A junior or second deed of trust is a deed of trust which is subordinate to existing liens on the securing property, usually because the junior deed of trust was made, executed and recorded after one or more earlier deeds of trust or other encumbrances.

Junior deeds of trust can be created in several ways. For example, such deeds of trust often arise as the result of a sale of real property, either when a new loan in the full amount of the purchase price cannot be obtained or when an existing loan on the securing property is assumed. In this situation, a junior deed of trust is given to secure the portion of the purchase price which exceeds the balance of the new or existing loan.

Additionally, a junior deed of trust may be created where an existing lienholder, typically a seller, subordinates to another secured debt, usually a construction loan. Finally, junior deeds of trust may arise where the owner of real property obtains a loan secured by the property after its purchase.

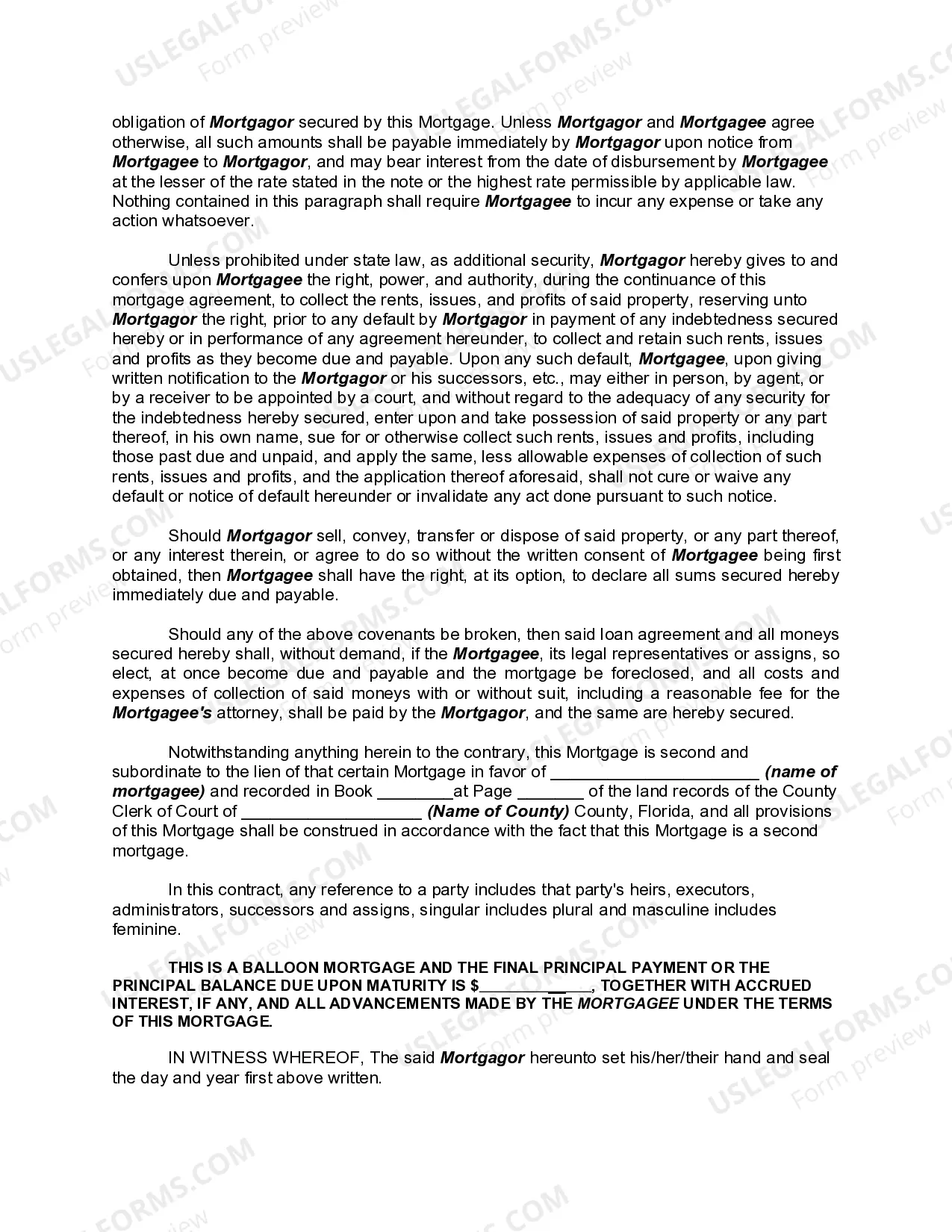

Miami-Dade Florida Junior or Second Mortgage Deed (Keywords: Miami-Dade, Florida, Junior Mortgage, Second Mortgage, Deed) A Miami-Dade Florida Junior or Second Mortgage Deed is a legal document that allows homeowners in Miami-Dade County, Florida, to obtain additional funds by using their property as collateral. This mortgage type is specifically used when there is already an existing first mortgage on the property. In Miami-Dade County, residents have the option to pursue a junior or second mortgage to access additional financing. This type of mortgage is secondary to the primary or first mortgage, meaning that the first mortgage has priority in the event of default or foreclosure. There are different types of Miami-Dade Florida Junior or Second Mortgage Deeds available to property owners. Some common variations include: 1. Junior Fixed-Rate Mortgage: This type of mortgage allows homeowners to secure a fixed interest rate for the duration of the loan. By opting for a fixed rate, borrowers can enjoy stable monthly payments over the life of the loan. 2. Junior Adjustable-Rate Mortgage (ARM): An ARM provides borrowers with an interest rate that may fluctuate over time based on market conditions. This option could be appealing for homeowners looking for lower initial interest rates or planning to sell or refinance their property before the rate adjusts. 3. Junior Interest-Only Mortgage: With an interest-only mortgage, borrowers are only required to pay the interest on the loan for a specified period. This allows for lower monthly payments initially, but eventually, the principal balance will need to be paid off. 4. Junior Balloon Mortgage: A balloon mortgage involves making lower monthly payments for a set number of years, with a large "balloon" payment due at the end of the term. This option may be suitable for borrowers who anticipate having a significant sum available in the future to cover the final payment. 5. Junior Cash-Out Refinance Mortgage: A cash-out refinance allows homeowners to refinance their existing mortgage for an amount greater than what is currently owed. This type of mortgage provides the opportunity to access additional funds that can be used for various purposes, such as home improvements, debt consolidation, or investing. It is important to note that obtaining a Miami-Dade Florida Junior or Second Mortgage Deed requires meeting specific eligibility criteria and financial assessments. Borrowers are advised to consult