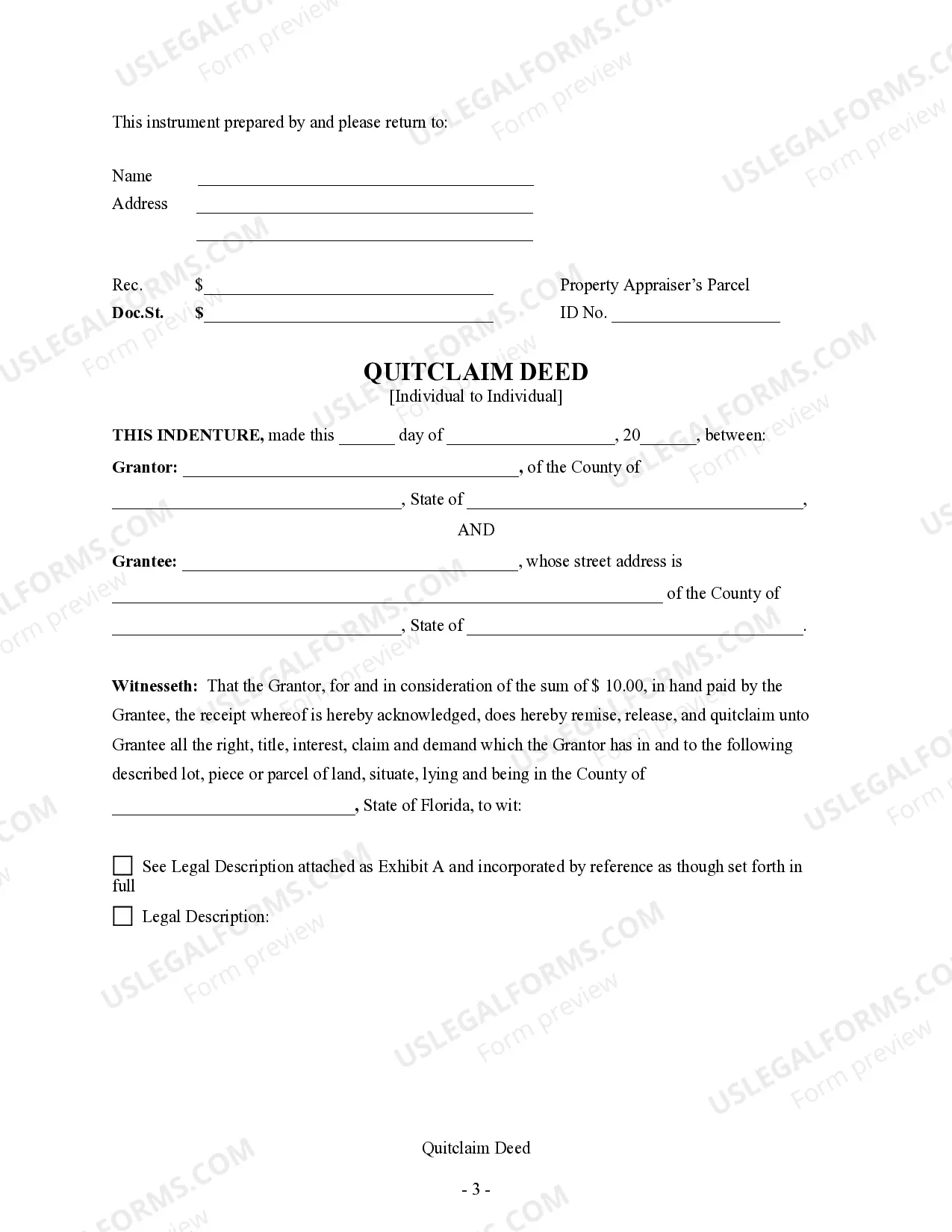

This Quitclaim Deed from Individual to Individual form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Broward Florida Quitclaim Deed from Individual to Individual

Description

How to fill out Florida Quitclaim Deed From Individual To Individual?

