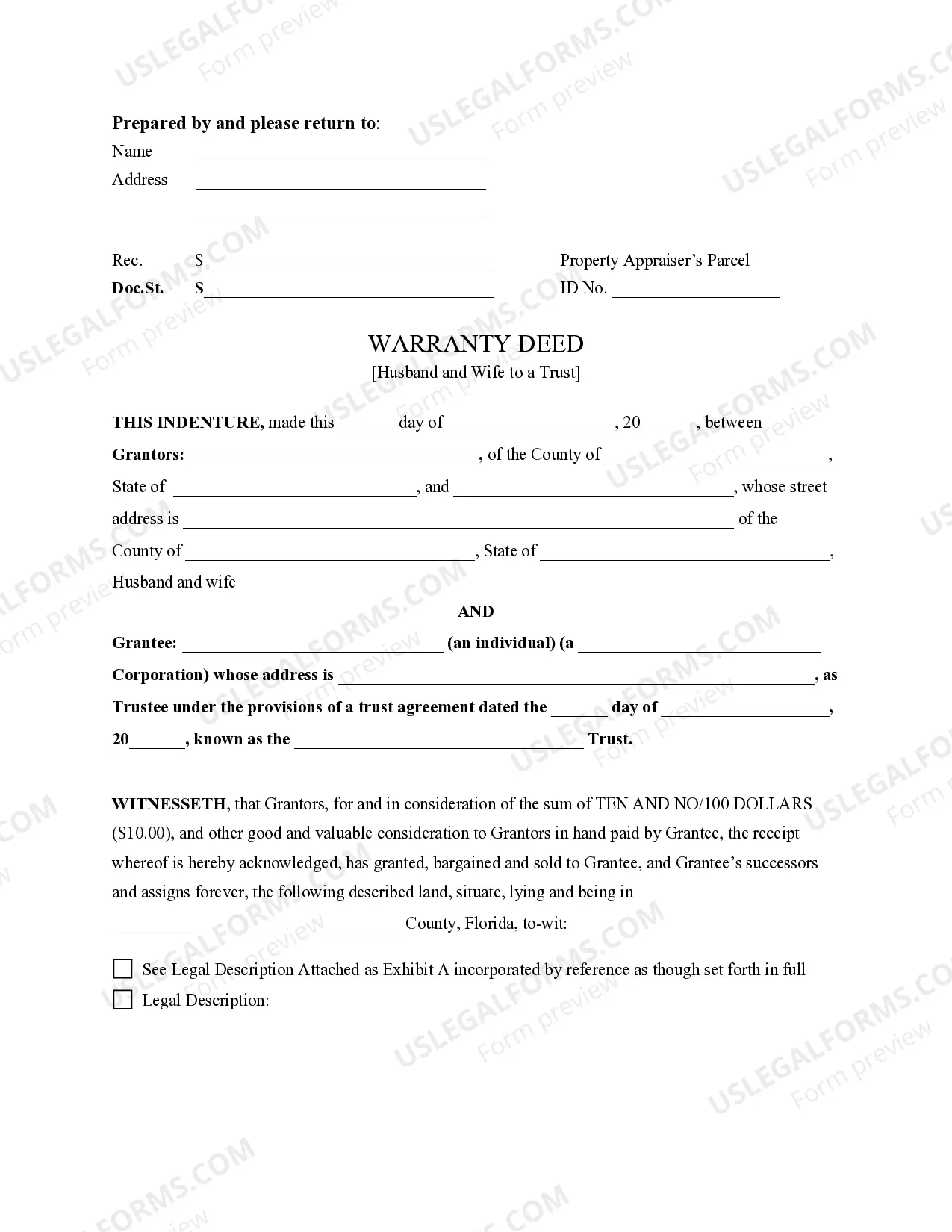

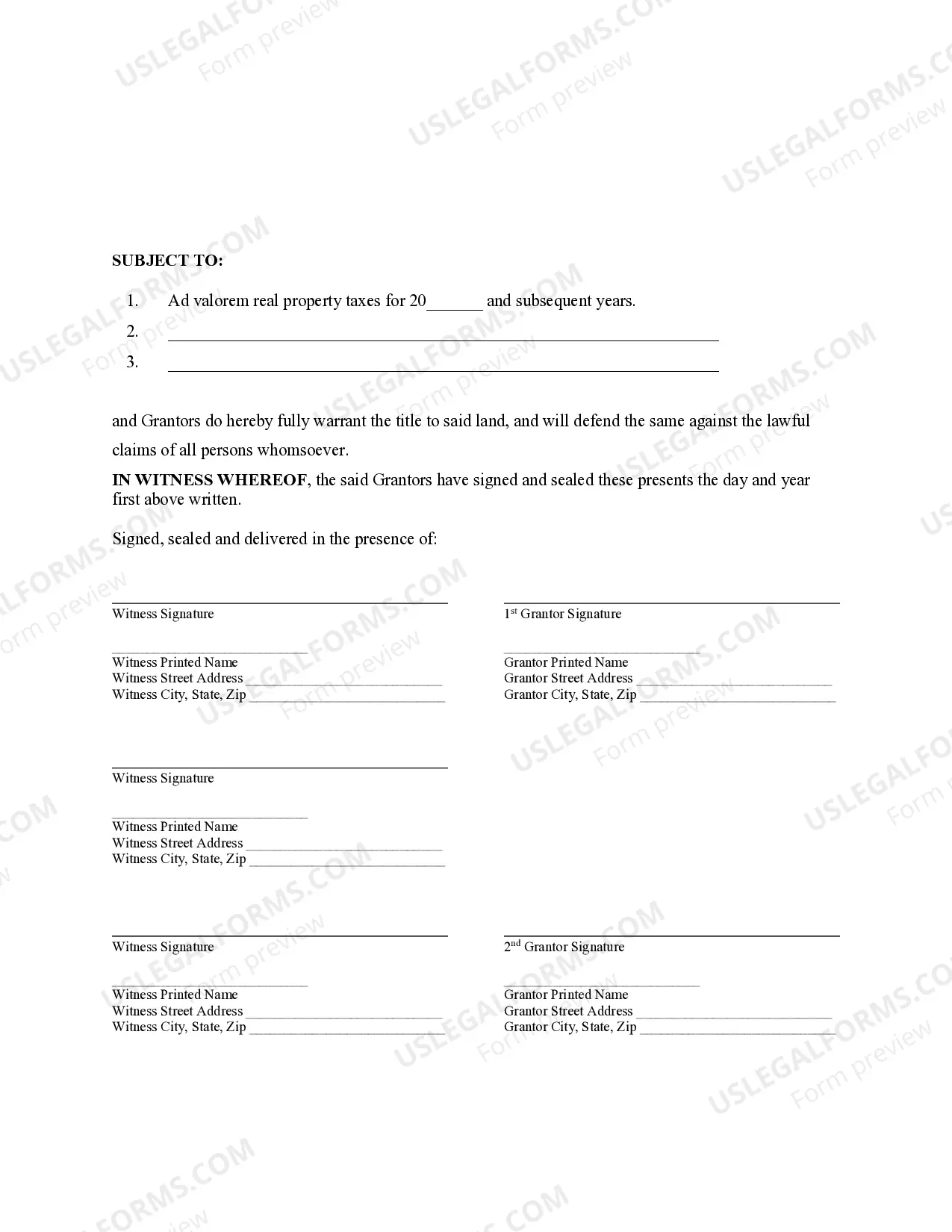

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Coral Springs Florida Warranty Deed is a legal document that transfers ownership of real estate property from a husband and wife to a trust. This type of transaction provides benefits such as asset protection, estate planning, and potential tax advantages for the individuals involved. The warranty deed is a binding legal agreement that guarantees the granter's (husband and wife) ownership rights and promises that the property is free from any liens or encumbrances. The trust, acting as the grantee, assumes all rights and responsibilities associated with the property. There are generally two main types of Coral Springs Florida Warranty Deed from Husband and Wife to a Trust, which are: 1. Revocable Living Trust Warranty Deed: This type of warranty deed is commonly used for estate planning purposes. It allows the husband and wife, as granters, to transfer their property to a revocable living trust they have established. This trust can be modified or revoked during their lifetime, providing flexibility and control over the property. It also allows for a smooth transfer of ownership upon the death or incapacity of the husband and wife. 2. Irrevocable Trust Warranty Deed: An irrevocable trust warranty deed is used when the husband and wife want to permanently transfer ownership of the property to an irrevocable trust. Once the property is transferred, the trust becomes the legal owner, and the granters no longer have control or ownership rights. This type of trust generally offers additional asset protection from creditors, estate tax reduction benefits, and eligibility for certain government assistance programs. When creating a Coral Springs Florida Warranty Deed from Husband and Wife to a Trust, it is essential to consult with an experienced real estate attorney or estate planning professional who will draft the document to ensure its compliance with Florida state