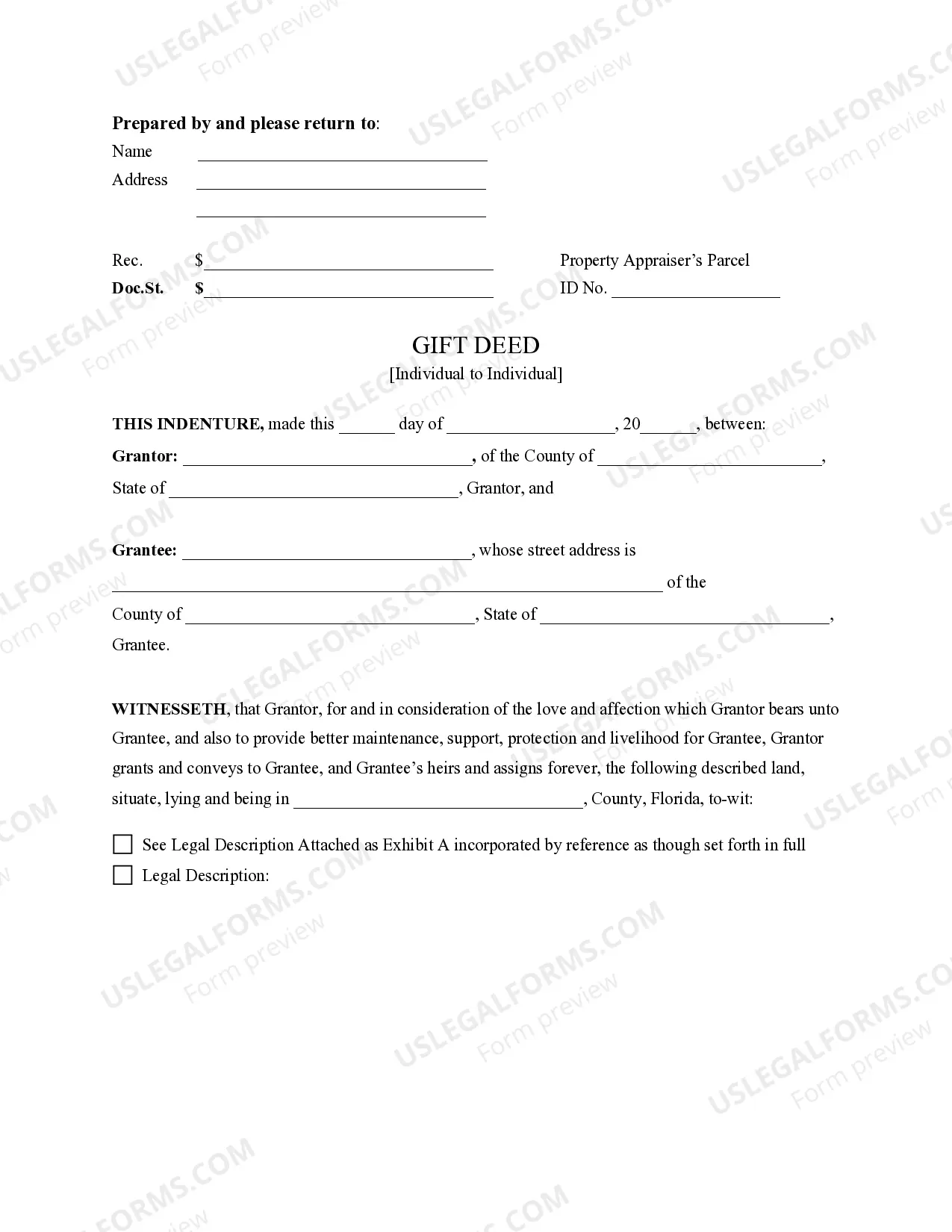

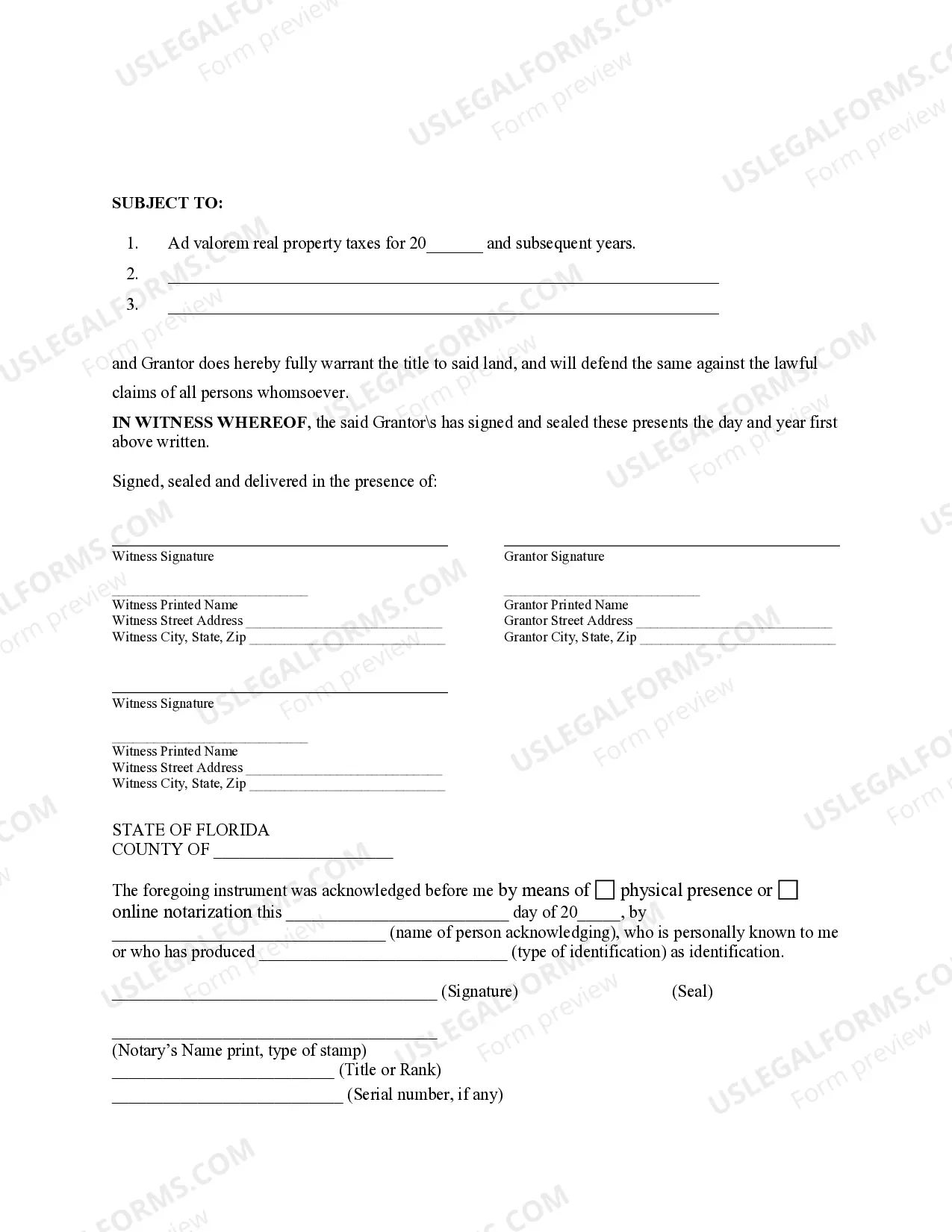

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Florida - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Lakeland Florida Gift Deed for Individual to Individual is a legal document used to transfer ownership of real estate or property from one person (the donor) to another person (the recipient) without any monetary consideration. In this type of transaction, the donor voluntarily gives up their rights and interests in the property as a gift to the recipient. This gift deed is commonly used for various purposes, such as transferring property to family members, close friends, or loved ones, or for estate planning and tax purposes. It allows individuals to transfer property without the need for a purchase agreement or monetary exchange. There are several types of Lakeland Florida Gift Deeds for Individual to Individual, including: 1. General Gift Deed: This type of gift deed transfers the property from the donor to the recipient without any conditions or restrictions. The recipient becomes the absolute owner of the property. 2. Conditional Gift Deed: In this case, the gift deed comes with certain conditions or restrictions that the recipient must meet or fulfill. These conditions can include the use of the property or limitations on selling or transferring the property for a specified period. 3. Gift Deed with Reservation of Life Estate: This gift deed allows the donor to transfer the property to the recipient while reserving the right to live in or enjoy the property until their death. After the donor's passing, the recipient becomes the full owner of the property. 4. Gift Deed with Joint Tenancy: This type of gift deed creates a joint tenancy between the donor and recipient, where both individuals hold an undivided equal interest in the property. If one person passes away, their interest automatically transfers to the surviving joint tenant. 5. Gift Deed with Right of Reverted: This gift deed includes a provision allowing the donor to regain ownership of the property if certain specified conditions are breached or not met by the recipient. When drafting a Lakeland Florida Gift Deed for Individual to Individual, it is essential to consult with a qualified real estate attorney to ensure that all legal requirements are met. The gift deed should contain accurate property descriptions, the names and contact information of the donor and recipient, and be signed and notarized in the presence of witnesses. Note: The above content is a general description of the topic and should not be considered legal advice. It is recommended to consult with a legal