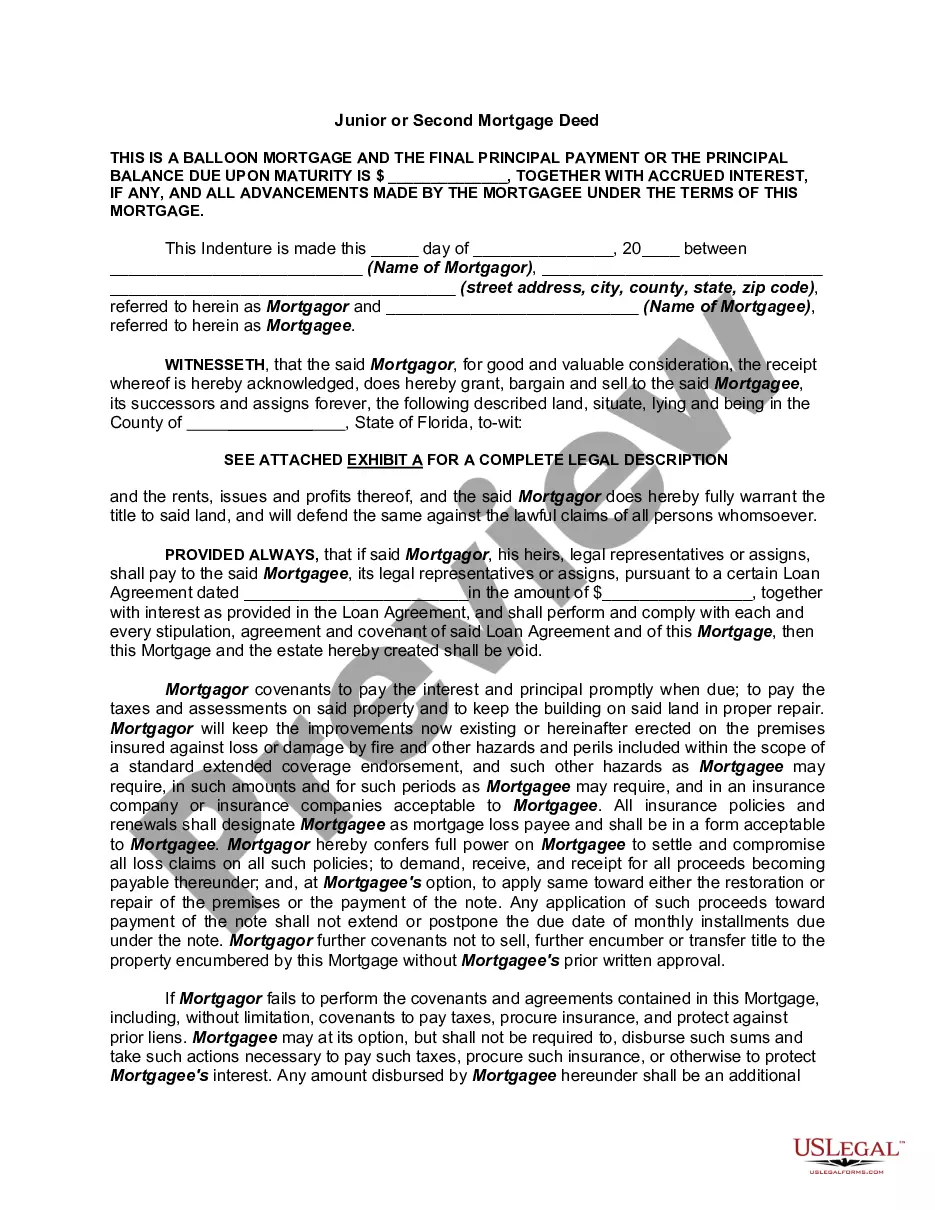

A junior or second deed of trust is a deed of trust which is subordinate to existing liens on the securing property, usually because the junior deed of trust was made, executed and recorded after one or more earlier deeds of trust or other encumbrances.

Junior deeds of trust can be created in several ways. For example, such deeds of trust often arise as the result of a sale of real property, either when a new loan in the full amount of the purchase price cannot be obtained or when an existing loan on the securing property is assumed. In this situation, a junior deed of trust is given to secure the portion of the purchase price which exceeds the balance of the new or existing loan.

Additionally, a junior deed of trust may be created where an existing lienholder, typically a seller, subordinates to another secured debt, usually a construction loan. Finally, junior deeds of trust may arise where the owner of real property obtains a loan secured by the property after its purchase.

