This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Florida - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Orange Florida Gift Deed for Individual to Individual

Description

How to fill out Florida Gift Deed For Individual To Individual?

We consistently seek to diminish or evade legal repercussions when handling intricate legal or financial matters. To achieve this, we subscribe to legal services that, as a general rule, are quite costly. Nevertheless, not all legal issues are of the same complexity. Most can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorney to articles of incorporation and petitions for dissolution. Our collection enables you to manage your affairs autonomously without relying on attorney services. We provide access to legal form templates that aren't always publicly available. Our templates are tailored to specific states and regions, which greatly streamlines the search process.

Utilize US Legal Forms whenever you need to locate and download the Orange Florida Gift Deed for Individual to Individual or any other form swiftly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-acquire it in the My documents tab.

The procedure is equally simple if you're not familiar with the platform! You can establish your account in just a few minutes.

For over 24 years in the market, we’ve assisted millions by providing ready-to-customize and current legal documents. Capitalize on US Legal Forms now to save time and resources!

- Ensure to verify if the Orange Florida Gift Deed for Individual to Individual adheres to the laws and regulations of your state and locality.

- It is also vital that you review the form's outline (if provided), and if you notice any inconsistencies with your initial expectations, look for a different form.

- Once you've confirmed that the Orange Florida Gift Deed for Individual to Individual is suitable for your situation, you can select the subscription plan and move to payment.

- Then you can download the form in any preferred file format.

