This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Florida - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Broward Florida Gift Deed for Individual to Individual

Description

How to fill out Florida Gift Deed For Individual To Individual?

Regardless of one's social or professional standing, fulfilling law-related documentation is a regrettable requirement in the modern world.

Frequently, it’s nearly impossible for someone without any legal expertise to construct such documents entirely from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms steps in to assist.

Make sure the form you’ve selected is relevant to your jurisdiction as the laws of one state or locality may not apply to another.

Preview the document and review a brief summary (if available) of situations the form can be utilized for.

- Our service has an extensive collection of over 85,000 ready-to-use forms tailored to specific states that cater to almost any legal requirement.

- US Legal Forms also serves as an excellent tool for associates or legal advisors seeking to conserve time by utilizing our DIY documents.

- If you need the Broward Florida Gift Deed for Individual to Individual or any other document that will be applicable in your region, with US Legal Forms, everything is accessible.

- Here’s how you can quickly acquire the Broward Florida Gift Deed for Individual to Individual using our reliable service.

- If you are already a member, you can proceed to Log In to your account to retrieve the necessary form.

- However, if you are new to our repository, please ensure to follow these steps before obtaining the Broward Florida Gift Deed for Individual to Individual.

Form popularity

FAQ

To avoid gift tax on property in Florida, you can leverage the annual gift tax exclusion, which allows you to gift a certain amount without tax implications. When using a Broward Florida Gift Deed for Individual to Individual, keep in mind that properly documenting your gift can help ensure compliance with tax regulations. Additionally, consulting with a tax professional can provide you with personalized strategies to mitigate any potential gift tax liabilities. Our platform, uslegalforms, also offers resources to help you navigate these legal complexities.

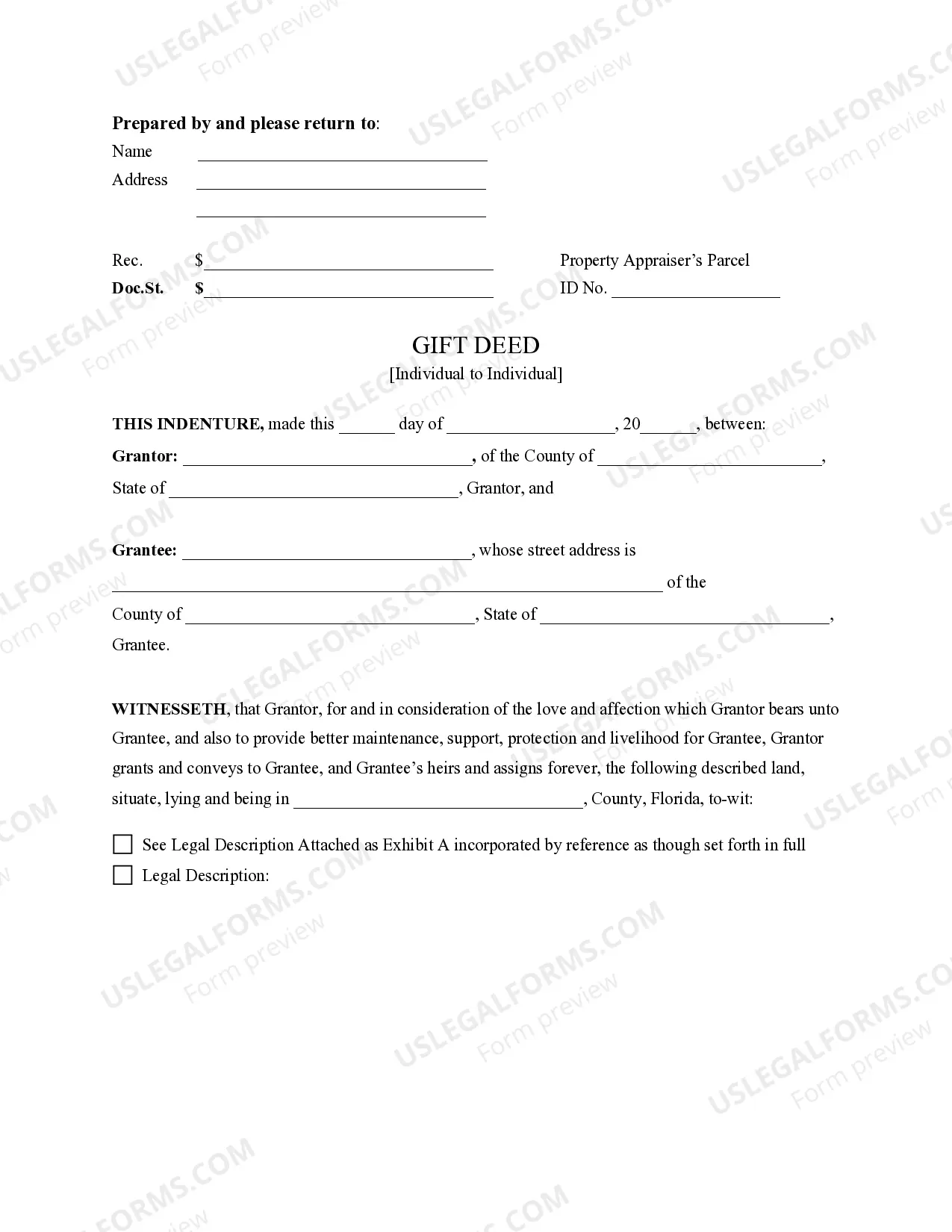

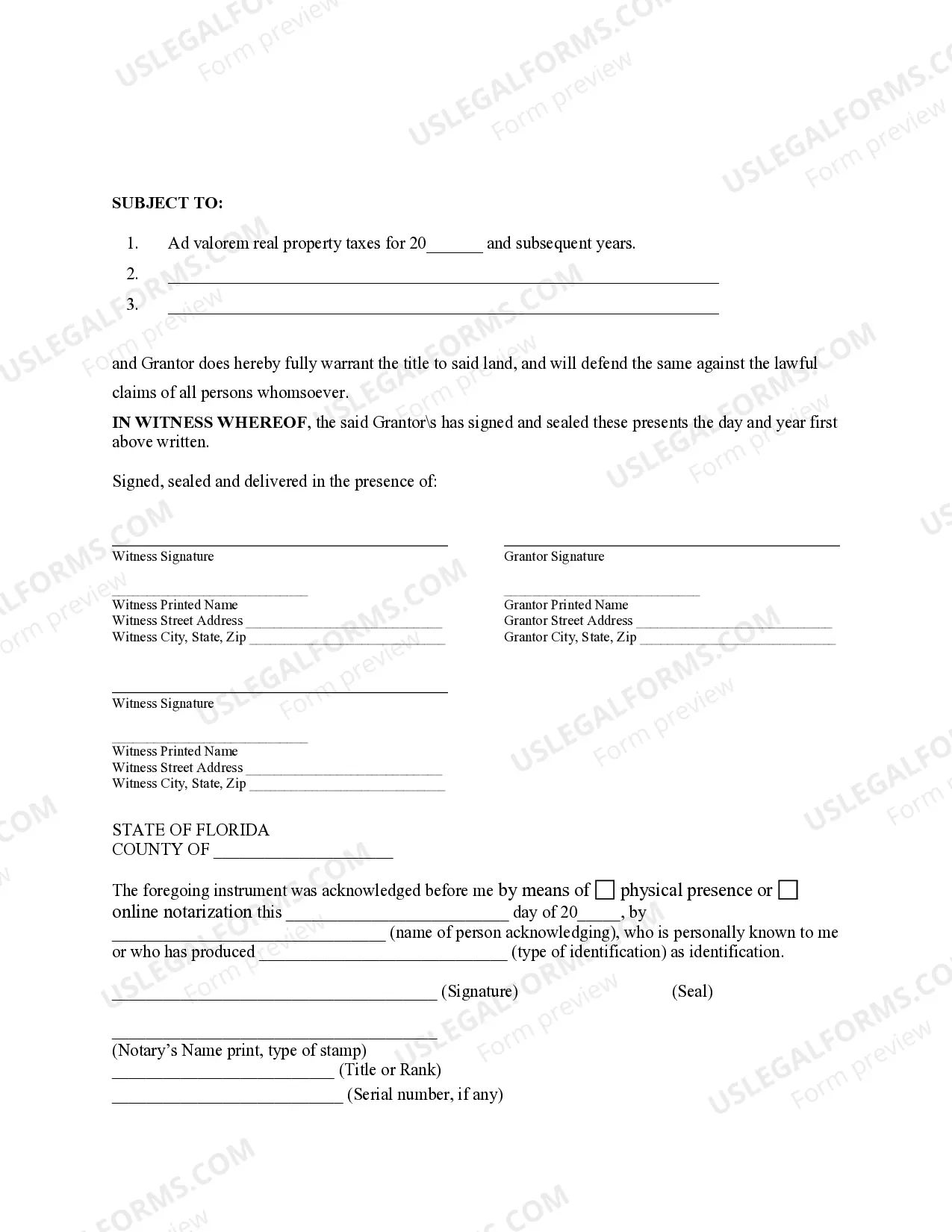

Transferring a property title to a family member in Florida requires the completion of a gift deed, specifically a Broward Florida Gift Deed for Individual to Individual. You need to fill out the deed accurately, including the legal description of the property and the names of both the donor and recipient. It's essential to sign the deed in the presence of a notary public and file it with the county clerk's office. Using uslegalforms can simplify this process, providing you with the necessary forms and clear instructions.

You do not necessarily need a lawyer for a deed of gift in Florida, especially if you are using a Broward Florida Gift Deed for Individual to Individual. Many resources, including USLegalForms, provide templates and guidelines to assist you with this transfer. While many people handle the process independently, it’s wise to seek legal advice if complications arise or you want to ensure all legal requirements are met.

Yes, you can add someone to a deed without involving a lawyer by using a Broward Florida Gift Deed for Individual to Individual. Many individuals successfully manage this process on their own by ensuring they follow the correct procedures and complete the necessary forms. However, if you feel uncertain about the process, consulting with a legal professional can provide peace of mind and ensure everything is done correctly.

To add someone to a deed in Florida, you will typically create a Broward Florida Gift Deed for Individual to Individual. This document allows current owners to grant a share of property to another individual. It's important to accurately complete the deed, as it needs to be executed in front of a witness and notarized. Once you have completed these steps, file the deed with the local county clerk.

To add a person to a property deed in Florida, you will want to prepare a new Broward Florida Gift Deed for Individual to Individual. This deed will officially transfer ownership rights and must be signed by all current owners. After preparing the deed, you should file it with the county clerk's office where the property is located. A properly recorded deed ensures that ownership reflects the new changes.

The main difference between a survivorship deed and a quitclaim deed lies in the rights they confer. A survivorship deed ensures that, upon the death of one owner, the property automatically transfers to the remaining owner. Conversely, a quitclaim deed, such as the Broward Florida Gift Deed for Individual to Individual, simply transfers ownership rights without any guarantees, meaning it does not provide such survivorship benefits.

When one person purchases property from another, a warranty deed is most often used. This type of deed provides a guarantee that the seller has the right to sell the property and will defend the title against claims. However, for instances where property is gifted, a Broward Florida Gift Deed for Individual to Individual serves as an effective option, ensuring a smooth transfer without consideration.

A quitclaim deed is most commonly used to transfer ownership without warranty. This type of deed, including the Broward Florida Gift Deed for Individual to Individual, allows one person to relinquish their rights to the property, enabling a simple transfer. It's often utilized in situations like transferring property between family members or clearing up title issues.

To transfer property from one person to another in Florida, you typically need a deed. Specifically, for a Broward Florida Gift Deed for Individual to Individual, you must complete the deed form, listing the grantor and grantee, and include a legal description of the property. After signing, the deed must be filed with the county clerk's office to finalize the transfer legally.