laws and accurately represents the intentions of the parties involved.A Coral Springs Florida Warranty Deed is a legal document that transfers ownership of real estate property from a husband and wife to a trust. This type of transaction provides benefits such as asset protection, estate planning, and potential tax advantages for the individuals involved. The warranty deed is a binding legal agreement that guarantees the granter's (husband and wife) ownership rights and promises that the property is free from any liens or encumbrances. The trust, acting as the grantee, assumes all rights and responsibilities associated with the property. There are generally two main types of Coral Springs Florida Warranty Deed from Husband and Wife to a Trust, which are: 1. Revocable Living Trust Warranty Deed: This type of warranty deed is commonly used for estate planning purposes. It allows the husband and wife, as granters, to transfer their property to a revocable living trust they have established. This trust can be modified or revoked during their lifetime, providing flexibility and control over the property. It also allows for a smooth transfer of ownership upon the death or incapacity of the husband and wife. 2. Irrevocable Trust Warranty Deed: An irrevocable trust warranty deed is used when the husband and wife want to permanently transfer ownership of the property to an irrevocable trust. Once the property is transferred, the trust becomes the legal owner, and the granters no longer have control or ownership rights. This type of trust generally offers additional asset protection from creditors, estate tax reduction benefits, and eligibility for certain government assistance programs. When creating a Coral Springs Florida Warranty Deed from Husband and Wife to a Trust, it is essential to consult with an experienced real estate attorney or estate planning professional who will draft the document to ensure its compliance with Florida state laws and accurately represents the intentions of the parties involved.