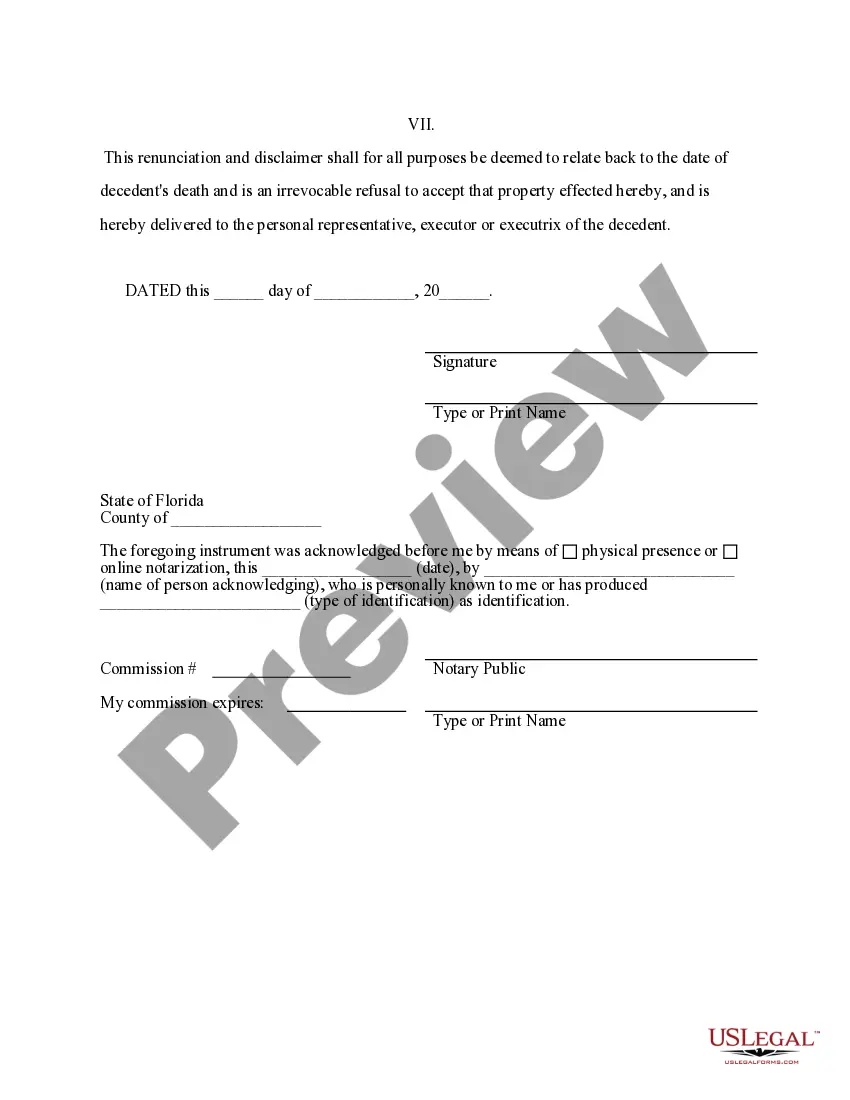

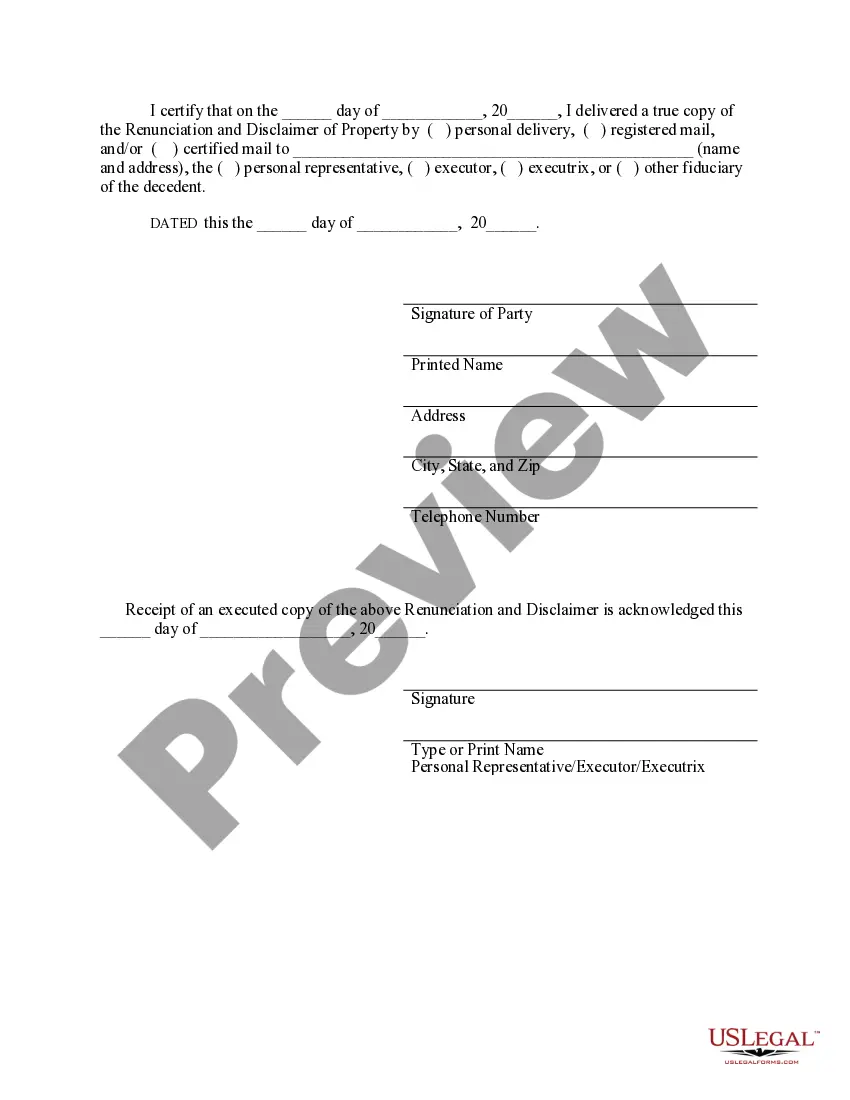

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our helpful website features a vast collection of records that enables you to locate and acquire nearly any document template you require.

You can export, complete, and validate the Fort Lauderdale Florida Renunciation And Disclaimer of Property obtained through Intestate Succession in just a few minutes instead of spending hours searching the web for a suitable template.

Leveraging our library is an excellent method to enhance the security of your document submissions.

The Download option will appear on all the documents you view. Additionally, you can access all previously saved records in the My documents section.

If you haven’t created an account yet, follow the steps outlined below.

- Our skilled attorneys routinely examine all the documents to verify that the forms are applicable for a specific state and adhere to new laws and regulations.

- How can you obtain the Fort Lauderdale Florida Renunciation And Disclaimer of Property acquired via Intestate Succession.

- If you're already subscribed, simply Log In to your account.

Form popularity

FAQ

To disclaim inheritance in Florida, an individual must file a formal disclaimer following the guidelines set forth by Florida statutes, specifically under section 739.104. This process involves submitting a written notice indicating the intent to disclaim property received through intestate succession. Using platforms such as US Legal Forms can simplify this process, providing necessary forms and guidance tailored to residents of Fort Lauderdale, Florida.

Disclosure laws in Florida require individuals to provide transparency regarding their interests in property and financial matters. Specifically, these laws aim to protect the integrity of estate planning and inheritance processes. For those involved in Power of Attorney or Intestate Succession in Fort Lauderdale, Florida, being aware of these laws helps ensure compliance and proper management of inherited assets.

The disclaimer law in Florida permits individuals to refuse property or interests they receive under intestate succession. This law serves to protect the rights and choices of heirs, allowing them to make decisions that align with their personal or financial situations. When considering property received through intestate succession, understanding the disclaimer law is essential for residents of Fort Lauderdale, Florida.

The statute 739.104 in Florida outlines the legal process for a renunciation and disclaimer of property received through intestate succession. It allows heirs to refuse or reject their inheritance without incurring liability to creditors of the decedent. By utilizing this statute, individuals can safeguard their financial interests while clarifying their intentions regarding property they did not wish to inherit.

