A junior or second deed of trust is a deed of trust which is subordinate to existing liens on the securing property, usually because the junior deed of trust was made, executed and recorded after one or more earlier deeds of trust or other encumbrances.

Junior deeds of trust can be created in several ways. For example, such deeds of trust often arise as the result of a sale of real property, either when a new loan in the full amount of the purchase price cannot be obtained or when an existing loan on the securing property is assumed. In this situation, a junior deed of trust is given to secure the portion of the purchase price which exceeds the balance of the new or existing loan.

Additionally, a junior deed of trust may be created where an existing lienholder, typically a seller, subordinates to another secured debt, usually a construction loan. Finally, junior deeds of trust may arise where the owner of real property obtains a loan secured by the property after its purchase.

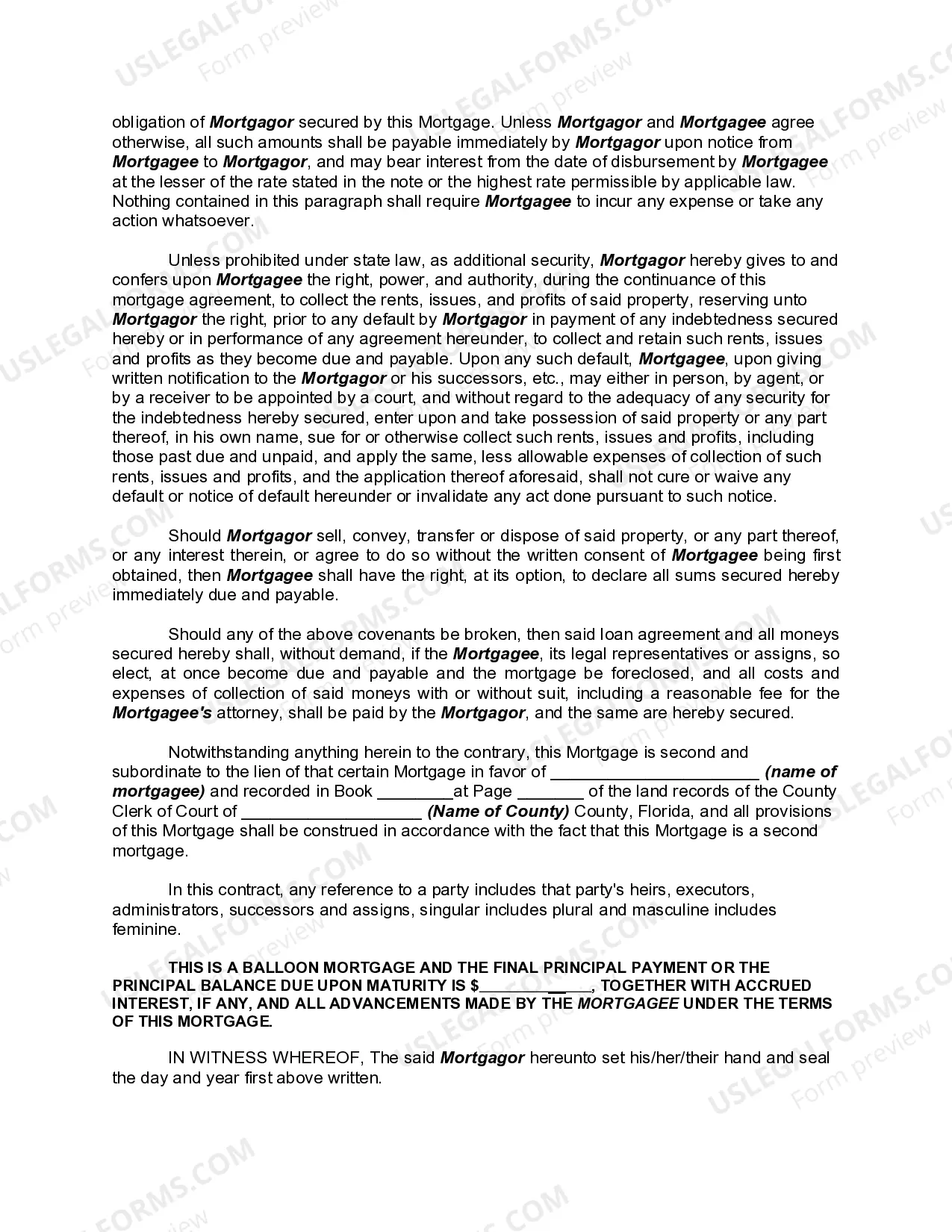

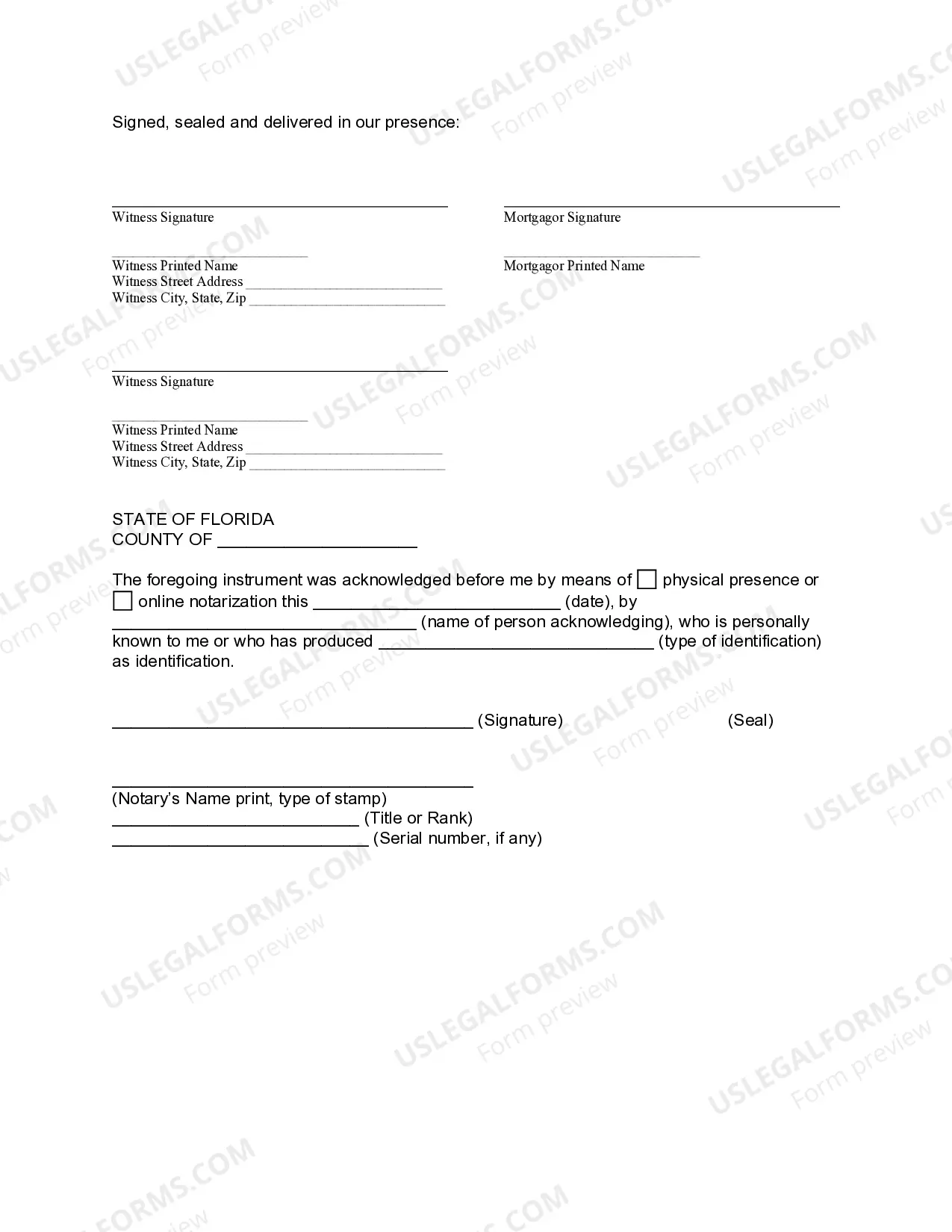

A Hillsborough Florida Junior or Second Mortgage Deed is a legal document used in real estate transactions where a property owner in Hillsborough County, Florida, obtains a second mortgage loan on their property. This type of mortgage deed is subordinate to an existing or first mortgage on the property. The purpose of a Hillsborough Florida Junior or Second Mortgage Deed is to provide additional financing options to property owners, allowing them to access the equity in their property without having to refinance their first mortgage. This type of arrangement is beneficial for homeowners who need funds for various purposes such as home renovations, debt consolidation, or other personal financial needs. The Hillsborough Florida Junior or Second Mortgage Deed acts as a lien on the property, securing the loan taken by the homeowner. In the event of default, the lender of the second mortgage has the right to foreclose on