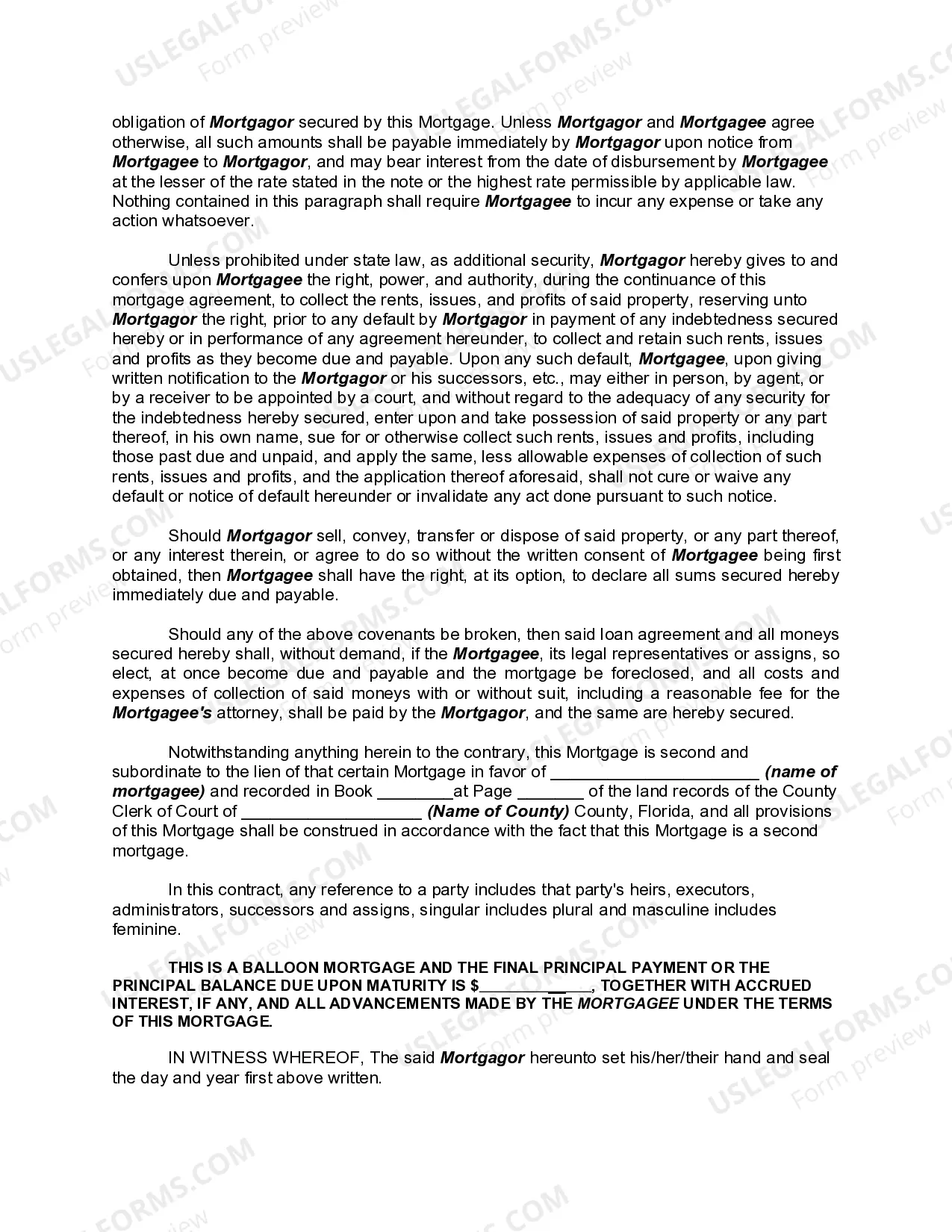

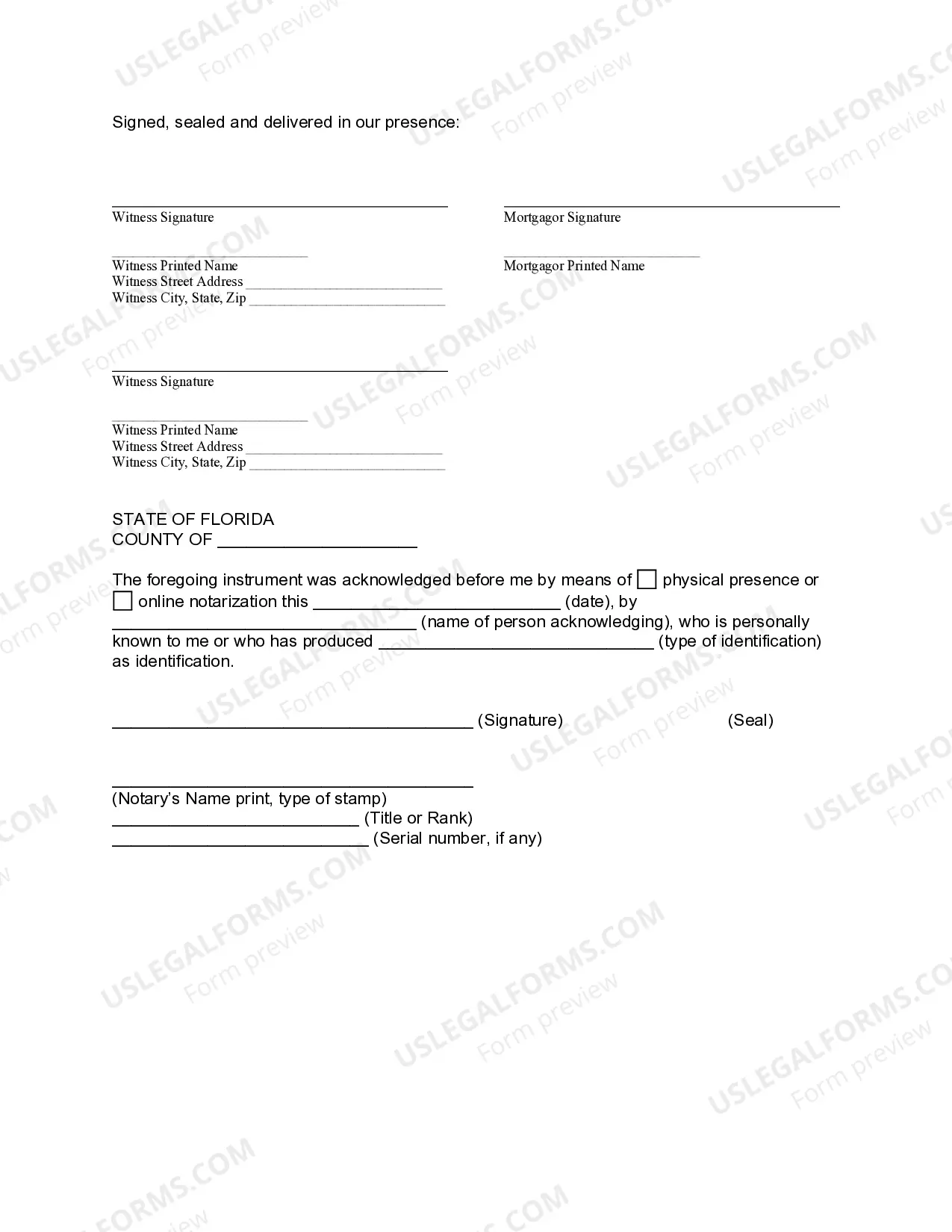

Are you considering purchasing a property in Tallahassee, Florida, but are unsure about the mortgage options available to you? Look no further! In this comprehensive description, we will delve into the details of Tallahassee Florida Junior or Second Mortgage Deeds and provide you with valuable insights to make an informed decision. What is a Tallahassee Florida Junior or Second Mortgage Deed? A Tallahassee Florida Junior or Second Mortgage Deed is a legal document used to secure a secondary loan against a property that already has an existing primary mortgage. It is an additional lien placed on the property, subordinate to the first mortgage, and is often taken out by homeowners to access additional funds for various purposes such as home improvements, debt consolidation, or emergencies. Types of Tallahassee Florida Junior or Second Mortgage Deeds: 1. Fixed-Rate Second Mortgage: This type of mortgage loan offers a fixed interest rate for the entire loan term, providing predictable monthly payments. Homeowners seeking stability in their mortgage payments often opt for this option. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage, the interest rate is initially fixed for a certain period, typically 3 to 10 years, after which it adjusts periodically. This type of mortgage may offer lower initial rates but carries the uncertainty of potential rate fluctuations. 3. Home Equity Line of Credit (HELOT): A HELOT allows homeowners to access funds as needed, similar to a credit card, up to a certain credit limit. Interest payments are typically required only on the amount borrowed, providing flexibility and control over the borrowed funds. 4. Piggyback Mortgage: A piggyback mortgage involves taking out a second mortgage simultaneously with the primary mortgage. It allows borrowers to avoid private mortgage insurance (PMI) and may be advantageous for those with a smaller down payment or those seeking a higher loan-to-value ratio. 5. Reverse Mortgage: Specifically available to homeowners aged 62 or older, a reverse mortgage allows seniors to convert a portion of their home's equity into tax-free income or a lump sum payment. Repayment is typically deferred until the homeowner moves out or passes away. Key Considerations for Tallahassee Florida Junior or Second Mortgage Deeds: 1. Interest Rates and Fees: Compare interest rates, closing costs, and fees associated with different lender offerings to ensure you choose the most affordable option. 