Transferring property after death without a will in Florida typically involves going through the state’s intestate succession laws. This process may require you to file legal documents and may involve going to court if disputes arise among heirs. Familiarizing yourself with the Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession can provide clarity and help facilitate this transfers smoothly.

To disclaim an inheritance in Florida, you must submit a written disclaimer to the relevant estate executor or administrator. The disclaimer must be filed within a specific time frame, and it should clearly state your intent to renounce the property. By focusing on the Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession, you can ensure that you follow the correct procedures and avoid potential complications.

To transfer a property deed from a deceased relative in Florida, you typically need to go through probate or ensure the property falls under the transfer on death provisions. It involves filling out specific forms and presenting relevant documents to the right authorities. Utilizing the guidance related to the Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession can streamline this process.

When a homeowner dies without a will in Florida, the property typically passes to their heirs according to state intestacy laws. This process means that the house could be divided among relatives, which may not align with the deceased's wishes. Understanding the implications of the Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession can help beneficiaries make informed decisions regarding their inheritance.

The disclaimer statute in Florida allows individuals to refuse an inheritance or gift without accepting the legal responsibilities that come with it. This can be particularly important in cases where the property involves debts or liabilities. By understanding the Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession, individuals can navigate this process with greater ease.

Florida's rules for intestate succession determine how property is distributed when someone dies without a will. The primary rule is that the surviving spouse and children share the estate, with specific percentages depending on whether there are surviving children. Additionally, if no immediate family exists, extended relatives may be considered heirs. For more detailed insights into these rules and their application in Fort Lauderdale Florida Renunciation and Disclaimer of Property received by Intestate Succession, explore the helpful tools available on the US Legal Forms platform.