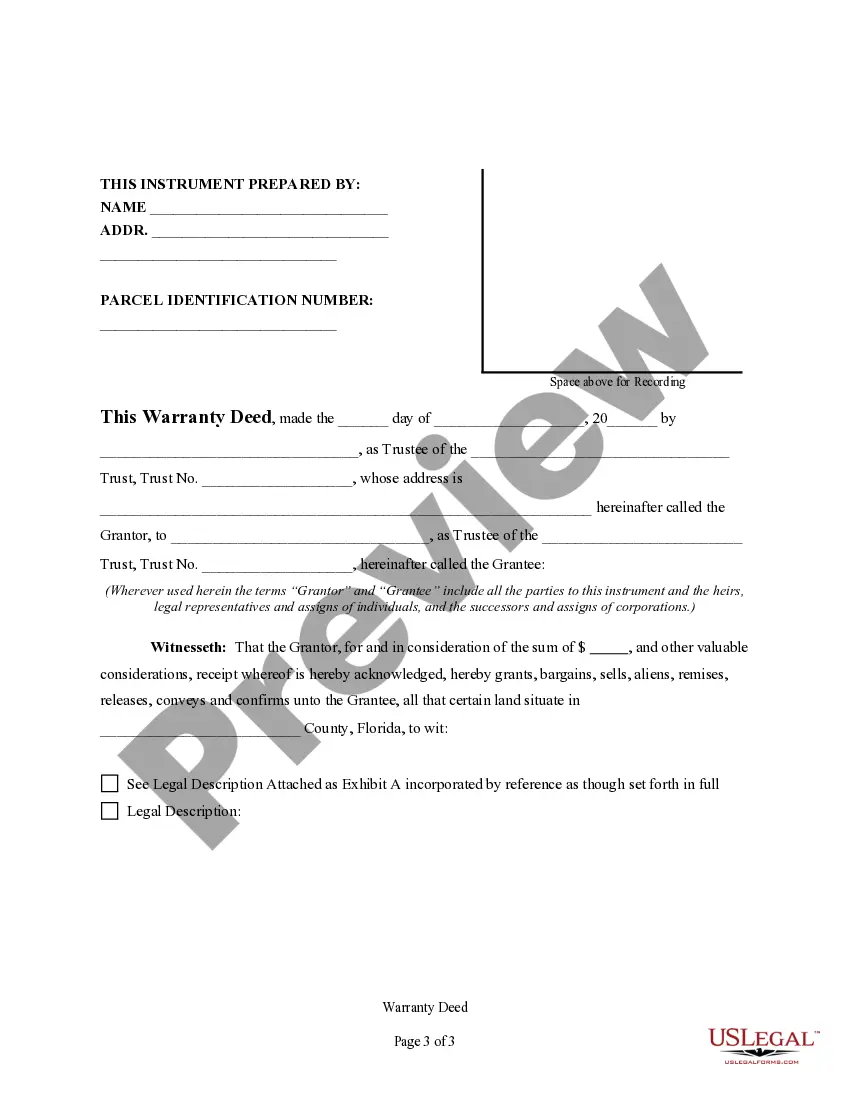

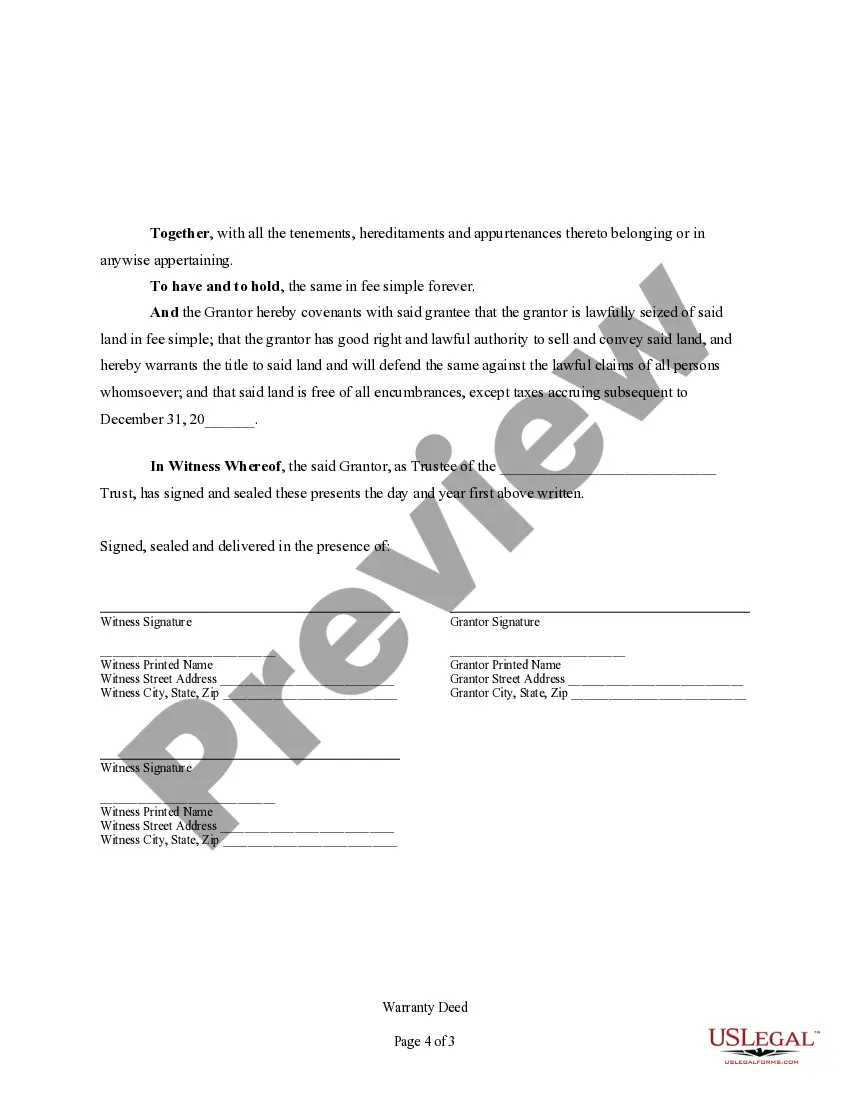

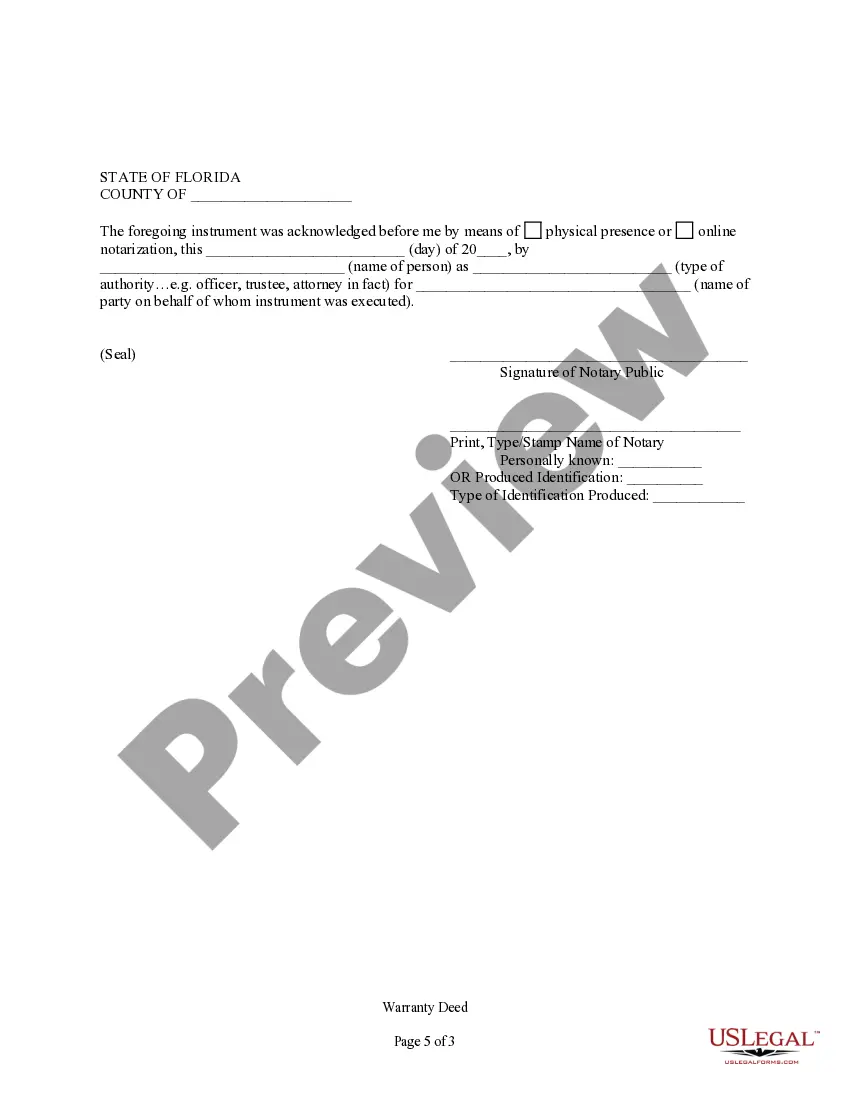

This form is a Warranty Deed where the grantor is a trust and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Lakeland Florida Warranty Deed from Trust to a Trust is a legal document that facilitates the transfer of real estate property from one trust to another within the jurisdiction of Lakeland, Florida. This type of deed is commonly used for estate planning purposes and ensures a smooth transfer of property ownership between trusts. The warranty deed includes several relevant keywords such as "Lakeland Florida," "Warranty Deed," "Trust," and "Transfer." These keywords help to accurately describe and explain the process and nature of the document. There are different types of Lakeland Florida Warranty Deeds from Trust to a Trust based on the circumstances and intentions of the parties involved. Some common types include: 1. Revocable Trust to Revocable Trust: This type of warranty deed from trust to trust involves transferring property from one revocable trust to another. Revocable trusts are typically created by individuals for their own benefit and have the flexibility to be altered or revoked during the granter's lifetime. 2. Irrevocable Trust to Irrevocable Trust: In this scenario, property ownership is transferred from one irrevocable trust to another. Irrevocable trusts usually have stricter terms and cannot be altered or revoked without the consent of beneficiaries. 3. Living Trust to Living Trust: This type of warranty deed involves the transfer of real estate property from one living trust to another. Living trusts are created during the lifetime of the granter and can be revocable or irrevocable. 4. Testamentary Trust to Testamentary Trust: Testamentary trusts are established through a will and come into effect upon the death of the granter. In this case, a warranty deed from one testamentary trust to another facilitates property transfer after the granter's passing. It is essential to consult with a qualified attorney specializing in estate planning and real estate law to ensure compliance with all applicable laws, regulations, and the specific requirements of the trusts involved.A Lakeland Florida Warranty Deed from Trust to a Trust is a legal document that facilitates the transfer of real estate property from one trust to another within the jurisdiction of Lakeland, Florida. This type of deed is commonly used for estate planning purposes and ensures a smooth transfer of property ownership between trusts. The warranty deed includes several relevant keywords such as "Lakeland Florida," "Warranty Deed," "Trust," and "Transfer." These keywords help to accurately describe and explain the process and nature of the document. There are different types of Lakeland Florida Warranty Deeds from Trust to a Trust based on the circumstances and intentions of the parties involved. Some common types include: 1. Revocable Trust to Revocable Trust: This type of warranty deed from trust to trust involves transferring property from one revocable trust to another. Revocable trusts are typically created by individuals for their own benefit and have the flexibility to be altered or revoked during the granter's lifetime. 2. Irrevocable Trust to Irrevocable Trust: In this scenario, property ownership is transferred from one irrevocable trust to another. Irrevocable trusts usually have stricter terms and cannot be altered or revoked without the consent of beneficiaries. 3. Living Trust to Living Trust: This type of warranty deed involves the transfer of real estate property from one living trust to another. Living trusts are created during the lifetime of the granter and can be revocable or irrevocable. 4. Testamentary Trust to Testamentary Trust: Testamentary trusts are established through a will and come into effect upon the death of the granter. In this case, a warranty deed from one testamentary trust to another facilitates property transfer after the granter's passing. It is essential to consult with a qualified attorney specializing in estate planning and real estate law to ensure compliance with all applicable laws, regulations, and the specific requirements of the trusts involved.