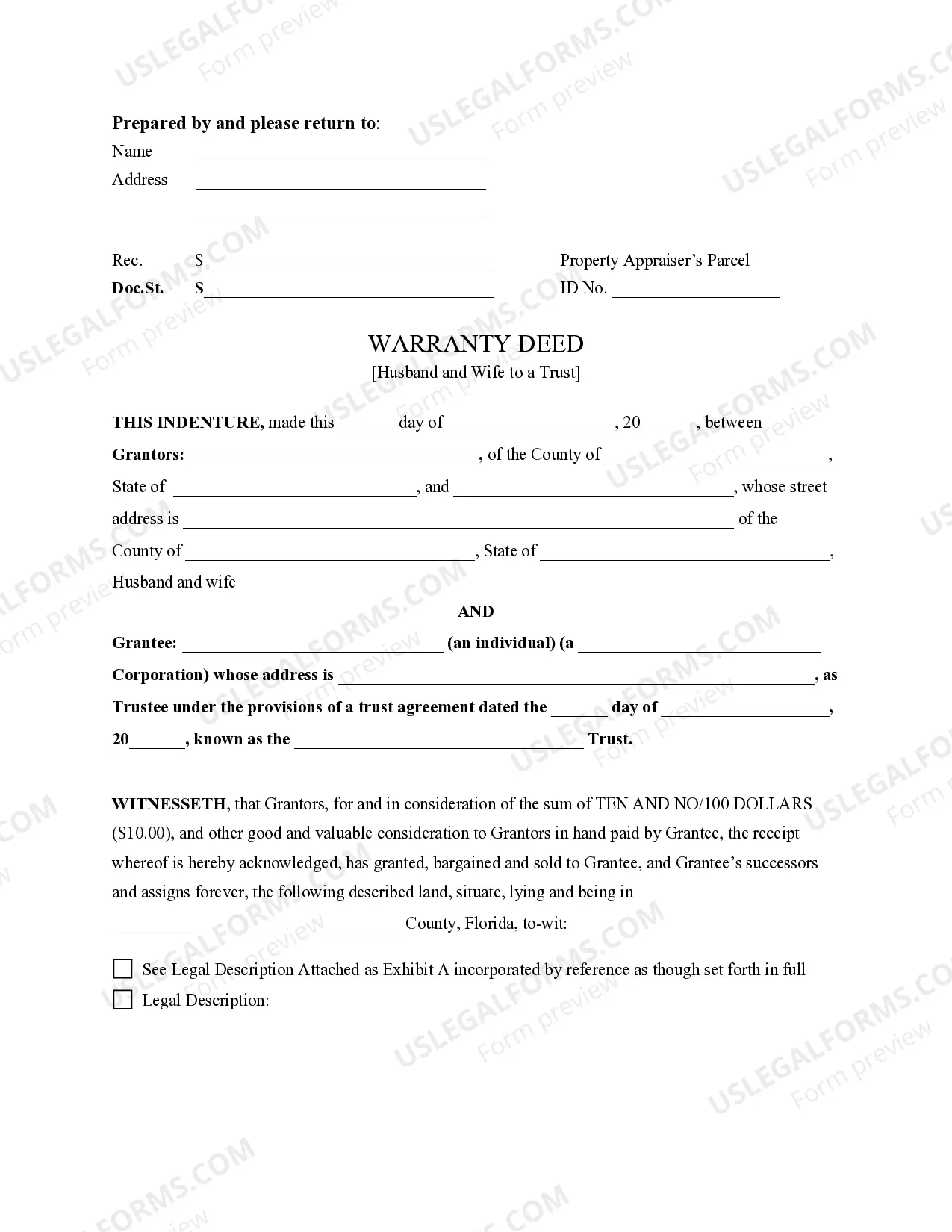

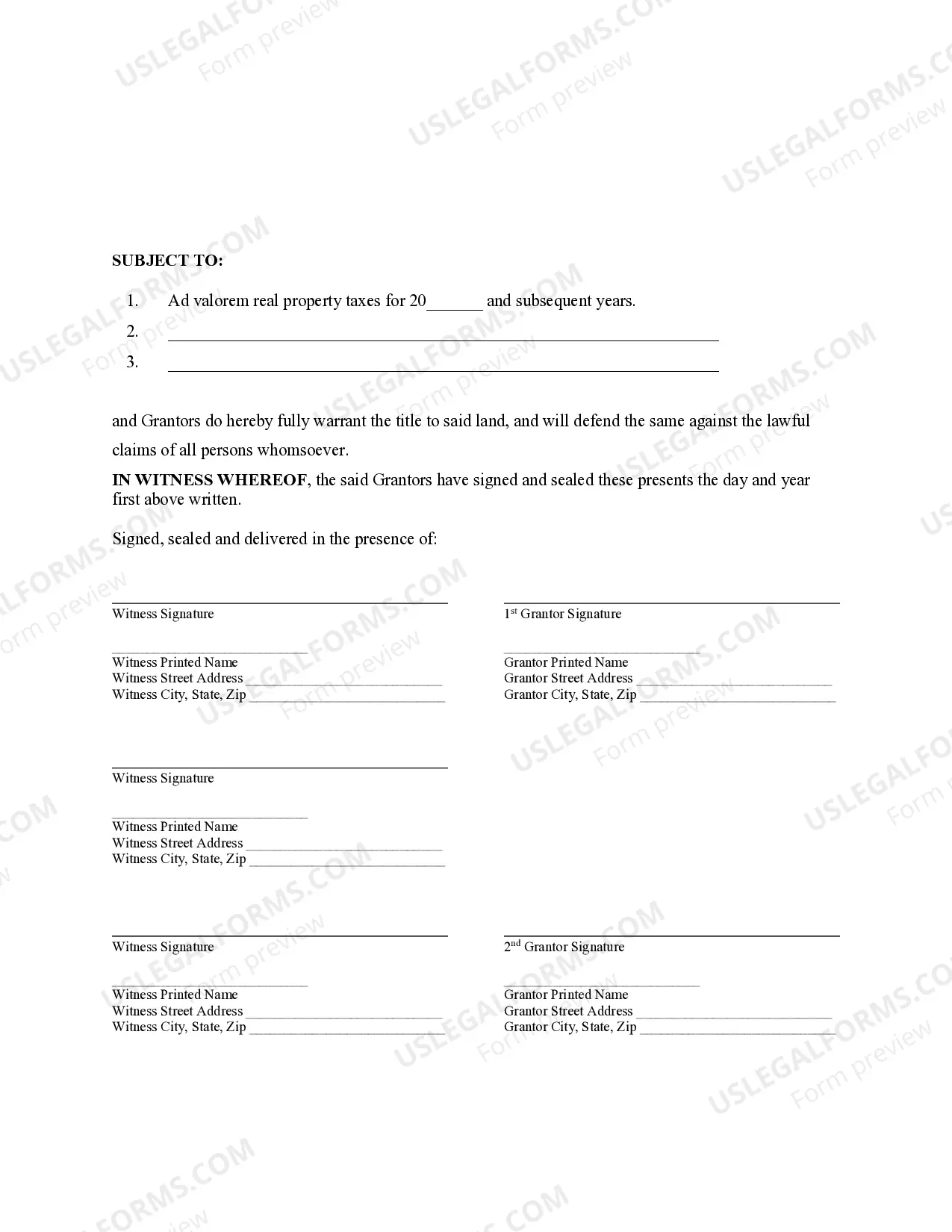

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Tallahassee Florida Warranty Deed from Husband and Wife to a Trust is a legal document that transfers ownership of real estate from a married couple to a trust entity. This type of deed provides a guarantee, or warranty, that the property is being transferred free and clear of any encumbrances or claims. The purpose of creating a trust and transferring property through a warranty deed is often to protect assets, plan for estate distribution, or for tax planning purposes. By transferring the property to a trust, the couple ensures that the property will be managed and distributed according to their wishes, while also potentially minimizing estate taxes. There are different types of Tallahassee Florida Warranty Deed from Husband and Wife to a Trust that can be used based on specific circumstances: 1. Revocable Living Trust: This type of trust allows the couple to maintain control and make changes to the trust during their lifetimes. They can designate themselves as trustees and beneficiaries, providing flexibility and ease of management. The property can be transferred into the trust using a warranty deed, ensuring legal ownership is transferred. 2. Irrevocable Trust: An irrevocable trust, once created, cannot be changed or revoked without the consent of all parties involved. This type of trust can provide additional asset protection and tax benefits. Transferring property to an irrevocable trust through a warranty deed can help protect the property from potential creditors and remove it from the couple's taxable estate. 3. Testamentary Trust: Unlike a revocable living trust, a testamentary trust is created through a person's last will and testament and does not take effect until their death. This type of trust can be used if the couple wants to ensure the property is transferred to a trust upon their passing, allowing for specific instructions on how the property should be managed and distributed. When drafting a Tallahassee Florida Warranty Deed from Husband and Wife to a Trust, it is essential to include relevant keywords to accurately describe the document, such as "Tallahassee Florida," "Warranty Deed," "Husband and Wife," and "Trust." Additionally, incorporating keywords such as "real estate transfer," "asset protection," "estate planning," and "tax benefits" can further enhance the content's relevance