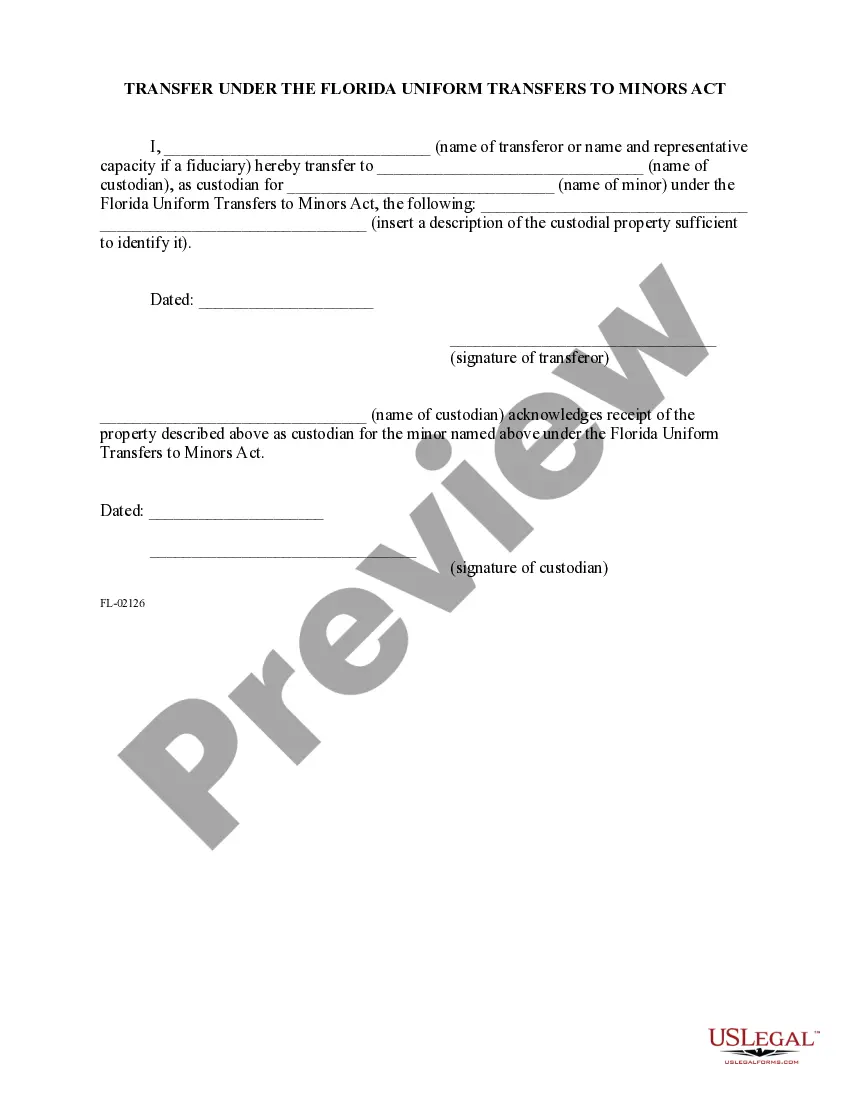

Transfer Under The Florida Uniform Transfers to Minors Act: This is an official Florida Court form that complies with all applicable Florida codes and statutes. USLF amends and updates all Florida forms as is required by Florida statutes and law.

The St. Petersburg Transfer under the Florida Uniform Transfers to Minors Act is a legal mechanism used to transfer assets to minors in a structured and regulated manner. This act helps facilitate the management of assets for the benefit of minors until they reach a certain age of maturity determined by law. Under the St. Petersburg Transfer, a custodian is appointed to handle and manage the assets on behalf of the minor beneficiary. The custodian can be an individual or a financial institution, such as a bank or a trust company, who acts in the best interest of the minor. The purpose of this legal framework is to protect the assets and ensure their effective use for the minor's benefit. The custodian has the fiduciary duty to make prudent investment decisions and manage the funds responsibly. They must act in the best interest of the minor while considering their long-term financial needs. The St. Petersburg Transfer allows for various types of assets to be transferred, including cash, securities, real estate, and other investments. The assets are held in an account or a trust specifically created for the minor beneficiary. Different types of St. Petersburg Transfer under the Florida Uniform Transfers to Minors Act may include: 1. Cash Transfers: This involves transferring liquid funds to the custodian's account, which is then managed for the minor's benefit. The custodian may use the funds for the minor's education, healthcare, or other necessary expenses. 2. Securities Transfers: This type of transfer involves the transfer of stocks, bonds, or mutual funds to the custodian. The custodian manages the investment portfolio and makes decisions regarding buying, selling, or holding securities based on the minor's best interests. 3. Real Estate Transfers: Under this type of transfer, real property is transferred to the custodian on behalf of the minor. The custodian oversees the management of the property, including collecting rent, paying property expenses, and ensuring its proper maintenance. 4. Business Interest Transfers: If the minor is entitled to a share in a family business or partnership, such interests can be transferred to the custodian. The custodian manages the business interest and ensures its growth and profitability for the minor's future benefit. The St. Petersburg Transfer under the Florida Uniform Transfers to Minors Act provides a valuable and structured approach for transferring assets to minors. It offers flexibility in terms of the types of assets that can be transferred and provides legal safeguards to ensure responsible management.