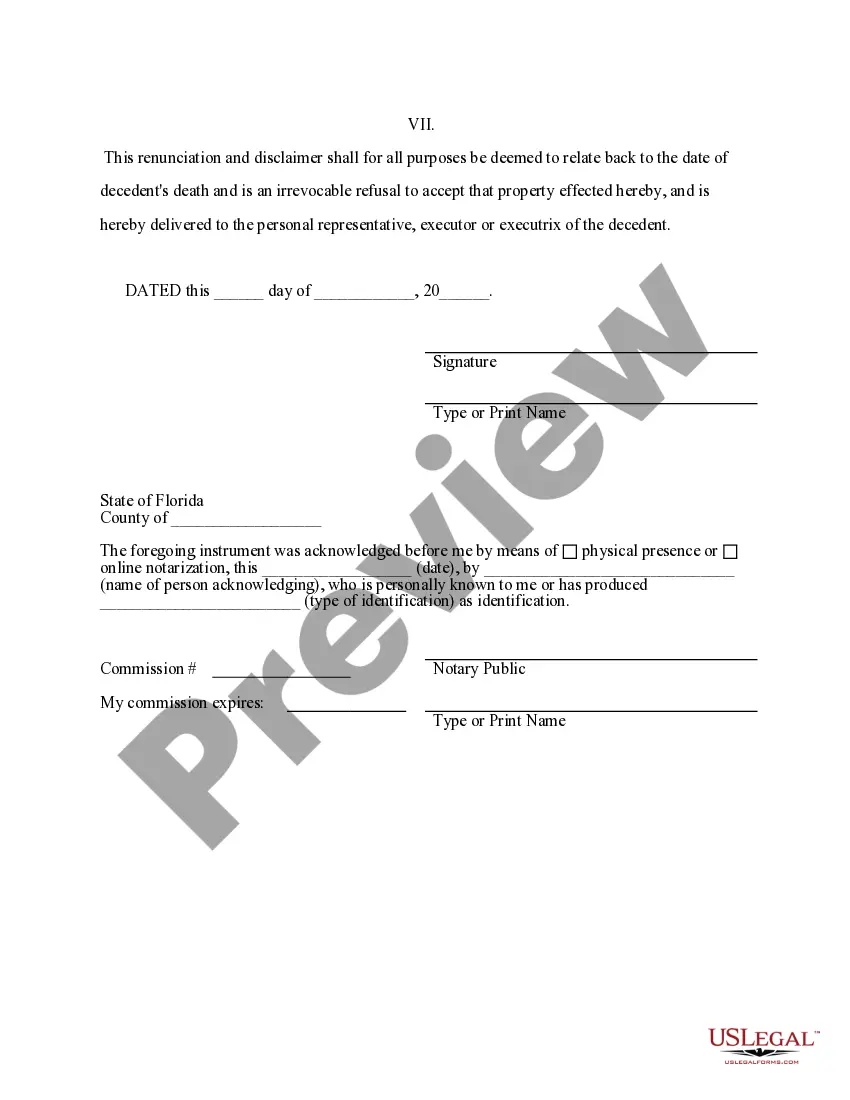

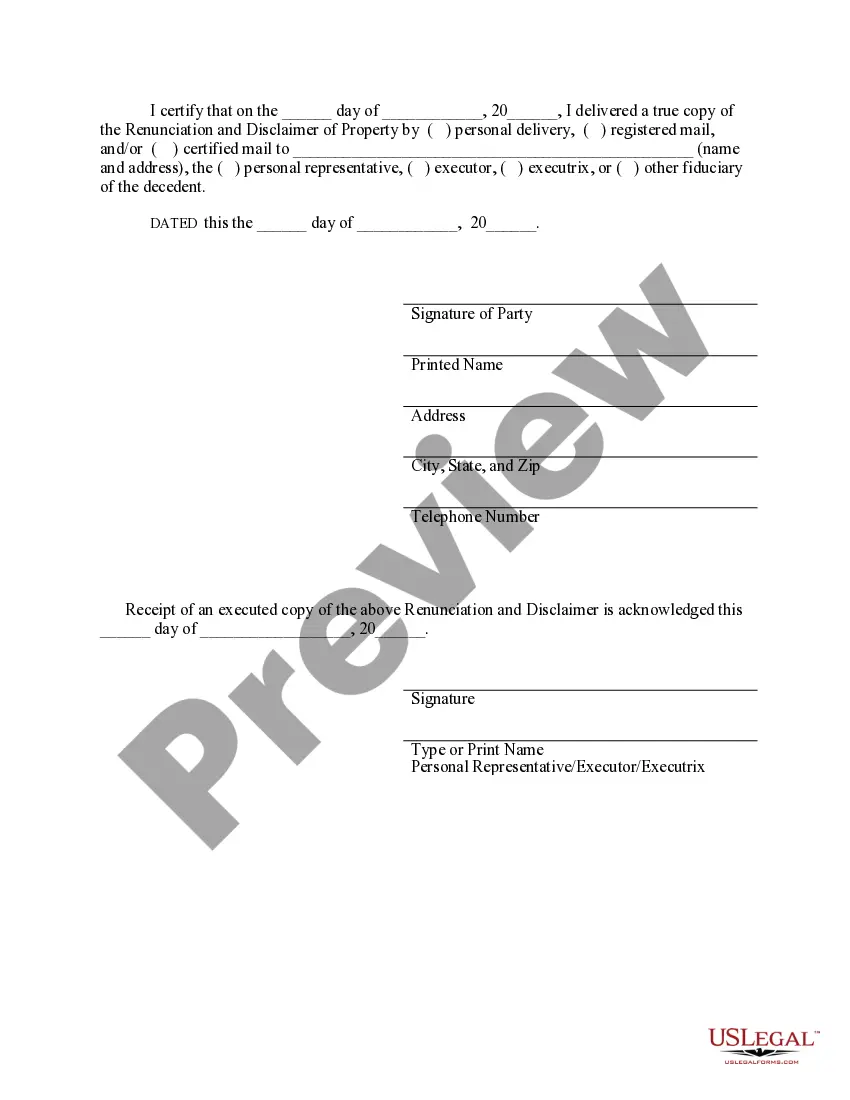

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Gainesville Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our practical platform with numerous templates streamlines the process of locating and obtaining nearly any document sample you require.

You can export, fill out, and sign the Gainesville Florida Renunciation and Disclaimer of Property obtained through Intestate Succession in just a few minutes instead of spending hours online searching for an appropriate template.

Using our collection is a superb method to enhance the security of your record submissions. Our experienced attorneys consistently review all documents to ensure that the forms are suitable for a specific area and in accordance with the latest laws and regulations.

Start the saving process. Click Buy Now and choose your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

Save the file. Specify the format to obtain the Gainesville Florida Renunciation and Disclaimer of Property from Intestate Succession and modify and complete it, or sign it as per your requirements. US Legal Forms is likely the largest and most reliable form library online. We are always eager to help you with any legal situation, even if it is merely downloading the Gainesville Florida Renunciation and Disclaimer of Property obtained through Intestate Succession. Feel free to utilize our service and make your document experience as simple as possible!

- How do you obtain the Gainesville Florida Renunciation and Disclaimer of Property received through Intestate Succession.

- If you already have a subscription, simply Log In to your account. The Download button will be activated on all documents you view.

- Moreover, you can find all previously saved documents in the My documents section.

- If you do not have an account yet, follow these steps.

- Locate the form you need. Verify that it is the correct form: check its title and description, and utilize the Preview function if available. Otherwise, use the Search bar to find the suitable one.

Form popularity

FAQ

To transfer property after death without a will in Florida, you can follow the intestate succession laws outlined by the state. Utilizing the Gainesville Florida Renunciation and Disclaimer of Property received by Intestate Succession can further simplify the transfer process. Working with a legal expert ensures that all necessary steps are taken correctly to avoid future disputes.

When the owner of a house dies without a will in Florida, the property typically goes through intestate succession. This means the estate is distributed according to state law, which designates heirs. Engaging in the Gainesville Florida Renunciation and Disclaimer of Property received by Intestate Succession can help in managing your inherited property efficiently.

To claim property of a deceased relative in Florida, you must first determine if they left behind a will or died intestate. If they died without a will, consider utilizing the Gainesville Florida Renunciation and Disclaimer of Property received by Intestate Succession. This process can help you formally claim your inheritance and clarify the ownership of assets.

