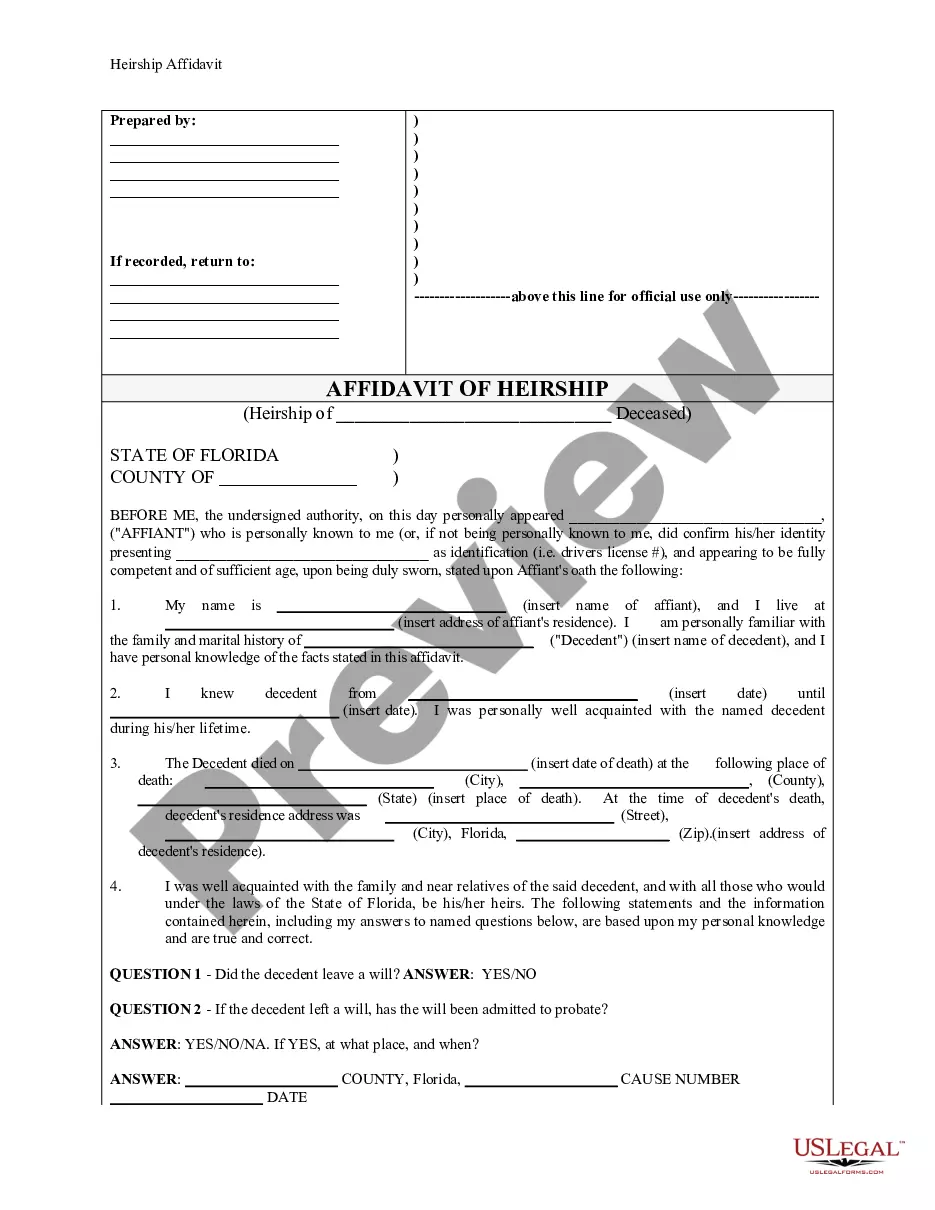

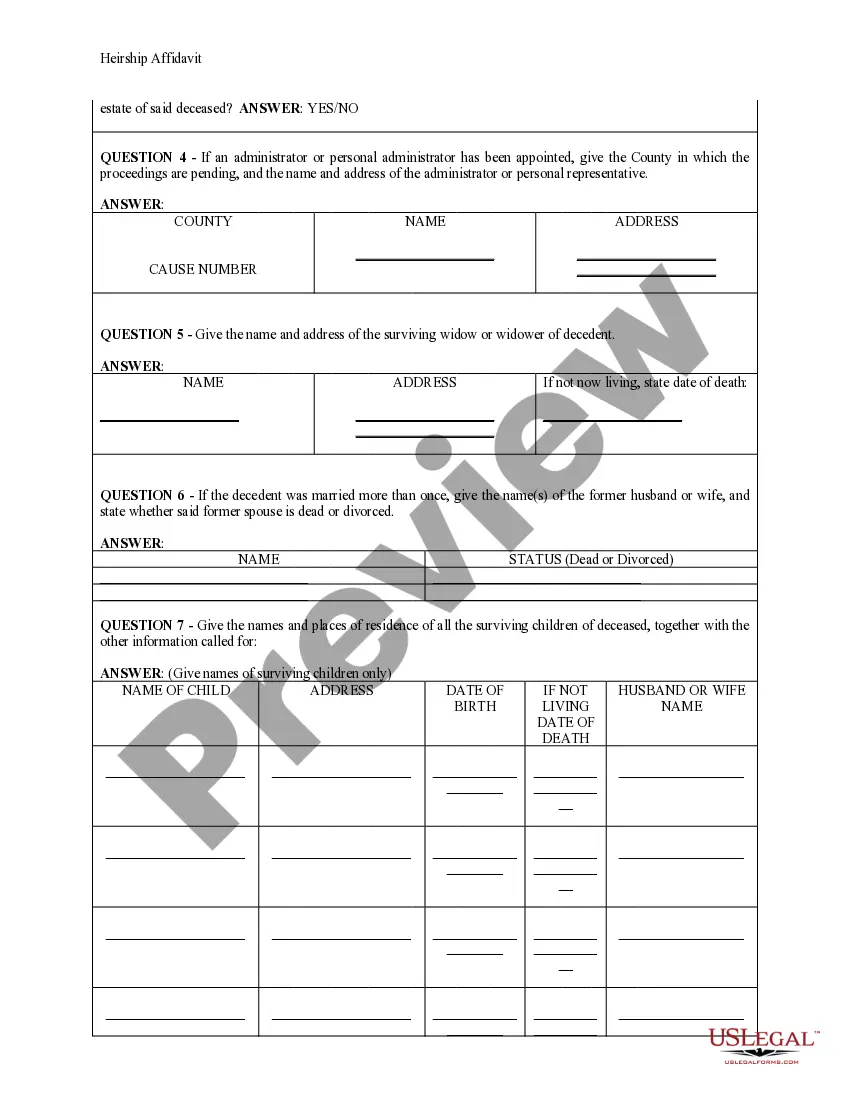

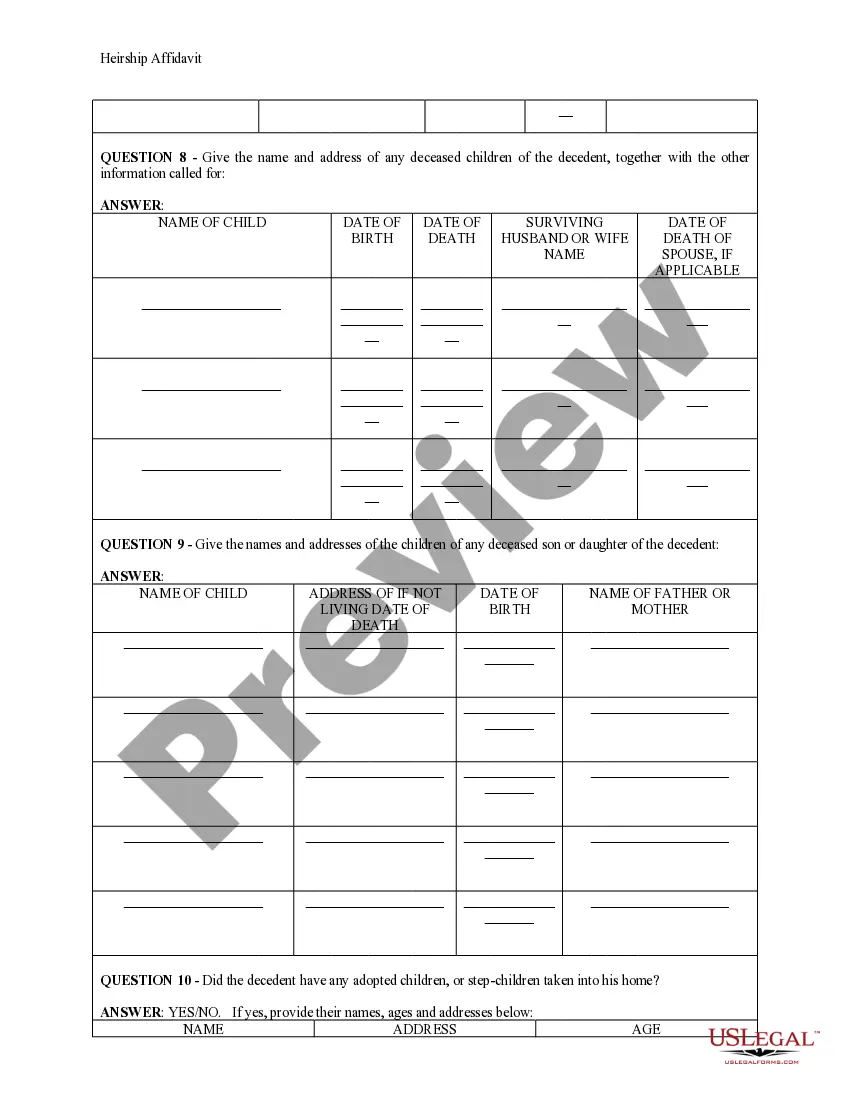

