A junior or second deed of trust is a deed of trust which is subordinate to existing liens on the securing property, usually because the junior deed of trust was made, executed and recorded after one or more earlier deeds of trust or other encumbrances.

Junior deeds of trust can be created in several ways. For example, such deeds of trust often arise as the result of a sale of real property, either when a new loan in the full amount of the purchase price cannot be obtained or when an existing loan on the securing property is assumed. In this situation, a junior deed of trust is given to secure the portion of the purchase price which exceeds the balance of the new or existing loan.

Additionally, a junior deed of trust may be created where an existing lienholder, typically a seller, subordinates to another secured debt, usually a construction loan. Finally, junior deeds of trust may arise where the owner of real property obtains a loan secured by the property after its purchase.

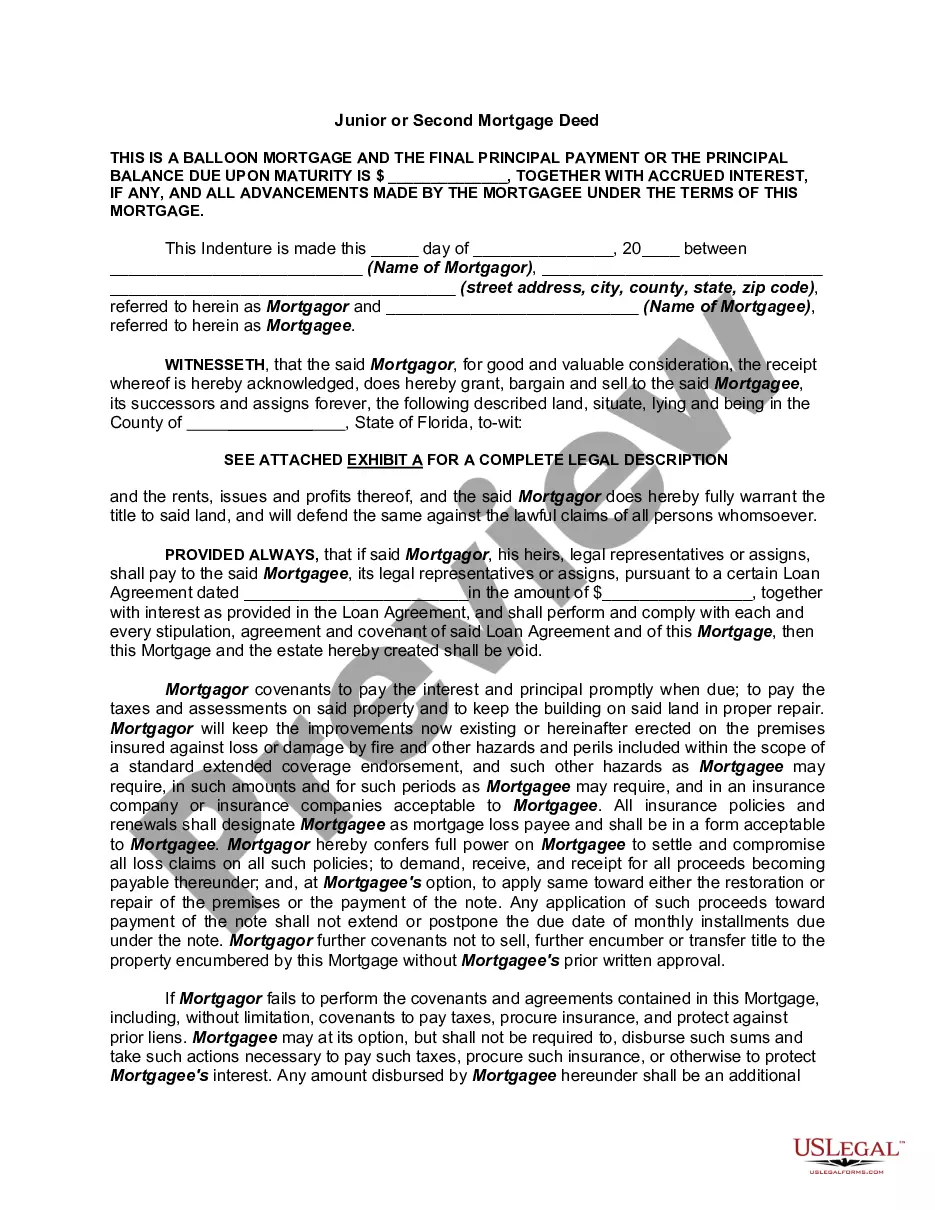

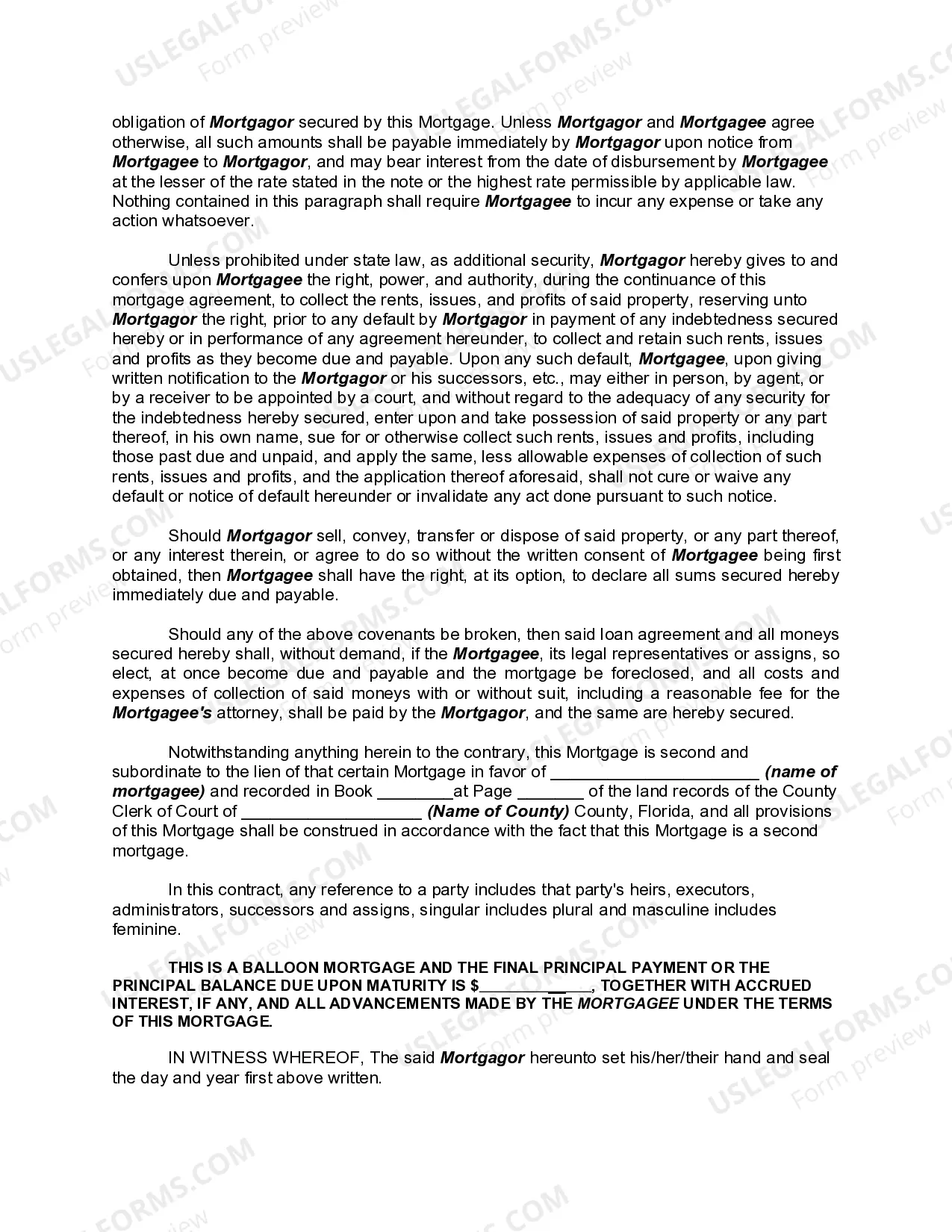

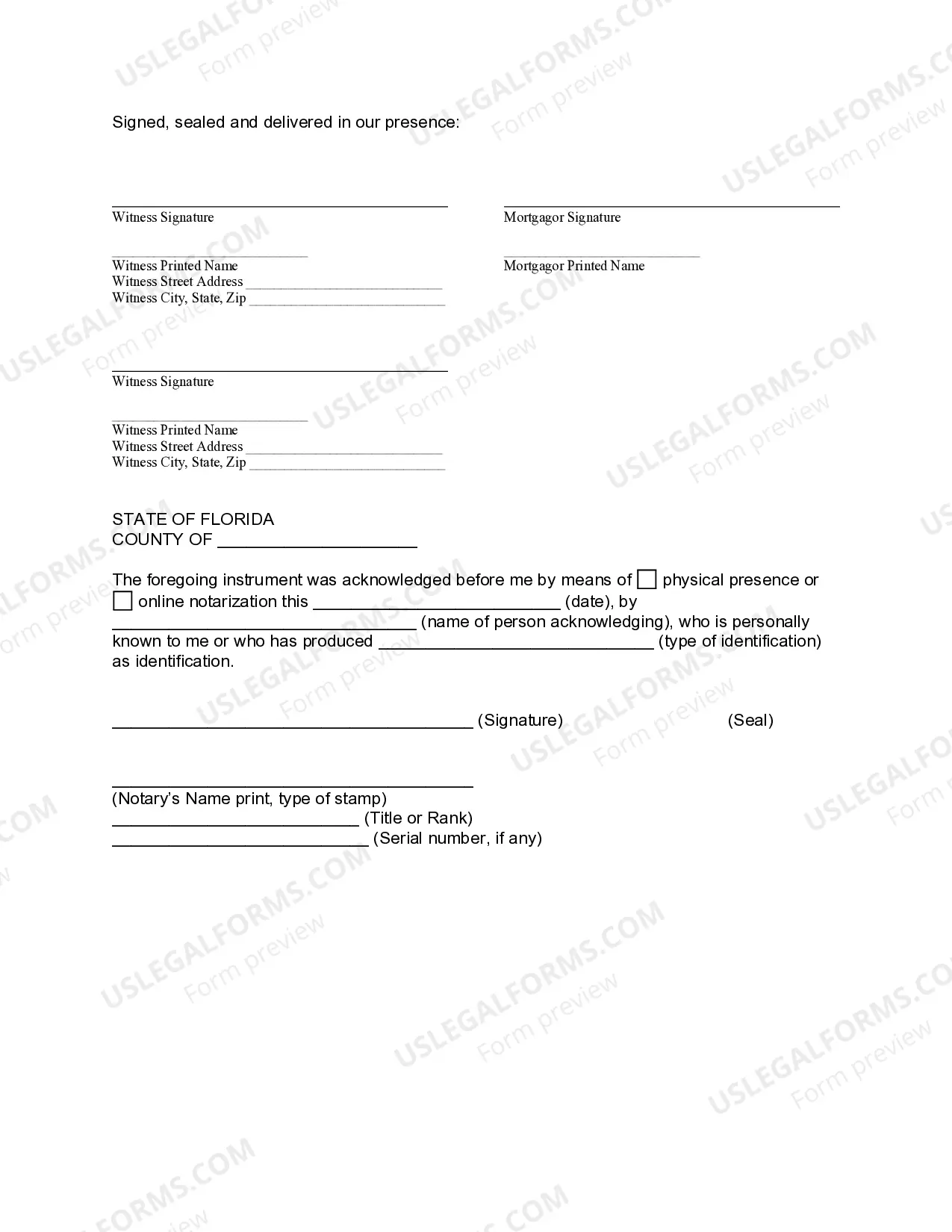