the property and recoup their investment. There are different types of Hillsborough Florida Junior or Second Mortgage Deeds available, depending on the terms negotiated between the homeowner and the lender. Some common types include: 1. Fixed-Rate Second Mortgage: This type of second mortgage deed offers a fixed interest rate for a set period of time, usually ranging from 5 to 15 years. It allows homeowners to have a predictable monthly payment amount throughout the loan term. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage deed, the interest rate is initially fixed for a specific period, typically 3 to 10 years, and then adjusts periodically based on market fluctuations. This type of mortgage offers a potentially lower initial interest rate, but the monthly payment amount may change over time. 3. Home Equity Line of Credit (HELOT): A HELOT serves as a revolving line of credit secured by the property. Homeowners can borrow and repay funds within a predetermined limit during the draw period, usually five to ten years. Interest is only charged on the amount borrowed, providing flexibility for homeowners with fluctuating financial needs. It is essential for homeowners considering a Hillsborough Florida Junior or Second Mortgage Deed to carefully review the terms and conditions offered by lenders, including interest rates, repayment terms, and any fees associated with the loan. Seeking advice from a qualified real estate attorney or a reputable mortgage professional can help ensure a well-informed decision is made.A Hillsborough Florida Junior or Second Mortgage Deed is a legal document used in real estate transactions where a property owner in Hillsborough County, Florida, obtains a second mortgage loan on their property. This type of mortgage deed is subordinate to an existing or first mortgage on the property. The purpose of a Hillsborough Florida Junior or Second Mortgage Deed is to provide additional financing options to property owners, allowing them to access the