforcement liens are the two primary types, each serving as a mechanism to uphold financial obligations and maintain the overall integrity of the community.Orange Florida Satisfaction of Homeowners Association Lien is a legal document that homeowners associations (Has) in Orange County, Florida may file against a property owner who fails to pay their association dues, fees, or fines. This lien serves as a claim or encumbrance on the property, which means that it gives the HOA the right to potentially foreclose the property if the homeowner continues to neglect their financial obligations. The purpose of an Orange Florida Satisfaction of Homeowners Association Lien is to protect the interests and financial stability of the HOA, ensuring that all members contribute fairly to the maintenance of the community and its amenities. When a homeowner purchases a property in an HOA-governed community, they agree to abide by the association's guidelines and pay the necessary fees to support the shared costs of the community's upkeep, landscaping, security, and other collective expenses. In Orange County, Florida, there are two primary types of Satisfaction of Homeowners Association Lien: 1. Regular Lien: This type of lien is typically filed when a homeowner fails to pay their regular monthly or annual HOA dues. The lien amount includes the unpaid dues, plus any late fees, interest, or administrative charges incurred due to non-payment. 2. Enforcement Lien: In cases where a homeowner repeatedly neglects their financial obligations or violates the HOA's governing documents, an enforcement lien may be filed. This type of lien can be triggered by chronic non-payment, significant violations of community rules, or failure to rectify violations after receiving proper notice. The process of filing an Orange Florida Satisfaction of Homeowners Association Lien requires the HOA to follow specific legal procedures and timelines. Initially, the homeowner will receive written notices and opportunities to resolve the outstanding debt. If the homeowner continues to neglect their obligations, the HOA may initiate the lien process and file the necessary documents with the Orange County clerk's office. This creates a public record of the lien against the property. Once the homeowner settles their outstanding debt, the HOA will file a Satisfaction of Lien document with the Orange County clerk's office, officially releasing the lien and removing the encumbrance from the property's title. It is important for homeowners to resolve any outstanding liens promptly to avoid potential negative consequences such as damaged credit, legal disputes, or foreclosure. In summary, Orange Florida Satisfaction of Homeowners Association Lien is a legal instrument used by Has in Orange County, Florida, to claim a property owner's unpaid dues or fines. Regular and enforcement liens are the two primary types, each serving as a mechanism to uphold financial obligations and maintain the overall integrity of the community.