2. Loan Terms: Evaluate the loan term and monthly payments to determine the feasibility of repayment within your financial situation. 3. Equity and Loan-to-Value Ratio: The amount of equity in your property and the loan-to-value ratio play a crucial role in determining the maximum loan amount available to you. Assess these factors to gauge your potential borrowing capacity. 4. Creditworthiness: Lenders will review your credit history and score to assess your eligibility for a second mortgage. A strong credit profile enhances your chances of securing a favorable loan. 5. Lender Reputation: Research and select a reputable lender known for their reliability, customer service, and favorable terms. By understanding the different types of Tallahassee Florida Junior or Second Mortgage Deeds available and considering the key factors discussed above, you can make an informed decision that suits your specific financial needs and goals. Remember to consult with a financial advisor or mortgage professional to ensure all aspects of your mortgage decision align with your long-term plans.Are you considering purchasing a property in Tallahassee, Florida, but are unsure about the mortgage options available to you? Look no further! In this comprehensive description, we will delve into the details of Tallahassee Florida Junior or Second Mortgage Deeds and provide you with valuable insights to make an informed decision. What is a Tallahassee Florida Junior or Second Mortgage Deed? A Tallahassee Florida Junior or Second Mortgage Deed is a legal document used to secure a secondary loan against a property that already has an existing primary mortgage. It is an additional lien placed on the property, subordinate to the first mortgage, and is often taken out by homeowners to access additional funds for various purposes such as home improvements, debt consolidation, or emergencies. Types of Tallahassee Florida Junior or Second Mortgage Deeds: 1. Fixed-Rate Second Mortgage: This type of mortgage loan offers a fixed interest rate for the entire loan term, providing predictable monthly payments. Homeowners seeking stability in their mortgage payments often opt for this option. 