This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Florida - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

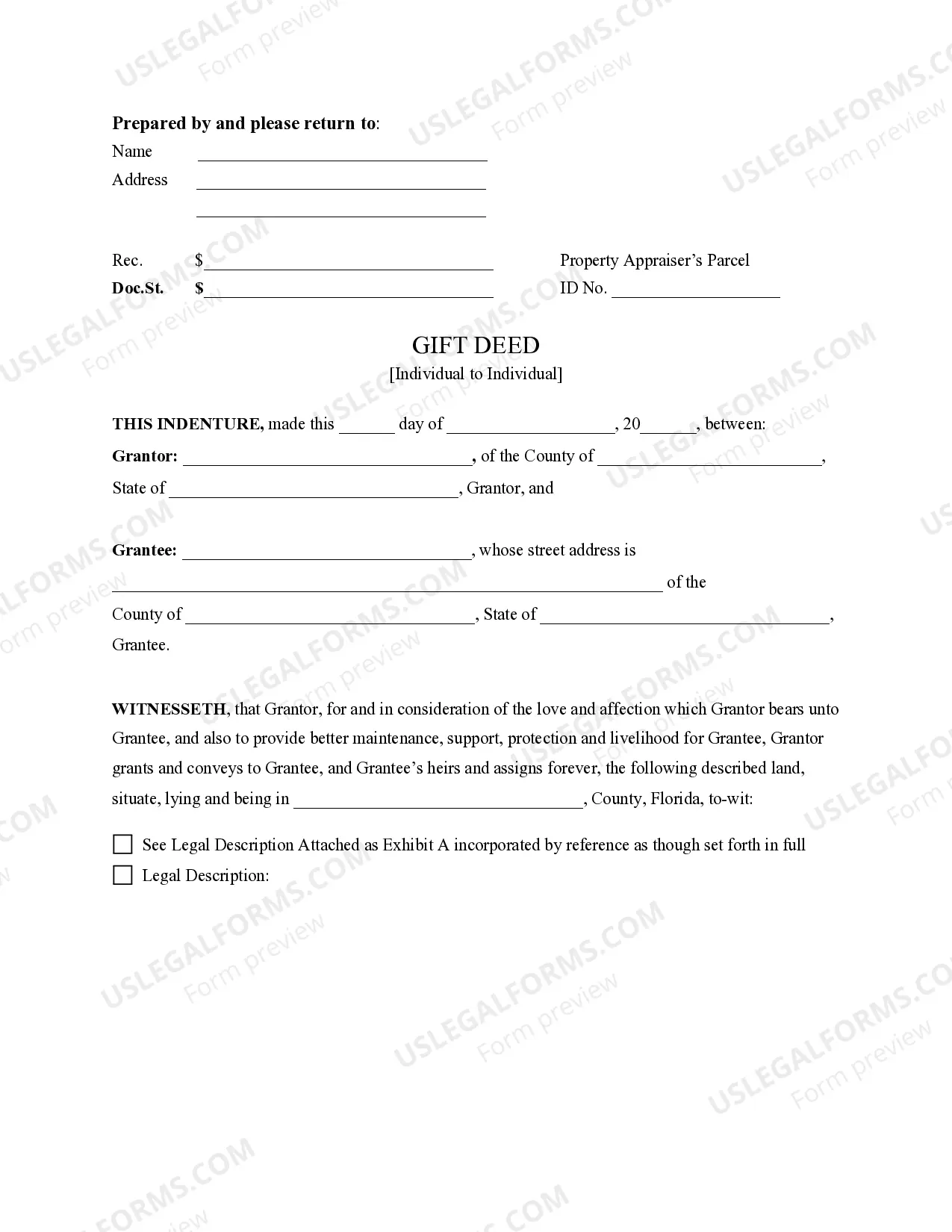

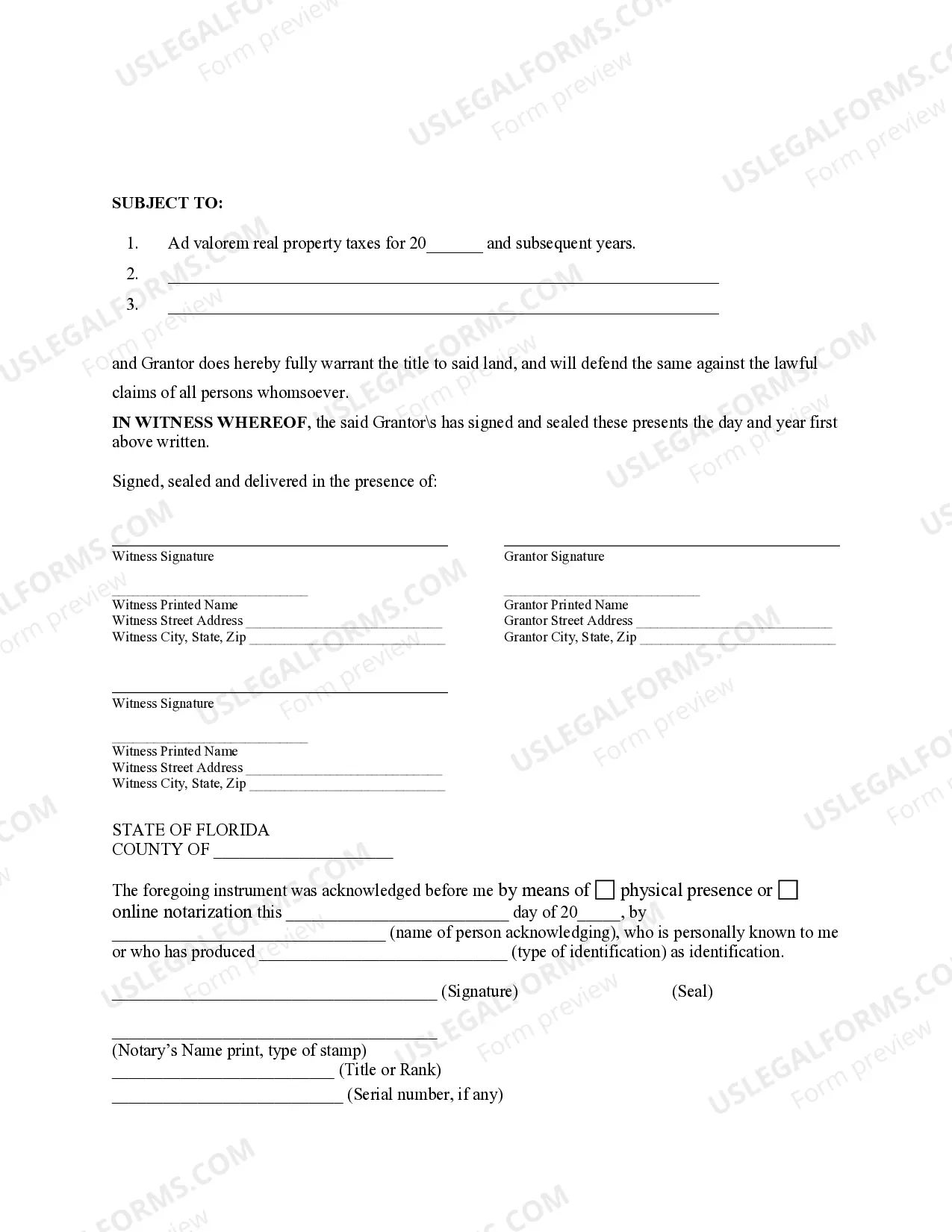

A Miramar Florida gift deed for individual to individual is a legal document used to transfer ownership of real property as a gift from one individual to another in Miramar, Florida. This type of deed is typically used when someone wishes to gift their property to another person without compensation. The gift deed serves as evidence of ownership transfer and must meet the legal requirements established by the state of Florida. The document should include essential information such as the names and addresses of both the donor (the person giving the gift) and the done (the recipient of the gift), as well as a detailed description of the property being gifted. This includes the property's address, legal description, and parcel number. Furthermore, the gift deed must contain a clear statement indicating that the transfer is a gift and that no consideration or payment is involved. It is crucial to emphasize the voluntary nature of the transfer and that it is not a result of any obligation or agreement. Different types of Miramar Florida gift deeds for individual to individual may include: 1. General Gift Deed: This is the most common type of gift deed, where the donor transfers ownership of the property to the done without any restrictions or conditions. 2. Conditional Gift Deed: In this type of gift deed, certain conditions may be attached to the transfer. For example, the donor may specify that the done must use the property for a specific purpose or that the transfer is contingent upon a certain event occurring. 3. Life Estate Gift Deed: This type of gift deed allows the donor to transfer ownership of the property to the done while retaining the right to use and occupy the property for the remainder of their life. Once the donor passes away, full ownership of the property automatically transfers to the done. 4. Joint Tenancy Gift Deed: With this type of gift deed, the donor transfers ownership of the property to multiple individuals as joint tenants. Each joint tenant holds an equal share of the property, and upon the death of one joint tenant, their share automatically transfers to the surviving joint tenants. It is essential to consult with an experienced real estate attorney or legal professional when creating a Miramar Florida gift deed for individual to individual. They