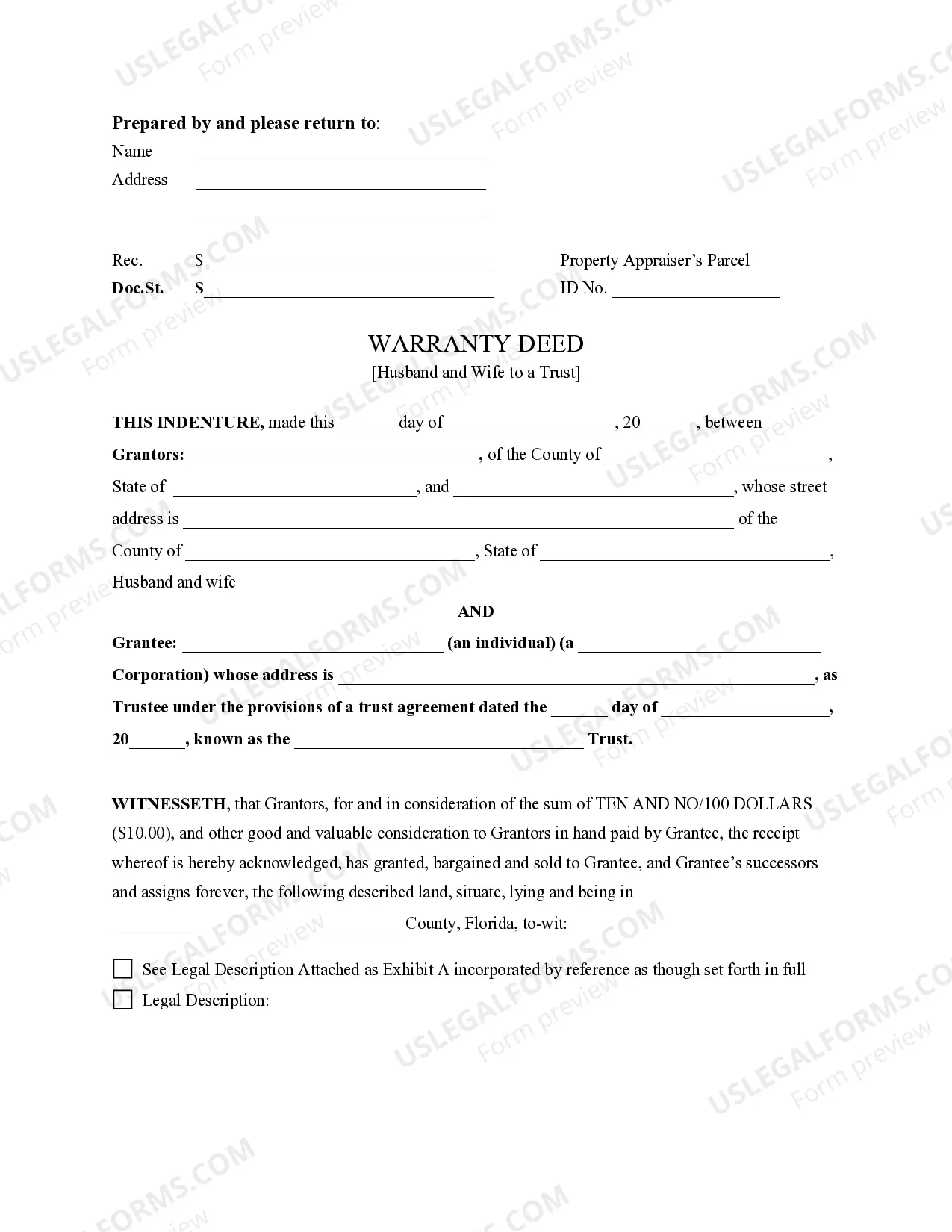

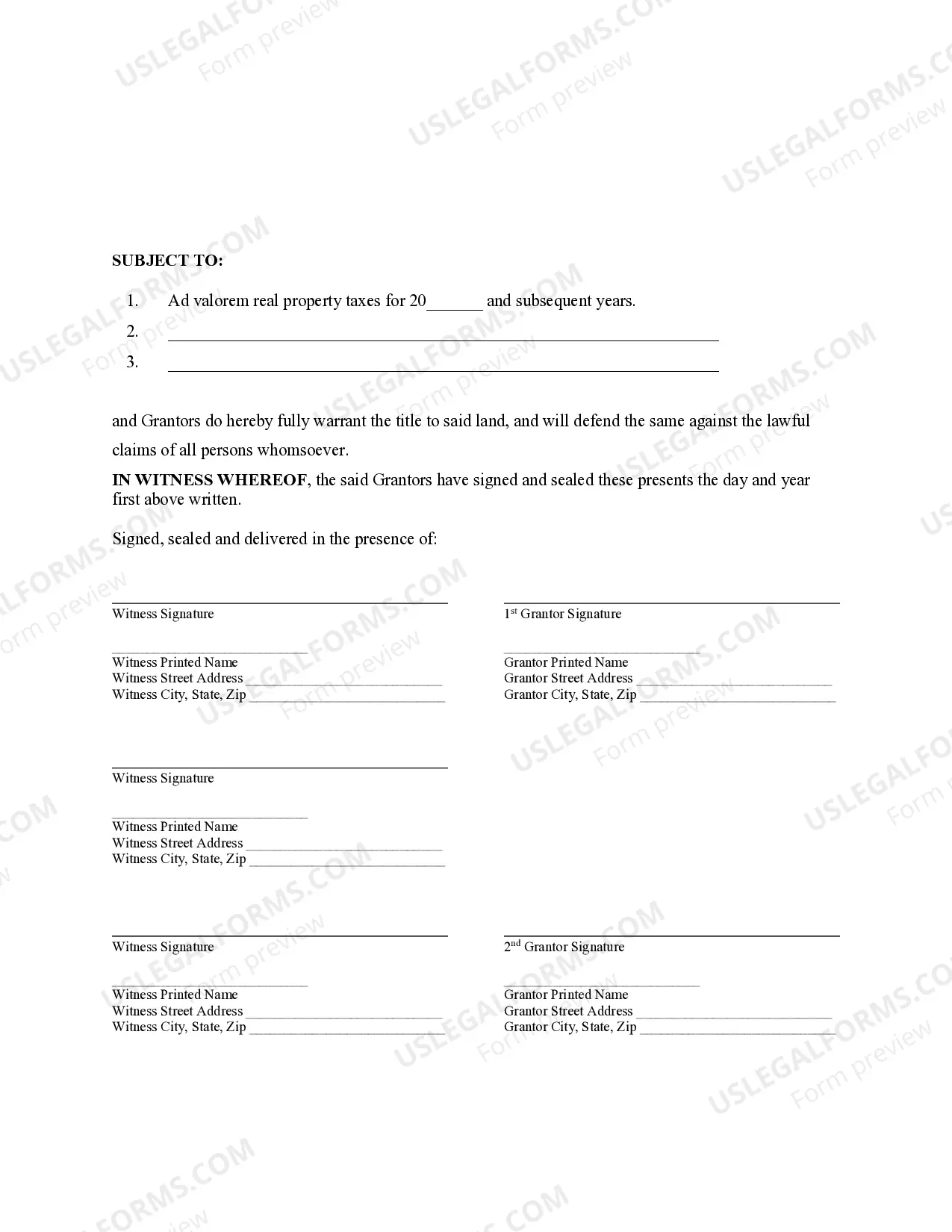

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Palm Beach Florida Warranty Deed from Husband and Wife to a Trust is a legal document that allows the transfer of property ownership from a married couple to a trust entity. This type of deed provides a guarantee that the property is being transferred with full warranty and clear title, protecting the trust from any potential claims or disputes. By creating a trust and transferring the property into it, the couple can ensure the seamless management and distribution of their assets while enjoying various benefits related to estate planning and asset protection. There are different types of Palm Beach Florida Warranty Deed from Husband and Wife to a Trust, including the following: 1. Revocable Living Trust Warranty Deed: This type of warranty deed is commonly used when the trust being established is a revocable living trust. With a revocable living trust, the trust creators (husband and wife) maintain full control over the property, allowing them to modify or terminate the trust during their lifetime. 2. Irrevocable Trust Warranty Deed: In contrast to a revocable living trust, an irrevocable trust warranty deed cannot be modified or terminated without the consent of the trust beneficiaries. This deed type is often chosen when the couple wants to transfer the property to a trust for long-term asset management, protecting it from potential financial liabilities or future estate taxes. 3. Family Trust Warranty Deed: A family trust warranty deed is created to transfer property ownership from a married couple to a trust established for the benefit of their family members. This type of deed is commonly used to ensure asset protection, seamless inheritance distribution, and estate planning for future generations. 