Form popularity

FAQ

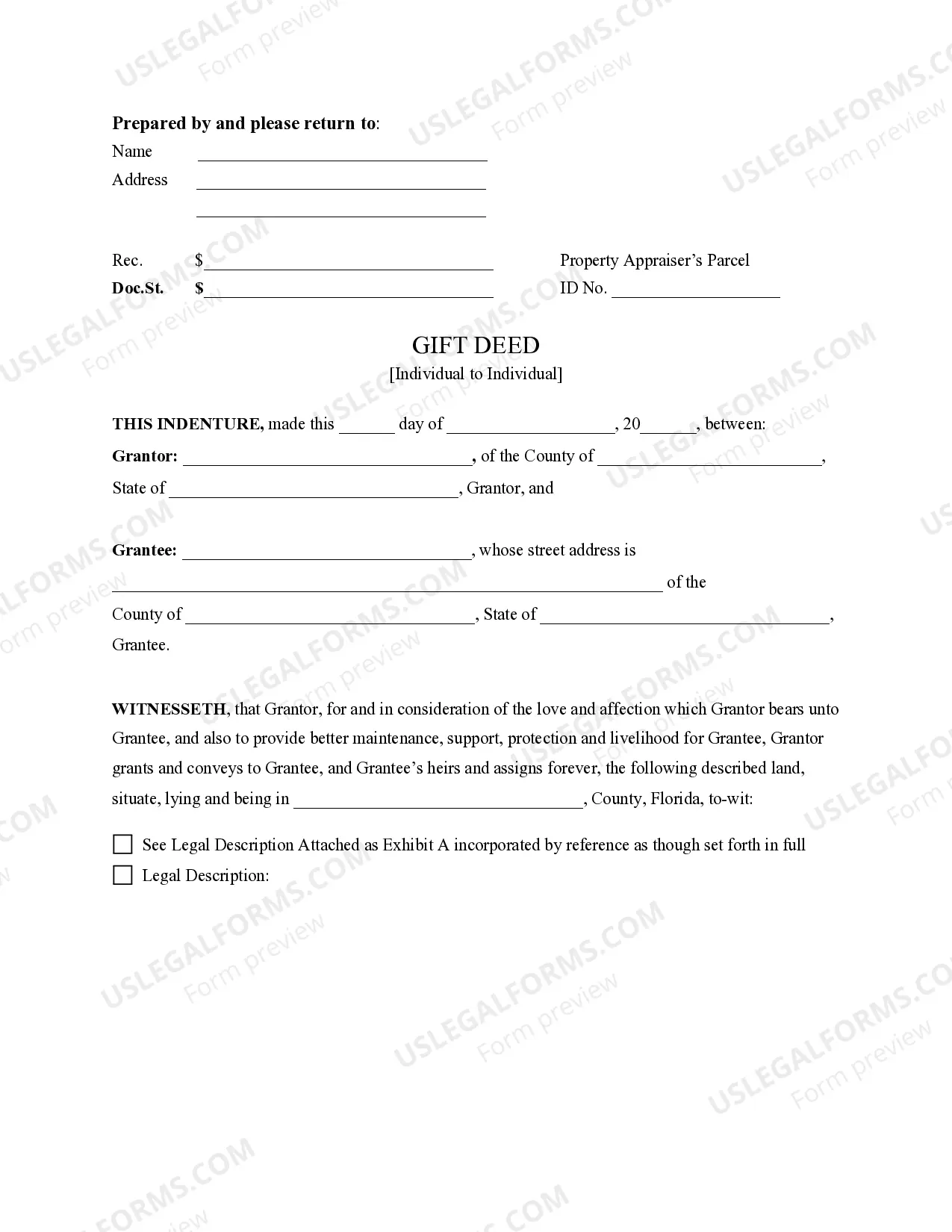

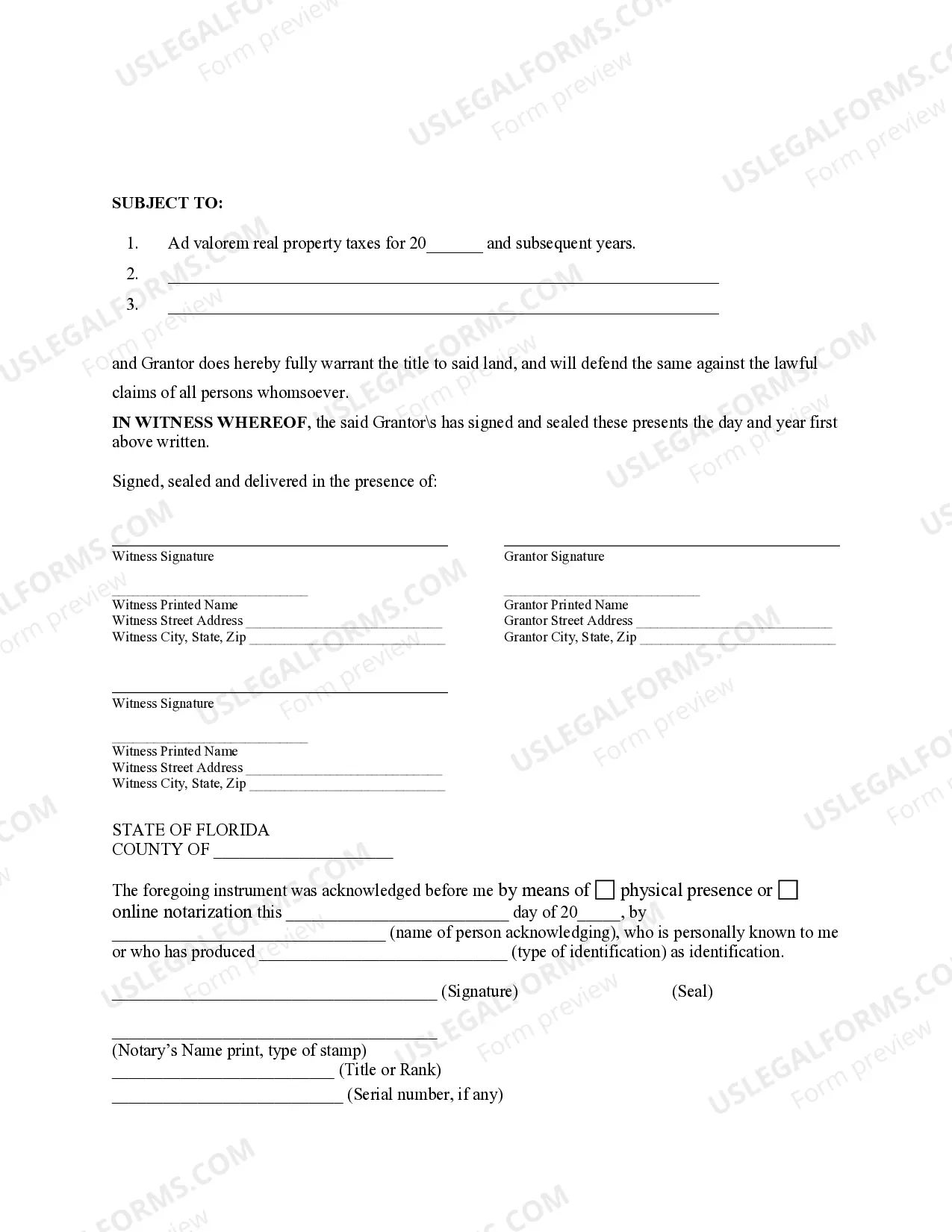

To add someone to your deed in Florida, utilize an Orange Florida Gift Deed for Individual to Individual. First, draft the new deed that lists both your name and the individual's name. Make sure to specify the type of ownership, whether joint tenants or tenants in common. After signing the new deed before a notary, record it with the county clerk's office to finalize the addition.

To gift a portion of your property using an Orange Florida Gift Deed for Individual to Individual, you will need to create a deed that specifies the portion you intend to transfer. Begin by gathering necessary documentation, such as the property title and tax information. After drafting the deed, sign it in the presence of a notary. Finally, record the deed with your local county office to ensure the transfer is legally recognized.

A quitclaim deed generally presents the most risk regarding ownership, as it offers no guarantees about the property's title. The Orange Florida Gift Deed for Individual to Individual is a more secure option, as it indicates a clear intent to transfer property as a gift. This deed protects both the giver and the receiver, ensuring a smoother transition of ownership.

No, a quitclaim deed is not the same as a gift deed. A quitclaim deed typically transfers ownership without any warranties, while an Orange Florida Gift Deed for Individual to Individual explicitly states the intent to gift property, offering more clarity about the transfer. Understanding this distinction is essential when deciding on the method of property transfer.

Gifting property can have several disadvantages, particularly regarding taxes and future ownership issues. For example, the recipient may face capital gains taxes if they sell the property later. Furthermore, using an Orange Florida Gift Deed for Individual to Individual removes your ownership rights, which means you cannot change your mind later about the asset.