To change ownership of a property after death in Florida, you typically need to file the necessary documents with the county clerk. If the property owner died intestate, you may need to implement the Gainesville Florida Renunciation and Disclaimer of Property received by Intestate Succession. Consulting with a legal professional can help ensure the ownership transfer is completed correctly.

The best way to transfer property after death in Gainesville, Florida, is through the process of renunciation and disclaimer of property received via intestate succession. This allows heirs to formally refuse property, which can streamline the process and avoid lengthy probate. You can also consider working with a legal expert to ensure all steps are completed accurately.

In Florida, a beneficiary has nine months from the date of the decedent's death to file a disclaimer of an inheritance. This time frame is critical, as filing after the deadline could result in an automatic acceptance of the inheritance. For those seeking to understand their options under the Gainesville Florida Renunciation And Disclaimer of Property received by Intestate Succession, knowing this timeline allows for better planning and decision-making.

The disclaimer statute in Florida, found in Florida Statutes Chapter 732.401, allows beneficiaries to renounce property they receive through intestate succession. This statute provides guidelines on how disclaimers must be executed to be valid, detailing the necessary timeframe and documentation. Understanding this statute is pivotal for anyone navigating the Gainesville Florida Renunciation And Disclaimer of Property received by Intestate Succession process.

To write a disclaimer for an inheritance, you must clearly state your intent to refuse the property, identify the specific inheritance you are disclaiming, and sign the document. Furthermore, it is essential to file the disclaimer with the appropriate court or estate representatives, as required by state law. By doing this correctly, you can ensure compliance with the regulations surrounding Gainesville Florida Renunciation And Disclaimer of Property received by Intestate Succession.

A disclaimer in property law is a legal document that allows a beneficiary to refuse an inheritance or transfer of property. This legal action helps those who wish to disclaim property, ensuring that they do not bear the tax liabilities or responsibilities that come with the inheritance. In the context of Gainesville Florida Renunciation And Disclaimer of Property received by Intestate Succession, understanding how to properly execute a disclaimer is crucial for making informed financial decisions.

Florida statute 119.071 outlines regulations regarding the public's right to access government records while balancing the privacy rights of individuals. This law is essential for understanding how personal information is protected, including in matters related to the Gainesville Florida Renunciation And Disclaimer of Property received by Intestate Succession. It's important to always be aware of how these statutes may impact the disclosure of property details during legal processes.