4. Testamentary Trust Warranty Deed: A testamentary trust is established as part of a will, dictating the transfer of property to a trust upon the death of the husband and wife. This type of warranty deed ensures that the property is transferred to the trust according to the couple's wishes, avoiding probate court proceedings and providing a smoother transition of assets. 5. Special Needs Trust Warranty Deed: This particular trust is designed for individuals with special needs or disabilities. The warranty deed transfers the property to a trust that can manage and distribute assets specifically for the care and support of the beneficiary with special needs, without jeopardizing their eligibility for government assistance. In summary, a Palm Beach Florida Warranty Deed from Husband and Wife to a Trust involves the transfer of property ownership to a trust entity, providing various benefits related to estate planning, asset protection, and seamless wealth management. The specific type of warranty deed will depend on the purpose and nature of the trust being established, such as revocable living trust, irrevocable trust, family trust, testamentary trust, or special needs trust.

A Palm Beach Florida Warranty Deed from Husband and Wife to a Trust is a legal document that allows the transfer of property ownership from a married couple to a trust entity. This type of deed provides a guarantee that the property is being transferred with full warranty and clear title, protecting the trust from any potential claims or disputes. By creating a trust and transferring the property into it, the couple can ensure the seamless management and distribution of their assets while enjoying various benefits related to estate planning and asset protection. There are different types of Palm Beach Florida Warranty Deed from Husband and Wife to a Trust, including the following: 1. Revocable Living Trust Warranty Deed: This type of warranty deed is commonly used when the trust being established is a revocable living trust. With a revocable living trust, the trust creators (husband and wife) maintain full control over the property, allowing them to modify or terminate the trust during their lifetime. 