In Florida, you can transfer a deed without a lawyer, but it's advisable to seek legal assistance for clarity and accuracy. A gift deed, such as the Orange Florida Gift Deed for Individual to Individual, involves specific legal requirements that a professional can help navigate. Additionally, a lawyer can ensure that all necessary paperwork is completed correctly, preventing potential future issues.

You can add a person to a deed in Florida by creating a new deed that lists both the current and new owners. Using an Orange Florida Gift Deed for Individual to Individual is the preferred method for transferring property ownership between individuals. Once you complete the deed, ensure that it is signed, notarized, and recorded with your local county clerk's office. This action will legally recognize the new individual as a co-owner of the property.

To add someone to your property deed in Florida, you must prepare a new deed that clearly specifies the addition of the new owner. This involves using an Orange Florida Gift Deed for Individual to Individual, which is a legal document designed for this purpose. After drafting the deed, sign it in front of a notary and file it with the appropriate county office. This process will effectively update the ownership records to include the new individual.

To avoid gift tax on property in Florida, you can take advantage of the annual exclusion limit set by the IRS. By gifting amounts below this limit, you can bypass taxes completely. Planning strategically when using an Orange Florida Gift Deed for Individual to Individual can help you navigate tax implications effectively.

Choosing between a gift deed and a sale deed depends on your objectives. An Orange Florida Gift Deed for Individual to Individual allows for a tax-efficient transfer of property without consideration, while a sale deed involves a financial transaction. If you aim to transfer ownership without exchange, a gift deed is typically the better option.