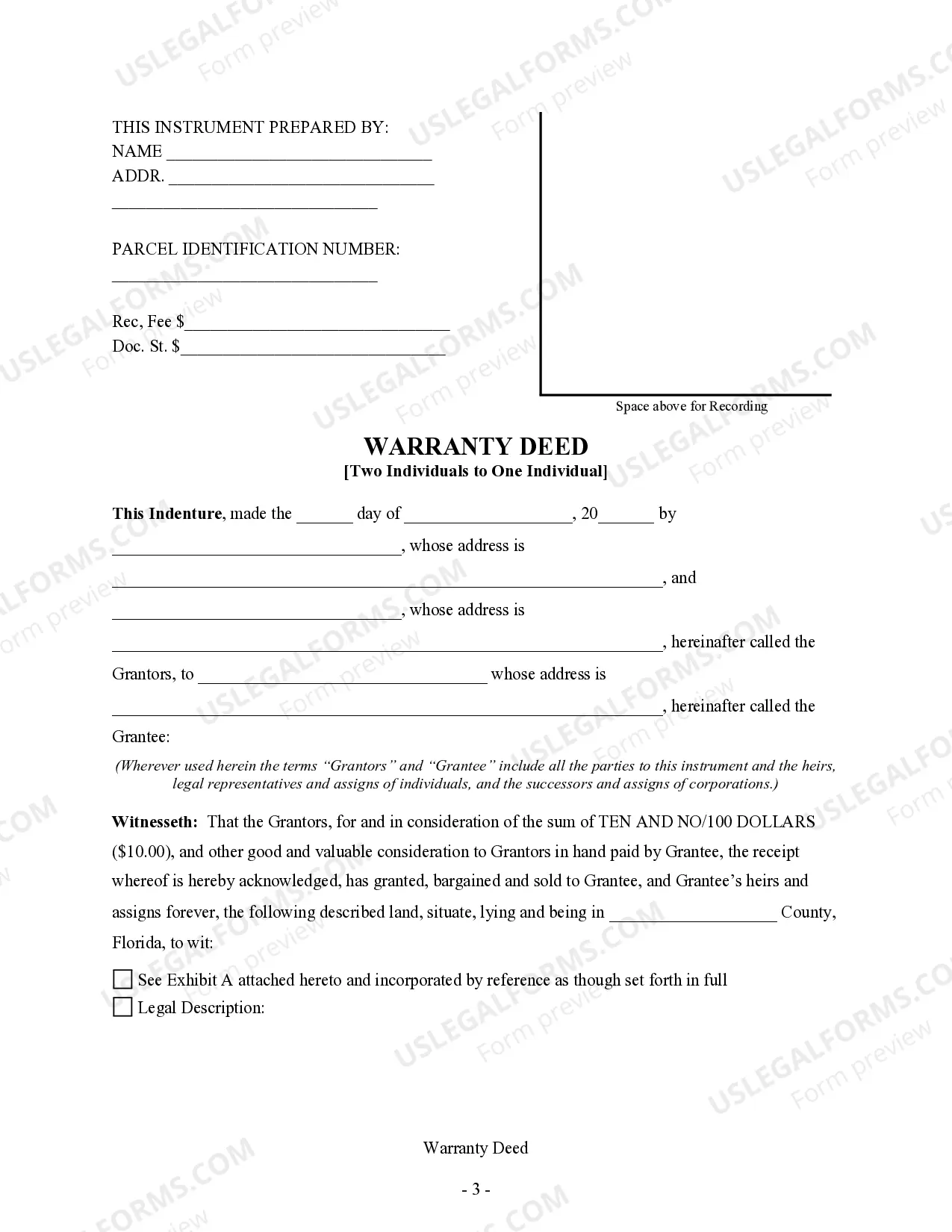

This form is a Warranty Deed where the grantors are two individuals and the grantee is an individual. Grantors convey and warrant the described property to the grantee. This deed complies with all state statutory laws.

