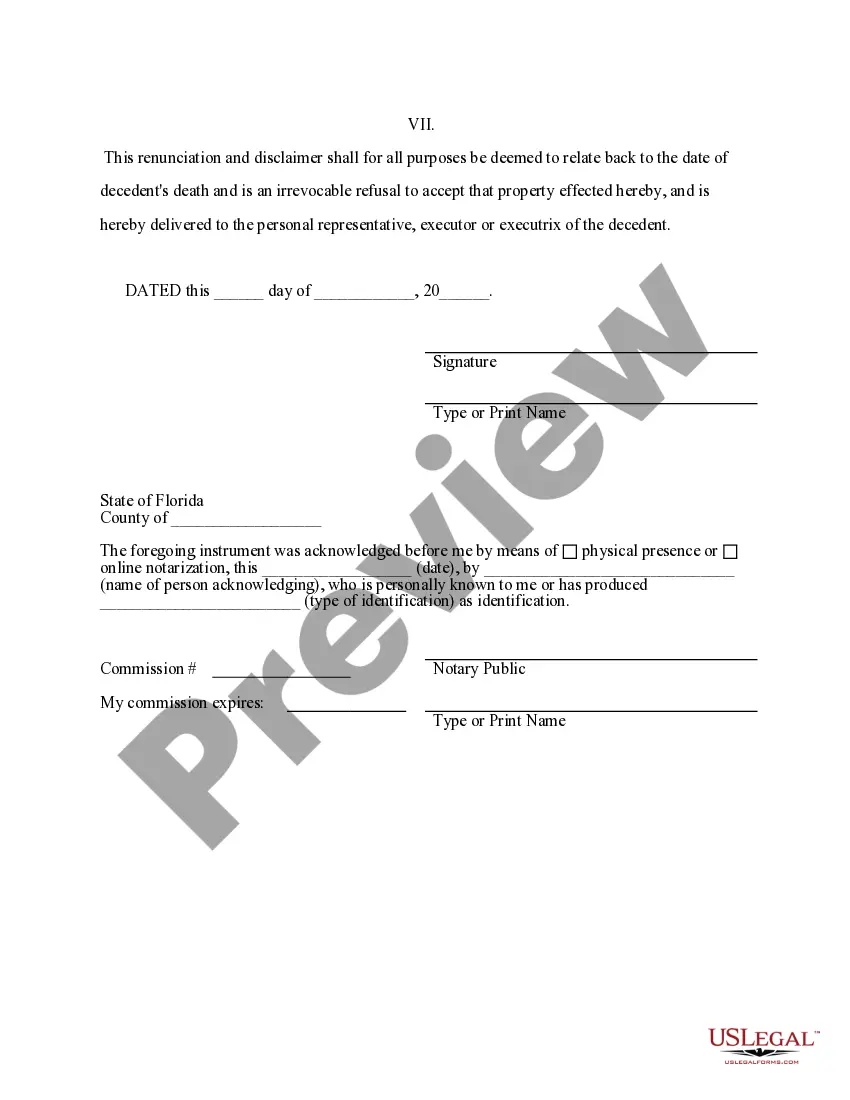

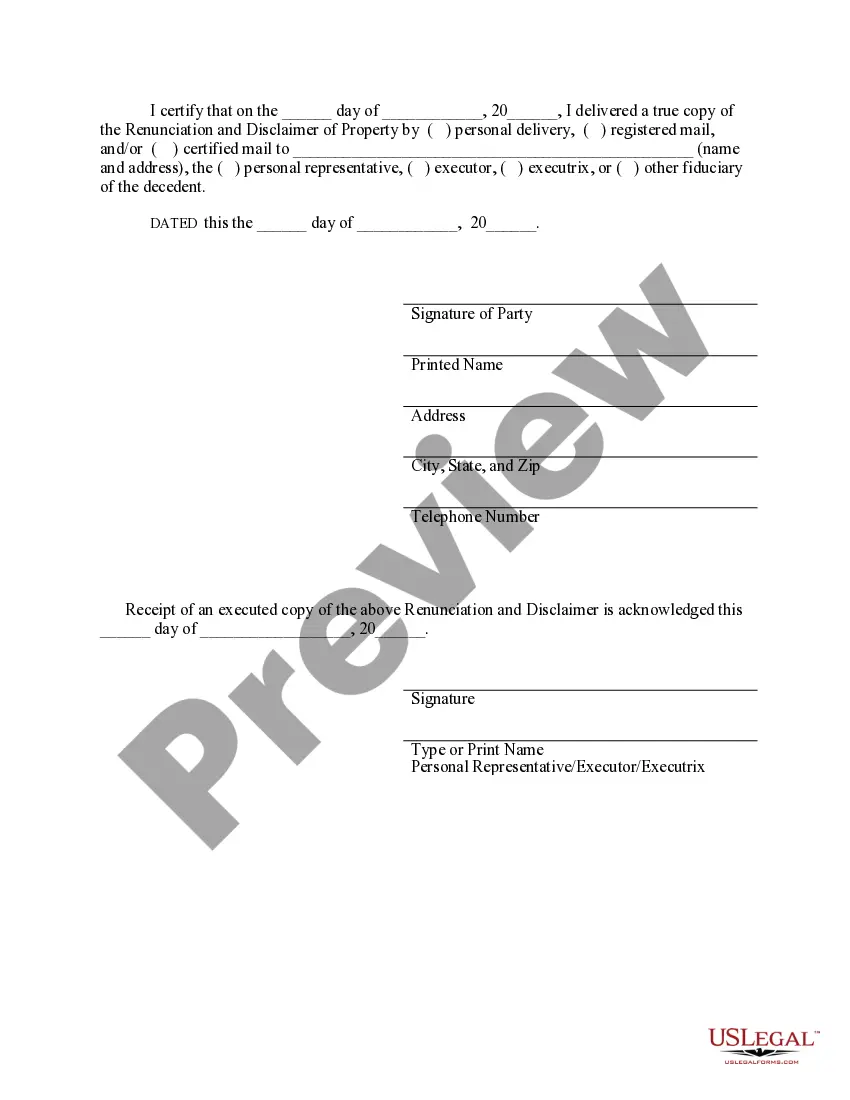

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

Regardless of social or professional position, completing legal documents is an unfortunate obligation in today's corporate landscape.

Frequently, it’s nearly unfeasible for individuals without a legal background to generate such documentation from the ground up, primarily due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms steps in to assist.

Ensure that the template you've located is appropriate for your jurisdiction since the laws in one state or region may not apply in another.

Examine the document and read a brief summary (if available) of the scenarios for which the document can be applied.

- Our platform provides an extensive collection of over 85,000 ready-to-use, state-specific templates that cater to virtually any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time with our DIY forms.

- Whether you need the Orange Florida Renunciation And Disclaimer of Property related to Intestate Succession or any other document applicable in your state or region, US Legal Forms makes everything accessible.

- Here are steps to obtain the Orange Florida Renunciation And Disclaimer of Property connected to Intestate Succession swiftly using our trusted service.

- If you’re already a member, you can proceed to Log In to your account to access the necessary form.

- However, if you are new to our interface, make sure to follow these guidelines before acquiring the Orange Florida Renunciation And Disclaimer of Property concerning Intestate Succession.

Form popularity

FAQ

An appropriate disclaimer is one that is concise, clear, and legally binding, specifically addressing your intent to renounce property. In the context of the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession, it should detail the property and the relationship to the deceased. Using a formal template or guidance from platforms like USLegalForms can help ensure all legal requirements are met effectively.

To write a disclaimer of interest, start by identifying yourself, the deceased, and the specific property being disclaimed. Ensure the statement expresses your intent to renounce any interest in the property in a clear and unambiguous manner. It’s also beneficial to consult legal resources or tools, like USLegalForms, to ensure compliance with the procedures for the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession.

An example of a disclaimer of interest would involve a beneficiary who chooses to decline a portion of their inheritance from an estate. The beneficiary would draft a disclaimer that identifies the specific property or assets and clearly states the decision to renounce their rights. This action prevents the property from being included in their estate, aligning with the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession.

