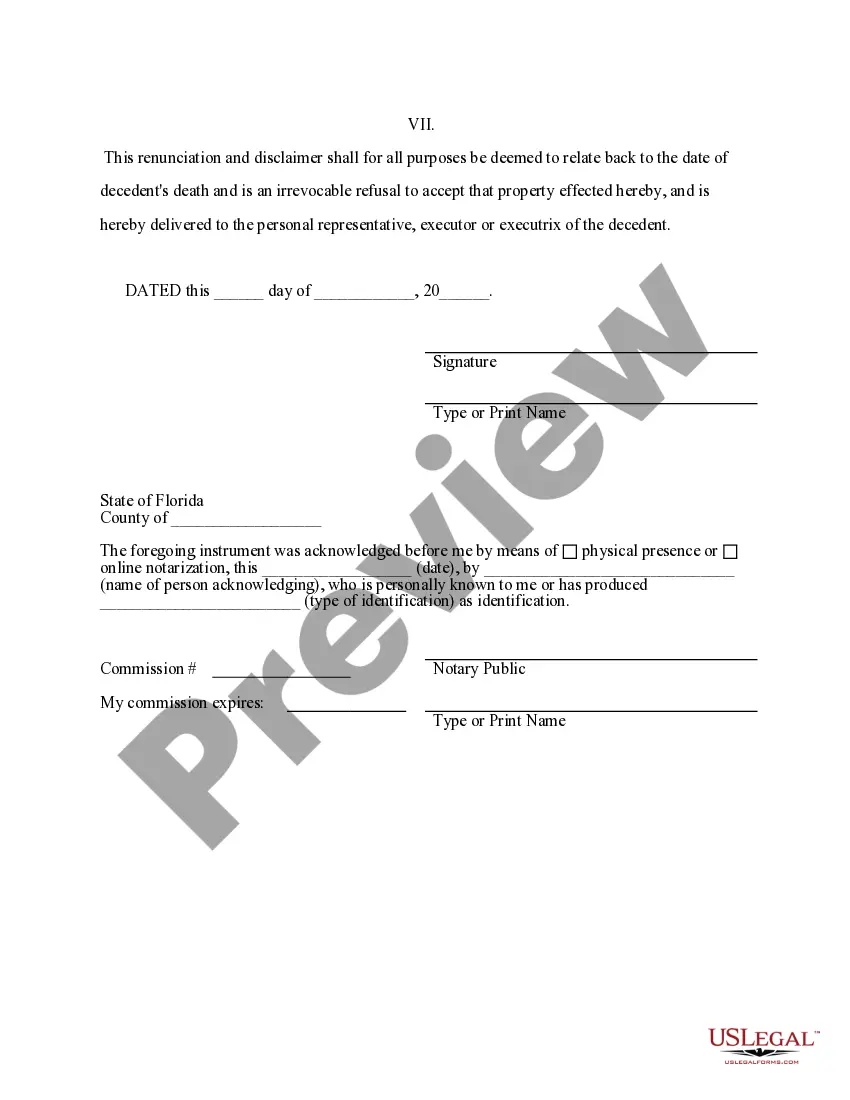

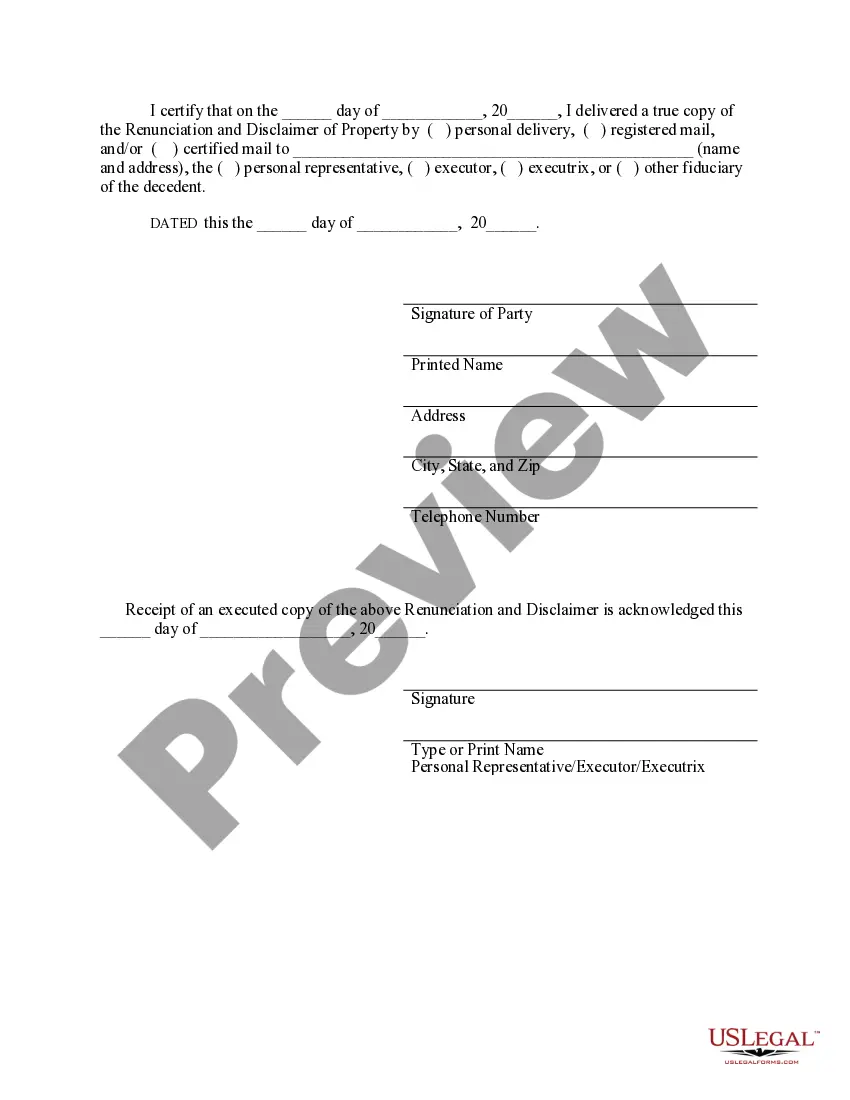

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Orange Florida Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to officially decline their right to inherit property from a deceased person who has not left a valid will or trust. This renunciation and disclaimer can be carried out by the potential beneficiaries of the deceased's estate in order to transfer their share of the property to other eligible successors. There are two main types of Orange Florida Renunciation and Disclaimer of Property received by Intestate Succession: 1. Formal Renunciation: In this type, the potential beneficiary submits a formal document stating their decision to renounce their share of the property. This renunciation is typically filed with the probate court handling the deceased person's estate. It is important to note that a renunciation does not automatically transfer the disclaimed property to the next eligible successor but rather allows it to pass according to the laws of intestate succession. 2. Qualified Disclaimer: This type of disclaimer is similar to formal renunciation, but it also carries specific IRS requirements. To qualify for a disclaimer, the potential beneficiary must not have accepted any benefits from the property they wish to disclaim, such as receiving income or using the property. The disclaimer must also be made within a specific timeframe, generally nine months from the date of the deceased's passing. By renouncing or disclaiming the property received through intestate succession, individuals have the opportunity to redirect their inheritance to other rightful heirs. This process can be useful in cases where the potential beneficiaries do not wish to take on the responsibilities or burdens associated with owning or managing the inherited property. It is important to consult with an attorney specializing in probate and estate planning laws to properly navigate the Orange Florida Renunciation and Disclaimer of Property received by Intestate Succession. These professionals can guide potential beneficiaries through the legal requirements and implications of the renunciation or