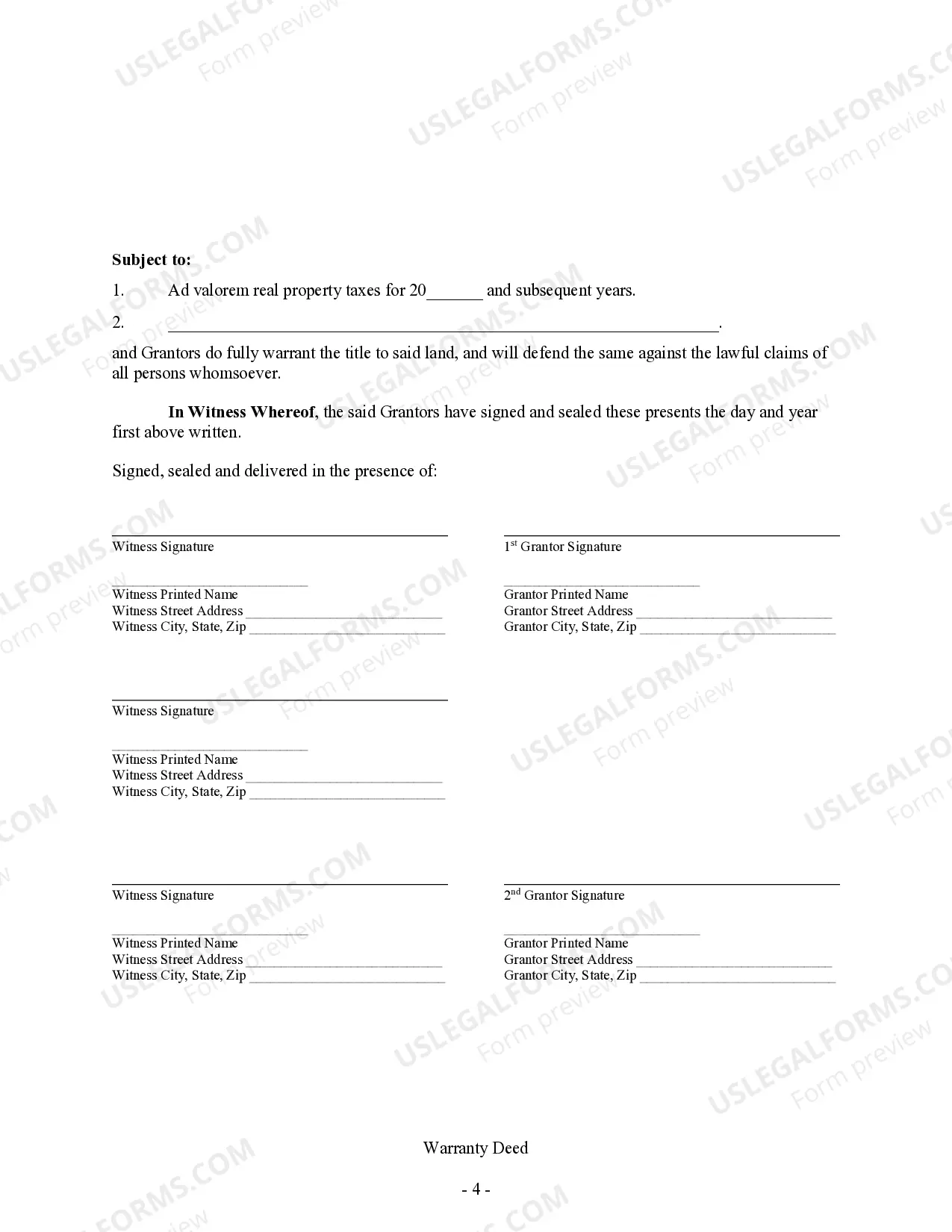

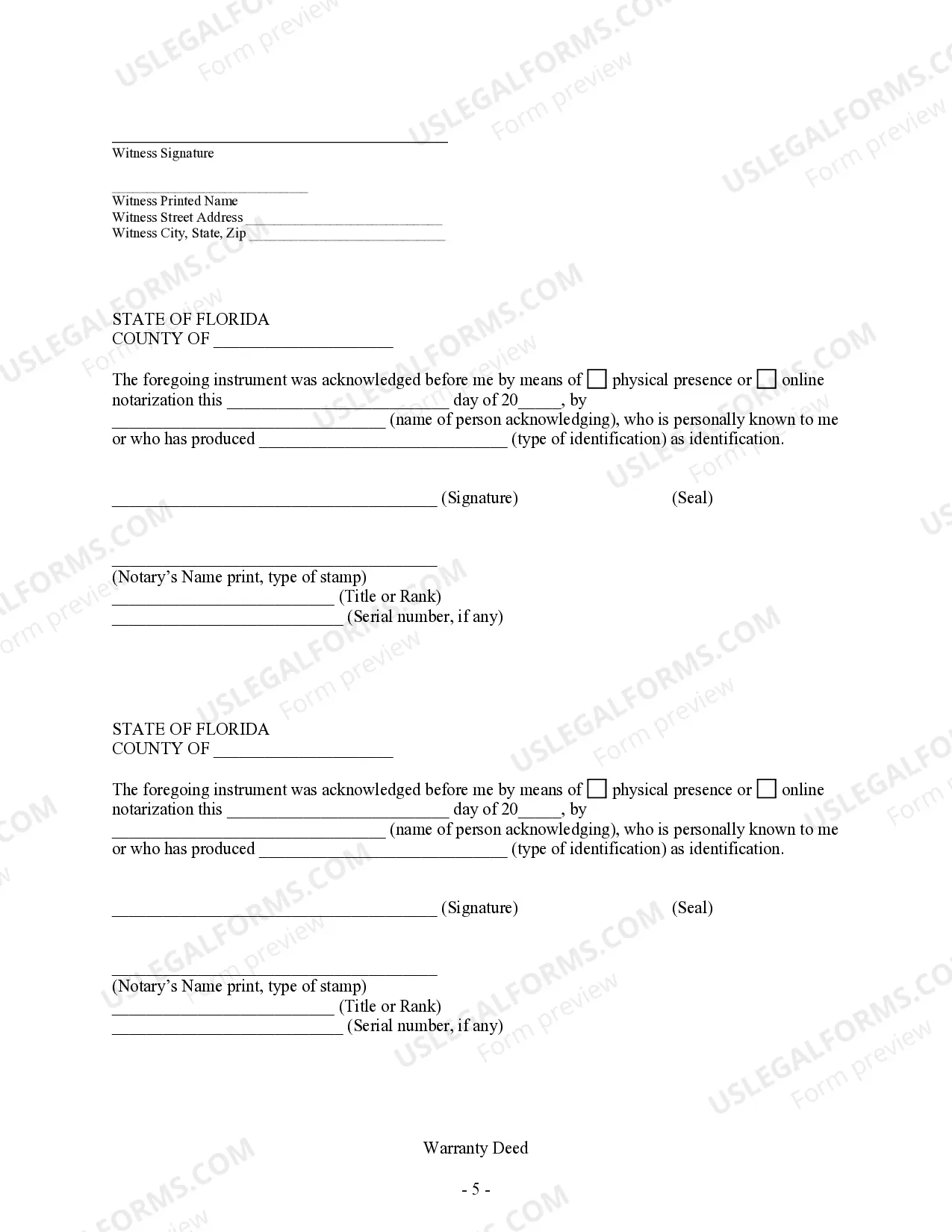

Title: Understanding Gainesville Florida Warranty Deed — Two Individuals to One Individual Introduction: A Gainesville Florida Warranty Deed — Two Individuals to One Individual is a legal document that facilitates the transfer of ownership of real estate from two individuals (granters) to a single individual (grantee) in Gainesville, Florida. This type of deed guarantees the grantee that the property is free from any liens or encumbrances, ensuring a clean transfer of ownership. Let's delve into the different types of Gainesville Florida Warranty Deed — Two Individuals to One Individual and their key features. 1. General Warranty Deed: A General Warranty Deed is the most common type of warranty deed used in Gainesville, Florida. It offers the highest level of protection to the grantee, as it ensures the granter's guarantee of having the rightful ownership and right to sell the property. It also protects against any title defects or claims that may arise. 2. Special Warranty Deed: A Special Warranty Deed, although less common than a General Warranty Deed, is another type of Gainesville Florida Warranty Deed — Two Individuals to One Individual. It guarantees that the granters have not done anything to impair the title during their ownership, but it does not provide protection against title issues that existed before they acquired the property. 3. Quitclaim Deed: While not technically a warranty deed, a Quitclaim Deed is sometimes used for transferring property in Gainesville, Florida. This type of deed does not provide any warranties or guarantees to the grantee. It simply conveys whatever interest the granters may have in the property, if any. Key Elements of Gainesville Florida Warranty Deed — Two Individuals to One Individual: 1. Names and addresses of granters and grantee: The full legal names and addresses of both parties involved in the transaction should be clearly stated in the warranty deed. 2. Property description: A detailed description of the property being transferred, including the legal description, lot numbers, and any relevant details, should be provided. 