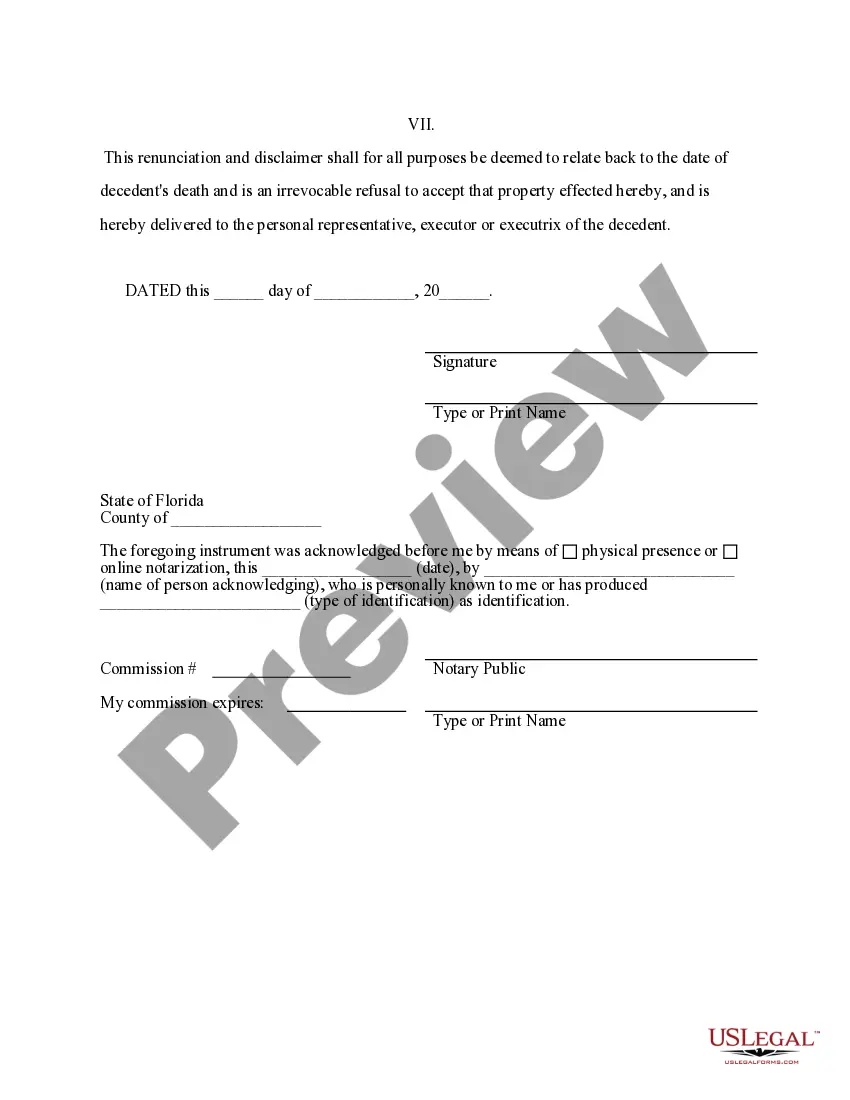

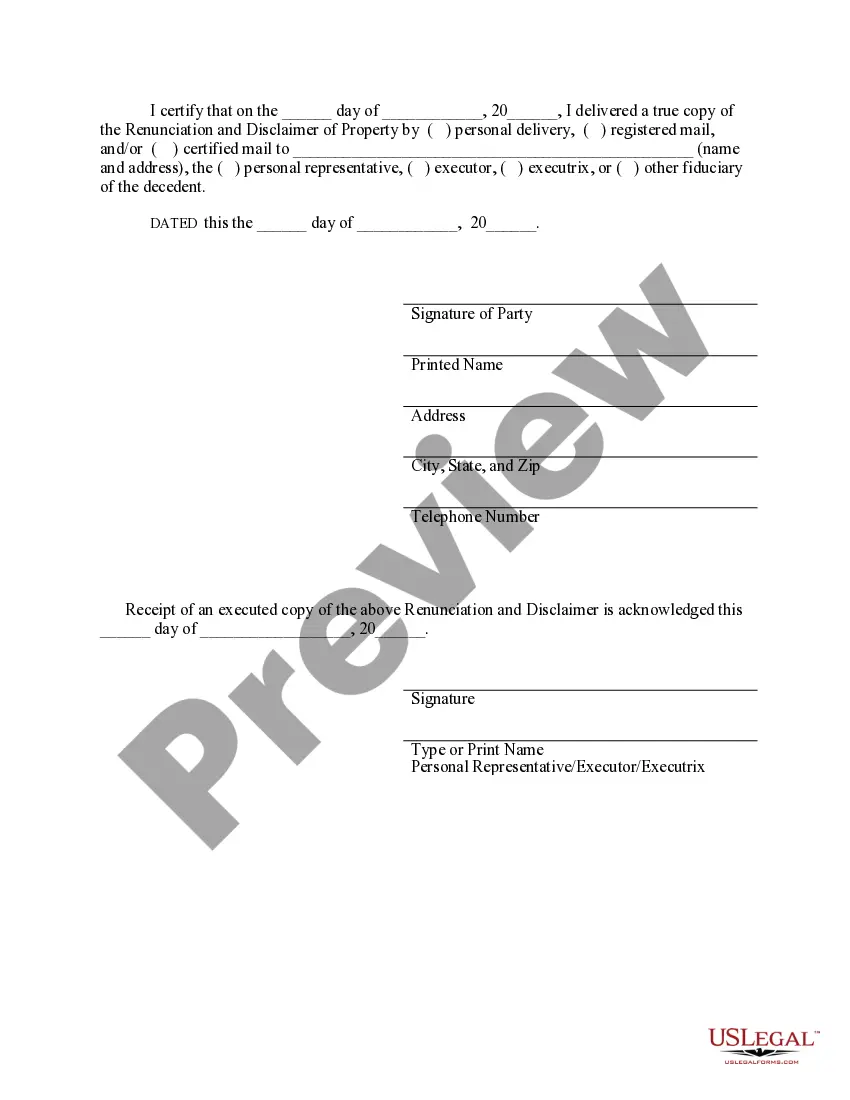

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Miami-Dade Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you are looking for an authentic form, it’s tough to find a superior site than the US Legal Forms platform – likely the most extensive collections available online.

With this collection, you can discover myriad form examples for business and personal needs categorized by type and jurisdiction, or by keywords.

Utilizing our premium search function, obtaining the latest Miami-Dade Florida Renunciation And Disclaimer of Property obtained through Intestate Succession is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the document. Specify the file format and download it to your device.

- Furthermore, the relevance of each document is validated by a team of professional attorneys who consistently review the templates on our site and refresh them based on the latest state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Miami-Dade Florida Renunciation And Disclaimer of Property via Intestate Succession is to Log In to your account and press the Download button.

- If you are using US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have selected the template you desire. Review its description and utilize the Preview option to examine its contents. If it does not meet your requirements, employ the Search box at the upper part of the screen to find the suitable file.

- Confirm your choice. Click the Buy now button. After that, choose your favored payment plan and submit information to create an account.

Form popularity

FAQ

The rules for disclaiming inheritance in Florida include submitting a disclaimer within a specified timeframe, typically nine months from the inheritance date. The disclaimer must be irrevocable and should comply with state laws. Understanding the Miami-Dade Florida Renunciation And Disclaimer of Property received by Intestate Succession helps navigate these rules effectively, ensuring you follow the correct procedures.

To disclaim an inheritance in Florida, you must submit a written disclaimer to the estate's representative or probate court. This document should state your intention to refuse the inheritance clearly. Utilizing the Miami-Dade Florida Renunciation And Disclaimer of Property received by Intestate Succession can help streamline this process, ensuring you understand your rights as an heir.

In Florida, property transfer after death without a will occurs through intestate succession laws. This process determines rightful heirs, typically passing property to immediate family members. The Miami-Dade Florida Renunciation And Disclaimer of Property received by Intestate Succession may also play a role in how property is managed and divided among heirs, ensuring clarity in asset distribution.

