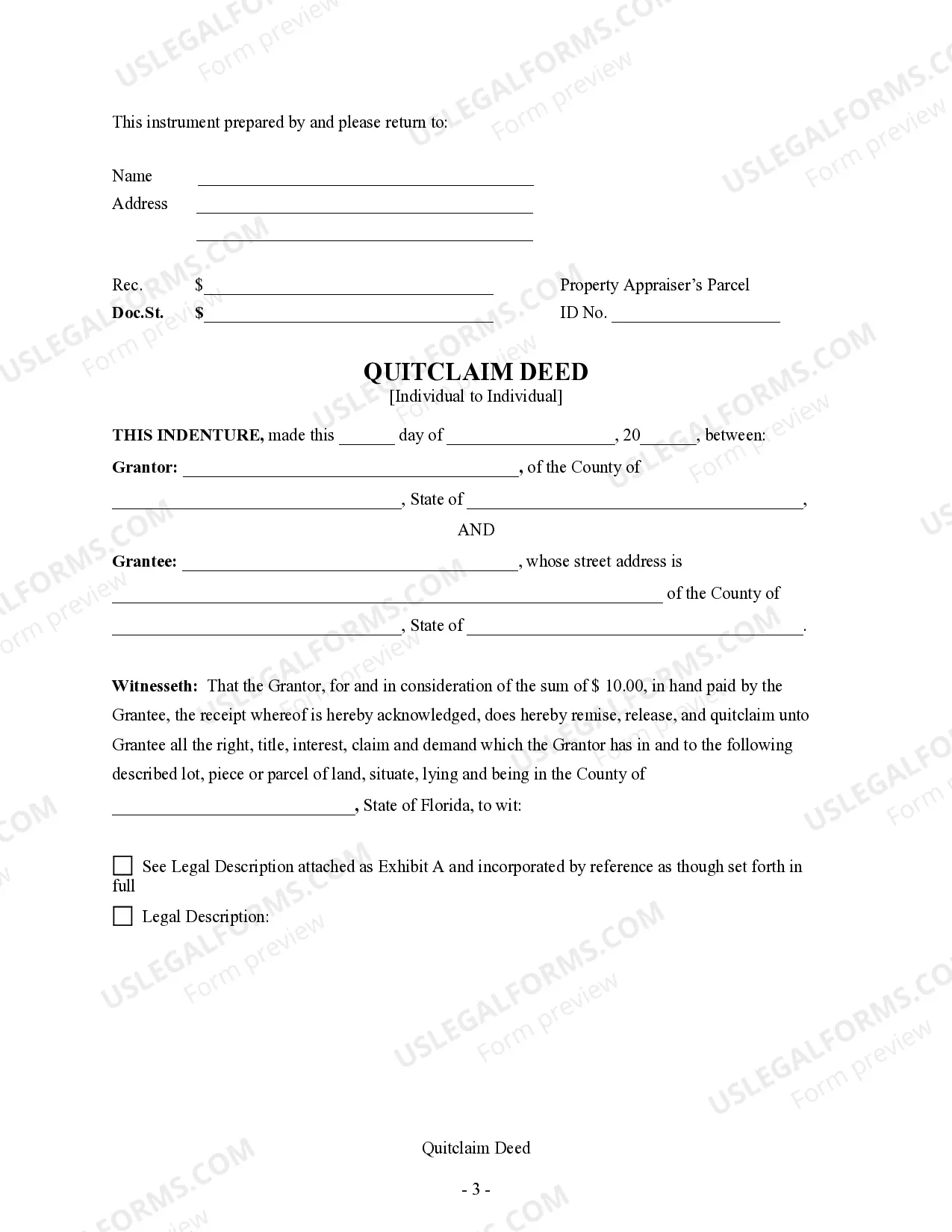

This Quitclaim Deed from Individual to Individual form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

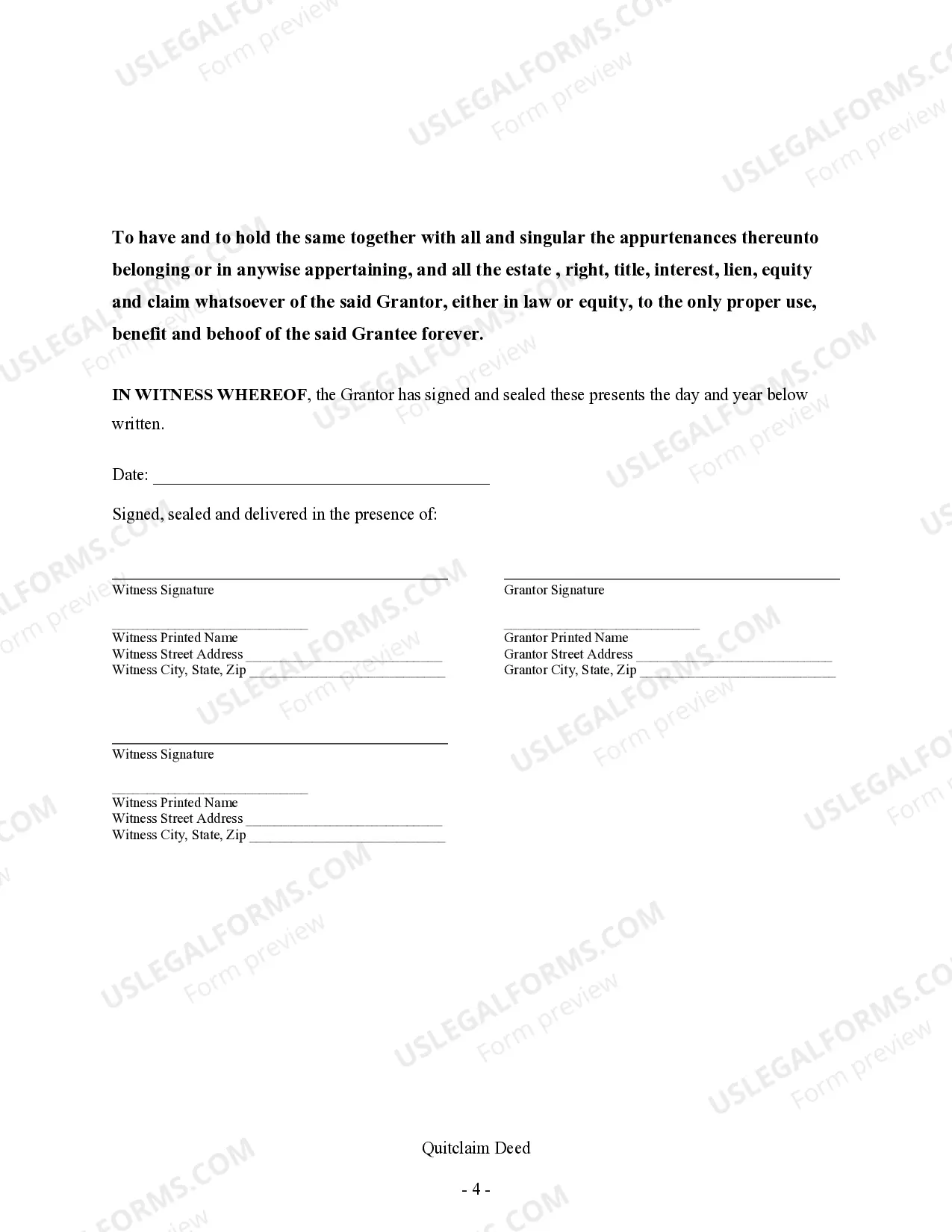

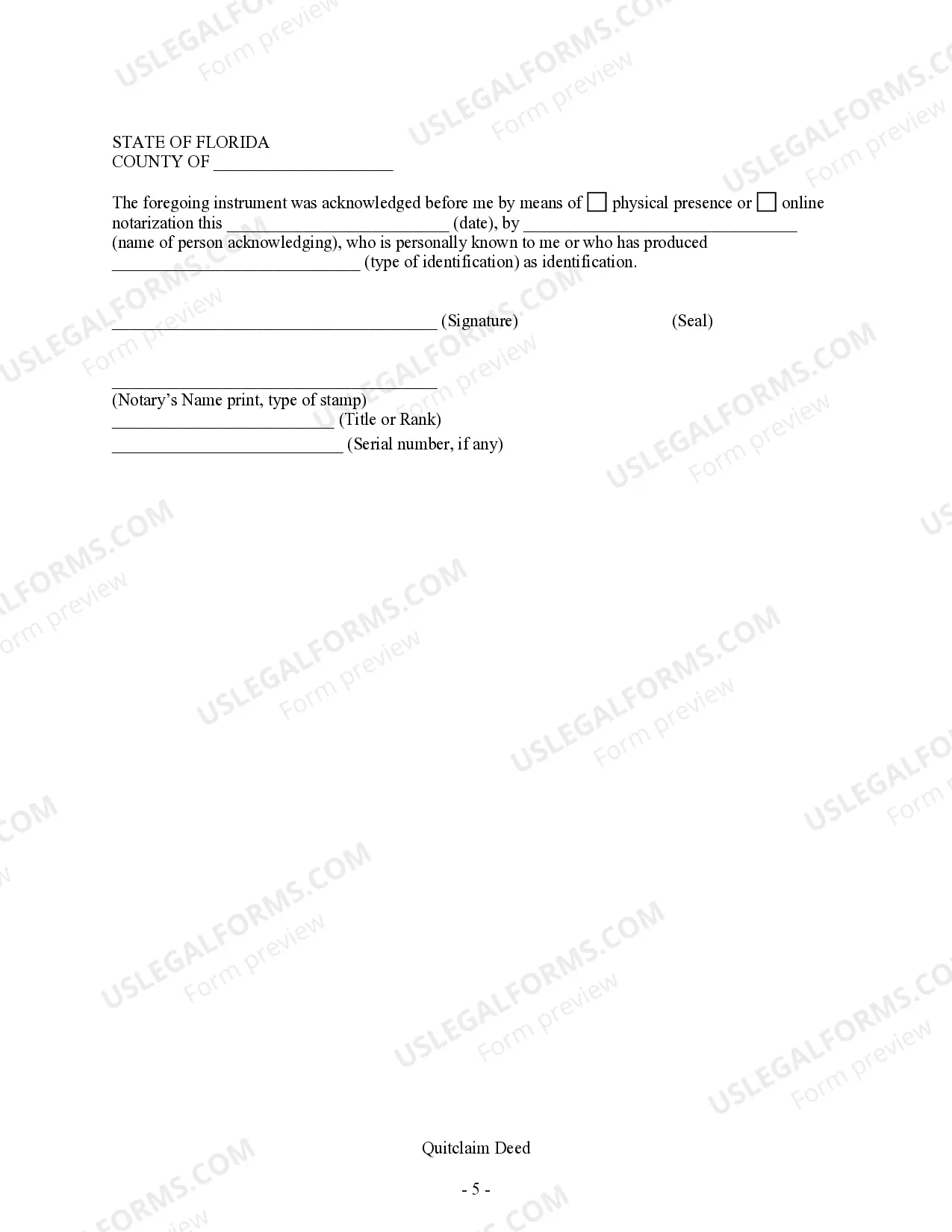

A Quitclaim Deed is a legal document used to transfer ownership of a property from one individual (granter) to another individual (grantee) in Jacksonville, Florida. This type of deed is commonly used when the transfer of property is between family members, friends, or in situations where the granter wishes to relinquish their interest in the property without making any warranties or guarantees regarding the title. The Jacksonville Florida Quitclaim Deed from Individual to Individual is a specific type of quitclaim deed that is tailored to meet the legal requirements and regulations specific to the state of Florida, particularly in the Jacksonville area. Some key elements that are typically included in a Jacksonville Florida Quitclaim Deed from Individual to Individual are: 1. Identification of the parties: The deed must clearly identify both the granter (the individual transferring the property) and the grantee (the individual receiving the property). This includes their full legal names and addresses. 2. Property description: The deed should provide a detailed and accurate description of the property being transferred. This includes the legal description of the property, such as its lot number, block number, and subdivision name. A surveyor's description or a reference to previously recorded documents may also be included. 