A Broward Florida Junior or Second Mortgage Deed is an important legal document that is commonly used in real estate transactions. It is specifically designed for borrowers who already have an existing primary mortgage on their property and wish to secure a secondary loan using their property as collateral. In Broward County, Florida, a Junior or Second Mortgage Deed is used to establish a lien on a property that ranks below the first mortgage or primary lien. This means that if the borrower defaults on their loan payments, the first mortgage lender has the first claim to the property's proceeds in case of foreclosure, and the second mortgage lender has the subsequent claim. This type of mortgage deed is often sought after by homeowners who require additional funds for various purposes, such as home improvements, debt consolidation, education expenses, or investment opportunities, but may not want to or are unable to refinance their existing primary mortgage. There are different types of Broward Florida Junior or Second Mortgage Deed that borrowers can consider, depending on their specific needs and goals: 1. Fixed-Rate Second Mortgage: This type of mortgage deed offers a fixed interest rate for the entire loan term, ensuring predictable and consistent monthly payments. Borrowers who prefer stability and want to avoid potential interest rate fluctuations often opt for this option. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage, borrowers are provided with an initial fixed interest rate for an agreed-upon period, usually 5 to 10 years. After the initial period, the interest rate can adjust periodically based on an index such as the prime rate. This option may be suitable for borrowers who expect their financial situation to improve over time or prefer a lower initial interest rate. 3. Home Equity Line of Credit (HELOT): A HELOT functions as a revolving line of credit, allowing borrowers to draw funds as needed within a specified timeframe, typically 10 years. During the draw period, borrowers make interest-only payments on the amount borrowed. This type of second mortgage offers flexibility and convenience, as borrowers can borrow and repay multiple times. It is crucial for borrowers to carefully consider the terms, interest rates, and repayment options offered by lenders when selecting a Broward Florida Junior or Second Mortgage Deed. Consulting with a qualified real estate attorney or a mortgage professional is highly recommended to fully understand the legal obligations, financial risks, and potential benefits associated with this type of mortgage.