equity in their property without having to refinance their first mortgage. This type of arrangement is beneficial for homeowners who need funds for various purposes such as home renovations, debt consolidation, or other personal financial needs. The Hillsborough Florida Junior or Second Mortgage Deed acts as a lien on the property, securing the loan taken by the homeowner. In the event of default, the lender of the second mortgage has the right to foreclose on the property and recoup their investment. There are different types of Hillsborough Florida Junior or Second Mortgage Deeds available, depending on the terms negotiated between the homeowner and the lender. Some common types include: 1. Fixed-Rate Second Mortgage: This type of second mortgage deed offers a fixed interest rate for a set period of time, usually ranging from 5 to 15 years. It allows homeowners to have a predictable monthly payment amount throughout the loan term. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage deed, the interest rate is initially fixed for a specific period, typically 3 to 10 years, and then adjusts periodically based on market fluctuations. This type of mortgage offers a potentially lower initial interest rate, but the monthly payment amount may change over time. 3. Home Equity Line of Credit (HELOT): A HELOT serves as a revolving line of credit secured by the property. Homeowners can borrow and repay funds within a predetermined limit during the draw period, usually five to ten years. Interest is only charged on the amount borrowed, providing flexibility for homeowners with fluctuating financial needs. It is essential for homeowners considering a Hillsborough Florida Junior or Second Mortgage Deed to carefully review the terms and conditions offered by lenders, including interest rates, repayment terms, and any fees associated with the loan. Seeking advice from a qualified real estate attorney or a reputable mortgage professional can help ensure a well-informed decision is made.