and outline the purpose and benefits of executing this type of deed.A Tallahassee Florida Warranty Deed from Husband and Wife to a Trust is a legal document that transfers ownership of real estate from a married couple to a trust entity. This type of deed provides a guarantee, or warranty, that the property is being transferred free and clear of any encumbrances or claims. The purpose of creating a trust and transferring property through a warranty deed is often to protect assets, plan for estate distribution, or for tax planning purposes. By transferring the property to a trust, the couple ensures that the property will be managed and distributed according to their wishes, while also potentially minimizing estate taxes. There are different types of Tallahassee Florida Warranty Deed from Husband and Wife to a Trust that can be used based on specific circumstances: 1. Revocable Living Trust: This type of trust allows the couple to maintain control and make changes to the trust during their lifetimes. They can designate themselves as trustees and beneficiaries, providing flexibility and ease of management. The property can be transferred into the trust using a warranty deed, ensuring legal ownership is transferred. 2. Irrevocable Trust: An irrevocable trust, once created, cannot be changed or revoked without the consent of all parties involved. This type of trust can provide additional asset protection and tax benefits. Transferring property to an irrevocable trust through a warranty deed can help protect the property from potential creditors and remove it from the couple's taxable estate. 3. Testamentary Trust: Unlike a revocable living trust, a testamentary trust is created through a person's last will and testament and does not take effect until their death. This type of trust can be used if the couple wants to ensure the property is transferred to a trust upon their passing, allowing for specific instructions on how the property should be managed and distributed. When drafting a Tallahassee Florida Warranty Deed from Husband and Wife to a Trust, it is essential to include relevant keywords to accurately describe the document, such as "Tallahassee Florida," "Warranty Deed," "Husband and Wife," and "Trust." Additionally, incorporating keywords such as "real estate transfer," "asset protection," "estate planning," and "tax benefits" can further enhance the content's relevance and outline the purpose and benefits of executing this type of deed.