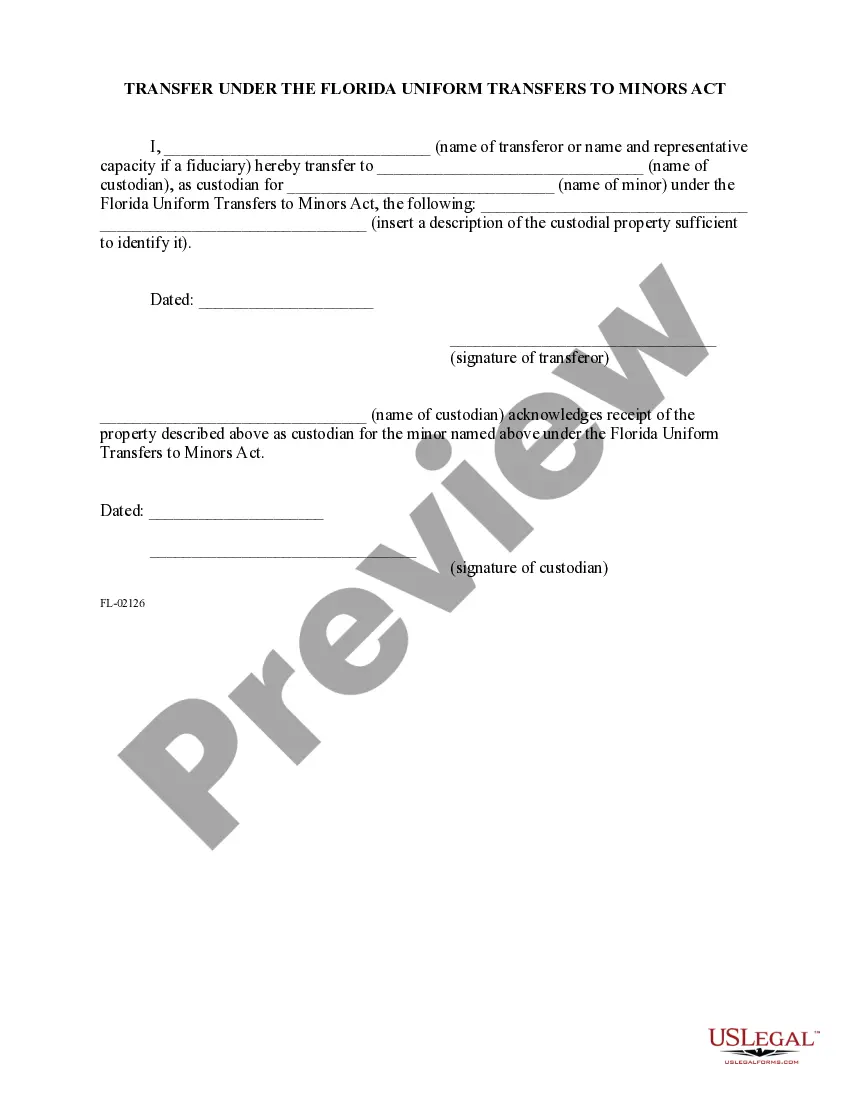

Transfer Under The Florida Uniform Transfers to Minors Act: This is an official Florida Court form that complies with all applicable Florida codes and statutes. USLF amends and updates all Florida forms as is required by Florida statutes and law.

The Hillsborough Transfer under the Florida Uniform Transfers to Minors Act refers to a legal provision that allows the transfer of property or assets to a minor under specific conditions. This act aims to facilitate the management and protection of these assets until the minor reaches the age of majority. Understanding the Hillsborough Transfer under the Florida Uniform Transfers to Minors Act is crucial for individuals or families who wish to establish provisions for the transfer of assets to minors. Under this act, a Hillsborough transfer creates a custodial relationship where property or assets are held in a trust for the benefit of a minor. The custodian, usually a trusted adult, is responsible for managing and protecting the assets until the minor becomes of legal age, typically 18 or 21 years old, depending on the state legislation. There are different types of Hillsborough Transfer under the Florida Uniform Transfers to Minors Acts, categorized based on the nature of the assets or property being transferred: 1. Financial Accounts: These transfers involve monetary assets such as bank accounts, savings bonds, and investment accounts. By establishing a custodial account, the donor can transfer funds to a minor, with the custodian having the authority to manage the assets until the minor reaches the designated age. 2. Real Estate: Hillsborough Transfer also applies to the transfer of real estate properties to minors. This could include transferring ownership of a house, land, or other immovable property. The custodian would be responsible for managing the property and any related financial responsibilities until the minor reaches legal age. 3. Personal Property: This refers to the transfer of personal belongings, valuables, or collectibles to a minor. It could include items like jewelry, artwork, vehicles, or any other assets of significant worth. The custodian ensures the preservation and responsible management of these assets on behalf of the minor. The Hillsborough Transfer under the Florida Uniform Transfers to Minors Act provides certain benefits for both donors and minors. Donors can have peace of mind by knowing their assets are securely held until the minor is deemed capable of managing them independently. Additionally, this act may offer certain tax advantages for the donor. Meanwhile, minors benefit from having valuable assets and property protected and managed until they are of legal age. It is important to consult with an attorney who specializes in estate planning and the Florida Uniform Transfers to Minors Act to ensure that all legal requirements are met when establishing a Hillsborough Transfer. Proper documentation and adherence to state laws are essential for a smooth and legally compliant transfer of assets to benefit minors.The Hillsborough Transfer under the Florida Uniform Transfers to Minors Act refers to a legal provision that allows the transfer of property or assets to a minor under specific conditions. This act aims to facilitate the management and protection of these assets until the minor reaches the age of majority. Understanding the Hillsborough Transfer under the Florida Uniform Transfers to Minors Act is crucial for individuals or families who wish to establish provisions for the transfer of assets to minors. Under this act, a Hillsborough transfer creates a custodial relationship where property or assets are held in a trust for the benefit of a minor. The custodian, usually a trusted adult, is responsible for managing and protecting the assets until the minor becomes of legal age, typically 18 or 21 years old, depending on the state legislation. There are different types of Hillsborough Transfer under the Florida Uniform Transfers to Minors Acts, categorized based on the nature of the assets or property being transferred: 1. Financial Accounts: These transfers involve monetary assets such as bank accounts, savings bonds, and investment accounts. By establishing a custodial account, the donor can transfer funds to a minor, with the custodian having the authority to manage the assets until the minor reaches the designated age. 2. Real Estate: Hillsborough Transfer also applies to the transfer of real estate properties to minors. This could include transferring ownership of a house, land, or other immovable property. The custodian would be responsible for managing the property and any related financial responsibilities until the minor reaches legal age. 3. Personal Property: This refers to the transfer of personal belongings, valuables, or collectibles to a minor. It could include items like jewelry, artwork, vehicles, or any other assets of significant worth. The custodian ensures the preservation and responsible management of these assets on behalf of the minor. The Hillsborough Transfer under the Florida Uniform Transfers to Minors Act provides certain benefits for both donors and minors. Donors can have peace of mind by knowing their assets are securely held until the minor is deemed capable of managing them independently. Additionally, this act may offer certain tax advantages for the donor. Meanwhile, minors benefit from having valuable assets and property protected and managed until they are of legal age. It is important to consult with an attorney who specializes in estate planning and the Florida Uniform Transfers to Minors Act to ensure that all legal requirements are met when establishing a Hillsborough Transfer. Proper documentation and adherence to state laws are essential for a smooth and legally compliant transfer of assets to benefit minors.