3. Consideration: The deed must state the amount of money or other consideration exchanged during the transfer. It could be a nominal amount, token payment, or even no consideration at all. 4. Signature and notarization: The quitclaim deed must be signed by the granter before a notary public who will then acknowledge the granter's signature. The grantee is not typically required to sign the deed. Types of Jacksonville Florida Quitclaim Deeds from Individual to Individual: 1. Individual to Individual without consideration: This type of quitclaim deed is used when the transfer of property is a gift or without the exchange of any monetary consideration. 2. Individual to Individual with consideration: This type of quitclaim deed is used when there is a monetary exchange between the granter and the grantee. 3. Joint Tenants to Individual: This type of quitclaim deed may be used when one or more joint tenants wish to transfer their ownership interest in the property to an individual. 4. Life Tenant to Remainder man: This type of quitclaim deed is used when a life tenant wishes to transfer their interest in the property to the remainder man, who will gain full ownership rights after the life tenant's death. It is important to consult with a qualified attorney or title company to ensure that all legal requirements and provisions specific to Jacksonville, Florida, are met when executing a Quitclaim Deed from Individual to Individual. This will help ensure a smooth transfer of property ownership and protect the interests of both the granter and the grantee.A Quitclaim Deed is a legal document used to transfer ownership of a property from one individual (granter) to another individual (grantee) in Jacksonville, Florida. This type of deed is commonly used when the transfer of property is between family members, friends, or in situations where the granter wishes to relinquish their interest in the property without making any warranties or guarantees regarding the title. The Jacksonville Florida Quitclaim Deed from Individual to Individual is a specific type of quitclaim deed that is tailored to meet the legal requirements and regulations specific to the state of Florida, particularly in the Jacksonville area. Some key elements that are typically included in a Jacksonville Florida Quitclaim Deed from Individual to Individual are: 1. Identification of the parties: The deed must clearly identify both the granter (the individual transferring the property) and the grantee (the individual receiving the property). This includes their full legal names and addresses. 2. Property description: The deed should provide a detailed and accurate description of the property being transferred. This includes the legal description of the property, such as its lot number, block number, and subdivision name. A surveyor's description or a reference to previously recorded documents may also be included. 3. Consideration: The deed must state the amount of money or other consideration exchanged during the transfer. It could be a nominal amount, token payment, or even no consideration at all. 4. Signature and notarization: The quitclaim deed must be signed by the granter before a notary public who will then acknowledge the granter's signature. The grantee is not typically required to sign the deed. Types of Jacksonville Florida Quitclaim Deeds from Individual to Individual: 1. Individual to Individual without consideration: This type of quitclaim deed is used when the transfer of property is a gift or without the exchange of any monetary consideration. 2. Individual to Individual with consideration: This type of quitclaim deed is used when there is a monetary exchange between the granter and the grantee. 3. Joint Tenants to Individual: This type of quitclaim deed may be used when one or more joint tenants wish to transfer their ownership interest in the property to an individual. 4. Life Tenant to Remainder man: This type of quitclaim deed is used when a life tenant wishes to transfer their interest in the property to the remainder man, who will gain full ownership rights after the life tenant's death. It is important to consult with a qualified attorney or title company to ensure that all legal requirements and provisions specific to Jacksonville, Florida, are met when executing a Quitclaim Deed from Individual to Individual. This will help ensure a smooth transfer of property ownership and protect the interests of both the granter and the grantee.