3. Consideration: The compensation or value exchanged for the property should be mentioned in the deed. 4. Signatures and acknowledgement: Both granters and grantee must sign the document in the presence of a notary public for the deed to be legally binding. 5. Legal language: The deed should include the specific language required by Florida state law to ensure its validity. Conclusion: In Gainesville, Florida, a Warranty Deed is a vital legal document that facilitates the transfer of real estate from two individuals to one individual. Whether you opt for a General Warranty Deed, Special Warranty Deed, or a Quitclaim Deed, it is essential to understand the different types and their specific features to ensure a smooth and secure transfer of property ownership. Consulting with a knowledgeable real estate attorney or professional is recommended to ensure compliance with all legal requirements and protect your interests during the process.Title: Understanding Gainesville Florida Warranty Deed — Two Individuals to One Individual Introduction: A Gainesville Florida Warranty Deed — Two Individuals to One Individual is a legal document that facilitates the transfer of ownership of real estate from two individuals (granters) to a single individual (grantee) in Gainesville, Florida. This type of deed guarantees the grantee that the property is free from any liens or encumbrances, ensuring a clean transfer of ownership. Let's delve into the different types of Gainesville Florida Warranty Deed — Two Individuals to One Individual and their key features. 1. General Warranty Deed: A General Warranty Deed is the most common type of warranty deed used in Gainesville, Florida. It offers the highest level of protection to the grantee, as it ensures the granter's guarantee of having the rightful ownership and right to sell the property. It also protects against any title defects or claims that may arise. 