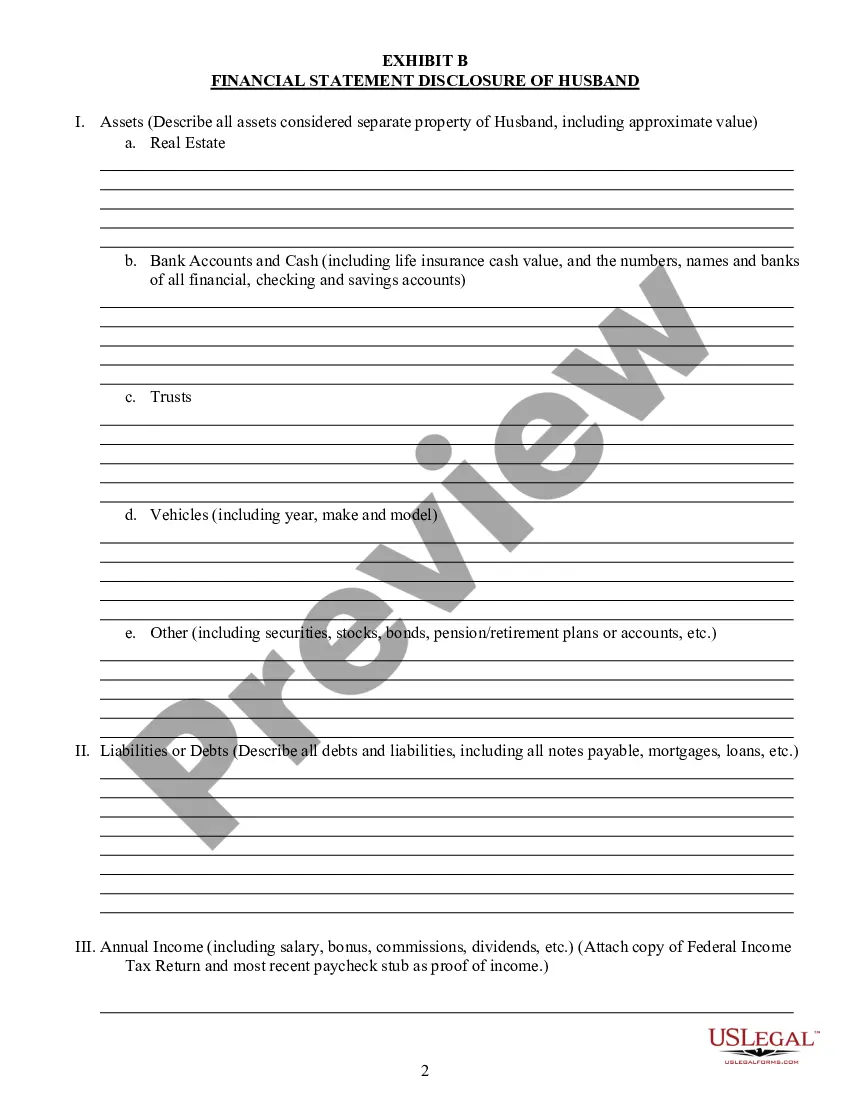

A Coral Springs postnuptial property agreement is a legal document used in the state of Florida to outline the division of property and assets between spouses in the event of separation, divorce, or death. It is typically drafted after the couple has married, hence the term "postnuptial." This agreement aims to provide clarity and fairness to both parties regarding the distribution of their marital and separate assets. Keywords: Coral Springs, postnuptial property agreement, Florida, division of property, assets, separation, divorce, death, spouses, clarity, fairness, marital assets, separate assets. There can be different types of Coral Springs postnuptial property agreements based on the specific clauses and provisions included: 1. Equitable Distribution Agreement: This type of postnuptial agreement outlines how property, income, and debts will be divided between the spouses in the event of divorce or separation. It focuses on following Florida's legal principle of equitable distribution, which considers various factors to determine a fair division of marital assets. 2. Alimony Waiver Agreement: This agreement specifies that one spouse waives their right to seek alimony or spousal support in the event of divorce or separation. It can contain provisions related to the duration and amount of support, taking into account factors such as the length of the marriage and the financial situation of the parties involved. 3. Business Asset Protection Agreement: In cases where one or both spouses own a business, this type of postnuptial agreement can be designed to safeguard the business assets from being considered marital property during a divorce. It can establish how the business will be valued, how its assets will be protected, and whether any compensation or buyout options will be provided. 4. Inheritance Protection Agreement: This agreement addresses the protection of inheritance assets received by one spouse during the marriage. It ensures that any inherited property or funds remain separate and are not subject to division in case of divorce. 5. Debt Allocation Agreement: This type of postnuptial agreement addresses the division of debts incurred during the marriage. It outlines how the repayment of debts such as mortgages, loans, or credit cards will be allocated between the spouses, ensuring fairness and clarity in case of separation or divorce. In summary, a Coral Springs postnuptial property agreement in Florida is a legal document that sets forth the division of property, assets, and debts between spouses. It aims to provide clarity, fairness, and protection to both parties in various scenarios, such as divorce, separation, or death. Different types of postnuptial agreements include equitable distribution, alimony waiver, business asset protection, inheritance protection, and debt allocation agreements.

Coral Springs Florida Postnuptial Property Agreement

Description

How to fill out Coral Springs Florida Postnuptial Property Agreement?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Coral Springs Postnuptial Property Agreement - Florida becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Coral Springs Postnuptial Property Agreement - Florida takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Coral Springs Postnuptial Property Agreement - Florida. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!