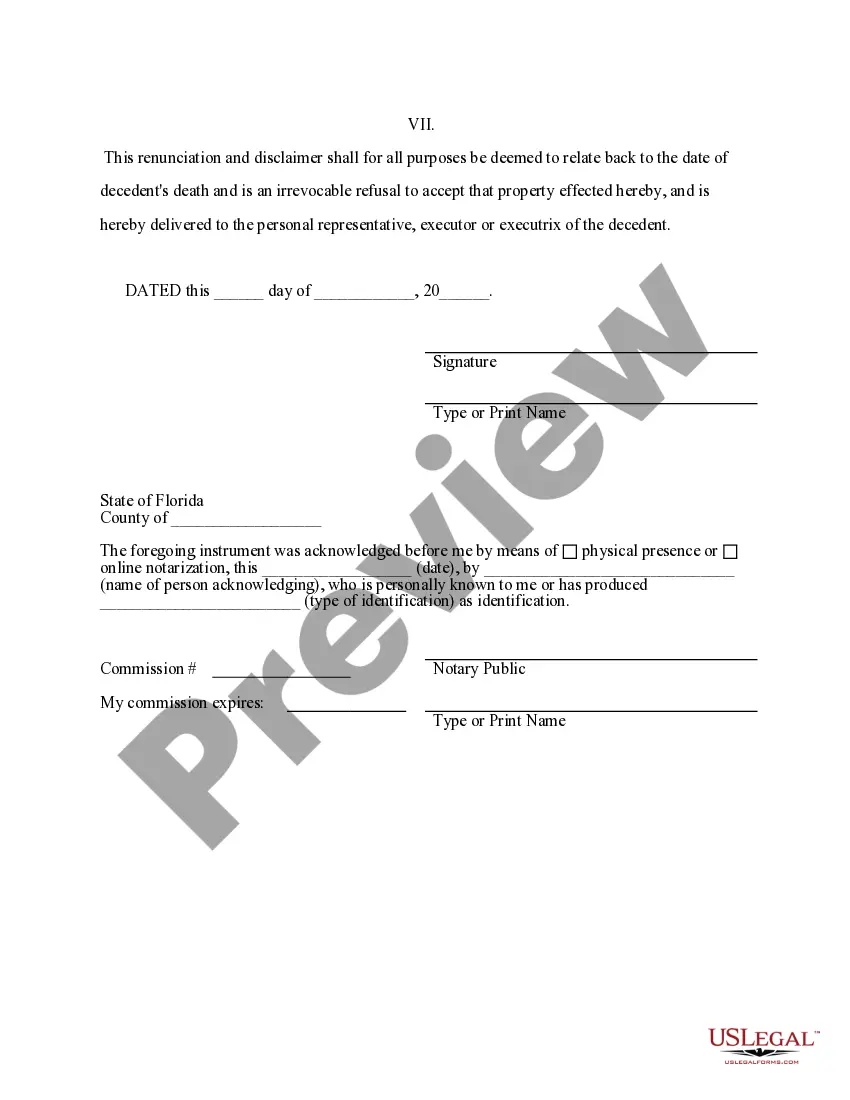

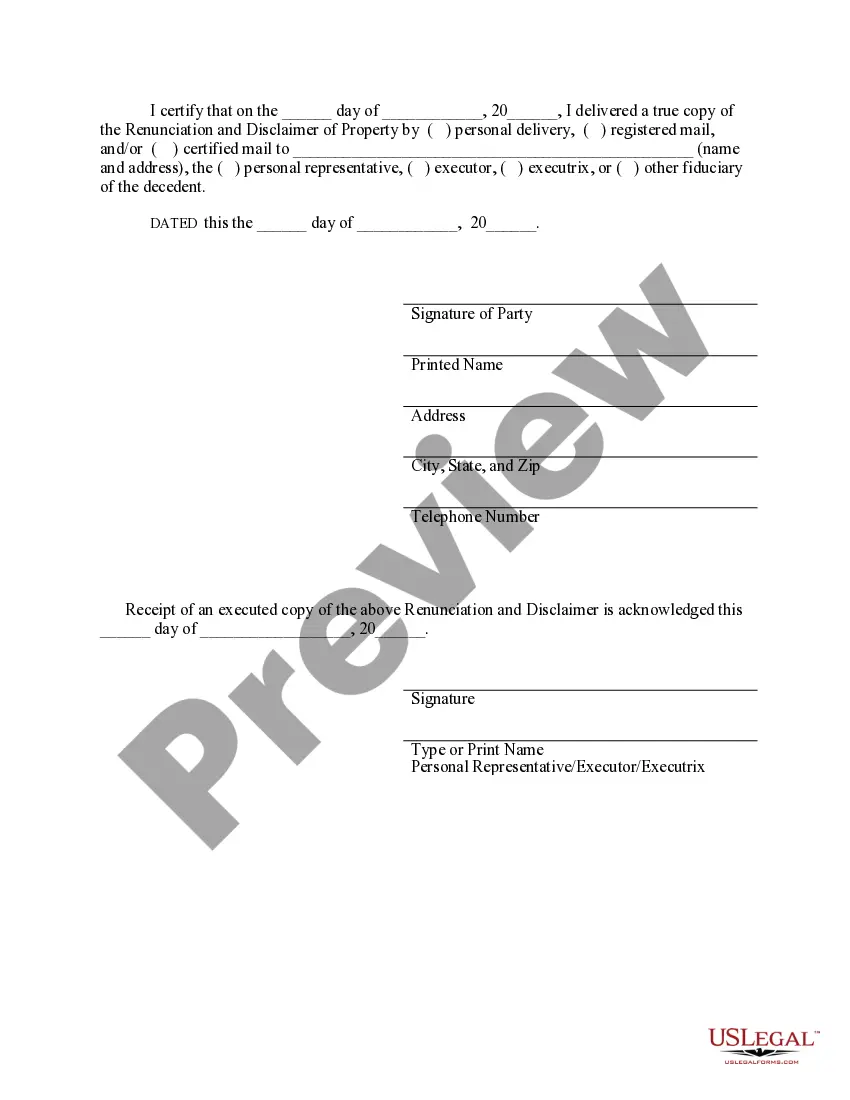

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Jacksonville Florida Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows an individual to voluntarily give up or refuse any rights or claims they may have to property received through intestate succession. Intestate succession refers to the distribution of a deceased person's property when they die without a valid will. In such cases, the state's laws determine how the property is distributed among the deceased person's heirs. By renouncing or disclaiming the property, the individual is essentially stating that they do not wish to inherit or accept the property, usually for personal or financial reasons. This process allows them to avoid the legal responsibilities and obligations that come with inheriting property. There are different types of renunciation and disclaimer that can be utilized in Jacksonville, Florida, depending on the circumstances and the individual's goals. These include: 1. Renunciation of Property: This is the act of formally giving up one's right to inherit any property received through intestate succession. By renouncing, the individual is stating that they do not wish to be a beneficiary and will not accept any portion of the deceased person's property. 2. Disclaimer of Property: This is similar to renunciation but may have slightly different legal implications. By disclaiming the property, the individual is refusing to accept any ownership or responsibility for the inherited property. This can be done for various reasons, such as avoiding potential tax liabilities or declining an inheritance to prevent the property from being subject to certain legal claims. In Jacksonville, Florida, the renunciation and disclaimer process typically requires a written statement that clearly expresses the individual's intention to renounce or disclaim the property received through intestate succession. This statement must be filed in the appropriate court or with the appropriate legal authority within a specified time frame, which is typically within nine months of the deceased person's death. It is important to note that renunciation and disclaimer laws may vary from state to state, so it is advisable to consult with a qualified attorney familiar with Jacksonville and Florida laws to ensure compliance with local regulations and to understand the legal consequences of