can ensure that all legal requirements are met, and the transfer of ownership is properly executed.A Miramar Florida gift deed for individual to individual is a legal document used to transfer ownership of real property as a gift from one individual to another in Miramar, Florida. This type of deed is typically used when someone wishes to gift their property to another person without compensation. The gift deed serves as evidence of ownership transfer and must meet the legal requirements established by the state of Florida. The document should include essential information such as the names and addresses of both the donor (the person giving the gift) and the done (the recipient of the gift), as well as a detailed description of the property being gifted. This includes the property's address, legal description, and parcel number. Furthermore, the gift deed must contain a clear statement indicating that the transfer is a gift and that no consideration or payment is involved. It is crucial to emphasize the voluntary nature of the transfer and that it is not a result of any obligation or agreement. Different types of Miramar Florida gift deeds for individual to individual may include: 1. General Gift Deed: This is the most common type of gift deed, where the donor transfers ownership of the property to the done without any restrictions or conditions. 2. Conditional Gift Deed: In this type of gift deed, certain conditions may be attached to the transfer. For example, the donor may specify that the done must use the property for a specific purpose or that the transfer is contingent upon a certain event occurring. 3. Life Estate Gift Deed: This type of gift deed allows the donor to transfer ownership of the property to the done while retaining the right to use and occupy the property for the remainder of their life. Once the donor passes away, full ownership of the property automatically transfers to the done. 4. Joint Tenancy Gift Deed: With this type of gift deed, the donor transfers ownership of the property to multiple individuals as joint tenants. Each joint tenant holds an equal share of the property, and upon the death of one joint tenant, their share automatically transfers to the surviving joint tenants. It is essential to consult with an experienced real estate attorney or legal professional when creating a Miramar Florida gift deed for individual to individual. They can ensure that all legal requirements are met, and the transfer of ownership is properly executed.