with lenders or mortgage professionals who specialize in Miami-Dade County to determine the best options available based on their unique circumstances. In conclusion, a Miami-Dade Florida Junior or Second Mortgage Deed is a flexible financial tool that allows homeowners to tap into the equity of their property while maintaining an existing first mortgage. The availability of different types of second mortgages in Miami-Dade County provides borrowers with various choices to suit their financial needs and goals.Miami-Dade Florida Junior or Second Mortgage Deed (Keywords: Miami-Dade, Florida, Junior Mortgage, Second Mortgage, Deed) A Miami-Dade Florida Junior or Second Mortgage Deed is a legal document that allows homeowners in Miami-Dade County, Florida, to obtain additional funds by using their property as collateral. This mortgage type is specifically used when there is already an existing first mortgage on the property. In Miami-Dade County, residents have the option to pursue a junior or second mortgage to access additional financing. This type of mortgage is secondary to the primary or first mortgage, meaning that the first mortgage has priority in the event of default or foreclosure. There are different types of Miami-Dade Florida Junior or Second Mortgage Deeds available to property owners. Some common variations include: 1. Junior Fixed-Rate Mortgage: This type of mortgage allows homeowners to secure a fixed interest rate for the duration of the loan. By opting for a fixed rate, borrowers can enjoy stable monthly payments over the life of the loan. 2. Junior Adjustable-Rate Mortgage (ARM): An ARM provides borrowers with an interest rate that may fluctuate over time based on market conditions. This option could be appealing for homeowners looking for lower initial interest rates or planning to sell or refinance their property before the rate adjusts. 3. Junior Interest-Only Mortgage: With an interest-only mortgage, borrowers are only required to pay the interest on the loan for a specified period. This allows for lower monthly payments initially, but eventually, the principal balance will need to be paid off. 4. Junior Balloon Mortgage: A balloon mortgage involves making lower monthly payments for a set number of years, with a large "balloon" payment due at the end of the term. This option may be suitable for borrowers who anticipate having a significant sum available in the future to cover the final payment. 5. Junior Cash-Out Refinance Mortgage: A cash-out refinance allows homeowners to refinance their existing mortgage for an amount greater than what is currently owed. This type of mortgage provides the opportunity to access additional funds that can be used for various purposes, such as home improvements, debt consolidation, or investing. It is important to note that obtaining a Miami-Dade Florida Junior or Second Mortgage Deed requires meeting specific eligibility criteria and financial assessments. Borrowers are advised to consult with lenders or mortgage professionals who specialize in Miami-Dade County to determine the best options available based on their unique circumstances. In conclusion, a Miami-Dade Florida Junior or Second Mortgage Deed is a flexible financial tool that allows homeowners to tap into the equity of their property while maintaining an existing first mortgage. The availability of different types of second mortgages in Miami-Dade County provides borrowers with various choices to suit their financial needs and goals.