2. Adjustable-Rate Second Mortgage: With an adjustable-rate second mortgage, the interest rate is initially fixed for a certain period, typically 3 to 10 years, after which it adjusts periodically. This type of mortgage may offer lower initial rates but carries the uncertainty of potential rate fluctuations. 3. Home Equity Line of Credit (HELOT): A HELOT allows homeowners to access funds as needed, similar to a credit card, up to a certain credit limit. Interest payments are typically required only on the amount borrowed, providing flexibility and control over the borrowed funds. 4. Piggyback Mortgage: A piggyback mortgage involves taking out a second mortgage simultaneously with the primary mortgage. It allows borrowers to avoid private mortgage insurance (PMI) and may be advantageous for those with a smaller down payment or those seeking a higher loan-to-value ratio. 5. Reverse Mortgage: Specifically available to homeowners aged 62 or older, a reverse mortgage allows seniors to convert a portion of their home's equity into tax-free income or a lump sum payment. Repayment is typically deferred until the homeowner moves out or passes away. Key Considerations for Tallahassee Florida Junior or Second Mortgage Deeds: 1. Interest Rates and Fees: Compare interest rates, closing costs, and fees associated with different lender offerings to ensure you choose the most affordable option. 2. Loan Terms: Evaluate the loan term and monthly payments to determine the feasibility of repayment within your financial situation. 3. Equity and Loan-to-Value Ratio: The amount of equity in your property and the loan-to-value ratio play a crucial role in determining the maximum loan amount available to you. Assess these factors to gauge your potential borrowing capacity. 4. Creditworthiness: Lenders will review your credit history and score to assess your eligibility for a second mortgage. A strong credit profile enhances your chances of securing a favorable loan. 5. Lender Reputation: Research and select a reputable lender known for their reliability, customer service, and favorable terms. By understanding the different types of Tallahassee Florida Junior or Second Mortgage Deeds available and considering the key factors discussed above, you can make an informed decision that suits your specific financial needs and goals. Remember to consult with a financial advisor or mortgage professional to ensure all aspects of your mortgage decision align with your long-term plans.