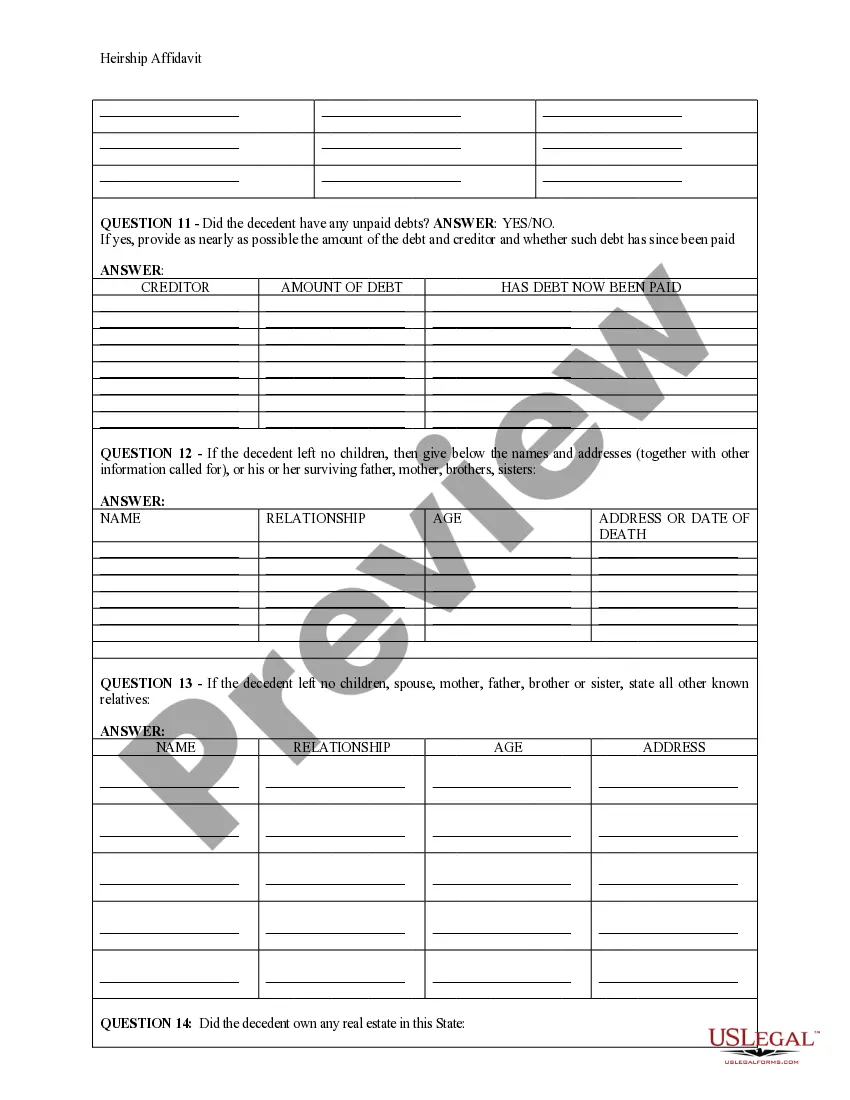

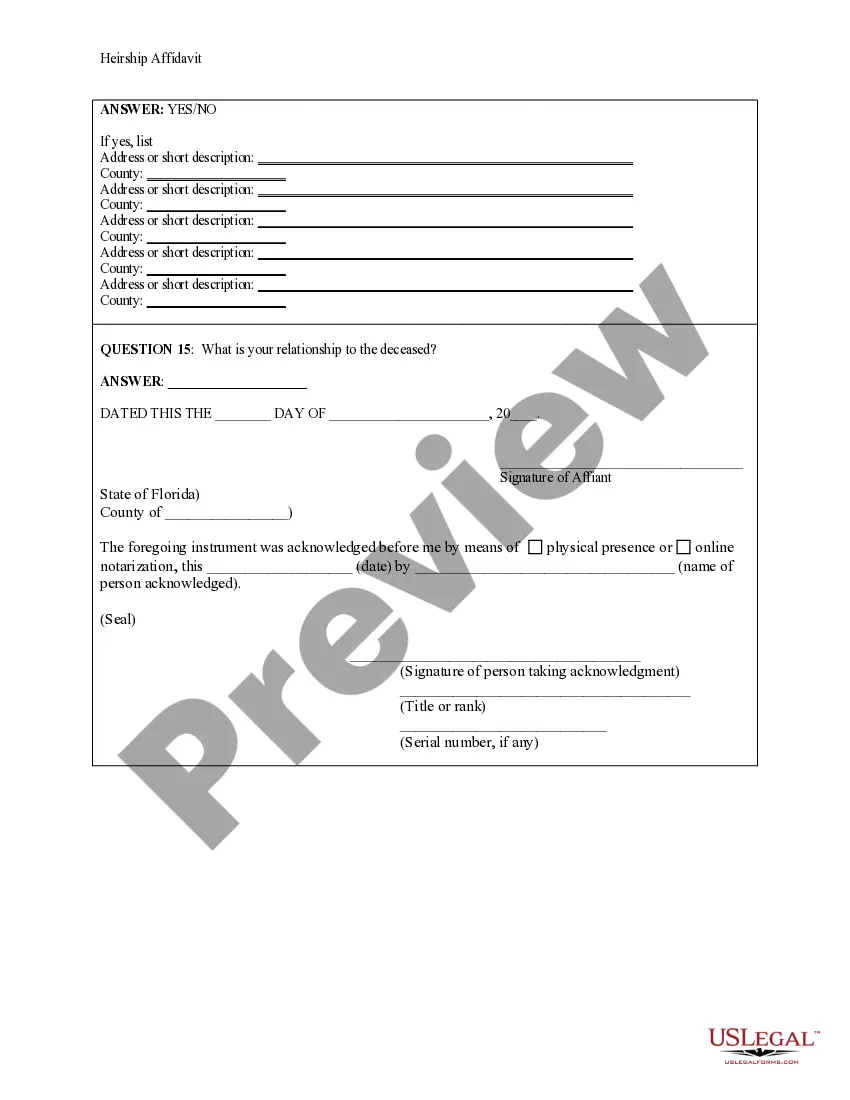

This Affidavit of Heirs is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It is used in a specific county and may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Miami-Dade Florida Heirship Affidavit - Affidavit of Heirs - Descent

Description

How to fill out Florida Heirship Affidavit - Affidavit Of Heirs - Descent?