We consistently aim to reduce or evade legal repercussions when engaging with complex law-related or financial matters.

To achieve this, we seek legal remedies that are typically quite costly.

However, not every legal concern is of similar complexity; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents that cover a wide range of topics from wills and powers of attorney to articles of incorporation and petitions for dissolution.

You just need to Log In to your account and click the Get button next to it. If the document is lost, you can always re-download it from the My documents section. The procedure remains just as simple if you are unfamiliar with the site! You can set up your account in mere minutes. Ensure that the Broward Florida Quitclaim Deed from Individual to Individual adheres to the laws and regulations of your specific state and area. Additionally, it is crucial to review the form's outline (if available), and if you identify any inconsistencies with what you initially sought, look for an alternative form. Once you have confirmed that the Broward Florida Quitclaim Deed from Individual to Individual is appropriate for your situation, you can select the subscription plan and proceed to payment. Then you can download the document in any format you prefer. For more than 24 years, we have assisted millions by providing ready-to-customize and contemporary legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- Our collection enables you to handle your affairs without the need for legal representation.

- We provide access to legal form templates that are not always readily available.

- Our templates cater to specific states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you require to locate and download the Broward Florida Quitclaim Deed from Individual to Individual or any other form swiftly and securely.

Form popularity

FAQ

While a quitclaim deed is a straightforward way to transfer property, it comes with potential issues. The main concern is that a quitclaim deed does not guarantee clear title, meaning the grantee may inherit debts or claims against the property. It's crucial to evaluate the implications carefully. Employing services like USLegalForms can help mitigate these risks by providing proper guidance.

