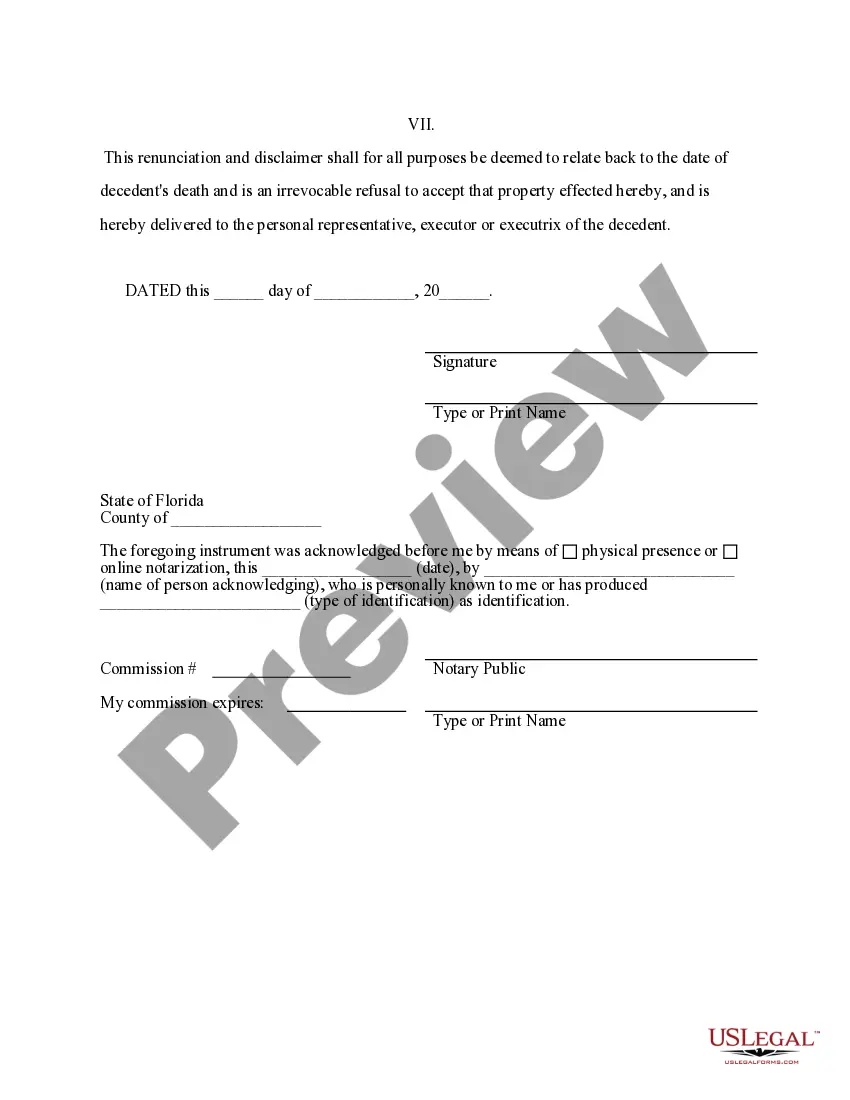

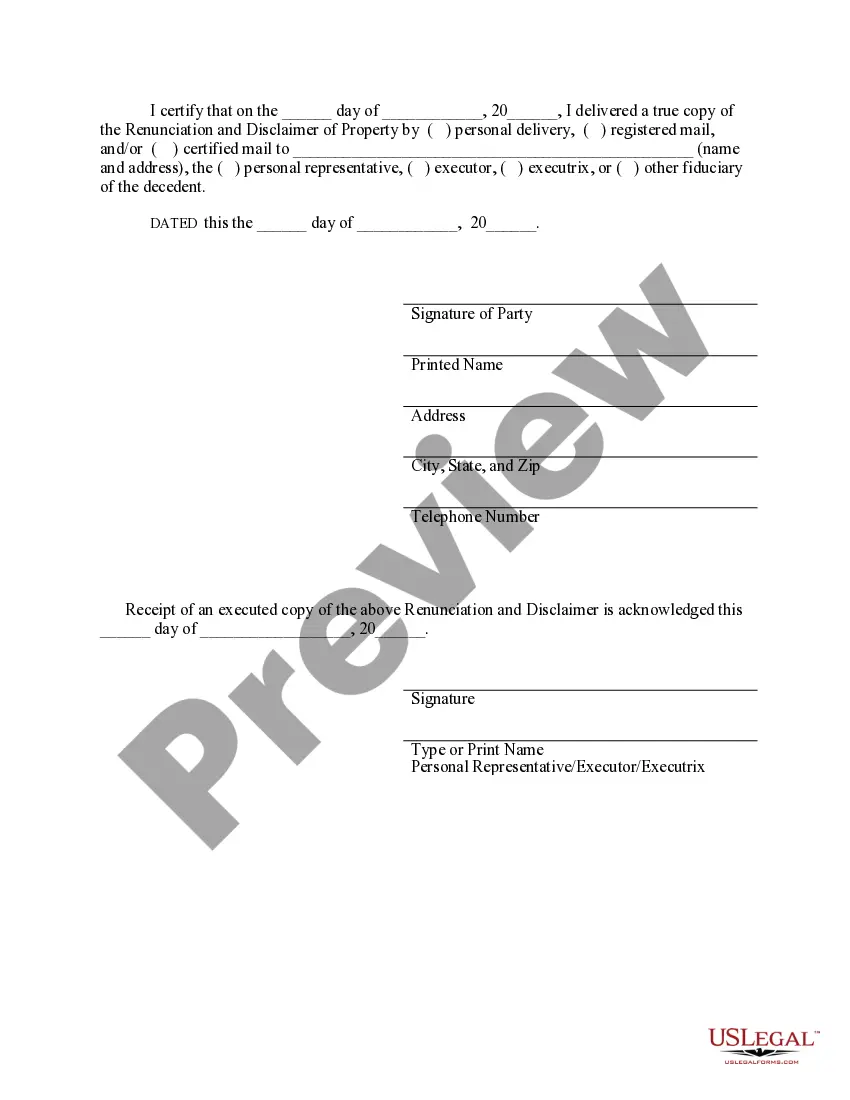

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our user-friendly website, featuring a vast array of templates, enables you to locate and obtain nearly any document sample you need.

You can download, fill out, and sign the Tallahassee Florida Renunciation And Disclaimer of Property obtained through Intestate Succession in just a few minutes, rather than spending hours online looking for the appropriate template.

Using our database is an excellent method to enhance the security of your document filing.

The Download button will show up on all the samples you view. Moreover, you can access all your previously saved documents in the My documents section.

If you don’t have an account yet, follow the steps outlined below.

- Our experienced legal professionals routinely examine all documents to ensure that the forms are suitable for specific states and compliant with updated laws and regulations.

- How can you acquire the Tallahassee Florida Renunciation And Disclaimer of Property obtained through Intestate Succession.

- If you already have an account, simply Log In to your profile.

Form popularity

FAQ

When an owner dies in Florida, their property must go through a legal process known as probate. If the deceased did not leave a will, the property typically transfers according to Florida's intestacy laws, which dictate how assets are distributed among relatives. However, interested parties can utilize the Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession to refuse their inheritance. This option allows individuals to decline property they do not wish to accept, simplifying the process and avoiding complications.

To disclaim part of an inheritance, you need to submit a written disclaimer that clearly states your intention. The disclaimer should include specific information about the property you are renouncing and must comply with Florida laws. Ensure that you act within a specific timeframe, as delays may affect your ability to disclaim. Resources such as USLegalForms can provide you with the necessary templates and guidance for a proper Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, making the process straightforward.

If you decide to refuse your inheritance, it is important to understand that it will not go back to the deceased’s estate. Instead, it typically passes on to the next eligible beneficiary, as defined by the state's intestacy laws. This process is known as the renunciation of an inheritance, which can be formally executed through a Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession. Using USLegalForms can help you navigate this process easily and correctly.

In Florida, there is no state inheritance tax, which simplifies the process for you. However, it is crucial to plan your estate effectively to minimize potential federal estate tax implications. By utilizing tools such as trusts and other estate planning strategies, you can ensure that your assets are transferred smoothly. For tailored guidance related to Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, consider leveraging USLegalForms to access essential templates and resources.