2. Irrevocable Trust Warranty Deed: In contrast to a revocable living trust, an irrevocable trust warranty deed cannot be modified or terminated without the consent of the trust beneficiaries. This deed type is often chosen when the couple wants to transfer the property to a trust for long-term asset management, protecting it from potential financial liabilities or future estate taxes. 3. Family Trust Warranty Deed: A family trust warranty deed is created to transfer property ownership from a married couple to a trust established for the benefit of their family members. This type of deed is commonly used to ensure asset protection, seamless inheritance distribution, and estate planning for future generations. 4. Testamentary Trust Warranty Deed: A testamentary trust is established as part of a will, dictating the transfer of property to a trust upon the death of the husband and wife. This type of warranty deed ensures that the property is transferred to the trust according to the couple's wishes, avoiding probate court proceedings and providing a smoother transition of assets. 5. Special Needs Trust Warranty Deed: This particular trust is designed for individuals with special needs or disabilities. The warranty deed transfers the property to a trust that can manage and distribute assets specifically for the care and support of the beneficiary with special needs, without jeopardizing their eligibility for government assistance. In summary, a Palm Beach Florida Warranty Deed from Husband and Wife to a Trust involves the transfer of property ownership to a trust entity, providing various benefits related to estate planning, asset protection, and seamless wealth management. The specific type of warranty deed will depend on the purpose and nature of the trust being established, such as revocable living trust, irrevocable trust, family trust, testamentary trust, or special needs trust.