renouncing or disclaiming property received through intestate succession.Jacksonville Florida Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows an individual to voluntarily give up or refuse any rights or claims they may have to property received through intestate succession. Intestate succession refers to the distribution of a deceased person's property when they die without a valid will. In such cases, the state's laws determine how the property is distributed among the deceased person's heirs. By renouncing or disclaiming the property, the individual is essentially stating that they do not wish to inherit or accept the property, usually for personal or financial reasons. This process allows them to avoid the legal responsibilities and obligations that come with inheriting property. There are different types of renunciation and disclaimer that can be utilized in Jacksonville, Florida, depending on the circumstances and the individual's goals. These include: 1. Renunciation of Property: This is the act of formally giving up one's right to inherit any property received through intestate succession. By renouncing, the individual is stating that they do not wish to be a beneficiary and will not accept any portion of the deceased person's property. 2. Disclaimer of Property: This is similar to renunciation but may have slightly different legal implications. By disclaiming the property, the individual is refusing to accept any ownership or responsibility for the inherited property. This can be done for various reasons, such as avoiding potential tax liabilities or declining an inheritance to prevent the property from being subject to certain legal claims. In Jacksonville, Florida, the renunciation and disclaimer process typically requires a written statement that clearly expresses the individual's intention to renounce or disclaim the property received through intestate succession. This statement must be filed in the appropriate court or with the appropriate legal authority within a specified time frame, which is typically within nine months of the deceased person's death. It is important to note that renunciation and disclaimer laws may vary from state to state, so it is advisable to consult with a qualified attorney familiar with Jacksonville and Florida laws to ensure compliance with local regulations and to understand the legal consequences of renouncing or disclaiming property received through intestate succession.