If you’ve previously made use of our service, Log In to your account and retrieve the Miami-Dade Florida Heirship Affidavit - Affidavit of Heirs - Descent on your device by selecting the Download button. Ensure your subscription is active. If it’s not, renew it as per your payment arrangement.

If this is your initial experience with our service, adhere to these straightforward steps to acquire your document.

You have lifelong access to all documents you have purchased: you can find it in your profile within the My documents section whenever you wish to reuse it. Leverage the US Legal Forms service to swiftly locate and save any template for your personal or professional requirements!

- Verify you’ve located the correct document. Browse through the description and utilize the Preview feature, if available, to determine if it fulfills your needs. If it’s unsuitable, employ the Search tab above to identify the correct one.

- Procure the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Miami-Dade Florida Heirship Affidavit - Affidavit of Heirs - Descent. Choose the file format for your document and save it to your device.

- Fill out your document. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The affidavit of heirs statute in Florida encompasses various provisions that govern the declaration of heirs. This statute allows heirs to establish their rights to the estate without lengthy probate procedures. By adhering to these laws and utilizing resources like the Miami-Dade Florida Heirship Affidavit from US Legal Forms, you can ensure a smoother transition of assets.

An affidavit of heirs in Florida statutes is a legal document that provides a declaration of the heirs of a deceased person's estate. This document is often used to clarify heirship when transferring real or personal property without formal probate. By filing a Miami-Dade Florida Heirship Affidavit, heirs can establish their inheritance rights, streamlining the process of asset distribution.

Section 735.201 of the Florida statutes provides the legal framework for creating affidavits of heirship in the state. This section highlights who qualifies as an heir and the legal instruments needed to validate heirship without going through probate. Understanding this statute is crucial when preparing the Miami-Dade Florida Heirship Affidavit to ensure compliance with Florida law.

Yes, you can prepare your own affidavit of heirship in Florida, as long as you follow the legal requirements accurately. However, the process can be complicated, and a mistake may lead to delays in the estate settlement. Using US Legal Forms can help you create a compliant Miami-Dade Florida Heirship Affidavit easily, allowing you to focus on other important matters during a difficult time.

Filling out an affidavit of heirs in Florida involves providing information about the deceased, including their full name, date of death, and details of the heirs. You will also need to indicate the relationship of each heir to the deceased. For a seamless experience, consider using US Legal Forms, which provides user-friendly templates specifically for the Miami-Dade Florida Heirship Affidavit.

The affidavit of heirs in Florida serves as a legal document that outlines the beneficiaries of a deceased person's estate. It establishes the heirs' identities and their respective shares of the estate, which can be critical in settling the estate without formal probate. By utilizing the Miami-Dade Florida Heirship Affidavit, you can simplify the process and expedite the distribution of assets.

In Florida, an affidavit of heirs must typically be signed by individuals who are legal heirs of the deceased person. These heirs must provide proof of their relationship to the deceased, which may include birth certificates or marriage licenses. The Miami-Dade Florida Heirship Affidavit process requires that all heirs agree to the affidavit's contents, ensuring that the distribution of assets follows the law.

An affidavit is a powerful legal tool, as it serves as a written declaration made under oath. This document can significantly influence probate proceedings and other legal matters. When you utilize a Miami-Dade Florida Heirship Affidavit - Affidavit of Heirs - Descent, it carries weight in establishing claims and ensuring the fair distribution of assets.

To prepare an affidavit of heirship, you typically need the deceased's information, proof of their death, and details of potential heirs. Gather any documents that support the familial relationships, such as birth certificates or marriage licenses. In a Miami-Dade Florida Heirship Affidavit - Affidavit of Heirs - Descent, these documents validate the claims of heirs and facilitate the legal process.

An affidavit of legal heirs is a document that identifies all rightful heirs of a deceased person's estate. This affidavit is often required when formalizing the transfer of property or assets to the heirs. In the Miami-Dade Florida Heirship Affidavit - Affidavit of Heirs - Descent process, this document helps establish the lineage and authority of heirs in estate matters.