professional for specific guidance related to Lakeland Florida Gift Deeds for Individual to Individual.Lakeland Florida Gift Deed for Individual to Individual is a legal document used to transfer ownership of real estate or property from one person (the donor) to another person (the recipient) without any monetary consideration. In this type of transaction, the donor voluntarily gives up their rights and interests in the property as a gift to the recipient. This gift deed is commonly used for various purposes, such as transferring property to family members, close friends, or loved ones, or for estate planning and tax purposes. It allows individuals to transfer property without the need for a purchase agreement or monetary exchange. There are several types of Lakeland Florida Gift Deeds for Individual to Individual, including: 1. General Gift Deed: This type of gift deed transfers the property from the donor to the recipient without any conditions or restrictions. The recipient becomes the absolute owner of the property. 2. Conditional Gift Deed: In this case, the gift deed comes with certain conditions or restrictions that the recipient must meet or fulfill. These conditions can include the use of the property or limitations on selling or transferring the property for a specified period. 3. Gift Deed with Reservation of Life Estate: This gift deed allows the donor to transfer the property to the recipient while reserving the right to live in or enjoy the property until their death. After the donor's passing, the recipient becomes the full owner of the property. 4. Gift Deed with Joint Tenancy: This type of gift deed creates a joint tenancy between the donor and recipient, where both individuals hold an undivided equal interest in the property. If one person passes away, their interest automatically transfers to the surviving joint tenant. 5. Gift Deed with Right of Reverted: This gift deed includes a provision allowing the donor to regain ownership of the property if certain specified conditions are breached or not met by the recipient. When drafting a Lakeland Florida Gift Deed for Individual to Individual, it is essential to consult with a qualified real estate attorney to ensure that all legal requirements are met. The gift deed should contain accurate property descriptions, the names and contact information of the donor and recipient, and be signed and notarized in the presence of witnesses. Note: The above content is a general description of the topic and should not be considered legal advice. It is recommended to consult with a legal professional for specific guidance related to Lakeland Florida Gift Deeds for Individual to Individual.