The Pembroke Pines Amendment to Postnuptial Property Agreement is a legally binding document that enables couples in Pembroke Pines, Florida, to modify and update their existing postnuptial property agreement. This amendment allows spouses to make changes to the division of their assets, debts, and other financial matters that were previously agreed upon in the original postnuptial agreement. By utilizing a Pembroke Pines Amendment to Postnuptial Property Agreement, couples can ensure that their current agreement reflects any changes in their circumstances, financial status, or personal preferences. This amendment is especially useful when there is a need to adjust property distribution following significant life events such as the birth of a child, changes in employment or business ventures, purchases of new assets, or inheritances. There are various types of Pembroke Pines Amendment to Postnuptial Property Agreements that couples may consider: 1. Asset reevaluation amendment: This type of amendment allows couples to reassess and modify the valuation or distribution of their assets based on market fluctuations or changes in their investment portfolio. 2. Debt allocation amendment: A debt allocation amendment permits couples to revisit the distribution of their liabilities, accommodating any changes in their financial situation or debts incurred after the initial postnuptial agreement. 3. Inheritance amendment: This amendment addresses the allocation of assets, including any inherited property or funds, by outlining how the postnuptial agreement will be adjusted in light of any future inheritances. 4. Business amendment: If either spouse owns a business or enters into a business partnership, this type of amendment allows the postnuptial agreement to incorporate the specifics of the business, such as ownership percentages, profit sharing arrangements, or division of business assets and debts. 5. Custody and support amendment: In cases involving children, this amendment can address child custody, visitation rights, and child support, providing the necessary safeguards to protect the best interests of the children involved. It is important to note that a Pembroke Pines Amendment to Postnuptial Property Agreement must comply with Florida state laws and be executed by both parties voluntarily and in the presence of witnesses. Additionally, seeking legal counsel before drafting or modifying such an agreement is highly recommended ensuring its validity and enforceability in the event of a dispute. By incorporating a Pembroke Pines Amendment to Postnuptial Property Agreement into their legal planning, couples can enjoy peace of mind knowing that their financial matters are up-to-date, in compliance with current laws, and reflective of their evolving circumstances.

Pembroke Pines Florida Amendment to Postnuptial Property Agreement

State:

Florida

City:

Pembroke Pines

Control #:

FL-01715-AZ

Format:

Word;