2. Special Warranty Deed: A Special Warranty Deed, although less common than a General Warranty Deed, is another type of Gainesville Florida Warranty Deed — Two Individuals to One Individual. It guarantees that the granters have not done anything to impair the title during their ownership, but it does not provide protection against title issues that existed before they acquired the property. 3. Quitclaim Deed: While not technically a warranty deed, a Quitclaim Deed is sometimes used for transferring property in Gainesville, Florida. This type of deed does not provide any warranties or guarantees to the grantee. It simply conveys whatever interest the granters may have in the property, if any. Key Elements of Gainesville Florida Warranty Deed — Two Individuals to One Individual: 1. Names and addresses of granters and grantee: The full legal names and addresses of both parties involved in the transaction should be clearly stated in the warranty deed. 2. Property description: A detailed description of the property being transferred, including the legal description, lot numbers, and any relevant details, should be provided. 3. Consideration: The compensation or value exchanged for the property should be mentioned in the deed. 4. Signatures and acknowledgement: Both granters and grantee must sign the document in the presence of a notary public for the deed to be legally binding. 5. Legal language: The deed should include the specific language required by Florida state law to ensure its validity. Conclusion: In Gainesville, Florida, a Warranty Deed is a vital legal document that facilitates the transfer of real estate from two individuals to one individual. Whether you opt for a General Warranty Deed, Special Warranty Deed, or a Quitclaim Deed, it is essential to understand the different types and their specific features to ensure a smooth and secure transfer of property ownership. Consulting with a knowledgeable real estate attorney or professional is recommended to ensure compliance with all legal requirements and protect your interests during the process.