This form is a Warranty Deed where the grantor is a trust and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Miami-Dade Florida Warranty Deed from Trust to a Trust

Description

How to fill out Florida Warranty Deed From Trust To A Trust?

We consistently endeavor to minimize or evade legal harm when navigating intricate legal or financial issues.

To achieve this, we seek out legal services that are typically quite expensive.

However, not all legal challenges possess the same level of complexity.

The majority can be addressed independently.

Make use of US Legal Forms anytime you need to locate and download the Miami-Dade Florida Warranty Deed from Trust to a Trust or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform allows you to manage your issues autonomously without the need for an attorney.

- We provide access to legal document templates that are not always publicly available.

- Our templates are tailored to specific states and regions, making the search process considerably easier.

Form popularity

FAQ

Yes, you can roll a trust into another trust, which is often referred to as trust consolidation. This might involve transferring assets using a Miami-Dade Florida Warranty Deed from Trust to a Trust. This strategy can streamline trust management and reduce administrative burdens, but it's wise to consult an attorney to ensure compliance with legal requirements and maintain the integrity of the trusts involved.

To transfer property from one trust to another, you will need to execute a Miami-Dade Florida Warranty Deed from Trust to a Trust. This legal document outlines the details of the transfer, including the truster's intentions and the assets involved. You can simplify the process by using uLegalForms, which provides templates and guidance for drafting the necessary documents.

Typically, transfers between trusts are not considered taxable events. However, it is crucial to handle these transfers properly to avoid triggering unintended tax consequences. Utilizing a Miami-Dade Florida Warranty Deed from Trust to a Trust can help you document the transfer and maintain compliance with tax regulations. Consulting a professional may provide additional clarity on your specific situation.

Yes, you can transfer assets from one trust to another. The process often involves using a Miami-Dade Florida Warranty Deed from Trust to a Trust. This deed legally documents the transfer of property, ensuring that all parties involved must adhere to the terms specified in the trust agreement. For further guidance, consider using uLegalForms to facilitate this process.

One disadvantage of a warranty deed is that it guarantees a clear title, which may lead to complications if undisclosed issues arise. If a problem comes up after the transfer, the previous owner may face legal repercussions. In Miami-Dade, Florida, understanding these aspects is crucial before proceeding with a warranty deed transfer, especially from a trust to another trust. Seeking guidance from professional platforms like USLegalForms can help mitigate these risks.

Yes, you can sell a property that has a warranty deed. The warranty deed assures buyers that the title to the property is clear of any claims, helping to facilitate the sale. In Miami-Dade, Florida, having this type of deed provides confidence to potential buyers. Always consult legal experts or services like USLegalForms to ensure that all aspects of the sale are properly handled.

To transfer ownership of property in Illinois, a new deed must be created that reflects the change in ownership. While this process is somewhat straightforward, it may not directly influence transferring a Miami-Dade Florida Warranty Deed from Trust to a Trust. Ensure that the new deed meets state requirements and is signed by the parties involved. After that, filing it with the local recorder’s office makes the change official.

A trustee can indeed give a warranty deed if this action aligns with the terms of the trust. In Miami-Dade, Florida, the trustee must ensure that they have the authority to make such a transfer. Proper documentation is essential to validate the transfer and protect the interests of all parties involved. Utilizing services like USLegalForms can simplify this process.

Yes, a warranty deed can be transferred between parties, including from a trust to a trust. The process requires creating a new warranty deed that facilitates this transfer, especially in Miami-Dade, Florida. The new deed should include the accurate legal description of the property and any relevant details. Once executed and recorded, the deed finalizes the transfer of ownership.

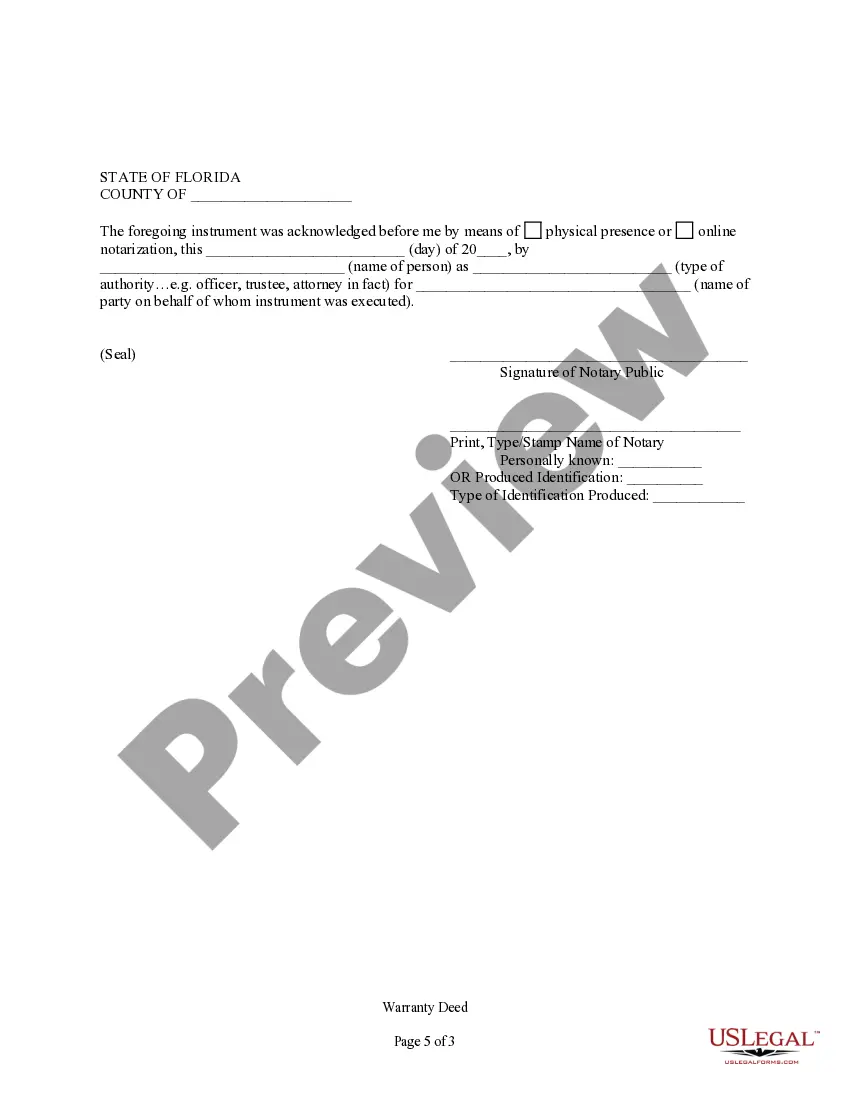

Transferring a warranty deed involves preparing a new deed that outlines the transfer details. You start by filling out a warranty deed form specific to Miami-Dade, Florida. Once completed, both parties must sign the deed in front of a notary. Finally, you must file the deed with the local county clerk to make the transfer official.