To disclaim part of an inheritance in Orange, Florida, you should create a written document stating your wishes. This document must include specific details about the property you wish to renounce and must be signed by you. It’s advisable to file this documentation with the appropriate court or estate executor to finalize the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession.

A good disclaimer example for the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession specifies the intent to decline any inheritance. It should clearly state the name of the deceased, the property being disclaimed, and the intent to disclaim the property outright. This clarity helps avoid any confusion and ensures compliance with Florida laws regarding disclaimers.

In Florida, intestate succession laws determine how an estate is divided when someone dies without a will. Generally, assets go to the surviving spouse and children, followed by other relatives. Understanding these rules is vital for anyone dealing with the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession to ensure the inherited property is handled correctly.

To disclaim an inherited property, you must file a written disclaimer that includes specific information about the property and your intention to renounce it. Ensure this document is signed and notarized to comply with Florida law. For a clear process regarding the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession, consider utilizing resources like the uslegalforms platform.

A beneficiary in Florida has nine months from the date of death to disclaim an inheritance. If you miss this window, you may lose the opportunity altogether. To successfully navigate the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession, it's essential to be aware of this timeline and take action accordingly.

Disclaiming an inheritance with the IRS typically involves filing Form 8939, Allocation of Increase in Basis for Property Received from a Decedent. Keeping your financial matters clear and properly documented is essential, especially for the Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession. Ensure you comply with all tax regulations to avoid issues.

In Florida, the time limit for disclaiming inheritance is typically nine months from the date of the decedent's death. However, this period may vary depending on specific circumstances surrounding the estate. For effective Orange Florida Renunciation And Disclaimer of Property received by Intestate Succession, it’s wise to act promptly and consult with an expert.