Florida's disclaimer law allows individuals to refuse an inheritance to avoid tax implications or unwanted responsibility for the property. The law stipulates that disclaimers must be made in writing, filed with the court, and should not benefit the person disclaiming. This process highlights the importance of understanding how it can impact your estate plan, especially concerning Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession.

To disclaim an inheritance in Florida, you must file a formal disclaimer with the court, signaling that you do not wish to accept the property. This step must meet specific legal guidelines, including being in writing and filed within a limited time after the inheritance is presented. Disclaiming property can affect the distribution of an estate and may relate to Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, so seeking advice from legal resources may be beneficial.

Florida's order of intestate succession begins with the surviving spouse and children, who inherit a significant portion of the estate. If no direct descendants exist, the inheritance passes to parents, siblings, or deeper relatives, depending on who is alive at the time of death. Understanding this hierarchy is crucial for anyone dealing with estate matters, especially in the context of Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession.

Transferring property after death without a will in Florida involves following the intestate succession process. The court will appoint a personal representative to oversee the estate's distribution. This representative must identify and locate heirs, settle debts, and ultimately distribute the property as per state law. Utilizing tools like uslegalforms can help facilitate this process, especially concerning Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession.

When a person dies without a will in Florida, the estate is distributed according to the state's intestate succession laws. The surviving spouse typically receives a portion of the estate, while children equally inherit the remaining assets. If there are no children or spouse, the estate may go to parents, siblings, or other relatives. Familiarity with this process is important, especially when considering Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession.

In Florida, intestate succession laws dictate how property is distributed when an individual dies without a will. Generally, the estate passes to the surviving spouse and children, with the distribution depending on the family structure. If there's no surviving spouse or children, the estate goes to parents, siblings, or further relatives. Understanding these rules is essential, especially in relation to Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession.