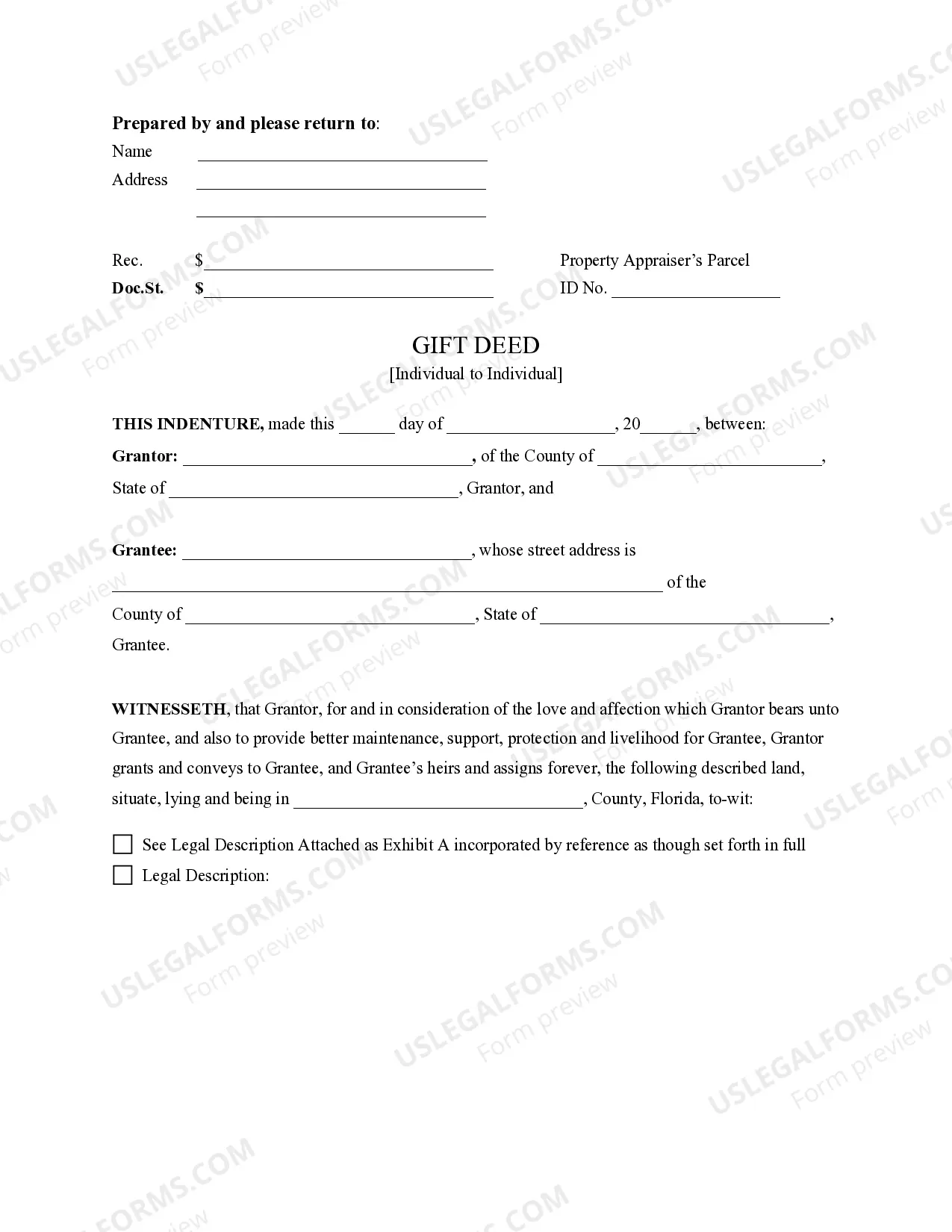

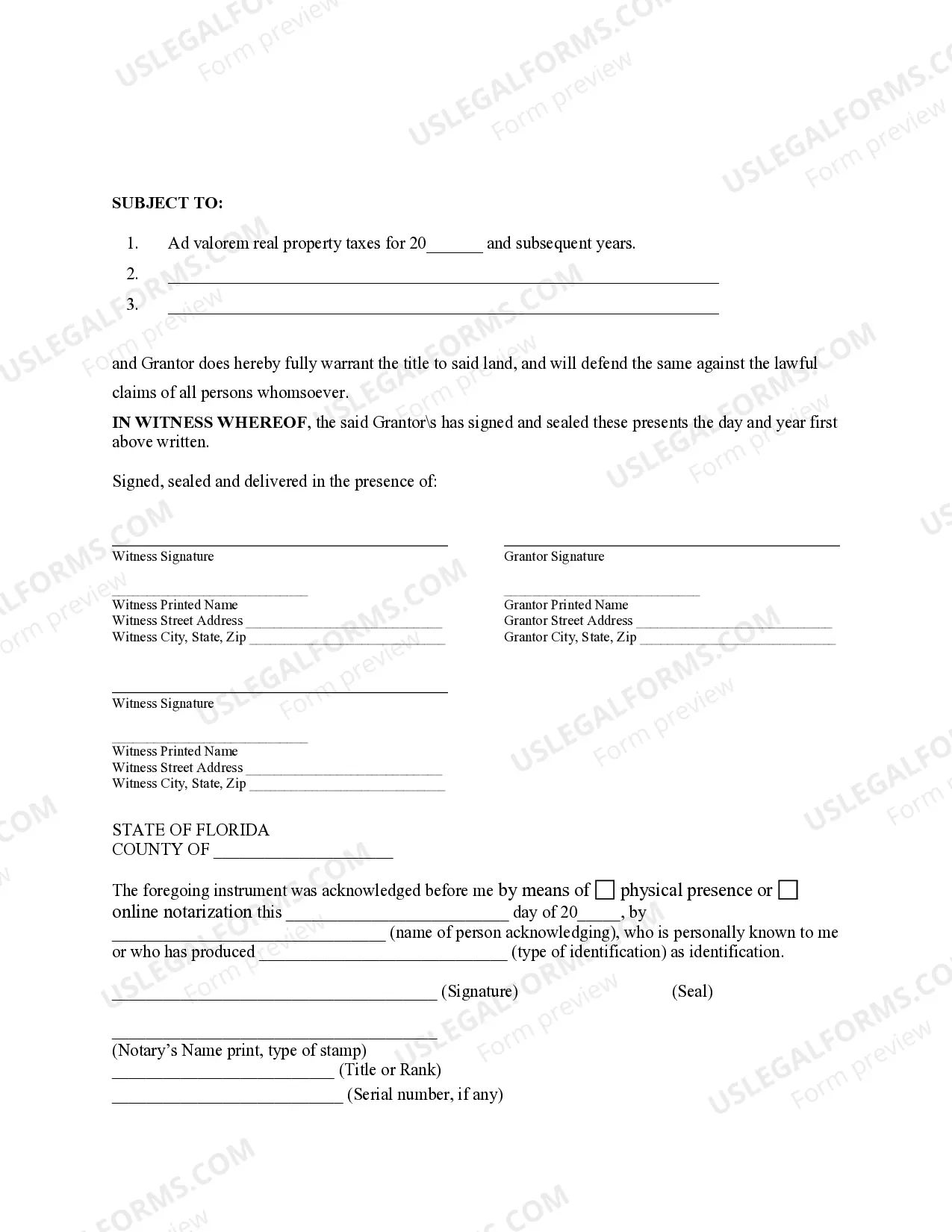

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Florida - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

A Jacksonville Florida Gift Deed for Individual to Individual is a legal document that allows for the transfer of ownership of a real property or valuable item from one individual to another without any monetary exchange. This type of deed is commonly used in situations where a person wants to gift a property or asset to a family member, friend, or loved one. The Gift Deed for Individual to Individual serves as evidence of the transfer of ownership and establishes the recipient as the new owner. It is important to note that this document does not involve any consideration or payment but rather represents a voluntary transfer of property rights. There are different types of Jacksonville Florida Gift Deeds for Individual to Individual, which vary depending on the specific circumstances and requirements. Some common variations include: 1. Simple Gift Deed: This is the most basic form of a gift deed, where the document outlines the transfer of ownership from the donor to the recipient. It typically includes information such as the names and addresses of both parties, a legal description of the property being gifted, and the signatures of both parties. 2. Conditional Gift Deed: In certain situations, a gift may be made with certain conditions or restrictions attached. For example, the donor may stipulate that the gifted property can only be used for a specific purpose or must be held in trust for a certain period of time. A conditional gift deed would outline these conditions and ensure their enforcement. 3. Gift Deed with Reservation: This type of gift deed allows the donor to retain certain rights or interests in the gifted property even after the transfer of ownership. For instance, the donor may choose to reserve a life estate, which grants them the right to occupy and use the property until their death. Regardless of the specific type, all Jacksonville Florida Gift Deeds for Individual to Individual must adhere to the legal requirements set forth by the state. This includes having the document notarized and filed with the appropriate county clerk's office to ensure its validity and make it part of the public record. In conclusion, a Jacksonville Florida Gift Deed for Individual to Individual is a legally binding document that facilitates the transfer of property ownership from one individual to another without any financial exchange. It is used to formalize the gifting process and establish the new owner's rights.