Rich Text

Instant download

Description

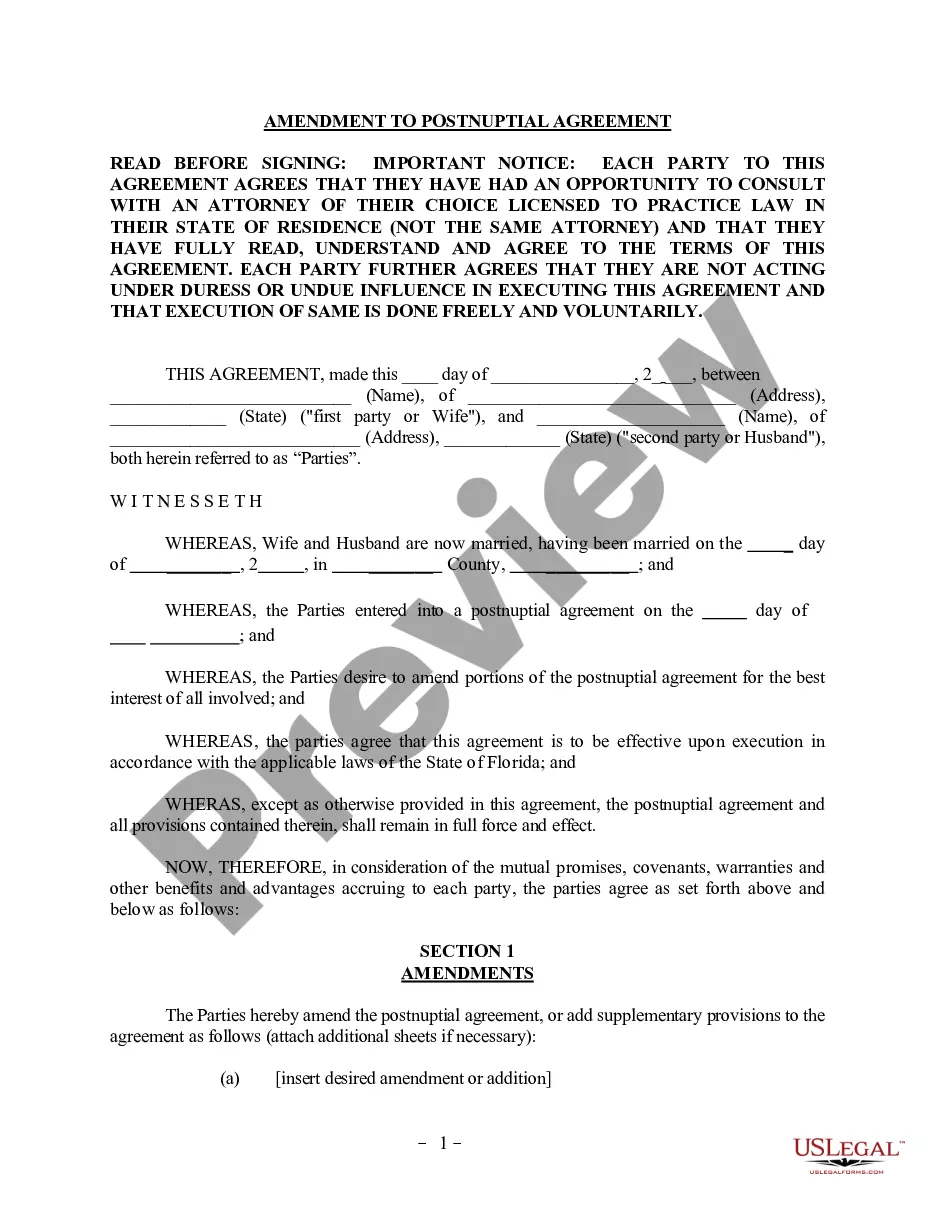

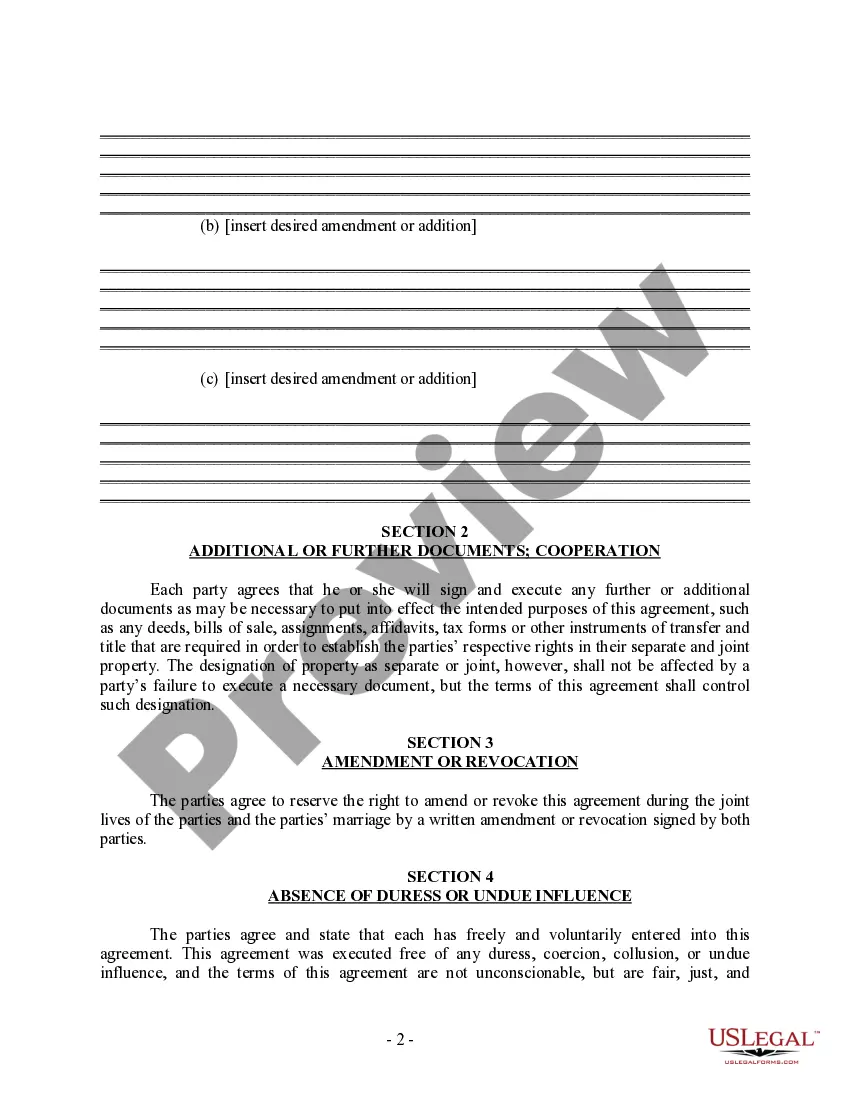

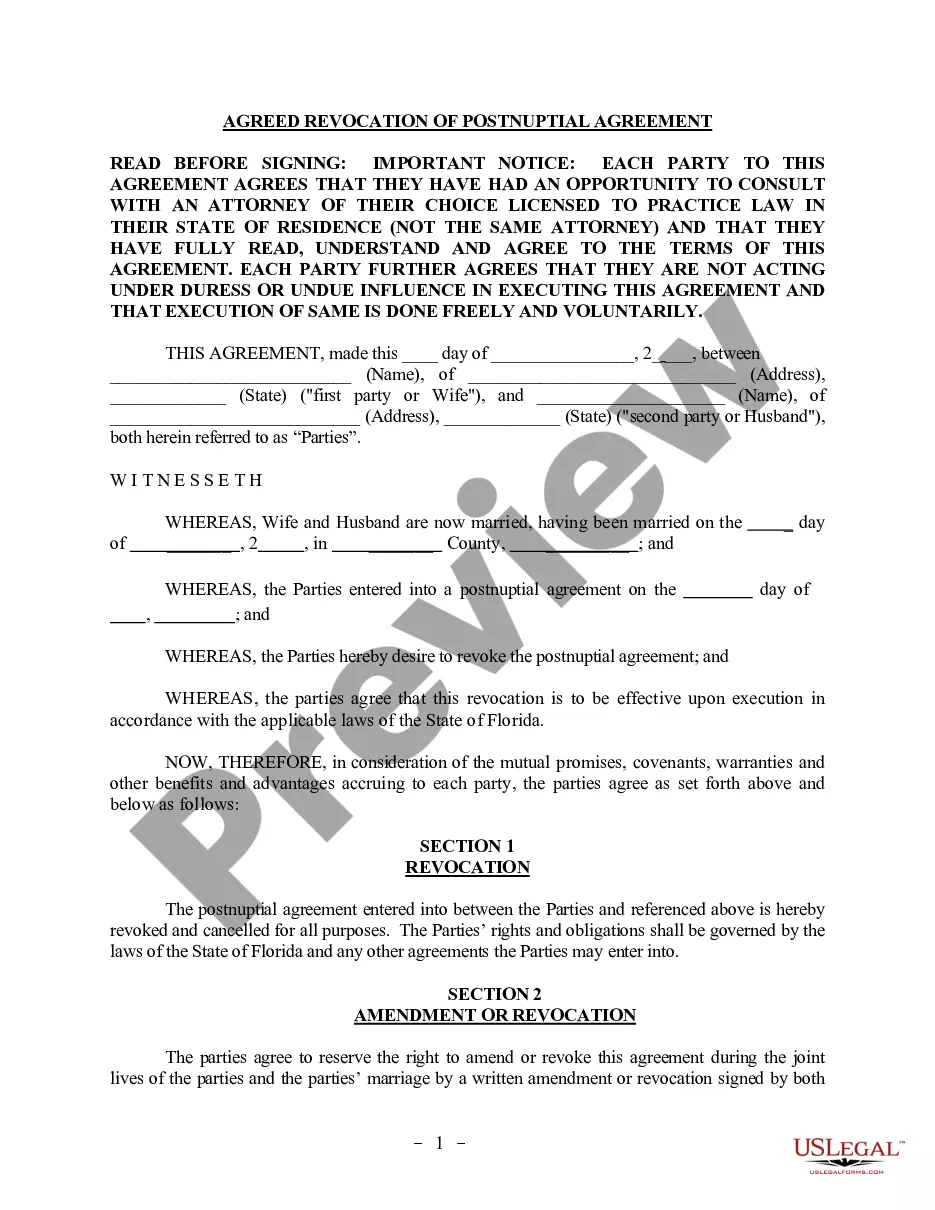

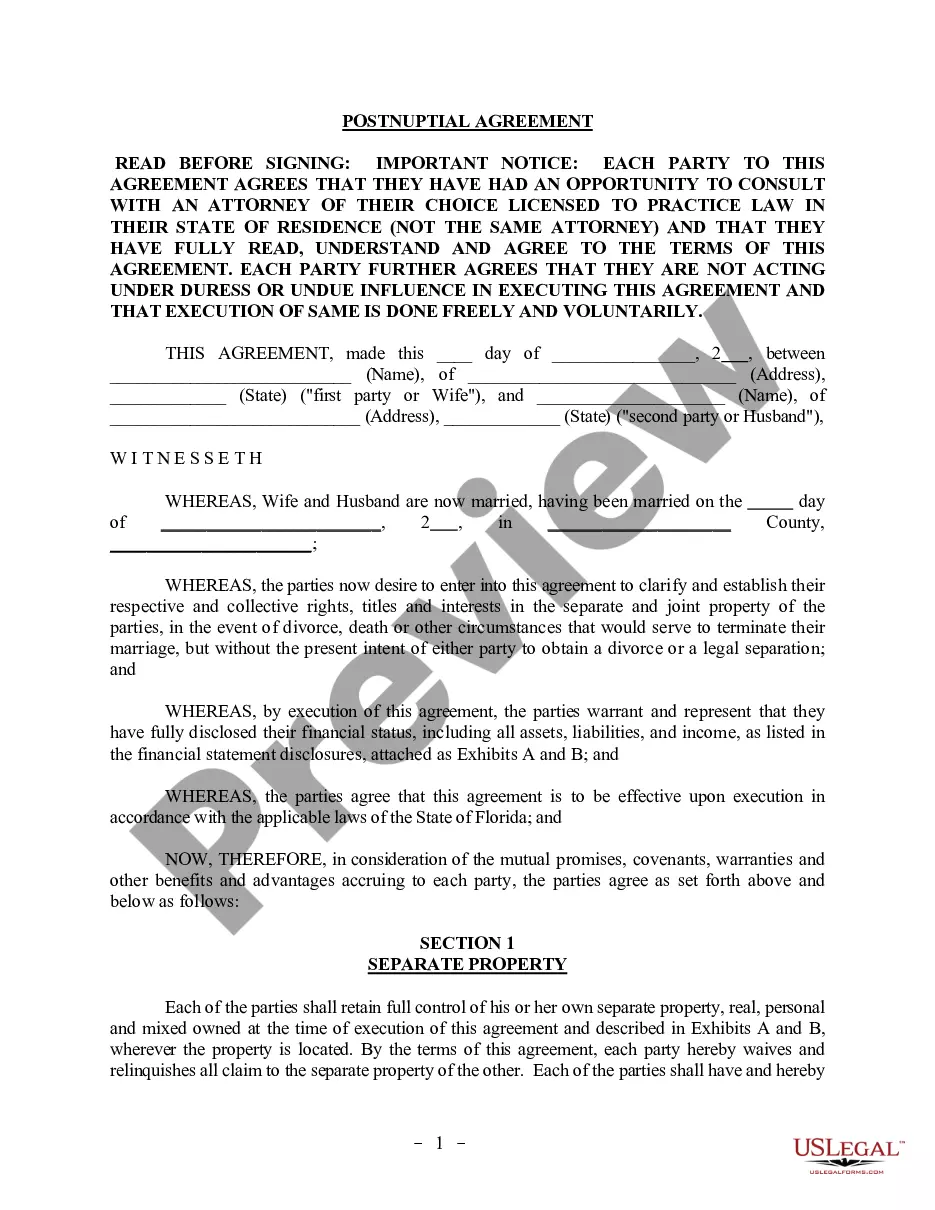

This Amendment Postnuptial Property Agreement form is for use by the parties to make amendments or additions to an existing postnuptial agreement. Both parties are required to sign the amendment in the presence of a notary public, and the agreement must be witnessed.

The Pembroke Pines Amendment to Postnuptial Property Agreement is a legally binding document that enables couples in Pembroke Pines, Florida, to modify and update their existing postnuptial property agreement. This amendment allows spouses to make changes to the division of their assets, debts, and other financial matters that were previously agreed upon in the original postnuptial agreement. By utilizing a Pembroke Pines Amendment to Postnuptial