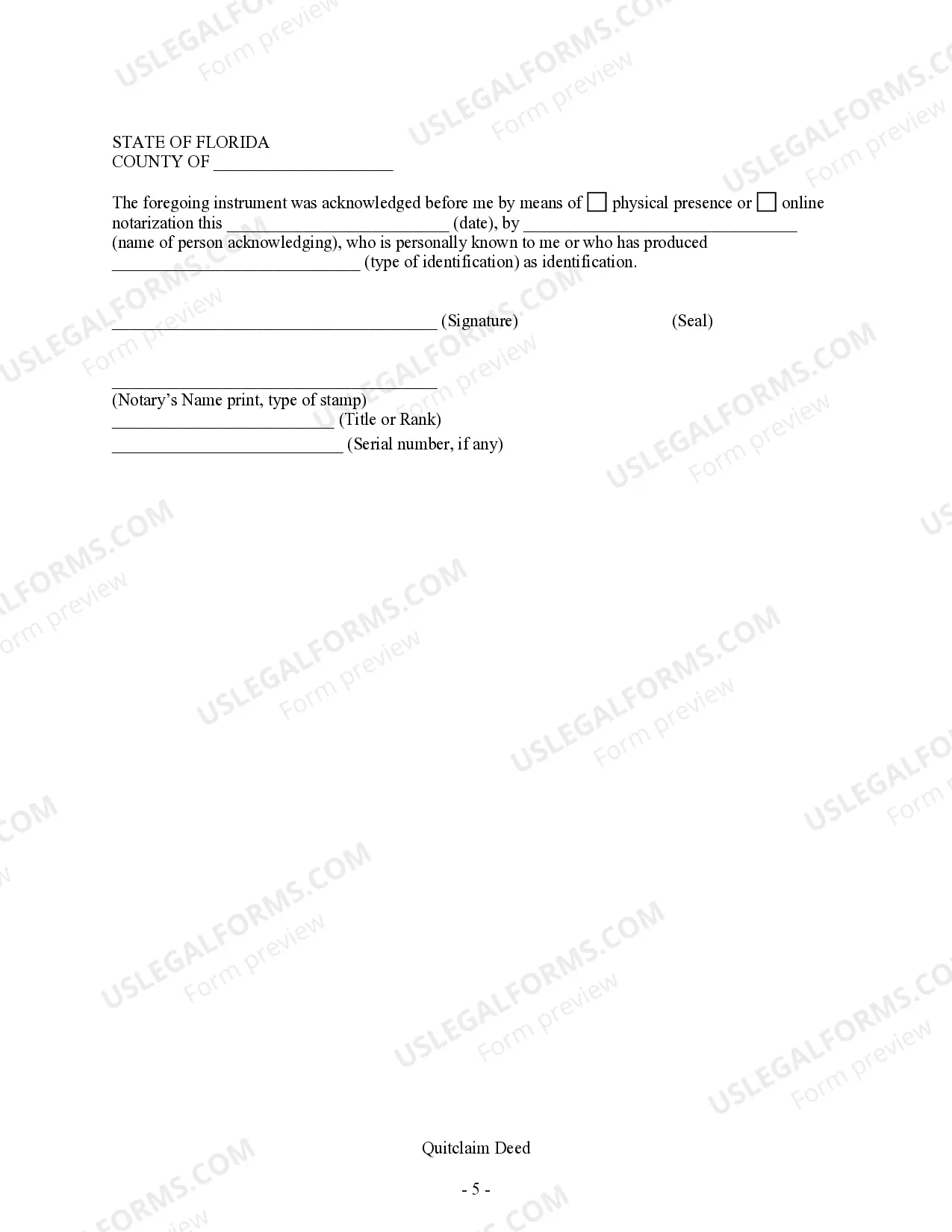

A quitclaim deed can be voided under certain circumstances such as fraud, lack of notarization, or if it was executed under duress. In Broward Florida, if there are significant errors in the deed, such as incorrect property descriptions, it can also be rendered invalid. Consulting legal resources or experts, such as those at USLegalForms, can help you avoid these pitfalls.

