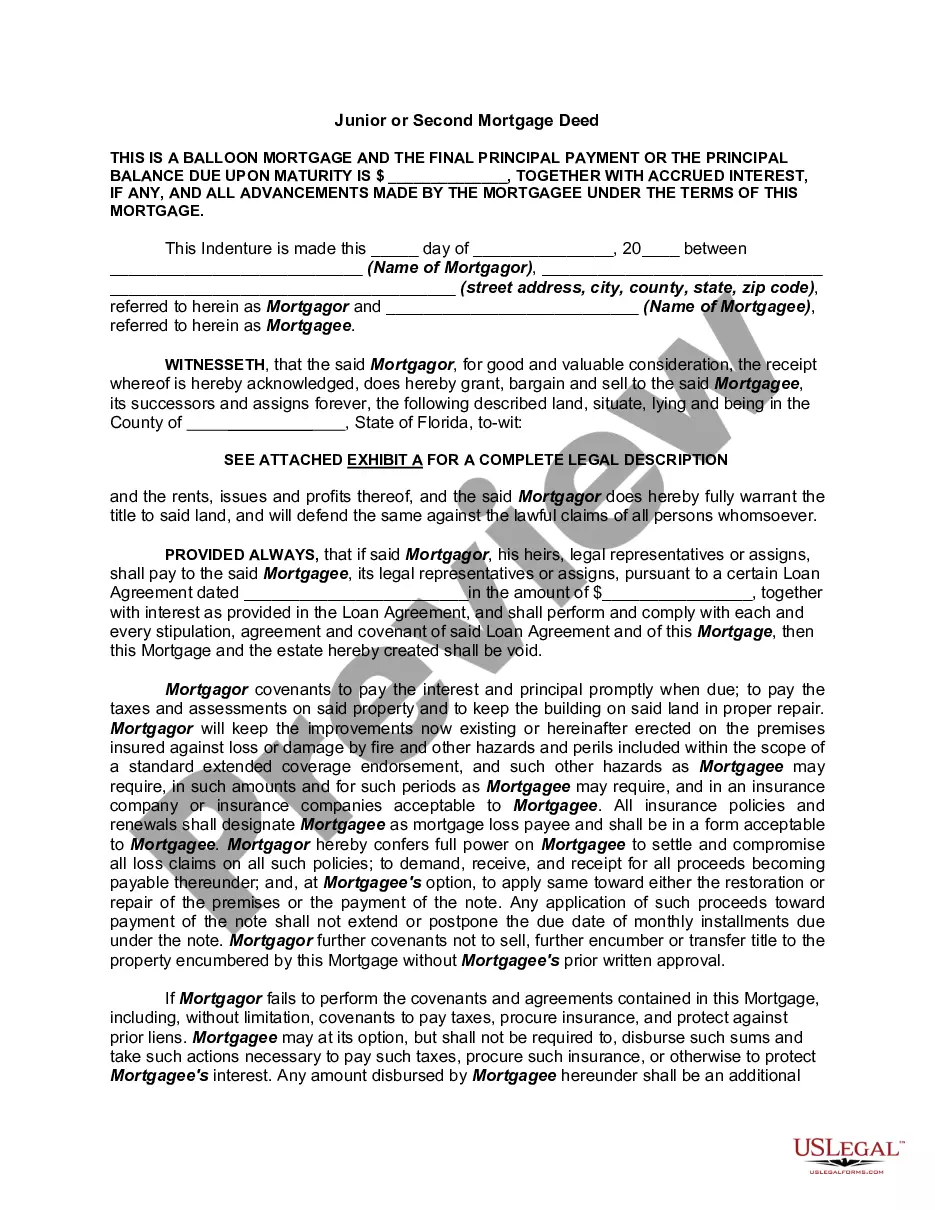

A junior or second deed of trust is a deed of trust which is subordinate to existing liens on the securing property, usually because the junior deed of trust was made, executed and recorded after one or more earlier deeds of trust or other encumbrances.

Junior deeds of trust can be created in several ways. For example, such deeds of trust often arise as the result of a sale of real property, either when a new loan in the full amount of the purchase price cannot be obtained or when an existing loan on the securing property is assumed. In this situation, a junior deed of trust is given to secure the portion of the purchase price which exceeds the balance of the new or existing loan.

Additionally, a junior deed of trust may be created where an existing lienholder, typically a seller, subordinates to another secured debt, usually a construction loan. Finally, junior deeds of trust may arise where the owner of real property obtains a loan secured by the property after its purchase.