An inheritance disclaimer is a legal document in which an individual formally refuses to accept property or assets they would otherwise inherit. For instance, if an heir decides to disclaim an inherited house due to tax implications, they can file a disclaimer. This process significantly aligns with the Miami-Dade Florida Renunciation And Disclaimer of Property received by Intestate Succession, allowing for clear communication regarding inheritance decisions.

A statement of inheritance is a document that outlines the beneficiaries of an estate when someone passes away. In cases of intestate succession, when there is no will, this statement helps clarify who is entitled to inherit property. Understanding how this document relates to the Miami-Dade Florida Renunciation And Disclaimer of Property received by Intestate Succession can guide beneficiaries in managing their rights.

Yes, you can disclaim an inheritance in Florida, provided you adhere to the state's legal requirements. This option is particularly relevant when dealing with the Miami-Dade Florida Renunciation and Disclaimer of Property received by Intestate Succession. Disclaiming can allow you to avoid tax implications or financial burdens associated with the property. It is often beneficial to seek guidance from legal experts to navigate this process effectively.

In Florida, you must typically file your disclaimer within nine months of the decedent's death. This requirement is particularly relevant for anyone managing the Miami-Dade Florida Renunciation and Disclaimer of Property received by Intestate Succession. Missing this deadline may result in forfeiting your right to renounce the inheritance. Therefore, it's advisable to act quickly and consult with professionals when necessary.

To disclaim inherited property in Florida, you must file a formal written disclaimer with the probate court within the appropriate time frame. This process is a vital aspect of the Miami-Dade Florida Renunciation and Disclaimer of Property received by Intestate Succession. Ensure your disclaimer clearly states your intention to renounce the inheritance. Using reputable platforms like uslegalforms can simplify this process for you.

A beneficiary in Florida typically has three months from the date they receive notice of the will’s admission to probate to contest it. This timeframe is essential for anyone exploring the Miami-Dade Florida Renunciation and Disclaimer of Property received by Intestate Succession. Engaging legal counsel during this period can help protect your rights. Timeliness can be the difference in achieving a favorable outcome.

In Florida, the statute of limitations for claims related to inheritance generally spans two years from the decedent's date of death. This timeline is important for anyone involved in Miami-Dade Florida Renunciation and Disclaimer of Property received by Intestate Succession. If you miss this window, you may lose your right to make a claim. Therefore, it’s crucial to act in a timely manner.