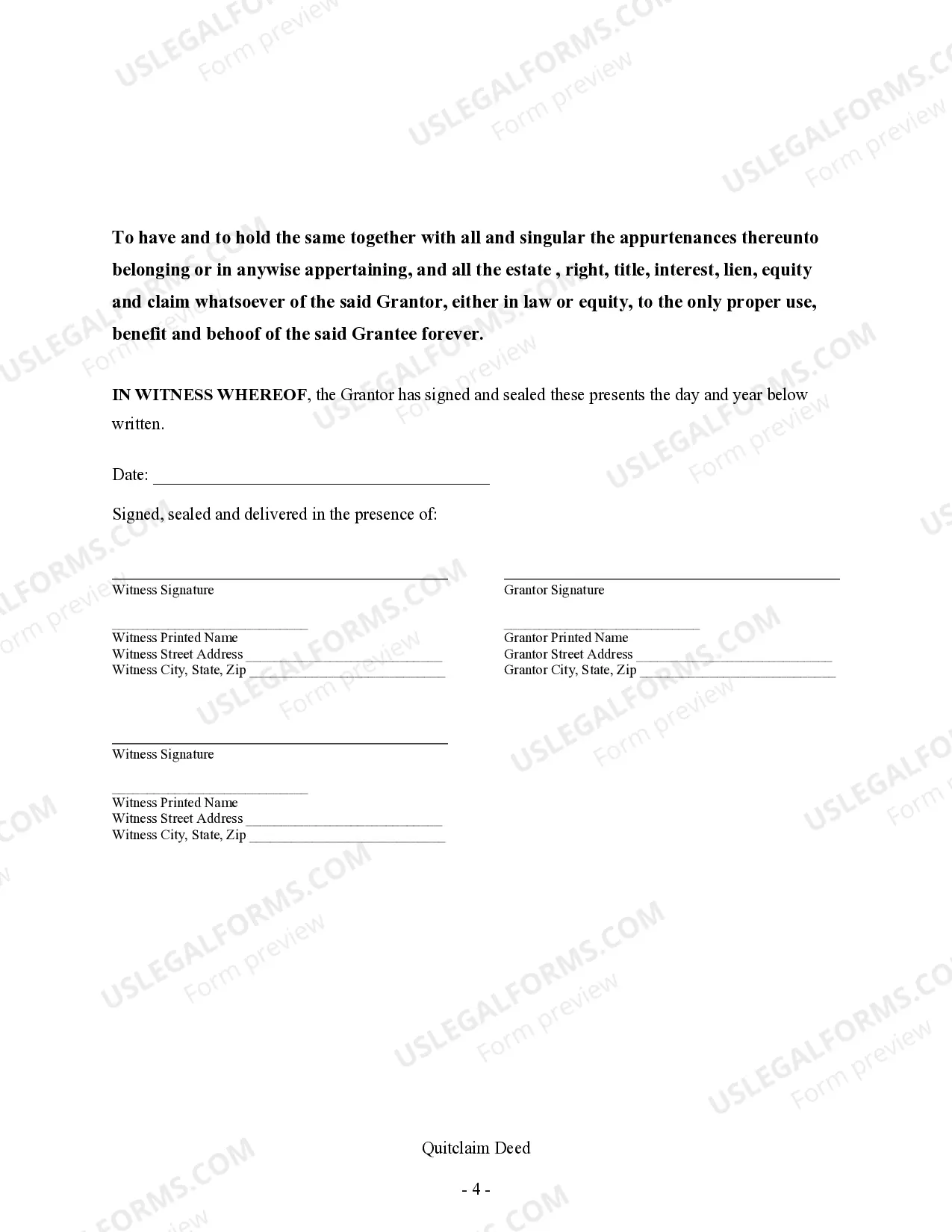

Yes, you can prepare a quitclaim deed yourself in Broward Florida, provided you follow the necessary guidelines. Make sure to accurately fill out the deed form, and ensure all required signatures, including notarization, are complete. However, utilizing a platform like USLegalForms can provide templates and support to make the process smoother and more secure.

Typically, only the person transferring the property needs to be present to sign the quitclaim deed in Broward Florida. However, having both parties sign can help avoid future disputes. It's advisable to consult local regulations or use resources from USLegalForms to ensure compliance. It's always better to be informed.

While this question pertains to Missouri, understanding the differences is important. Generally, a quitclaim deed in any state, including Broward Florida, must be in writing, identify the parties, and describe the property. In Broward, Florida, you will also need notarization and to comply with local filing rules. If you're unsure, USLegalForms can guide you through the requirements.

To transfer property from one person to another in Florida, you typically use a quitclaim deed. By completing a Broward Florida Quitclaim Deed from Individual to Individual, the ownership of the property is effectively transferred, provided the deed is properly executed and recorded. For assistance, consider utilizing tools available on uslegalforms to facilitate the transfer process.

You file a quitclaim deed at the Broward County Clerk of Courts. Make sure to visit their office or use the electronic filing system available for a Broward Florida Quitclaim Deed from Individual to Individual. Follow the specific instructions given by the Clerk's office to ensure your filing is successful.

You may file a quitclaim deed yourself in Florida, provided you have completed all necessary paperwork. After preparing your Broward Florida Quitclaim Deed from Individual to Individual, visit your county’s courthouse or use electronic options for submission. Still, if you're uncertain, using a service like uslegalforms can simplify the process.

Yes, you can prepare a quitclaim deed yourself, but it is important to understand the legal requirements. Creating a valid Broward Florida Quitclaim Deed from Individual to Individual requires specific information and formatting. For peace of mind, consider using resources like uslegalforms to ensure you meet all necessary guidelines and requirements.

To file a quitclaim deed in Broward County, Florida, you must complete the necessary form and provide it to the county's Clerk of Courts. After preparing your Broward Florida Quitclaim Deed from Individual to Individual, make sure to sign it in front of a notary before submitting it. You can also utilize online platforms like uslegalforms for guidance during the filing process.