disclaimer process, ensuring a smooth transition of property rights.Orange Florida Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to officially decline their right to inherit property from a deceased person who has not left a valid will or trust. This renunciation and disclaimer can be carried out by the potential beneficiaries of the deceased's estate in order to transfer their share of the property to other eligible successors. There are two main types of Orange Florida Renunciation and Disclaimer of Property received by Intestate Succession: 1. Formal Renunciation: In this type, the potential beneficiary submits a formal document stating their decision to renounce their share of the property. This renunciation is typically filed with the probate court handling the deceased person's estate. It is important to note that a renunciation does not automatically transfer the disclaimed property to the next eligible successor but rather allows it to pass according to the laws of intestate succession. 2. Qualified Disclaimer: This type of disclaimer is similar to formal renunciation, but it also carries specific IRS requirements. To qualify for a disclaimer, the potential beneficiary must not have accepted any benefits from the property they wish to disclaim, such as receiving income or using the property. The disclaimer must also be made within a specific timeframe, generally nine months from the date of the deceased's passing. By renouncing or disclaiming the property received through intestate succession, individuals have the opportunity to redirect their inheritance to other rightful heirs. This process can be useful in cases where the potential beneficiaries do not wish to take on the responsibilities or burdens associated with owning or managing the inherited property. It is important to consult with an attorney specializing in probate and estate planning laws to properly navigate the Orange Florida Renunciation and Disclaimer of Property received by Intestate Succession. These professionals can guide potential beneficiaries through the legal requirements and implications of the renunciation or disclaimer process, ensuring a smooth transition of property rights.