Property Agreement, couples can ensure that their current agreement reflects any changes in their circumstances, financial status, or personal preferences. This amendment is especially useful when there is a need to adjust property distribution following significant life events such as the birth of a child, changes in employment or business ventures, purchases of new assets, or inheritances. There are various types of Pembroke Pines Amendment to Postnuptial Property Agreements that couples may consider: 1. Asset reevaluation amendment: This type of amendment allows couples to reassess and modify the valuation or distribution of their assets based on market fluctuations or changes in their investment portfolio. 2. Debt allocation amendment: A debt allocation amendment permits couples to revisit the distribution of their liabilities, accommodating any changes in their financial situation or debts incurred after the initial postnuptial agreement. 3. Inheritance amendment: This amendment addresses the allocation of assets, including any inherited property or funds, by outlining how the postnuptial agreement will be adjusted in light of any future inheritances. 4. Business amendment: If either spouse owns a business or enters into a business partnership, this type of amendment allows the postnuptial agreement to incorporate the specifics of the business, such as ownership percentages, profit sharing arrangements, or division of business assets and debts. 5. Custody and support amendment: In cases involving children, this amendment can address child custody, visitation rights, and child support, providing the necessary safeguards to protect the best interests of the children involved. It is important to note that a Pembroke Pines Amendment to Postnuptial Property Agreement must comply with Florida state laws and be executed by both parties voluntarily and in the presence of witnesses. Additionally, seeking legal counsel before drafting or modifying such an agreement is highly recommended ensuring its validity and enforceability in the event of a dispute. By incorporating a Pembroke Pines Amendment to Postnuptial Property Agreement into their legal planning, couples can enjoy peace of mind knowing that their financial matters are up-to-date, in compliance with current laws, and reflective of their evolving circumstances.

Free preview

How to fill out Pembroke Pines Florida Amendment To Postnuptial Property Agreement?

If you’ve already utilized our service before, log in to your account and download the Pembroke Pines Amendment to Postnuptial Property Agreement - Florida on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Pembroke Pines Amendment to Postnuptial Property Agreement - Florida. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!